Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I spoke at an event the other week organised by Silicon Valley Bank and ADV, alongside Seedcamp, Episode 1 and my friend Volker Hirsch (angel investor whose sage advice I respect a lot)...

Anyhow, we were talking about seed rounds, when Volker asks:

‘How many founders in the room understand the business model of a VC?’

I didn’t see *any* — but this is England, so you could have asked how many people were breathing and probably got the same response.

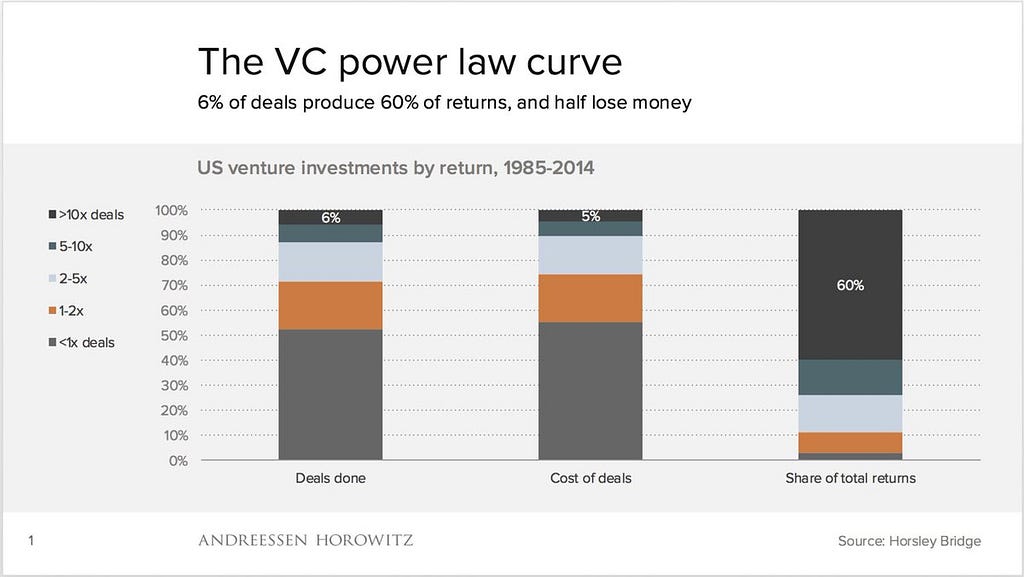

Venture capital lives by the ‘power law’ — essentially that normal distribution doesn’t apply in the venture world, but returns are governed by break-out companies achieving 10x+ returns, not a bunch of investments earning 10%.

This means VCs need to be skewed to backing companies capable of achieving returns way above the £100m mark, therefore hitting big markets with super-bold innovation.

In Nassim Nicholas Taleb’s language — VCs have to maximise their exposure to Black Swan events (unpredictable occurance with major effect, inappropriately rationalized with hindsight 😜). That doesn’t happen from thinking small, so every bullet in a venture fund’s belt, has to be capable of hitting the target and returning their fund.

Start-ups have to optimise for this, or look elsewhere for cash.

This Andressen Horowitz chart illustrates the power-law pretty well, in that 6% of VC deals pay out 60% of the fund and 50% of them pay less than 5%.

https://twitter.com/BenedictEvans/status/1008038770396942336

https://twitter.com/BenedictEvans/status/1008038770396942336

If you want to take a closer look:

- @HomanVC has a good post on how VC maths works here

- Peter Thiel does a great job here

- Shane Parrish talks more generally about the power law here

What the Power Law means for startups…

I’ve put together close to 40 transactions in the seed/Series A space and it’s clear that start-ups don’t just need to fit into a power-law model — to succeed, they need to make their own.

So, I try to do these things I’ve called ‘power rounds’ — those deals that stack the odds hugely in favour of a company’s breakout, and ultimate success.

To be clear, this isn’t a definition of success or a guarantee — but it can be a significant contributing factor. (I laboured the success point here.)

People talk about ‘smart money’, but I think that’s only part of the story.

For me, smart money means that the investors make an active commitment in a company they understand that operates in a sector whose dynamics and development they have a deep knowledge of.

I guess the opposite is ‘dumb money’ — where investors follow the crowd or use tax mitigation as an investment thesis exclusively.

The results aren’t always what you’d expect.

Smart money sometimes gets impaired by ‘expert bias’. Dumb money’s success depends on an investors dealflow and spread.Power money is different .Stay with me…

IT’S ALL ABOUT THE BREAKOUT

The entire VC industry is fuelled by breakout companies — it’s those that allows investors to pay back their entire fund with one deal (ideally, a few times over).

For start-ups as well, breakout is a whole new world— that point where you’re well defined in terms of product, model & strategy, in a strong revenue flow and you’ve left a pack of competitors behind.

Think Revolut’s seed (and then Series A/B ) with Balderton & Index, or FiveAI’s seed round (followed by A/B) with Amadeus, Notion & Kindred, or more recently, Chargifi’s A round with HP, Intel, ADV and Firstminute.

Each of these rounds are enablers, not just to shake off funding risk and bring on a great board, set of expertise and network of investors to the table — but to enable breakout…

…and it’s the breakout that gets you through the tipping point on the way to a meaningful market position and 🤑exit.

BUT one startup’s power round is another startup’s nightmare.

Imagine being a deeptech start-up in slowly developing market, with the same growth-hungry seed shareholder base as Revolut. These guys only came in at the seed round to double down on growth and pile cash in at A and B rounds. If you’re ahead of your market — that’s going to be a very uncomfortable place to sit.

Likewise, if you’ve taken cash from a corporate investor — that could make or break your company depending on who you are and what your strategy is. Maybe it’s a great signal to the market, but constrains your exit. Maybe the corporate investor changes strategic focus away from supporting its portfolio (or just your area) and you’re stuck with a dormant investor who can’t follow and gives a negative signal to everyone else.

Because breakout is such an individual thing, and no two power rounds look the same.

The challenge when it comes to fundraising, is to work out what your power round is and how to unlock it — how to build those critical investor relationships and make the VC model work for your company.

A couple of examples of a power round in action…

Taking funding risk off the table

A couple of years ago, the founders and I were putting together a large Series A for one of my portfolio. The company operated in an upcoming consumer space that wasn’t without competition — 2 major, well funded incumbents and a bunch of smaller, less relevant companies. We needed relatively impatient capital with lots of ambition and deep pockets.

My guys had the skill and ambition to breakout here, and we were offered terms from one of the large US investors — the sort of guys you want on your cap table.

I think it was a UK public holiday, so we took some time to think the offer over and gradually went sour on it:

- We’re going to need to raise a Series B — what if these guys lose appetite for Europe and we’re left to fundraise from scratch?

- Are they going to be almost maxed out with us when it comes to Series B? Then we’ll have a load of external raise to do.

- If they play in our space, aren’t they just going to give local VCs appetite to build that thesis and invest in competitors?

- What value do they bring beyond money and brand?

- Is this just a ‘bet’ in the space and geography for them?

In short, they weren’t our power round.

Who was?

A syndicate of top tier VCs with huge experience in consumer and a pretty good knowledge of our particular sector, who could commit now with a meaningful follow-on at B and maybe C, perhaps with some outside cash on top to set a price.

But isn’t that anyone’s power round? Nope.

Strategic positioning

I had a company early in my career that imported and sold e-cigarettes — at this point the market was really in its infancy. Their plan was to re-engineer the product so that it didn’t fail 95% of the time, and that led them to think about CE Mark and calling it a medical device.

We had offers from a number of VCs — but the power round? The guys that understood this was a regulation play, not a revenue spinner; and had the experience, money and patience to help us through that.

As it happens, it didn’t take long… 15 months after closing the round, the company got acquired.

Power round, init?

The Power Law Works Both Ways was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.