Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The blockchain revolution is undoubtedly spearheaded by the likes of cryptocurrencies and even more cryptocurrencies.

Startups are slapping their names on an ICO and marketing it out to raise millions of dollars under the guise of a “much needed” product.

However, blockchain technology is certainly more than a store-of-value or a mere speculative investment.

The logistics, shipping, and value chain sectors are at the forefront of blockchain adoption, while financial institutions are slowly yet cautiously embracing the tech.

Meanwhile, several other highly technical sectors could do with the good ol’ blockchain, and prove to be a large domain of implementation for the nascent technology.

It all really boils down to this one thing —

Blockchain = Trust.

An immutable ledger running on participant computers who don’t know and never interact with each other? Yes please, I’d take that.

More than me, think about those billion dollar sectors who rely on trust between vendors and sellers for conduct their businesses. (cough*logistics*cough*shipping*)

While these sectors command their fair share of attention, there’s one domain which is arguably worth trillions of dollars and looks primed to be benefited with the blockchain.

Intellectual Property.

Yeah, you heard that right.

Our creations, our arts, our music, our patents, our data, and our sensitive knowledge.

It may not be popular information, but I.P is a huge, huge deal for companies and public corporations.

IP is Vulnerable. The Owners are Cautious.

Think about one thing Facebook, Google, and Twitter have in common?

Yeah no, it’s not an alphabet, not a campus-freebie, not a similar UI.

The firms acquire and sell YOUR data.

Remember that Google survey you took? Or the Facebook page you liked? Or the Twitter celebrity you followed?And then somehow magically it all starts appearing around you?

It not a stroke of luck or God playing games. You see things they want you to see. You hear things they would like you to hear.

All because you casually accepted those pesky T&C’s and agree to share your data for them to monetize.

While sharing data, or I.P, is a million dollar market for the corporations, most of the public has no idea of this or can’t do this or can’t even choose what to sell and what not to.

The reason? Expenses.

For musicians or companies, from janitors to CEOs — The I.P process is a costly affair, and commands money paid out to a legion of bankers, lawyers, and taxi drivers.

While this won’t make that much of a different on an individual level, small business and startups are akin to innocent Facebook users — with their data and sensitive company information having the bare minimum of ease while selling or transferring rights.

But, blockchain and smart contracts can make it easy for facilitating the trade of I.Ps conducting a peer-to-peer transaction and recording it all on an immutable database.

Costs aside, low transparency of the IP sales process has highly discouraged entrepreneurs and young founders to list their valuable information online.

Clearly, there is a market of buyers of high-quality information, and there are sellers are well.

The missing piece of this puzzle is a robust, blockchain-based IP platform.

For filling this clear gap, companies like Lexit and Polymath are taking significant steps forward.

While Polymath offers a platform to build one’s own Security Token, Lexit tokenizes one’s I.P, and allows for seamless trading among trusted participants.

Based in Tallinn, Estonia, Lexit provides startup owners a noteworthy avenue for selling their companies.

The company believes that digital tokens need to have a solid backing, rather than a promise of hot air.

Hence, Lexit envisions an economy of the future which runs on individuals and corporations selling their data to each time in a real-time, quick, secure manner.

Simply put — Lexit transforms I.P, such as patents and rights, and into a single tradable token that is available to interested parties.

Lexit clients and users can not only trade their I.P, but even break their I.P into smaller chunks for sale.

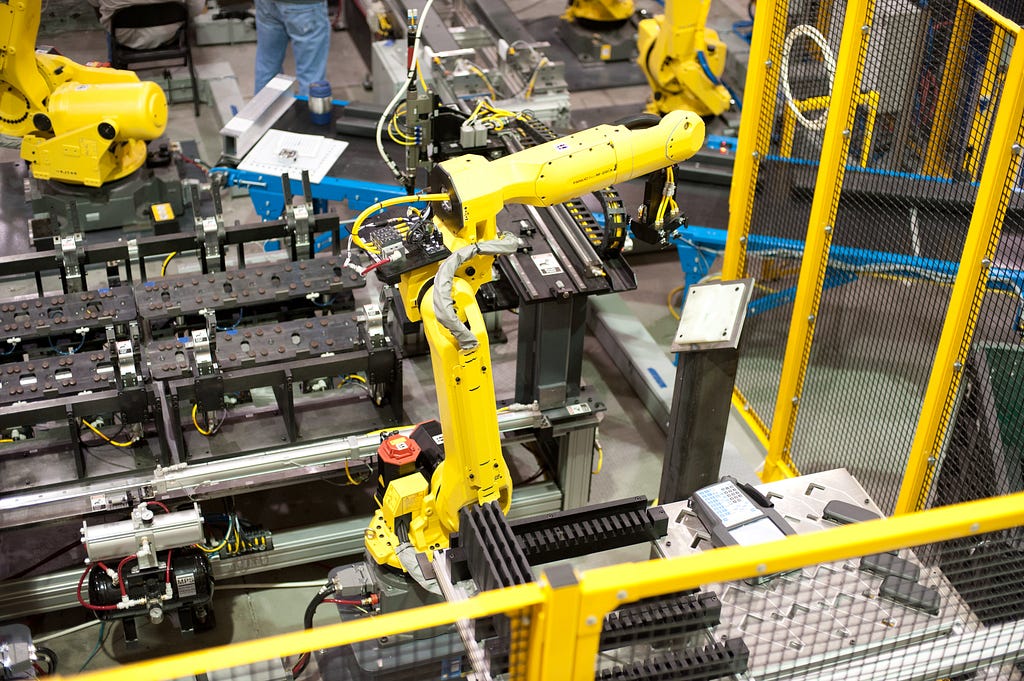

For example — purchasing an I.P in full is not only expensive, but there may be some information to it which of use to the buyer. Imagine an IP about a automobile factory’s chassis cutting arm.

Perhaps Company A is interested in the chassis design, and Company B in the arm itself?

Two different tokens are created for one underlying I.P with different, modular elements to it.

Lexit makes THAT possible.

In the tokenization of IP, the whole intellectual property will be one whole asset, and will be divided among several smaller chunks.

Think of it as one bar of gold in the bank which backs several fiat notes.

Tokenization of IP would be very close to that.

What founders can also do on LEXIT is put the whole startup on our platform and then decide that, if they can’t find the buyers, then they should tokenize it into smaller chunks, and then sell those to other people.

Additionally, in May 2018, Lexit partnered with China-based Metaverse to tokenize intellectual property.

As stated in the announcement —

Metaverse is an open-source public blockchain that will allow LEXIT to provide a safe and secure environment for the trading of intellectual property (IP), assets, and parts of or entire companies.Entrepreneurs will also for the first time have unfettered access to a global market where mergers and acquisitions can be conducted faster and cheaper than ever before.The functionality provided in digital assets, through the Metaverse Smart Token (MST), allows users and startup founders the power to generate and distribute their own cryptocurrency.

Digital Identification

In this highly-anonymous process, isn’t it implied to save one’s identity in a similar manner?

The blockchain brings trust to tokens, information, and even identities, and Lexit implements a digital I.D system to build a user’s “reputation” on their platform.

As a user contributes more — their trust increases in the system, and contributes towards creating a robust, secure, I.P-powered economy.

Fin.

Intellectual Property, Digital Identities, And the Blockchain was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.