Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Manipulating Crypto

Market manipulation, according to Investopedia, is defined as:

“The act of artificially inflating or deflating the price of a security or otherwise influencing the behavior of the market for personal gain.”

Do we see this type of artificial movement happen often in the cryptocurrency markets? You better believe it. In fact, due to the deregulated nature of both cryptocurrency and their markets, manipulation is more rampant in the cryptocurrency markets than virtually anything else you can trade. Since the value of cryptocurrencies are very sensitive to sentiment, emotion, and publicity, many are tempted to drive unnatural price movement and profit off of the loss of others. And unfortunately, many can actually succeed in doing so without any regulatory ramifications.

Source: cryptocurrencynews.com/bitcoin-news/bitcoin-price-manipulation

Source: cryptocurrencynews.com/bitcoin-news/bitcoin-price-manipulation

Market manipulation can come in many forms, and the more it catches the rest of us off guard, the more successful it can be. For starters, cryptocurrency is designed around anonymity. Anyone can make buys and sells with their own fiat or crypto, and anyone can trade coins without the rest of the world blinking an eye. So why does this matter? Jesse Powell, CEO of the Kraken cryptocurrency, recently addressed the question of why his and other exchanges don’t impose more regulations:

“Assumptions we make about how traditional markets work don’t apply to crypto markets and therefore we need to try to remember why we imposed a specific requirement in the first place, before we unnecessarily impose it on the crypto markets.”

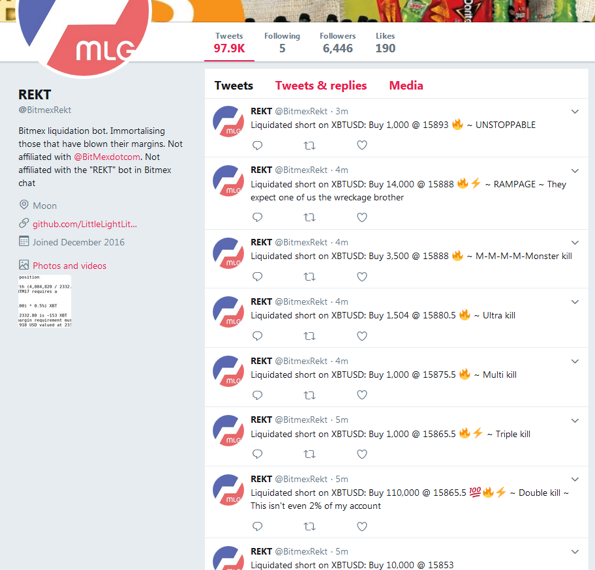

As of late May, the US Justice Department is in the midst of a criminal probe pertaining to crypto manipulation. But is there anything that can really be done? And if prices are prone to false movement and historically have been manipulated in both directions, does it really matter in the long run? Well little of the market noise may be of major interest to super long-term investors who are salivating over the potential prices of Bitcoin and Ethereum in the year 2050. But much of the trading in crypto involves investors who focus on the price of various currencies on a much shorter time scale, and the artificial volatility can very much effect their ability to remain in the space. Many of these short-term investors depend on margin investing (responsibly or not), and thanks to the massive volatility of crypto, these investments often end up getting margin called.

It can be difficult to gauge just how much regulation should be instilled into cryptocurrency trading, because the lack thereof is exactly why a lot of people have entered into the asset class. The crypto space needs to maintain its deregulatory nature while still minimizing the vulnerabilities of the investors. According to Gabriela Giancola at CoinJournal,

“Like everything, there are pros and cons as to why cryptocurrencies should be subject to increased scrutiny. However, too much red tape can stifle creativity and we cannot afford to let this happen to a rapidly growing industry. Regulations are here to help build the whole space. They are not against the space, but part of the solution to create a long-term blockchain and crypto space.”

Manipulative Tactics

So many of us have heard accusations of market manipulation in one form or another in investing, but how does one (or many) actually skew a cryptocurrency industry with a currently $300 billion market cap in their favor? There are several “techniques” and “strategies” that can and have been used to shift the value of Bitcoin and others in unnatural directions without any recourse due to inconspicuousness of trades:

- Wash Trading — buying and selling with one’s own funds with themselves in order to create the perception that there is more market activity than is actually occuring

- Pump and Dumps — artificially buying an excessive amount of a coin, usually in groups to gather capital, and selling for profit to unsuspecting traders

- Dark Pool Trading — large capital investors trading with one another outside of standard exchanges in order to avoid slippage.

- Shilling — Artificially generating false hype and excitement for a coin, generally for personal gain or an exchange of payment from another party

- Whale Trades — Using tools like buy and sell walls, traders with larger capital than most are able to push prices in the direction they favor, or alternatively prevent prices straying away from where they prefer

When we take an overall look at the entire overall historic value of Bitcoin, the largest cryptocurrency in terms of both volume and market capital, what kinds of things do we notice? Do these day to day and week to week pumps translate to an overall aggregate pump and dump of the entire coin? The price clearly has gone through some major volatility and grown exponentially, particularly in 2017, before crashing over 70% in the first half of 2018. Can we be certain that a crash of this magnitude is just a healthy correction, or could this be calculated price manipulation being made by whales, pump and dump groups, or governments? (looking at you, North Korea)

The reality is that the price of Bitcoin, under healthy growth conditions, would probably never have rocketed from a low of below $780 to a high of above $19,700 in one calendar year if not for external factors manipulating its price. Yes, this really was the range of Bitcoin’s value in 2017, and those who owned it throughout the year likely went through some serious peaks and valleys of emotion, just like BTC’s worth. Despite the fact that there is no real intrinsic value to cryptocurrency (yet), there can still be a healthy growth rate it could thrive under as more and more of the world adopts it and wants to obtain it.

To get into specific and direct market manipulation tactics, one example I referenced is a “strategy” known as wash trading. The basic concept is to create buys and sells simultaneously on exchanges to give the illusion that there is a higher volume in a given time period than their actually is. As a result, unknowing investors are given the impression that volume is picking up, perhaps after a long dormant period, and ended up buying or selling their own coins under false pretense.

Pump and dump groups are another form of market manipulation. Though they are not exclusive to the crypto world, there are less legal downsides within the specific crypto space, and more market impact to capitalize on. This is why the crypto markets are so ripe with these groups. Pump and dumps are organized groups of people on a mission together to buy large quantities of one particular coin simultaneously in order to push up the price of it in a very short timeframe.

Source: microcapclub.com/2014/12/hard-mailer-pump-and-dump-performance-part-10/

Source: microcapclub.com/2014/12/hard-mailer-pump-and-dump-performance-part-10/

As a result of the rapid price jump of the pumps, the hope is that other unsuspecting investors will see the movement and begin to purchase these coins and “jump on the ride to moonsville” just as this same group begins dumping their artificially inflated coins to the unknowing traders who find themselves holding near-empty bags in the end. These groups are organizing on a daily basis to make these trades, and ironically, most of the individuals in these pump and dump groups tend to lose money themselves, simply under the guise that they “sold too late” after being part of the initial pump. In reality, only the organizers and second tier members of the group benefit because they set the timings of the buys and are generally the first to sell while their own members are still in buy mode.

That’s Just the Way it is… For Now

There is really only one true way the price of Bitcoin could inflate over 2,500% times its value in under a year, then be followed by a deflation of 70% in just a month and a half. Without any semblance of market manipulation being a major factor, this is just unrealistic without some premeditation. If something was fundamentally altered in the value of the asset, there could be a case made for drastic highs and lows in a currency most consider to still be in its infancy.

However, Bitcoin’s potential and ability to change the world is the same now as it was back in 2011, when the value had brief parity with the price of one US dollar.

Now it sits at 7,000 times the value of the US dollar. There is simply more consciousness and awareness of the blockchain’s existence, more Bitcoins available to cycle from one hand to another, more diversification in types of coins available, and more excitement and optimism in regard to its future ability to change the world and currency as we know it.

So with the understanding that Bitcoin’s value should be growing in a more linear fashion than it has up to this point, there are quite a few reasons why it has yet to receive the stability that could bring in more conservative investors:

- The amount of good and bad press cryptocurrency gets directly correlates to the market’s perception of it. And in an asset class where value is completely based on market perception, you can sure bet that media has an impact. Would this be considered market manipulation? Absolutely. Whether media outlets intend to bring up or push down prices is debatable, but their discussions of the latest Bitcoin swing absolutely has market consequences. There is no doubt that a breaking news story on CNBC about Kim Jong Un’s latest Bitcoin heist is going to rock the markets. More importantly, when the CEO of Ripple is brought on to “Fast Money” for the 5th time in a year, this directly props up individual coins, often at the expense of other coins that are deserving of the attention.

- Bitcoin and other coins generally have constantly changing viewpoints in their perceived values, and a lot of it depends on where its price currently sits. As actual means of transferring value from person to person, cryptocurrency is built to be an incredible phenomenon that can change the world in this regard. But when it comes to an actual store of value, there is a strong case that can be made against the viability of it. Matt Ward at Hackernoon argues,

“There is literally no reason to have a “store of value.” In a scenario where one (or more) cryptocurrencies become actual currencies, ie begin being used for commerce and penetrate the mass market, there has to be relatively stable pricing. When supply and demand are relatively consistent, prices hardly fluctuate.”

- Security concerns are a major hurdle holding back cryptocurrency from stabilizing as well. We see all sorts of stories of new hacks of individual wallets or cryptocurrency exchanges on a fairly regular basis. The truth is that there are a lot of people who want to simply purchase Bitcoin and hold it safely somewhere, but don’t want to hold it in a wallet they don’t understand or on an exchange that is unregulated and not FDIC insured.

Yes, the wild, wild west of crypto markets is still very much in effect in 2018. Percentage swings can happen in coin values in a day that would take the S&P a month or even a year to replicate. And until cryptocurrency is more widely adopted and investments become more liquid, they will still be very susceptible to manipulated prices from individual buys and sells that may even have a ton of dollar value behind them.

This, along with having some general sanity, are the reasons that I personally have never invested more than I could afford to lose. Sweating the massive daily swings of a sector that isn’t regulated is not something I will ever want to put 80% of my life savings on, despite the fact that I am confident that blockchain technology will change the world one day. It requires a very strong will to stay sane investing in anything this volatile and blatantly pulled in premeditated directions every minute. I simply ask my readers to research how Bitcoin and other altcoins with particular use cases can eventually impact the world, and as hard as it is, try to avoid the noise and instability of prices. One must stay strong in their belief that coin prices will coincide with the true value they should reach with all of the potential in cryptocurrency, no matter how wobbly their path is to get there.

I write in depth cryptocurrency analysis at Samsa, the passive investing tool for crypto. See what we’re doing at Samsa.ai and see our other analysis at our magazine.

This article and related content is for informational purposes only. It should not be considered investment advice, and you should consult a financial advisor and do your own research and due diligence prior to making any investments. Where securities or commodities are referenced, it is only for illustrative purposes only, and does not imply any position on securities or commodities classification. To the extent that Samsa services are offered or discussed, those services are available only for Samsa whitelisted assets only.

The Mysterious Manipulation of Crypto Markets and How to Manage was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.