Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Everyone knows that bitcoin and cryptocurrency prices have been on a steady decline since the last month of 2017. While digital asset spot prices have been quite volatile, bitcoin futures products provided by two of the world’s largest derivatives exchanges, Cboe and CME Group, have seen a steady increase in trade volume and more liquidity within these markets. Furthermore, Cboe is hoping to launch a bitcoin-based exchange-traded-fund (ETF) and the US Securities Exchange Commission will decide on the fate of this new product on August 10.

Also Read: Bitcoin in Brief Thursday: Crypto Phones, Spy Games, Binance CEO vs Vitalik

While Spot Prices Decline Bitcoin-Based Futures Contracts Have Been Steadily Increasing

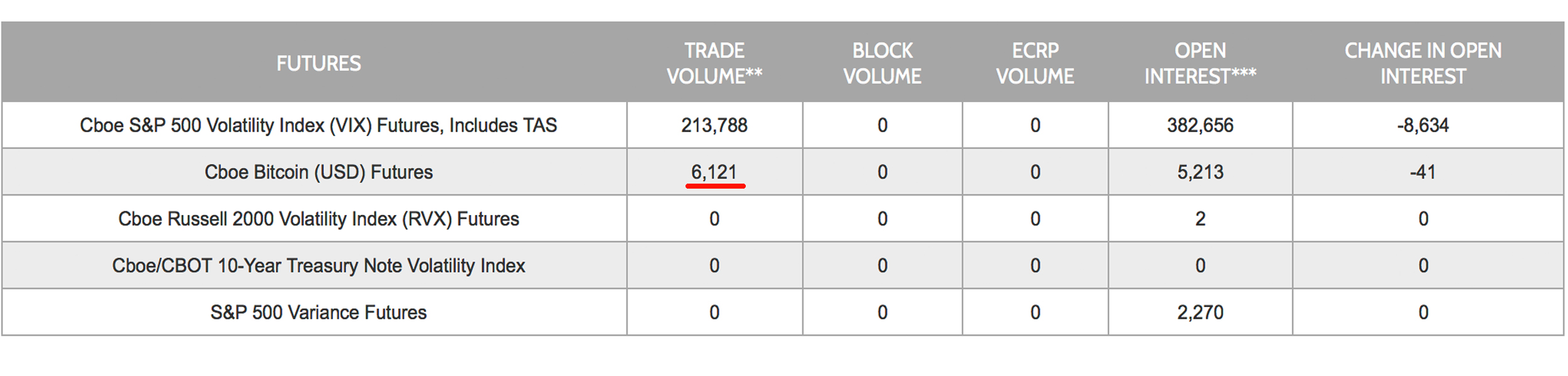

Cryptocurrency spot prices have been in a slump over the past two quarters of 2018 but rumor on the street is institutional interest in cryptocurrency custody and regulated investment vehicles is picking up speed. Even though market sentiment has been bearish, futures contracts sold by Cboe and CME Group have increased significantly during the second quarter of 2018. Right now, on July 12, there have been 1199 contracts filled so far and products for the month of August are adding up today as well. Cboe has been selling between 2500-18,000 bitcoin futures contracts per day.

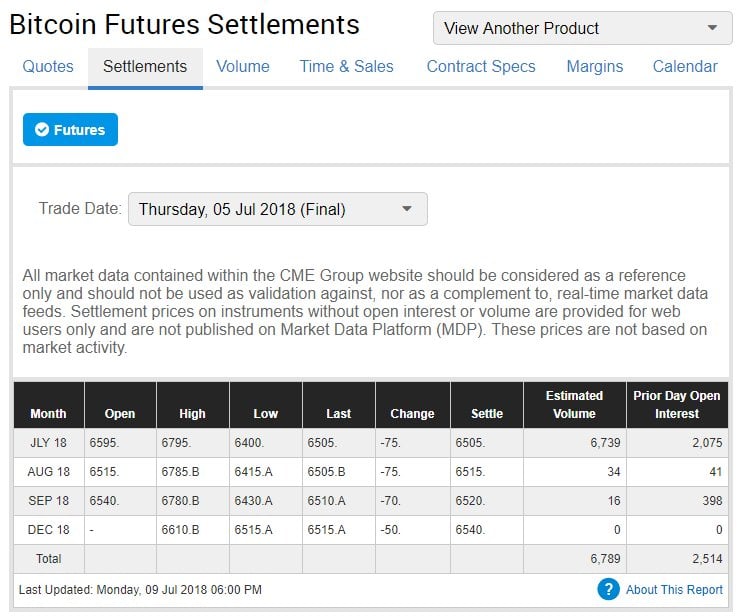

CME Group sees a spike in futures contract volumes on July 5.

CME Group sees a spike in futures contract volumes on July 5.

CME Group’s bitcoin futures volumes are usually less than Cboe’s trade volume but contracts sold on Globex have also spiked. Today CME has 2634 contracts sold for July and products for August and September are seeing a small increment of sales. CME Group’s contracts jumped to 6739 on July 5, marking a new record for CME’s bitcoin derivatives market. However, it’s still not even close to the record-setting 18,000+ contracts Cboe recorded on April 25. With the steady trend of investors getting into bitcoin-based futures products, Cboe hopes these derivatives markets will pave the way towards a bitcoin ETF.

Cboe bitcoin futures touched 6,121 contracts on July 5.

Cboe bitcoin futures touched 6,121 contracts on July 5.

The Fate of the Cboe Bitcoin ETF Will be Decided August 10 — Will the Futures Markets Launch Affect the SEC’s Decision?

On July 9, Cboe announced it has filed an application with the US Securities and Exchange Commission (SEC) so it can sell a bitcoin-based ETF backed by the Vaneck Solidx Bitcoin Trust. The SEC is seeking public opinion concerning the ETF application in order to help guide their decision on whether or not they will approve a bitcoin ETF this time around. Since the first announcement this past Monday, the SEC has revealed the fate of the ETF will be decided on August 10.

The SEC will decide on Cboe’s bitcoin ETF application on August 10, 2018.

The SEC will decide on Cboe’s bitcoin ETF application on August 10, 2018.

“We believe that collectively, we will build something that may be better than other constructs currently making their way through the regulatory process,” explained the Vaneck CEO Jan van Eck this week.

A properly constructed, physically-backed bitcoin ETF will be designed to provide exposure to the price of bitcoin, and an insurance component will help protect shareholders against the operational risks of sourcing and holding bitcoin.

The SEC may also look into how well the current bitcoin futures markets have done so far, and if there were any issues during the launch of those derivatives products. With the bitcoin futures volume spikes, there’s been a lot of action within these regulated market settings and investors seem to want these products — And some people think a bitcoin ETF should naturally follow.

What do you think about the bitcoin futures trade volumes and current interest in these products? Do you think that the SEC will approve Cboe’s ETF application based on their prior experience with these futures markets? Let us know your thoughts on this subject in the comment section below.

Images via Shutterstock, Cboe, and CME Group.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.