Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As the crypto ecosystem develop, exchanges are playing a significant role. Those which accept fiat, like Coinbase or Kraken are the gatekeepers of the whole ecosystem. Other token-only exchanges, such as Bittrex or Binance are essential to be able to buy various tokens.

If you compare even the most advanced exchanges to a regular (stock/bonds) trading platform, we are still in the junior’s league. To fill the gap, we’ll need professional-grade exchanges able to handle the flood of daily transactions AND all the legal requirements: KYC, AML compliance (money laundering prevention) and any other legal requirements the country they serve might have. And of course, they’ll need to be decentralized.

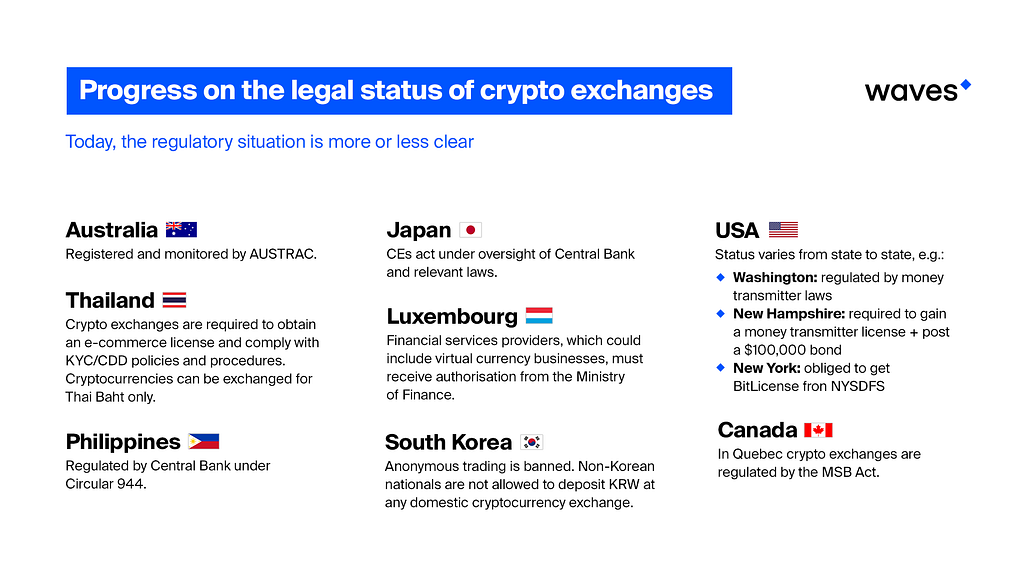

The current regulatory situation around cryptocurrency is getting more precise all around the world. Some countries are more permissive than others, and the tax laws also play a role. Establishing a global exchange is a gigantic task considering the patchwork of different local regulations (in the US, each state can make its own).

Before we dive into Epiphany, I think it’s good to take a step back to understand what this project is trying to achieve. Bitcoin is now ten years old, and the blockchain evolved since its beginnings. Satoshi’s vision for Bitcoin is enlightening to understand the current events in the cryptocurrency ecosystem.

THE IDENTITY CRISIS OF A TEENAGE BLOCKCHAIN

THE FOUNDING PRINCIPLES

Originally, Bitcoin was created as a reaction to the 2008 crash. Satoshi, its creator, wanted to create a new form of money, with two key characteristics to prevent the same scenario from happening again:

- Decentralized: unlike banks, blockchain networks are maintained by many users, and not only the company/development team. Depending on the project, the community can help by verifying transactions, running nodes, or even contributing to the communication and marketing. No one is sovereign to say where the project should go. There is no single point of failure on the network: to compromise it, one must gain control over it. (the 51% attack) Decentralization is critical, but it’s not given.

- Trustless: DAO (Decentralized Autonomous Organizations) are organizations that run through rules encoded in smart contracts. They allow the creation of services that are run by the community (mining/node/PoW) and publicly auditable (the code is available to review). Therefore, trust is no longer required, unlike regular institutions. Instead, you can audit the code yourself to make sure it’s honest, or check the reviews made by the community.

VERSUS THE CURRENT REALITY

Those principles were the spirit of the beginning, and it served the community well. Yet nowadays, some significant projects are compromising on decentralization. Indeed, decentralization is hard and tedious. Some companies chose to go another way instead: they start centralized and promise that they will decentralize once they scale, like Binance. Currently, most of the main crypto exchanges are centralized: the company running the exchange serves as a middleman. Coinbase or Bittrex are one of such exchanges.

You see the problem though? Not only the first principle is broken, as the service is no longer decentralized. No, you also need faith in the honesty of the project leaders so that they effectively work towards decentralization someday. Therefore one could argue that the second principle, being trustless, is also not respected.

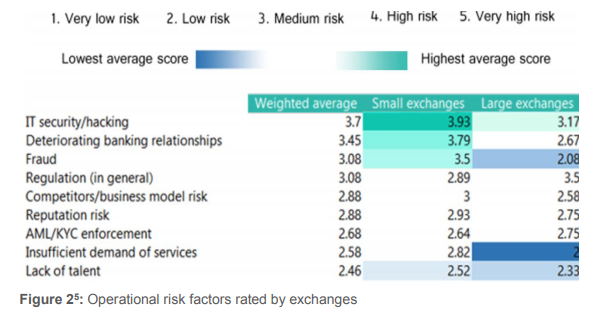

A summary of the main risks associated with centralized exchanges (

A summary of the main risks associated with centralized exchanges (

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.