Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

1. Introduction

A Statistical Analysis of ICO Performances in Differing Market Conditions

These past several months, an analysis of ICO performances in the midst of varying market volatility was conducted by the data science team at Lunar Digital Assets. Intuition would probably lead a typical retail investor to believe that an ICO will perform better in bull markets as opposed to bear markets (and in stable markets which are void of any particular direction).

A Survey of 288 Crypto Investors

At the inception of the idea for this study, we were curious to see what cryptocurrency traders and ICO investors thought regarding the performances in bull and bear markets. So we asked various networks of traders and investors a fairly simple question.

The results were astoundingly favored towards bull markets, as most would expect. However, it should be pretty noteworthy that 29% of those surveyed disagreed with the majority. (29% because the 12% that voted for “Anytime” would be investing in bull markets as well.)

In hindsight, we probably should have had “I don’t know” added to the list of choices.

When’s the best time to be investing into ICOs? (Survey Results)

- Bull Markets: 171 (59%)

- Neutral Markets: 40 (14%)

- Bear Markets: 35 (12%)

- Anytime, doesn’t matter: 33 (12%)

- Never: 9 (3%)

Note: This was not a scientific survey.

In this analysis, we aim to bring credence to or dispel this commonplace notion using statistical analysis and hypothesis testing. We strongly believe that this study is especially helpful in the relatively young market of cryptocurrencies and initial coin offerings, whereas traditional financial markets have a much longer history and established patterns and trends.

We will attempt to answer the question that everyone thinks they know, but doesn’t really know: Do ICOs really — statistically — perform better in bull markets?

2. Data Scraping, Cleaning & EDA

Data Overview and Exploratory Analysis: Finding reliable data in this fragmented, young market can be challenging.

The data for this study was acquired from Coinist, which provided a sample data size of 457 initial coin offerings. Although we are aware that there were many more ICO’s conducted, we believe that 457 is an ample size to draw inferences from. Coinist was also the only data source that readily had ROI information (the figures were also spot checked for accuracy), and went as far back as 2013 up until the data the captured in May 2018 when this study was being conducted.

As basis of analysis, we will be using each coin’s Return on Investment (ROI) since the ICO Ending date as a measure for investment performance. Due to the varied nature of ROI across ICOs, I will be using a common logarithmic function (Base 10) of each coin’s ROI as reasonable means of comparison. This is especially useful as we are concerned about relative performance in different market conditions and not an associated scalar value.

Captured Data

- Name of Coin

- 1-Hour % Change

- 24-Hour % Change

- Weekly % Change

- ICO Date (last day of token sale)

- ICO Price

- Current Price

- ICO Return on Investment (ROI)

Data Cleaning

We did not find any major issues with the data other than one mislabeled adte for the coin APX. The ICO date was set to May 21, 1970. While cross referencing with other sources, we had determined and fixed the APX ICO date to May 21, 2017.

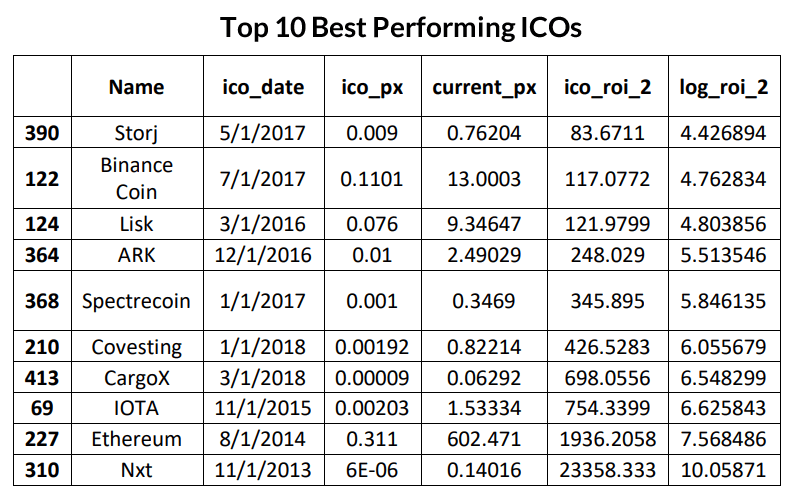

Outliers: NXT’s overall ROI of ~24,000% was an obstacle to proper comparison and analysis. Despite being a significant outlier (the next best performer was Ethereum at ~1,900%), we decided to keep this data and regularize it via a common logarithmic function for analysis.

Exploratory Data Analysis

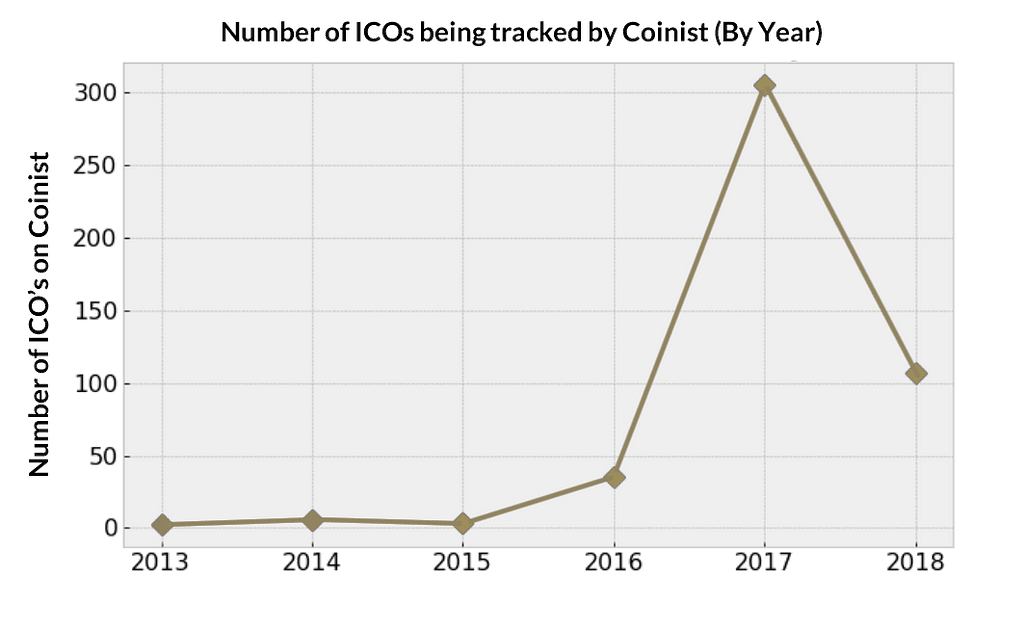

The goal of EDA is to visualize the data in different perspectives to glean additional insights for further analysis, anomaly detection, and data consistency. In this section, we will visualize the data from a high level. First, we wish to explore the pace of ICOs and visualize the rise of ICO as a means of capital funding:

We see a staggering yet unsurprising increase in ICOs in 2017 followed by a decline in 2018 YTD. However, we would not be surprised to see the annual 2018 value exceed 2017’s ending tally. It should be noted that since the data was taken in May, as predicted, the number of ICOs is steadily rising.

More EDA: Visualizing Winners and Losers

More EDA: Visualizing Winners and Losers

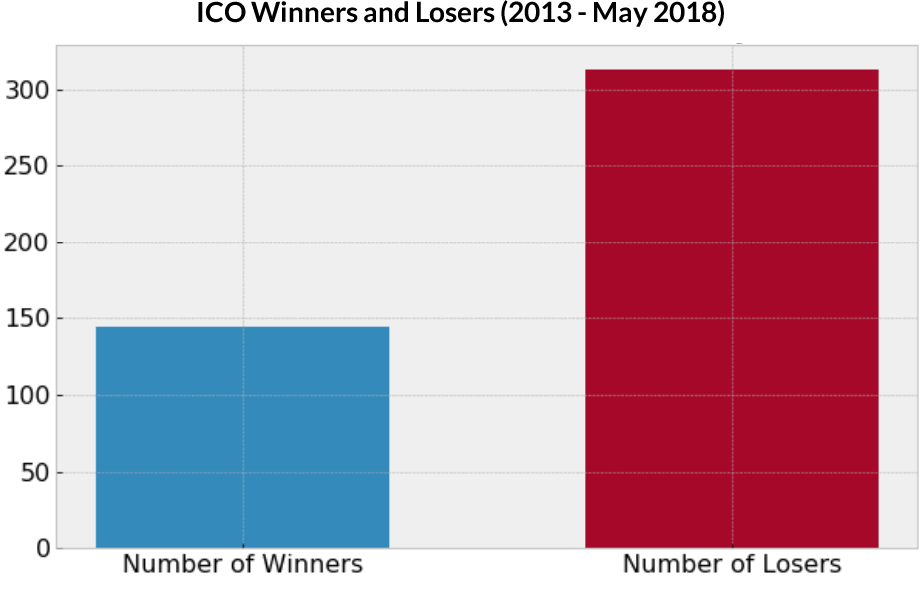

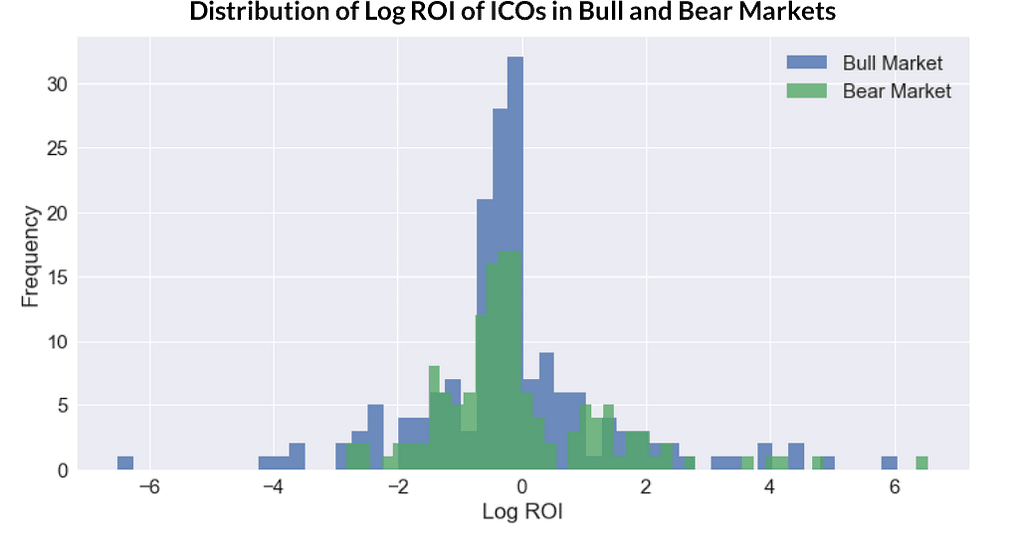

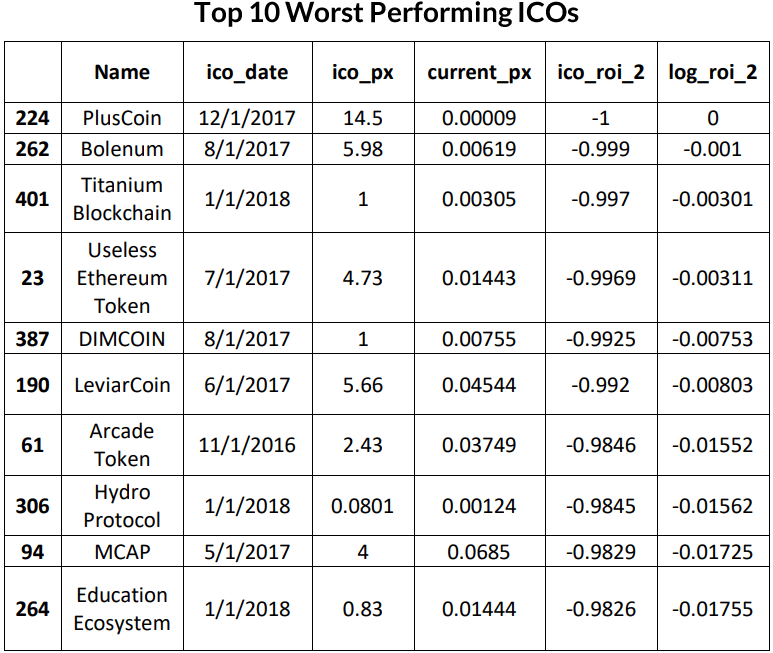

Dividing the dataset into losers (where an ICO’s current price is below its ICO price) and winners (where an ICO’s current price is at or above its ICO price, shows that the losers (314) outpace the winners (144) by a ratio of almost 2:1.

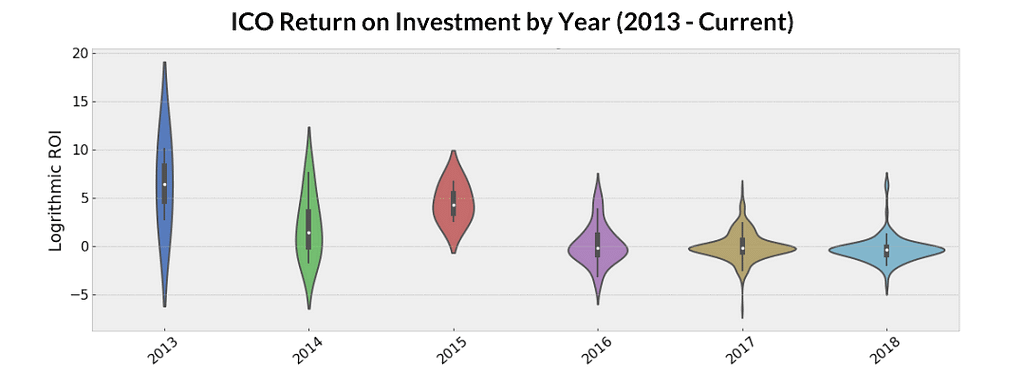

Our dataset captures the following years and the associated numbers of ICOs held in that year. The below violin plot provides a visual summary of statistical descriptors of the ROI performance by ICO Year:

Refer to below for key.Visualization Key

Refer to below for key.Visualization Key

- White Dot: Median Value

- Thick Candle: Interquartile Range

- Thin Candle Whisker: 95% Confidence Interval

- Width: Kernel Density Estimation

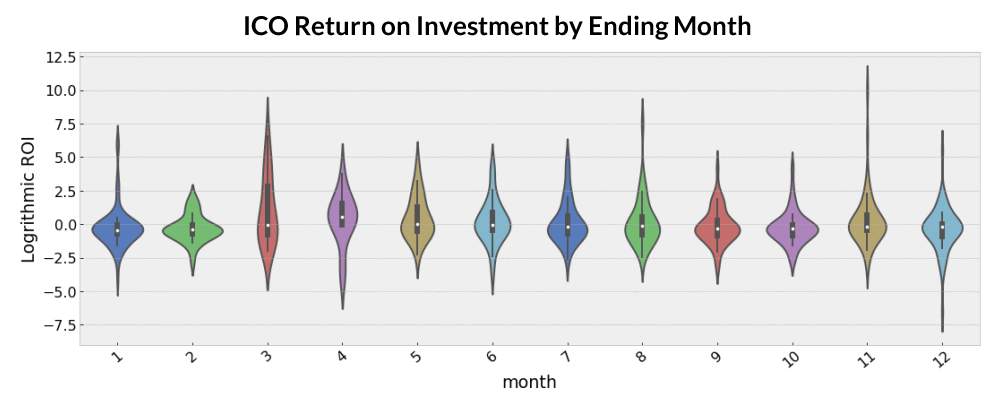

Monthly ROI

On a monthly basis, ICOs that end in April have the best median performance but also likelier to perform the worst of any month other than December. Otherwise, there does not seem to be a significant difference in ICO performance based on Ending Month.

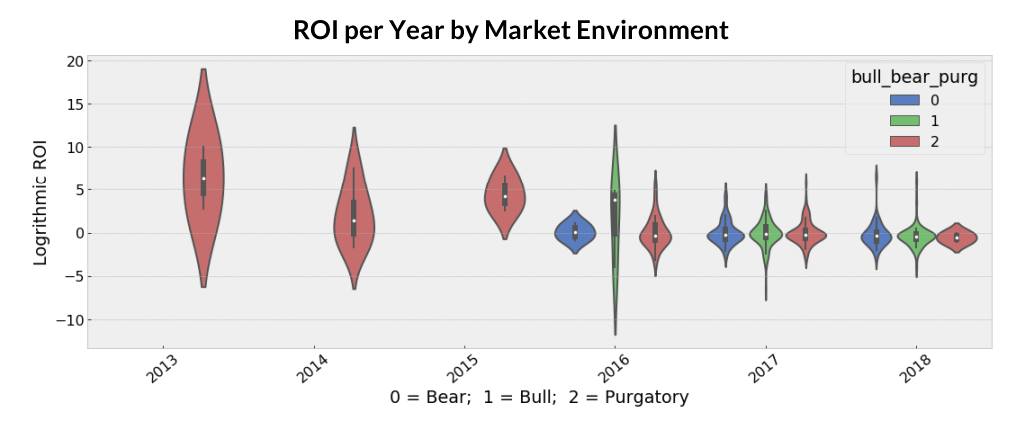

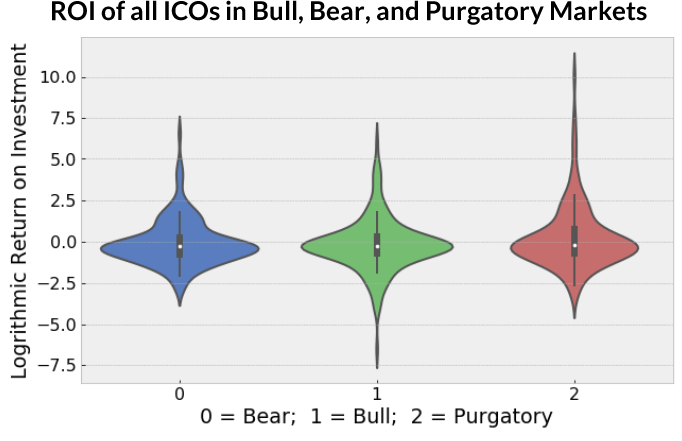

Another important distinction to consider when analyzing ICO ROI was whether or not the ICO occurred in a bear, bull, or purgatory market environment. Date ranges were leveraged from Thomas Lee, Head of Research at Fundstrat Global Advisors. Please also note that any date ranges not included are considered “purgatory runs.”

The date ranges were applied across the ICO dataset to classify each ICO and their respective ROI as belonging to a bull, bear, or purgatory market.

Bull Runs

06/17/2015–07/12/2015

02/07/2016–04/05/2016

03/18/2017–06/16/2017

11/12/2017–01/13/2018

Bear Runs

07/13/2015–08/29–2015

04/06/2016–05/29/2016

06/17/2017–09/21/2017

01/14/2018–03/18/2018

Any ICO that does not fall into the above ranges are classified as purgatory. The date ranges were then applied across the ICO dataset to classify each ICO and their respective ROI as belonging to a bull, bear or purgatory market.

When taking out the year dimension of the view, the plot suggests very little difference in median ROI performance.

The plot suggests very little difference in median ROI performance, but one very odd statistic was that bull markets see more outliers of negative performance and purgatory markets see more outliers of positive performance (likely due to NXT’s ROI as the coin had its massive run-up in a purgatory market in 2013).

It appears that the market conditions do not have a significant impact on the median returns of ICO’s. Now we can move on to see if, on average, ICOs perform better in bull markets than in bear markets.

3. Methodology and Statistical Analysis

Medians and Averages are NOT the Same!

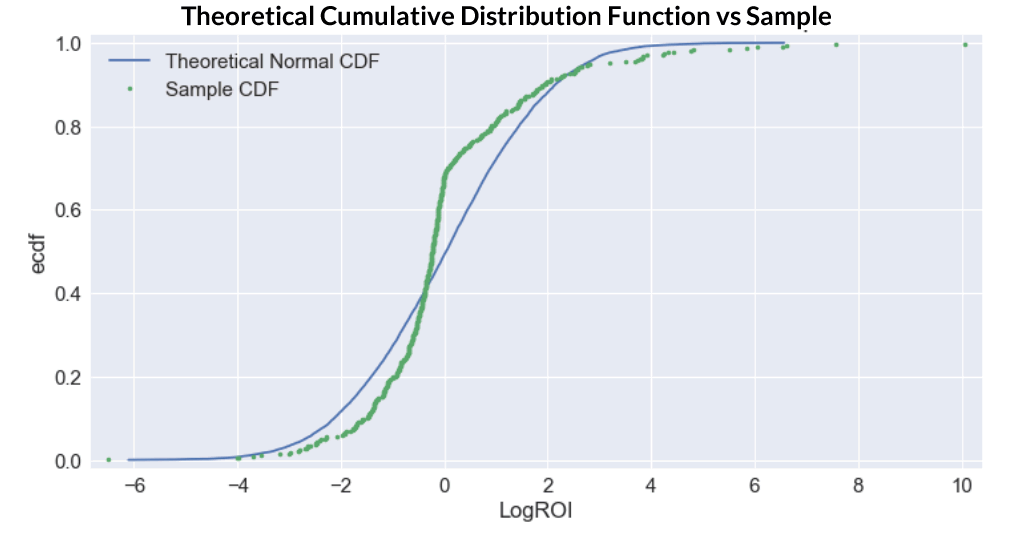

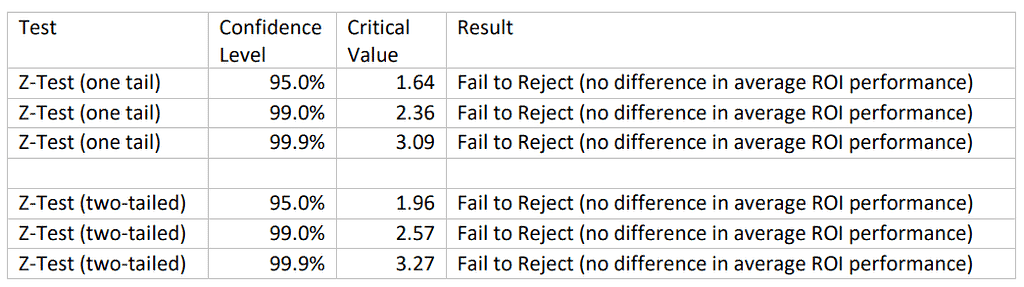

The primary method of analysis used to assert our assumption is a hypothesis test using a Z-Test. In order to appropriately perform the test, we require that the distribution of the data be unimodal and normally distributed. In our sampling method, the sample size must be larger than 30 and our samples be independent.

We find that each market environment contains 173 ICOs during a bull market, 143 during bear markets and 142 in purgatory markets. As a result, our population and ensuing sample sizes will be greater than 30. Moreover, our population samples are assumed to be independent.

To assert our data is unimodal, an Exponential Cumulative Distribution Function was constructed. The theoretical model takes the mean and standard deviation of our ROIs and plots hypothetical data points. We compare this with the actual plot of our ROI data. In the below graph, we find that our real data is closely aligned with the ideal model and thus can be assumed to be unimodal and normally distributed.

The goal of our statistical analysis and hypothesis test is to determine whether ICOs, on average, perform better (has a higher average ROI) during a bull market than in a bear market. To accomplish this, we need to construct the confidence intervals and then the hypothesis test parameters.

We begin with establishing a 95% confidence interval to provide insight on the range of differences that we can observe. Taking 100 random samples from the Bull and Bear populations, the difference in the mean is -0.159. At the 95% confidence level, the difference in Logarithmic ROI can range between -0.52 and 0.21.

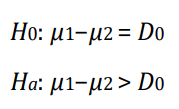

For our hypothesis tests, our statements will be expressed as:

Where μ1 is the mean bull market ROI and μ2 is the mean bear market ROI. D0 will be 0 (zero) to signify the difference in the means. Our null hypothesis posits that there is no difference between bull and bear market returns while our alternative hypothesis posits that there is a positive difference. Our critical rejection region will be [1.64 to infinity]. Following a stratified sampling method, we arrive at the two population means:

The Z-Test statistic formula will be the difference in means (μ1−μ2) less D0 divided by the square root of the standard error of both the bull and bear market ROIs. We arrive at a test statistic of -0.717. This value does not fall into our critical rejection region of [1.64 to infinity] and therefore fail to reject the null hypothesis. This suggests that there is no difference between the average ROI (and by extension performance) between bull and bear markets. This assertion continues to hold true at both the 99% and 99.9% confidence levels.

We additionally tested if this holds true when we change the Alternative hypothesis from Ha:μ1−μ2>D0 to Ha:μ1−μ2≠D0 (which denotes that there is a significant difference between the average ROI in bull and bear markets). We find that at the 95%, 99% and 99.9% confidence levels we still fail to reject the null hypothesis.

4. Summary of Findings

Surprise! Shitcoins will remain shitcoins, regardless of market’s health.

In summary, we found there to be no statistical significance in the average ICO performance in either a bull or bear market. In fact, we find that 1) there tends to be far more performance losers than winners regardless of market environment 2) ICOs, on average, tend to underperform in both bull and bear markets (where the market is driven by incumbent coins and tokens), and 3) bull markets see more outliers of negative performers!

We can safely say that there needs to be more studies done, and there are so many more variables at play here. But those looking to raise working capital through an ICO should not focus on trying to time the market but rather focus their efforts on other aspects such as the actual product, the white paper, marketing hype, building the community, and etc.

Editor’s Note: When I assigned Garrick this task, I thought that I was going to prove to the world that investing in ICOs during a bear market was a bad idea. Not only was I proven wrong, but this study has given me new epiphanies on how to further capitalize the downtrends.

If you are looking to launch an ICO, or need help with marketing one, let us help you. After all, we literally study these kinds of things.

Originally published at lunardigitalassets.com on July 6, 2018.

ICO Returns Are Unaffected by Bear Markets, Research Shows was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.