Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

From seeds and precious metals to coins and paper, is digital cash the next step in the evolution of money?How “currency” was born.

From seeds and precious metals to coins and paper, is digital cash the next step in the evolution of money?How “currency” was born.

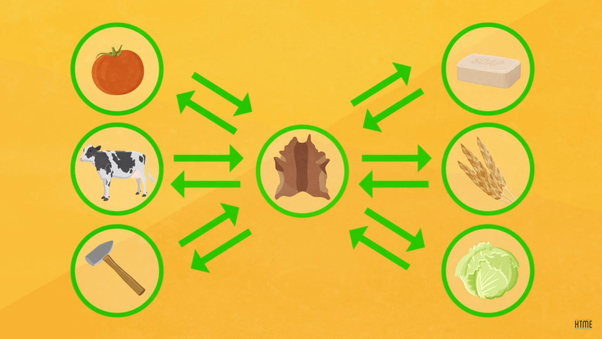

Before the invention of cash money, people relied on a bartering system, this meant that if one person wanted a certain commodity he would have to trade one of his own commodities with the person who owned the commodity he wanted.

For example if you wanted cotton and you found a cotton farmer who was willing to trade that cotton with you for some furs or wheat, you would have to own one of those two commodities to trade.

But what if you don’t have any furs or wheat? Simple, no deal.

Now what if you owned a commodity that was scarce, highly useful and desirable? You would have increased the amount of items you could possibly possess through trade, since this item could be easily traded with many different commodities.

Screenshot from video “Extracting Gold from Dirt: Gold Sluicing and History of Money”

Now we have currency or money, a medium of exchange that is so valuable that people are willing to trade many different commodities for it. It is essentially a bridge between people who need to exchange resources.

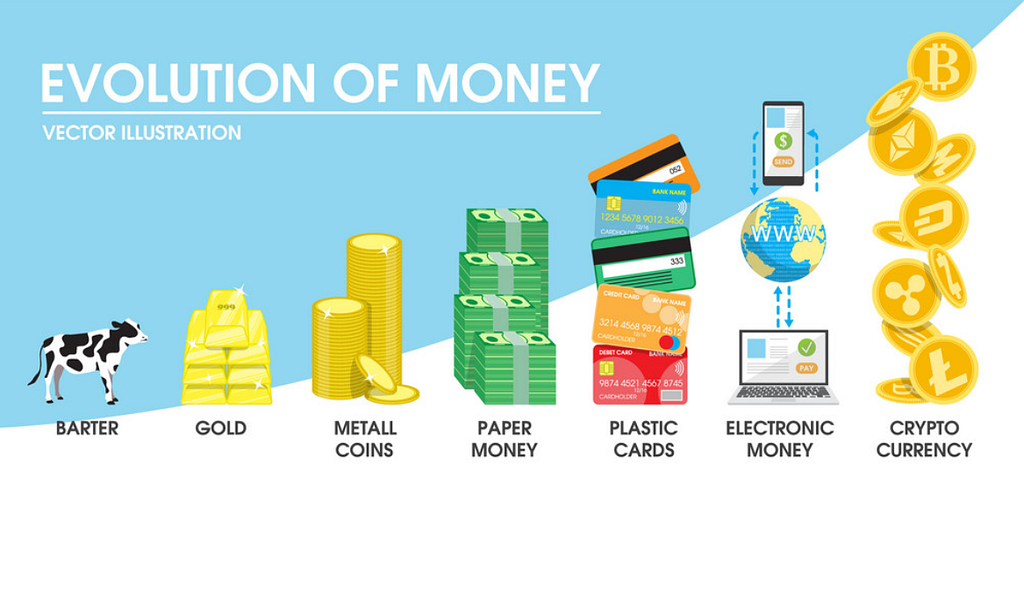

Money has gone through many forms, from seeds and shells to metal coins and paper. The money that we use today is called Fiat currency and it is backed by absolutely nothing, but that is a story for another time.

Is cryptocurrency the next logical step in the evolution of money?

Is cryptocurrency the next logical step in the evolution of money?

The next step we seem to be heading to is digital money, with many people now using their phones to purchase goods, online stores taking market share from physical stores and online banking proving more popular than traditional brick and mortar banking.

So now you must be thinking: Why cryptocurrency in particular?

Well:

- Cryptocurrency is borderless (can be accessed and used in any country).

- It is uncontrolled and built on a peer-to-peer network which ensures stability and prevents any one group from having control (well the good cryptocurrencies anyway). This is also referred to as decentralization.

- Transactions are fast and cheap, with speeds varying from 4 seconds, like the cryptocurrency Stellar Lumens, to a few minutes like Bitcoin and Ethereum.

- Cryptograghy verifies transactions, controls the creation of additional units and prevents double spending (it is called CRYPTOcurrency for a reason).

I could write about this until next week but lets cut to the chase, big money is moving into cryptocurrency now, they are using blockchains like Ethereum and Stellar to build their business infrastructure and to create their own cryptocurrencies.

Bitcoin is currently functioning like a sort of digital gold, for example, traders value their portfolios in terms of how much Bitcoin they are worth, not how much dollars, pounds or euros it is worth etc.

If a traders portfolio increased in dollar value but not in BTC (Bitcoin) value, that is rarely seen as a gain since the ultimate goal of a trader is to increase their Bitcoin holdings.

Cryptocurrency adoption is growing

Cryptocurrency adoption is growing

I remember someone asking me once if cryptocurrency is still a “thing”. Yes it is, a “thing” you can buy houses with, a “thing” you can buy Lamborghinis with, a “thing” you can even use to purchase Microsoft office or a Subway sandwich.

However the real value will be in the business uses of cryptocurrency, I believe we will all use cryptocurrency in the future, whether we are aware of it or not.

Blockchains like Ethereum (ETH) and Stellar Lumens (XLM) will be used to power decentralised applications and smart contracts as well as function as the backbones for the software and operating systems of future enterprises.

A good example is Software as a Service (SaaS) companies which create business software:

- When you log into a website and create an account

- When buy goods or make a payment online

- When you upload a video to a video sharing website

- When you create an online blog or website

All of these processes are powered by software that needs to be paid for, the company either creates their own in house solution or they use a third party solution from a SaaS company.

To access this services you either pay a monthly or one time fee or the SaaS company takes a percentage cut of any monetary transaction that takes place on the customers platform.

This is already being done with cryptocurrencies, blockchain developers are creating services where users will either pay (in that particular cryptocurrency) a fee to use the service, or they will have to hold or stake a certain amount of native tokens.

Another way these new blockchain companies are implementing this strategy is by charging transaction or “gas” fees in the blockchains native currency.

If these services can be adopted then everyday people will be interacting with cryptocurrency without even realising it.

Bitcoin and cryptocurrency seem to be the next steps in how people will transact and exchange value, however I believe we have only scratched the surface and still haven’t discovered cryptocurrency’s true potential yet.

I hope you enjoyed this story, please feel free to check out any of the useful resources below:

You can buy Bitcoin, Ethereum, Ripple, Bitcoin Cash, Bitcoin Gold, Dash, Zcash and Stellar Lumens from anywhere in the world using CEX

You can buy Bitcoin, Ethereum, IOTA, Komodo, Dash, Bitcoin Cash and Litecoin from BitPanda if you live anywhere in Europe.

If you are looking for a website designer for your business or project you can email info@liteworkdesign.com

You can also keep up with me on Twitter.

Bitcoin: How Money Has Evolved was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.