Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

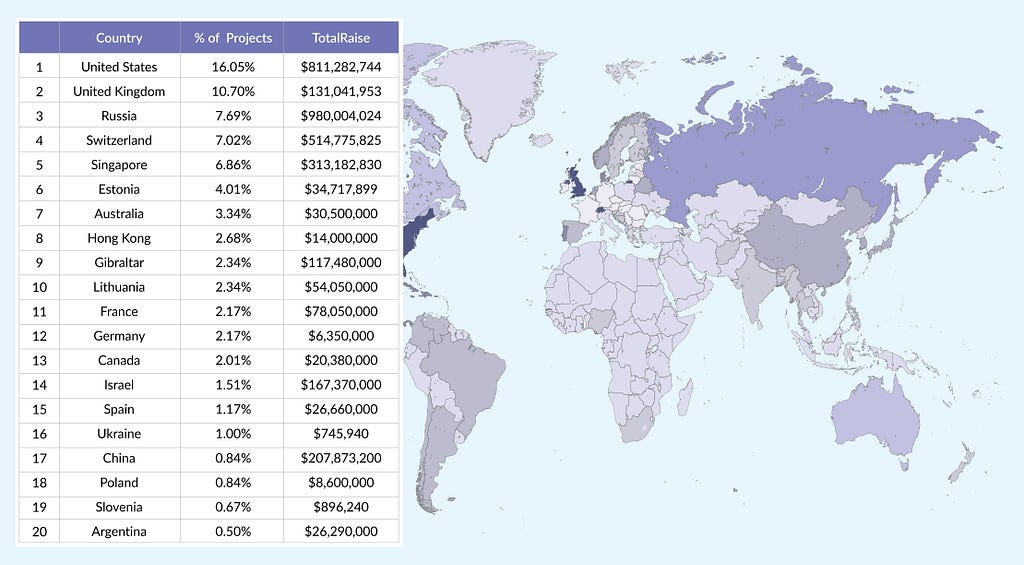

Top countries for blockchain startups and private investors

Cryptocurrency and everything associated with the blockchain is a Pandora box and all governments are well aware of this. That is why all countries are working on their legislation in the field of cryptocurrency and the tokensales to protect their citizens from fraud, as well as enrich the state treasury with tax payments. In this series of articles, we will survey countries that legislatively try to attract developers and buyers of cryptocurrencies, and others that, on the contrary, prohibit and limit as much as possible.

USA

US handles the largest segment of ICO market (by number of projects) and it’s the second largest market of bitcoin, roughly 26%, according to Cryptocompare.

For ICO projects: At the moment market regulation rules are under development, therefore different rules are applied depending on the type of the token, utilities or securities. It is more difficult to issue a security in full compliance with the requirements of the SEC, considering that they have not yet developed the final guidelines, but the company will be better protected from possible litigation with the government. More details can be found in our publications on the STO tokens.

For investors: The US government is working to regulate cryptocurrencies and treat them as securities. If a project is not registered properly with SEC, a US-citizen is prohibited to invest.

For crypto exchanges: Legal, depending on the state. Some states tend to legalize crypto to collect more taxes.

View on bitcoin: Illegal tender, according to Financial Crimes Enforcement Network. For the IRS cryptocurrency is not a currency, but a property that should be taxed. Bitcoin is seen as a tool for criminals and the authorities’ task is to ensure that they do not finance illegal activities.

European Union

About 4% of cryptocurrency’s daily volume is in euros, according to Cryptocompare. Most of the EU countries (Belgium, France, Cyprus, Denmark, Netherlands, Portugal and Spain) have not yet submitted the relevant restrictions, but they all are actively working on the issue, and companies that are planning to take advantage of the lack of regulation should carefully monitor the market.

For ICO projects: There’s a clear plan to implement regulations for the crypto market, though the date is not set yet. No EU member state can introduce its own currency, according to the European Central Bank President Mario Draghi. However ICOs are allowed to operate within the union, as long as they adhere to AML/KYC policies.

For investors: EU citizens are allowed to invest, but The European Securities and Market Authority declared that ICOs represent a high risk for investors.

For crypto exchanges: Legal, depending on the country.

View on bitcoin: There’s an intention to legitimize bitcoin under EU jurisdiction but forcing exchanges to go through the same KYC checking as traditional banks.

United Kingdom

Despite the fact that UK has more than $130 million already raised in 2018 and 10% of all ICOs, crypto market regulations are still to be developed and ICOs stay in the gray zone.

For ICO projects: Although right now there are no particular restrictions for ICOs and crypto, UK’s recently announced the creation of UK Cryptocurrency Task Force. The Minister of Finance is planning to fight anarchy and scams in this sphere.

For investors: UK citizens are free to invest in ICOs.

For crypto exchanges: Legal, and need to register with the Financial Conduct Authority. They are required to meet the same anti-money-laundering counter-terrorism standards as other financial institutions, according to the BOE.

View on bitcoin: Illegal tender. “Only sterling is legal tender in the UK,” according to Mark Carney, Governor of the Bank of England

Switzerland

Switzerland is super friendly to ICO projects. There’re lots of worldwide-known projects that are based there (Ethereum Foundation, Cardano, Filecoin, Tezos, Bancor and infamous TheDAO).

For ICO projects: In February 2018, the Swiss Financial Market Supervisory Authority has published ICO guidelines. Minister of Economics Johann Schneider-Ammann plans to convert Switzerland into “cryptonation”. So ICOs are more than welcome, but need to apply AML/KYC rules.

For investors: Swiss citizens are welcome to invest in crypto and have access to all exchanges.

For crypto exchanges: Legal, need to register with the Swiss Financial Market Supervisory Authority.

View on bitcoin: Legal. Swiss National Bank Chairman Thomas Jordan said in September that he sees bitcoin as more of investment than currency.

France

France holds the 11th place with 2% of all ICO projects by number and $98 million raised. France is very friendly and open to ICO projects and wants to be a destination of choice for them. Bruno Le Maire, the Minister of the Economy and Finance of France said that cryptocurrency is a revolution

For ICO projects: ICO projects are welcome. A group to develop cryptocurrency regulations was announced in January. The plan is to deliver clear guidelines to prevent tax evasion, money laundering, financial crimes, and terrorist activities. Under the draft rules, Autorité des Marchés (AMF) will be authorized to approve ICOs, although AMF approval is not necessary for issuers to proceed. The AMF may simply require heightened disclosure so investors may make a more informed decision.

For investors: French citizens are allowed to invest.

For crypto exchanges: Exchange should be authorized by the AMF. In May the AMF published a list of 15 unauthorized cryptocurrency exchange and investment platforms.

View on bitcoin: Legal tender.

Germany

Germany is showing strong interest in blockchain technology, observed in LBBW bank and the automotive leader Daimler issuing a blockchain debt certificate, 15 insurers (including Aegon, Allianz, Munich Re, Swiss Re, and Zurich) creating the Blockchain Insurance Industry Initiative (B3i) to reduce costs, etc.

For ICO projects: The German Federal Financial Supervisory Authority (BaFin) issued a statement with ICO’s obligations. According to BaFin, German ICO operators “are required to check exactly whether a regulated instrument, [such as] a financial instrument… or a security, is being dealt with, in order to fulfil potential legal requirements without any gaps.”

For investors: German citizens are allowed to invest.

For crypto exchanges: Cryptocurrency is classified as private money, similar to foreign currency. Thus, trading cryptocurrency in Germany is tax free for short-term gains under EUR 600, and for long-term capital gains of over one year.

View on bitcoin: Legal tender. But there will be further regulations according to Joachim Wuermeling, the Director of the German Central Bank (Bundesbank)

Italy

Italy begins to be actively interested in blockchain and following the general EU trends considers possible rules to regulate the industry. Italian startups have been quite successful, having raised $70 million through ICO in last 6 month.

For ICO projects: As for now ICOs are allowed while following AML/KYC rules. The Ministry of Economy and Finance (MEF) is planning to “understand the cryptocurrency phenomenon in Italy in all its aspects.” The Treasury Department of the Ministry of Economy and Finance is also planning to define how and when “service providers related to the use of digital currency” should report their activities to the Ministry.

For investors: Italian citizens are allowed to invest.

For crypto exchanges: MEF is working on improving AML laws by holding exchanges responsible to prevent illegal cryptocurrency transactions and money laundering. Right now cryptocurrency is not yet regulated heavily, being considered means of exchange, separate from legal tender, for purchases of goods and services, that is not issued by a public authority or central bank. Most cryptocurrency gains and holdings are exempt from taxation. However, the Italian parliament introduced a new law that would require identities of parties in cryptocurrency transaction.

View on bitcoin: Bitcoin is considered a currency according to tax authorities and purchases and sales made with Bitcoin remain exempt from VAT. However, Italian tax officials appear to be applying income tax to speculative uses of Bitcoin, or events in which money is made during a sale or purchase.

Russia

Russia has a very strong crypto market: Russian ICOs have already raised more than $900 million and occupy the third place by the number of projects.

For ICO projects: In April 2018 Russian government published a new set of rules demanding ICO companies to guarantee that investors can sell back their tokens. Also ICO initiators have to possess valid accreditations for a minimum period of five years. All accreditations are issued and regulated by the Ministry itself. All fundraising events are required to be registered within the Russian Federation.Crypto ventures need to possess specific licenses to facilitate the distribution and development of “cryptographic commodities.” Transactions need to be executed via the national currency exclusively, and a registered bank account needs to be associated with all monetary transfers.

For investors: Russian citizens can buy cryptocurrency on exchanges legally registered in Russia. The State Duma (the country’s main legislative body) released a document “On Digital Financial Assets” that requires KYC/AML procedures in line with US regulations.

For crypto exchanges: To operate in Russia crypto exchanges should be registered as legal entities that are established in accordance with the legislation of the Russian Federation. View on bitcoin: Legal tender.

Japan

Japan is the biggest market for bitcoin. Almost half of the digital currency’s daily volume is traded in the country’s currency, according to the data from Cryptocompare.

For ICO projects: The Japanese government went against the global grain recently by announcing its plans to legalize ICOs and utilize token sales for positive national gains. With such immense crypto-popularity that continues to grow, Japan is certainly an example of a country that is making huge leaps towards tokenization.

For investors: Japanese citizens are allowed to invest.

For crypto exchanges: Exchanges are legal if they are registered with the Japanese Financial Services Agency.

View on bitcoin: Legal tender.

South Korea

South Korea bitcoin market generates 4% of all bitcoin trading. South Korea has become a serious crypto hub, but its government has been working on strict regulations.

For ICO projects: the Korean regulator, the Financial Services Commission, outlawed token sales in September 2017, saying that they are over-speculative and constitute a “violation of capital market law.” Now, according to BusinessKorea, the National Assembly has officially proposed legislation to permit ICOs as long as investor protections are provided for.

For investors: No restrictions for Korean citizens, but on January 30 the Financial Services Commission Vice Chairman Kim Yong-beom announced measures to ban anonymous trading on domestic exchanges, while foreigners and minors would be completely banned from trading through cryptocurrency accounts.

For crypto exchanges: Exchange needs to register with South Korea’s Financial Services Commission. South Korea’s FTC (Fair Trade Commission) has demanded that crypto brokers modify their contracts to clamp down on fraud. There are also reports of a pending taxation framework set for June 2018. A newly appointed Financial Supervisory Servicegovernor has stated though, that he was in favor of more flexible lawmaking with regard to crypto.

View on bitcoin: Bitcoin is considered an asset that can be confiscated for illegal activity

China

Despite the fact that China is interested in the blockchain technology and spends a lot of money on its development, and even though China is the largest mining country, ICO and crypto exchanges were subjected to a state ban at the end of 2017 — beginning of 2018.

For ICO projects: In 2017, the government banned ICOs and shut down domestic cryptocurrency exchanges.

For investors: Blockchain technology and innovation remain hugely popular in China. Many cryptocurrency fans are not fazed by the China’s firewall; Ripple has stated that it is “very confident” about cryptocurrency re-entering the Chinese market by the end of this year. In addition, the shadow bitcoin trading goes on in popular instant messengers, such as WeChat, providing direct communication between a seller and a buyer.

For crypto exchanges: Illegal. In January, a senior Chinese central banker said authorities should ban trading of virtual currencies as well as individuals and businesses that provide related services.

View on bitcoin: Illegal tender.

Conclusion

At the moment, the most attractive countries for ICO launch is US (because of the size of the market first of all), Europe (due to loyal attitude to token sales), and Japan (as a significant market in volume with not strict restrictions). Russia and South Korea, despite significant restrictions, are still interested in attracting capital. China stands apart, having the most stringent restrictions at the moment, but experts are expecting that China can lift the ban until the end of 2018.

Cover: blog.parkapp.io

Cryptocurrency regulations of the biggest markets was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.