Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Steve Tendon is a prominent Blockchain Strategist and Advisor who founded and was the first Chairman of the Blockchain Malta Association. He’s also a key member of Malta’s National Blockchain Task Force. This is the team responsible for advising the Government of Malta on its trailblazing blockchain strategy.

Steve Tendon

And you know those three new groundbreaking laws passed by Malta last week? You can thank him partially for those. In fact, Tendon is among the brains who developed the vision of “Malta, the Blockchain Island” and he personally authored Malta’s “National Blockchain Strategy” in 2016, a proposal with six core projects.

We’ve all heard about Malta’s ambitious plans to foster innovation and encourage cutting-edge technology on its shores. But is it possible we underestimated the tiny island famous for its transparent waters, booming expat community, and fiscal leniency?

“Malta’s not well known for technology,” Tendon admits, “but it does have some outstanding companies and brains, and of course the success we’ve had with the iGaming sector (an industry worth some $1.4 billion and accounting for around 12 percent of Malta’s overall GDP) has brought a lot of knowledge in terms of modern scalable IT web-based services and solutions. There is also a lot of infrastructure and experience.”

Malta Has Ambitious Plans

Malta is small. With a population not even reaching half a million, it’s not exactly a key player on the global stage, but that could be about to change. “Of course, it’s not Silicon Valley,” Tendon smiles, “but the regulatory framework that we have been preparing for the last two years is attracting blockchain companies.”

And there are plenty of reasons it should. All businesses need clarity and certainty to grow and make long-term plans. But from what we’ve seen so far, regulators around the world are struggling to keep afloat when it comes to blockchain technology.

In some cases, they’re scrambling to catch up. In others, they’re over-compensating for a lack of involvement when swathes of investors were scammed out of their money. Some are finding loopholes in existing laws, others are trying to adapt existing frameworks. Malta is storming ahead as the first country in the world to create new regulation for new technologies.

And Malta’s blockchain strategy goes way beyond regulating ICOs and cryptocurrency. They’re preparing a regulatory framework for the future. Let’s take a look.

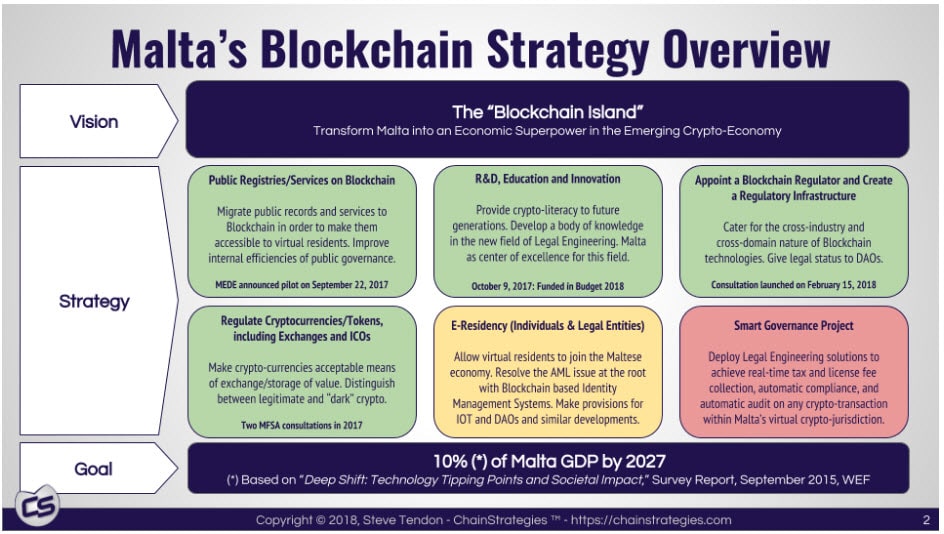

Malta’s Blockchain Strategy

Malta’s Blockchain Strategy / https://chainstrategies.com/2018/02/18/maltas-national-blockchain-strategy-the-big-picture/

Malta’s regulatory innovation is so interesting because it seeks to give a framework not just for ICOs but for blockchains, decentralized computation, decentralized organizations, DLT, and other innovations to come.

The following six key projects are at the strategy’s core.

1. Public Registries/Services on the Blockchain

“Project one is underway,” says Tendon. In fact, when the Ministry of Education and Employment in Malta announced they would place all academic records on the blockchain in September of last year, they became a world first. This is the status the country is starting to get used to.

2. R&D, Education, and Innovation with and on the Blockchain

This project is necessary to create knowledge around this sector on the island. Anyone invested in crypto knows that Malta plans to be a leader in the blockchain space. But, do people in Malta know they’re living on the blockchain island? What’s the general public’s level of awareness and understanding right now?

“Probably Malta is more aware than other countries, given the huge attention that has been given to the sector. I cannot say to what extent the familiarity with blockchain equates to an actual understanding,” says Tendon.

“We are concerned about educating all parts of society about the blockchain, which of course, starts in the public services sector where people using blockchain technology must have at least some working knowledge about it. But it goes up to all levels of academia, with the University of Malta carrying out cutting-edge research and development.”

3. Appoint a Blockchain Regulator and Create a Regulatory Infrastructure

“The most important project of all in those six was the inclusion of the digital innovation authority,” says Tendon, “because that created the necessary foundation so that all other projects can come to fruition.”

This is also partly why Malta was criticized for being slow to regulate ICOs. They were establishing the foundation for a much more holistic and inclusive regulatory framework.

4. Regulate Cryptocurrencies/Tokens, Including Exchanges and ICOs

“Of course, the regulation that everyone has been waiting for is the regulation in cryptocurrencies and ICOs. We are clearing out a lot of gray space between the security and the utility token.

There will be a so-called financial instrument test whereby whatever token is being proposed can clearly be qualified, and on one extreme it is a security and the other is a utility. But in between, it can be a hybrid and basically a virtual asset which is traded on an exchange.”

Regulating Cryptocurrencies and ICOs

5. E-Residency and Digital Identity (of Individuals and Legal Entities) on the Blockchain

This project involves giving E-Residency to individuals and legal entities. This is in Malta’s pipeline for the future. They see digital identity management as fundamental for the development of the Internet of Things. For IoT to flourish, there must also be a regulatory framework for the Identity of Things.

“This is one area I have really been researching, the Identity of Things. We all know about the Internet of Things, it’s going to be enormous in the next 5-10 years. But when we have all these things, many of which are going to be autonomous, going about in the physical world, at a certain point there must be some way to identify them.”

6. Smart Governance

This is a “very ambitious project which is still on the drawing board,” Tendon remarks. “Smart governance would apply smart contract technology to the working of regulatory bodies. So, for tax collection and licensing, for example, and many similar things.” It may be a few years before smart governance is ready, he admits, there are plenty of challenges ahead.

That said, out of Malta’s Blockchain Strategy, “Four of the projects are happening and the rest have been accepted with great openness and interest, so I think it will be a matter of time,” he says. “First, to get over the things done so far and then we will refocus and start working on the next projects.”

What Are Other Regulators Getting Wrong?

Even glancing through Malta’s strategy, you can see that clearly, there’s more to it than just deciding if tokens are equities or securities. So, while the rest of the world is still getting held up on that hurdle, Tendon believes a deeper understanding is needed. And, in fact, cryptocurrency and blockchain should not and cannot be separated.

“Many [regulators] are trying to draw a line, like cryptocurrencies are a bad thing and have a negative reputation for money laundering, crime, etc. That negative statement is often counter-balanced by a more positive outlook on blockchain technology. But, for me, the two things are tightly connected,” he explains.

“What makes blockchain technology so interesting and exciting and gives rise to all these incredible opportunities affecting any industrial sector is the notion of a smart contract. This is decentralized computation rather than decentralized storage. In that context when you have decentralized computation you need a mechanism to prevent the freezing of global computations–that are performed on a global network like the blockchain. In other words, to prevent that computation from getting into an infinite loop and blocking the whole system.

“There is no way you can have a smart contract platform that is as sophisticated as the one that Ethereum has implemented today (but there will be others in the future) unless you also have a cryptocurrency that is being used to “pay” for the computation. So the distinction between cryptocurrency and blockchains are really artificial: they are just two aspects of the same coin.”

The Danger of Using the Wrong Label

So, is it problematic putting labels on everything, whether they are equities or securities, or utilities, for example? “It basically shows that there is a lack of understanding,” Tendon says. “Once people realize the potential of these technologies, it will be clear that Malta is way ahead of other jurisdictions for regulating the blockchain space.”

This profound understanding of the technology is something that is lacking in many jurisdictions, quick to categorize and label.

“Certainly, these technologies can be both securities, equities, commodities, tokens. They have all these features and facets and attributes. It’s like beauty is in the eye of the beholder, whoever is looking at it will see what he or she wants.

“Of course, if it’s a regulator looking at this, the bias will show through in the regulation and that can either favor or hinder the adoption of innovation and further development of innovation. So yes, it is problematic, but it’s lack of understanding of what it’s really about.”

United States Securities and Exchange Commission, D Ramey Logan, CC BY 4.0, https://commons.wikimedia.org/w/index.php?curid=36799399

Existing Laws Cannot Suffice For New Ideas

Another tendency we’re seeing around the world is regulatory bodies using loopholes in existing systems or tweaking their current laws. Switzerland, for example, applies Principle-based law, judging on a case by case basis. Germany distinguishes between two types of securities to allow for compliant ICOs and Equity Token Offerings (ETOs). Why is new regulation essential if we can work with these existing frameworks?

“A ledger system is nothing new. It’s been around for thousands of years from the first clay tablets that were recording how many sheep the king owned, until modern times. It’s not a novelty. The novelty is that this ledger has two features, one it’s global and two it is uncensorable. You cannot change what goes on to the ledger. This creates a few problems that current laws and regulations are not prepared to handle.”

Tendon believes that existing laws are not sufficient for new ideas, for two main reasons:

1. Who Regulates What?

“Since it’s global and so generic, as a ledger it can affect literally any industry, any commercial activity in the world. So we have this problem that we have regulators that are concerned about certain areas of the economy. For example, in Malta, you have the Malta Financial Services Authority, which of course is about financial services. You have the MGA (the Malta Gaming Authority), concerned about gaming.

“Up until now, they have been working in isolation and had a clear mandate on what they were regulating. They were never stepping on each other’s toes. Since crypto turned up on the scene, last year we had incidents where statements that came out from one regulator were contradicting what was coming out from the other one. So that was a problem. And you see this even more in the US.

“This notion of the security. On the one side, the SEC is calling it a security, on the other side you have the tax authorities who claim it is a commodity. So even within the same jurisdiction, there are these contradictions. This has lead Malta to create a new regulator, the Malta Digital Innovation Authority.” Tendon emphasizes innovation, rather than simply blockchains, to accommodate other technologies.

“What this regulator will do is to ensure that when there are developments, technology innovations that can affect multiple regulatory spheres of action, there will be some sort of governance of management of those areas. So it becomes very clear to see who is responsible for what. So we don’t have different opinions–or even worse–different and conflicting regulations. And we don’t have entities regulating things that are outside of their original mandate, simply because they don’t understand the technology.”

2. We Need New Laws For New Situations

“The second area that needs new laws is this foundational idea of decentralized computation. Remembering what happened in 2016 with “The DAO” hack, that led to the famous fork and Ethereum Classic. Well, those people who were robbed, it appeared that the SEC was going after them as the co-responsibles for the hack, which is almost absurd: people investing become guilty of someone else’s crime.

“My point here is to capture that current laws do not deal with these innovative tech arrangements. With a DAO, decentralized application, you have these completely decentralized and autonomous organizations that are self-sufficient. They collect funds from the people and companies that consume their services.

“They are on the blockchain; and the blockchain remembers forever, so they will exist forever, even past the extinction of its initial creator. So we will end up (whether we like it or not) in a situation where services are provided by software on the blockchain and there is literally no one behind it.

“So what happens when something goes bad? Who is responsible? These are huge questions in my opinion and what is happening in the next regulation? These questions need new laws to be addressed. There aren’t existing laws that do.”

Will Malta Set the Standard for Global Regulation?

Is it ever going to be possible to achieve a global standard in regulation? When you have disputes within one jurisdiction and discord within the same authorities? Will we ever have a universal agreement on how to regulate the future?

“I don’t know if it’s possible, but maybe another question is: is it desirable? Think about the Internet Protocol, it’s a global technical communication standard but beside the W3C Consortium, there is really no international global standard of Law regulating the internet.

“In fact, we see this very clearly when it comes to privacy laws, Europe has the GDPR and the US has something different, and other countries have something different again. So there will be too huge interests to keep things distinct and avoid a global standard.

“It’s probably a positive thing because it creates competition between jurisdictions and that’s a good thing. Competition is always good for innovation and what we’re trying to do in Malta is innovate in terms of Law.

“Let’s hope this will continue. Maybe other countries will try to follow Malta… that would be a great testament to the work we’ve done here. It’s like open source technology, which is continuously evolving and new creations inspired by older ones. It would be great to see that kind of evolution in the regulatory space as well. The more competition there is, the faster things can evolve.”

The Malta Blockchain Summit is coming up this November and it will be interesting to see how Malta’s Prime Minister Joseph Muscat speaks about his country becoming a world-leader in blockchain regulation. Steve Tendon will also speak at the event.

Malta Blockchain Summit / https://maltablockchainsummit.com/

What Challenges Lie Ahead?

With unprecedented projects, including smart governance, on the table, one has to wonder what problems may arise from living in a completely autonomous, self-sufficient world. And in fact, the scenarios can seem a little scary. So, are there any problems that might arise from using smart contracts?

“There are many, many problems,” Tendon laughs, “and this has kept us busy for many late nights and hours thinking about these issues. With the technology that is today used to implement smart contracts, the expression of a smart contract is done in a programming language on a virtual machine which is “Turing Complete”. [Turing Complete is a technical term meaning that the machine can compute anything that is computational].

“But the problem is these smart contracts still do not fully capture the intention that the smart contract author might have in mind, with an example being “The DAO” hack. Because there is a mismatch between the intention of the author and the possible effective execution of the smart contract, well the whole notion that the code is law just falls to pieces. If execution does not represent the genuine intention, well, of course, it cannot be taken as what was meant.”

So, how can that be remedied?

“We have some way to intervene on this point and what we are doing in Malta at the moment is that any smart contract arrangement that involves people or companies on the one side, and technology on the other side, must also have a written natural language expression of what the intent and promise is–a paper contract if you like. In case of dispute, it is the paper contract that prevails, not the code.”

Code is Law Could Be Law in the Future

There’s something a little backward about having a paper contract in a natural language with all this high technology–and Tendon is keenly aware of that. “We understand the potential of having code as law in the long run. This might become a possibility but it requires the underlying technology to evolve in a spectacular way.

One possible solution is to have formal verification so that if a smart contract is published with a complete form of verification tied to it, it might not need an equivalent natural language expression of the smart contract’s intent. But, there is a huge distance between the first scenario with a paper contract and the second where we have a formal verification tied to it.

I am sure that the only way to find a resolution of these problems, though, is to provide Law that basically gives certainty and that sets expectations and establishes rules. They might not be correct, they might have flaws, but at least they bring clarity. And if they are not the best ones, there is always an opportunity to approve.”

What Is the Biggest Potential for Blockchain Technology?

“It is hard to crystallize one thing, but this is a new medium which is global and uncensorable. Because of only these two features, it will bear enormous social and political consequences.

The shape of the world, the shape of governance, the shape of finance, the power structures of the world will not be the same after the blockchain has reached its full potential. Bitcoin is still a micro drop in the ocean.”

Thank you very much, Steve Tendon!

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.