Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I will dive deep into answering all these questions to the best of my knowledge, back it with proper citation and try to cut the crap which anyways exists with sentiments and Ponzi schemes.

oh, I get it,

Pump and dump, government regulations, big players calling it out as a bubble, you might be sceptical, aren’t you?

I get your point but here’s the thing, Who are we actually listening to, players in the big league who have piles of cash invested in stock, piles of fiat , piles of conventional shit … and rigidness to accept a new technology/economy shift.

like really ….. ?don’t listen to me, don’t listen to them, listen and reflect on the numbers, the facts and the underlying technology that is powering this crazy stuff.

Foreword

This is not a investors guide or quick rich scheme , I will not go on to tell you that bitcoin will lose to some other coin some other day, because of all the flaws it is built with , I will not tell you that it could be seen as a store of value, just like gold — fixed in supply and governed by classic laws of supply and demand.

Disclaimer

please note that statements and visuals added here are concerned with a reference point in time, due to the volatility of these markets, statements may not always tend to be true.

so learn, unlearn and relearn accordingly.

Okay, enough with sentiments, here are the facts and numbers, again for all those pessimists and optimists, who just don’t a give a shit, be happy with your paper economy. yes you, I really meant that for you.

look, there is generalization everywhere, I would like to bring this to your notice — the varieties in which people are exposed to this concept, how they are brainwashed by the mainstream media may differ ……

so here is what it is

1. Western world governments who very well understand the decentralization it gives to people, and how it can literally mess up monetary systems, with peer to peer nature, are fumbling trying to impose tax and strict regulations.

2. while the totalitarian governments and third world countries- who just rule over people,are least bothered with peoples concern, went over to impose a ban and call it Ponzi scheme, finding ways to curb all earnings made via crypto.

so did anything changed in general ?

did morality of people change with their ability to become independent by all the decentralization hype these technologies have provided?

sadly, it’s a big NO right now, when we look at it at from global level.

What the hell, What do you really mean?

you might ask, and by this time assumed that I similar to all those con artists trying to sell shit technology with their mediocre white and blue papers.

No, I am not doing that, wait a sec and see for yourself …….

“Underlying most arguments against the free market is a lack of belief in freedom itself.” ― Milton Friedman

Nothing can change on its own until we accept the reality that we need to change To change things that are just not right yet. or we can just convince ourselves that things will change on their own.

the ultra ultra rich people are just not gonna do it, they love their paper and money just for the sake of loving it, money in the normal sense and in any form of their investment is like a god to them.

It is not the creation of wealth that is wrong, but the love of money for its own sake. -Margaret Thatcher

so when will the shift really happen ? The so-called “process “will start when all people of middle class intervene, masses in crypto ownership will propel the next-gen shift, it’s only then we can think of changing this world.

here is an interesting case study, to look at things with similar dust and fate…

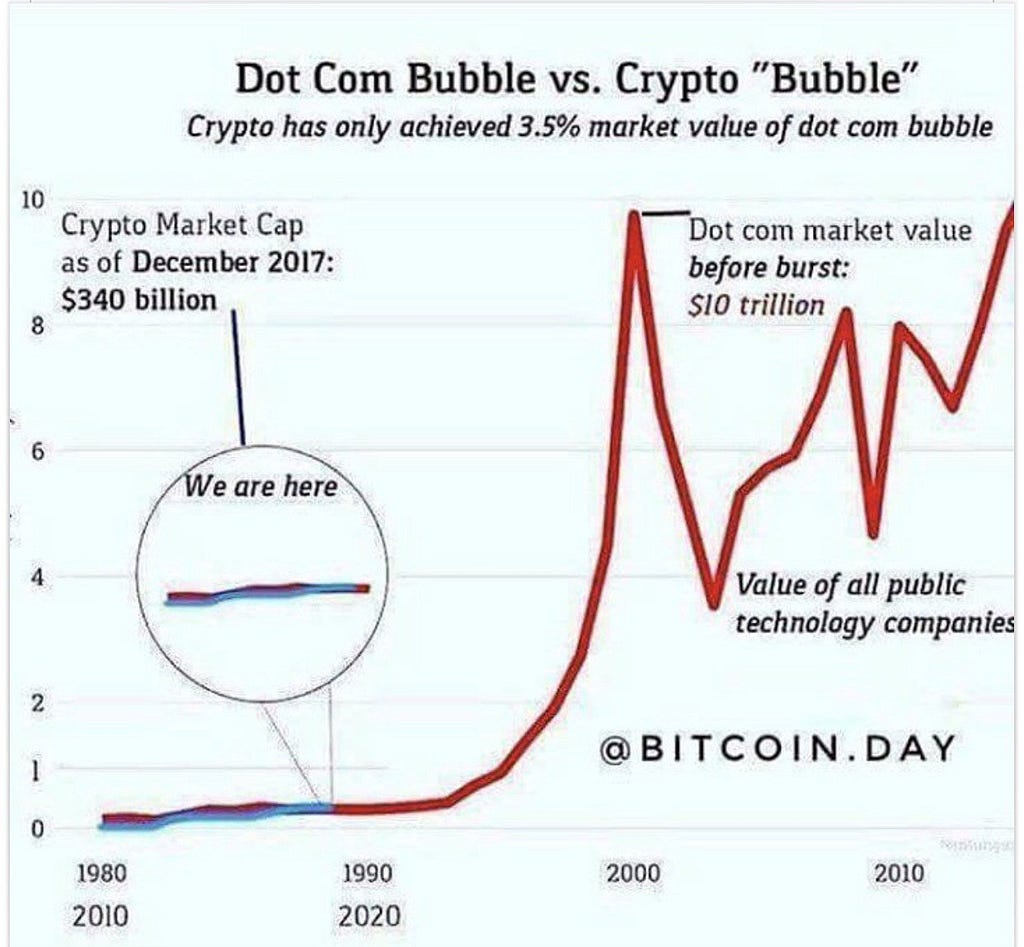

Case Study [ comparing crypto to .com bubble ]

create .com and go public —

back then, in the early days of internet , it was so easy buying into the .com, which was highly overpriced, there was no way the stocks would crash they said and speculated.

In quotes — Ill make him a value proposition that he can’t, refuse.

I sold my house, I sold my car, I sold my shit, I sold everything and I bought into every IPO of the .dot com, just because it was a boom back then, this is what amateur investors would tell you if you were to go back in time and ask them …..

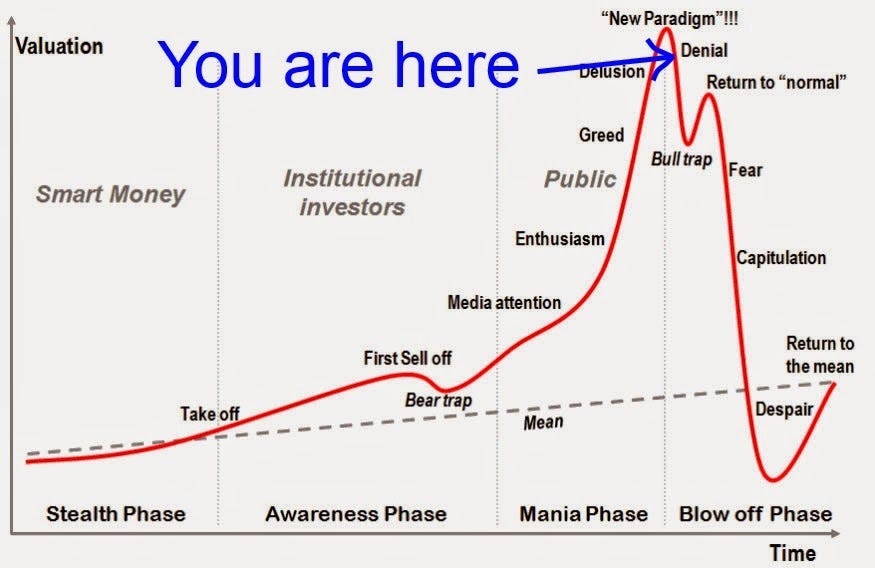

Bam! burst happened, there was a massive FUD, people losing hope and cursing each other, this happened mostly because they were investing not necessarily in a bubble but in a massive hype, the technology was nascent and was highly overpriced. The only way and the only one who survived were the ones who bought into real problem-solving stuff.

People talk about this on a lesser note, few companies actually survived, and they lived up, still doing well nowadays.

So will crypto vanish into thin air, and be valued nothing?

hell no, not at least in my intelligence

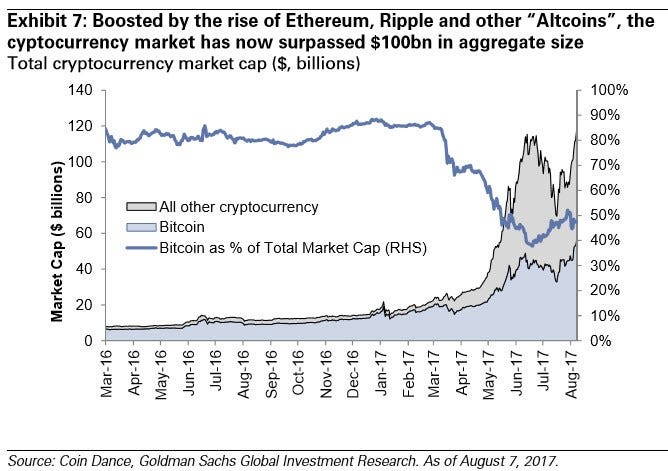

this graph shows, the market cap of cryptos in December 2017, where it was an all-time high, see what has happened today (mid-2018), nobody at that point of time would even have guessed in their wildest dreams about such a dip. This makes my point even clear I guess, you know what I am hinting at.

cryptos will follow the same fate, today we have a market full of speculative investor who is not buying into technology but the hype.

so what is propelling all these shitcoins , which have little to no value, well comrade it is pump and then dump, or vice versa scheme, honestly it might sound harsh but the reality of the fact is, whats wrong if you buy the low and sell the high? , not really, nothing wrong here but its pure gamble, no innovation or no change of the world longing here.

yes, it’s that simple.

This will continue until the market is less of stupid day trading — bots and more of mass investments with real hopes and beliefs in the technology.

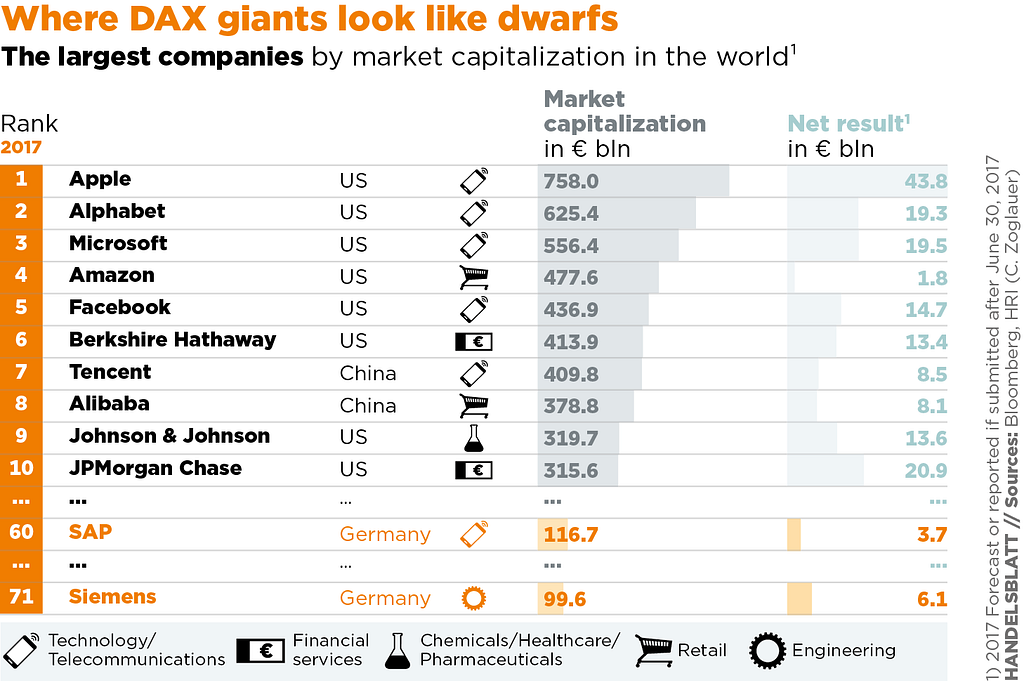

Crypto to Famga(Facebook, Apple Microsoft, Google and Amazon)

My point here is when these tech giants always dominate the charts they leave no room for innovation in such technologies, which could literally affect so many businesses.for ex -Google and Facebook with data management and Amazon with supply chain innovation. Though some of these companies have openly embraced the blockchain they are least concerned with the monetary values or tokenization of the Internet.

Take Facebook for example — facebook had banned all Ico, Crypto ads for few months and as I am writing this 27-Jun-2018 have re-enabled publishing ads in this domain for selected advertisers who shall go through a verification process.

Are Cryptos competing with famga ?

just because you can take an existing idea and put in on the blockchain doesn’t mean that it will change the world. Decentralization is what is the biggest threat to all these tech giants. few properties of blockchain that secure peoples right to freedom, privacy and security is an icing on the cake.

Not necessarily cryptos but the technology and the tokenization of the internet will pose a threat to these companies. ex — decentralized app tokens like Ethereum, Eos with proper governance etc.

Also : A lot of people have misunderstood blockchain with bitcoin .

Is it happening soon ?

not at all, it will take a lot of time for this shift to happen, right now the biggest problems to be solved are memory and scalability of any blockchain before cryptos can largely be adopted.

for instance, bitcoin can handle only seven transactions per second, Aye, an average transaction fee is greater than what it is to feed a child with a balanced meal in a third world country. proof of work, proof of shit?

when this happens, I am sure they would be head over heels.

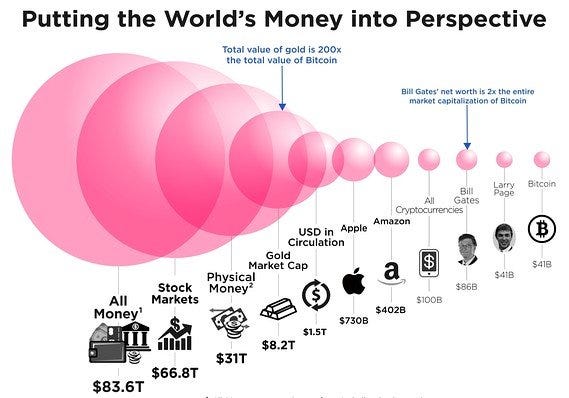

World money division into perspective sourceGiffens Paradox to explain dumps and pumps

sourceGiffens Paradox to explain dumps and pumps

As bitcoin continues to rally and dip, I was concerned whether this phenomenon can be explained by Giffen’s paradox.

here is how any Xcoin can be treated as Giffen good(with an increase in price the demand rises), bending conventional laws of supply and demand.

peter tchir notable economist — had to say this

“I think higher prices, for now, will attract more interest. As prices rise, more people who question the validity will decide it is worth a shot to invest. I currently think that behaviour is how a Giffen good works, the detractors will quickly point out that a Giffen good and what makes a bubble occur is nonexistent. The detractors may be correct (I continue to believe that blockchain will be important over the long run — I am less convinced that Bitcoin will be viable in the long run — but that doesn’t stop me from attempting to trade it.”Libertarian Wrap Up

I have no other FOMO, FUD or any another viewpoint to present to you, no other hype and optimistic words to say, no other rumours to buy and facts to sell.

Sincerely,Crypto Fanatic

How could Cryptos change the world? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.