Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Delegated Proof of Stake (DPoS) is a variation of the Proof of Stake (POS) consensus algorithm that introduces a voting element into the cryptocurrency’s network.

DPOS is a bit reminiscent of a reality tv show. Mess with the community and you are most likely to get voted off. It’s democracy on the blockchain!

By now, you’re most probably aware of Proof of Work (PoW) and Proof of Stake (PoS), two of the most widely used consensus methods for cryptocurrencies. Let’s take a look under the hood and see what advantages and disadvantages it brings to the ever-evolving cryptocurrency world.

Consensus Overview

Let’s take a step back first and review consensus. Blockchains solve the age-old problem called the Byzantine General’s Problem where multiple parts of an army must agree on the same strategy to achieve their goal. If the army is able to successfully coordinate their forces, we call this consensus.

In the case of cryptocurrencies, all users of the network must agree on a ledger (accounting system). Therefore, blockchain programmers need to ensure that this ledger is accurately recording transactions for all players in the network. When someone is able to tamper with the records of a ledger and for example, turn a transaction from 5 Bitcoin into 500, the system clearly cannot function.

Who Created DPoS?

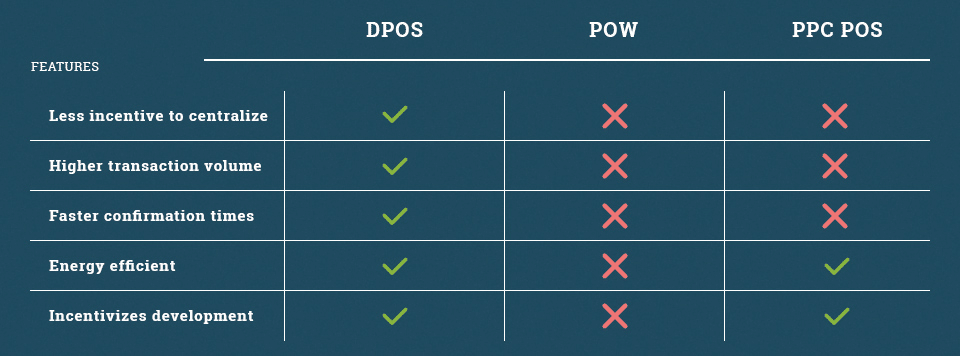

Delegated Proof of Stake is the brainchild of Dan Larimer, the creator of Bitshares. Bitshares was established in 2014 and has a fairly active community. Dan saw the possibility of mining centralization in Bitcoin and the potential environmental impact of Proof of Work. He argues that DPoS has the following benefits over traditional PoW and PoS systems:

Delegated Proof of Stake benefits

How Does it Work?

Witness Protection

In DPoS the community selects a number of witnesses or block producers to secure the cryptocurrency network. Witnesses sign each block in the blockchain, however, the users of the network must first approve the witnesses via a voting system.

The Delegated Proof of Stake model argues that we do not need to completely remove trust from a system. Instead, the system designers can create a system with trust in mind as long as several safeguards are put in place.

Some safeguards include the following:

- A witness cannot sign blocks randomly. They would need to verify that a trusted witness signed the previous block.

- If a witness doesn’t produce a block they are at risk of being fired and losing guaranteed profits in the future.

Key Differences

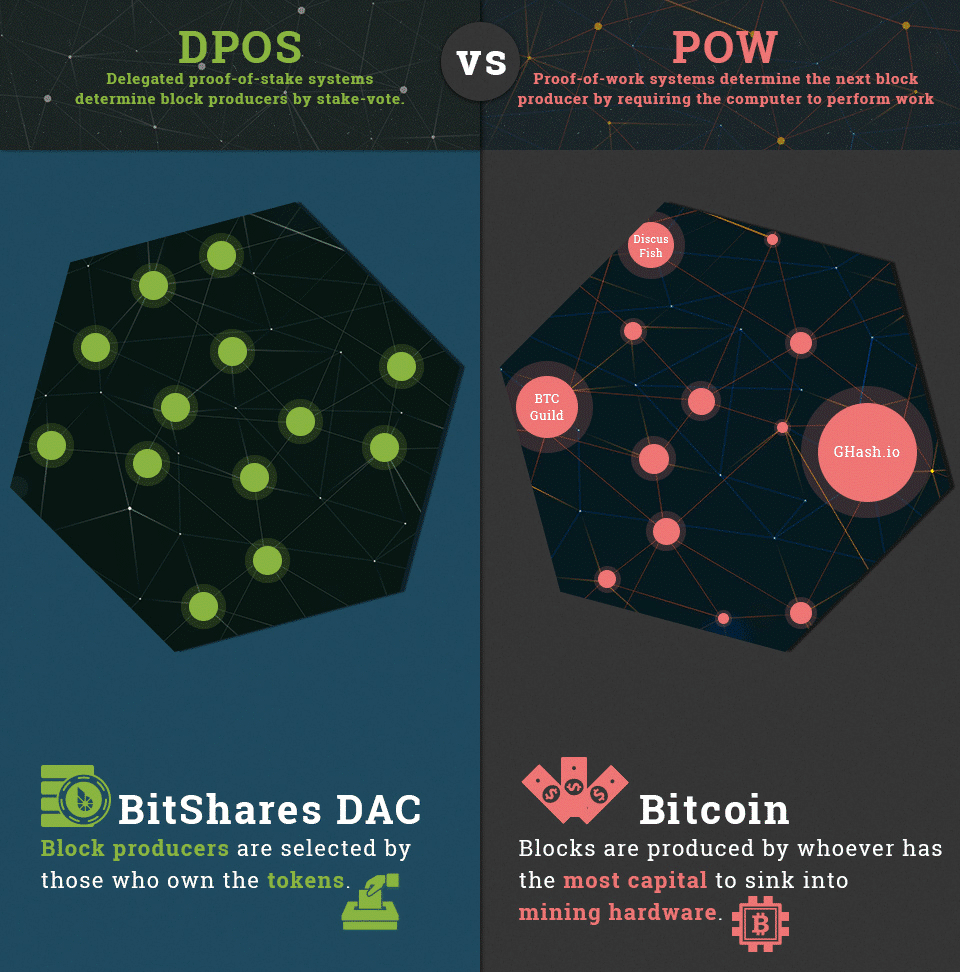

Courtesy of Bitshares

Since only a small number of trusted witnesses are required to verify each block in the chain, many more transactions can be included in each block. This dramatically increases the speed of transactions. Theoretically, DPoS can compete on a scale compared to traditional systems like Visa & Mastercard.

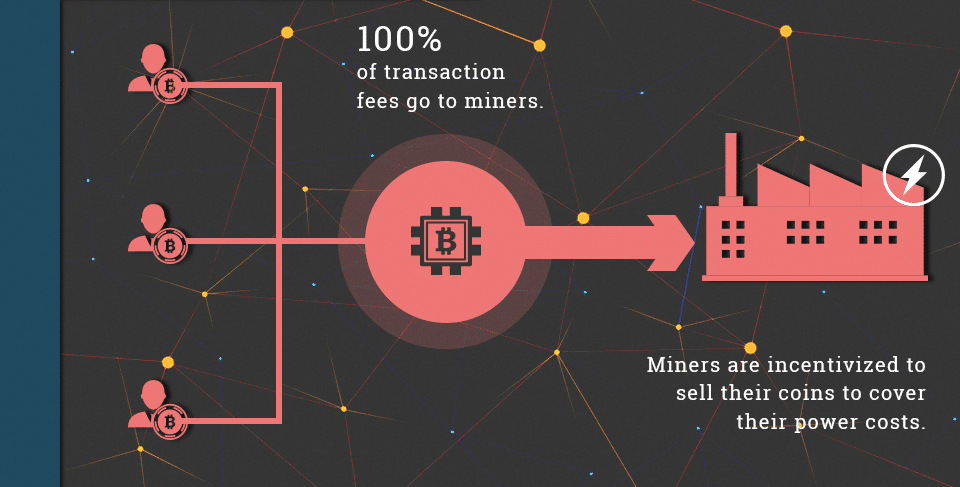

Despite Bitcoin‘s claims of decentralization, it’s Proof of Work system has so far created centralization of the miners. Ultimately, those with the most computing power (ie. most capital to spend on better hardware) get the most rewards.

Courtesy of Bitshares

On the other hand, in a DPoS system, everybody has the ability to decide who should be trusted. Trust is not concentrated in the hands of those with the most resources (At least, that’s the theory).

In this excellent interview, Amanda Johnson asks developer Fabian Schuh for some further details on how the Bitshares DPoS network operates:

It’s All About Perception

Unlike traditional democratic institutions, the community constantly monitors witnesses. Bad actions like attempts to double spend or prevent transactions can result in a loss of reputation. And according to Fabian, reputation is not an easy thing to gain. It takes a long time to build up but is very easily lost. Since the network pays the top witnesses in the system with the greatest reward (payment in the networks cryptocurrency), competition remains high for those top spots.

In addition, witnesses cannot pool their resources (as in Bitcoin) to increase their power in the network. Power is shared equally among the witnesses. Here’s a list of notable DPoS networks and the number of block producers securing their networks:

Criticisms

As you can imagine, the major argument against a Delegate Proof of Stake system is the centralization element. Dan’s latest project EOS currently only has 21 block producers signing transactions. This is a fairly high amount of centralization. The community is forced to trust only a few key witnesses. Furthermore, the more EOS you hold the stronger your voting power in the so-called EOS democracy.

This isn’t so much of a problem if EOS distributes it’s currency evenly among users of the network. However, this could be a problem since many cryptocurrencies are concentrated among a few addresses when first launched. Vitalik Buterin of the Ethereum project recently jumped in on the issue by claiming that DPoS creates incentives for witnesses to form cartels and bribe voters for support.

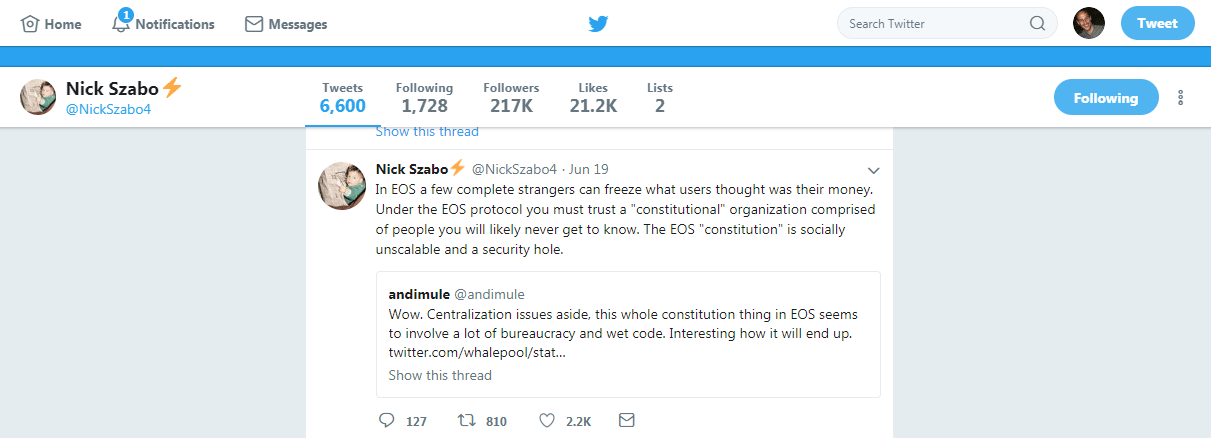

In addition, there have been some pretty fiery debates around the EOS implementation on social media. And notable bitcoin maximalist, Nick Szabo has had some fairly negative things to say:

Nick Szabo criticizes the EOS protocol

Out in the Wild

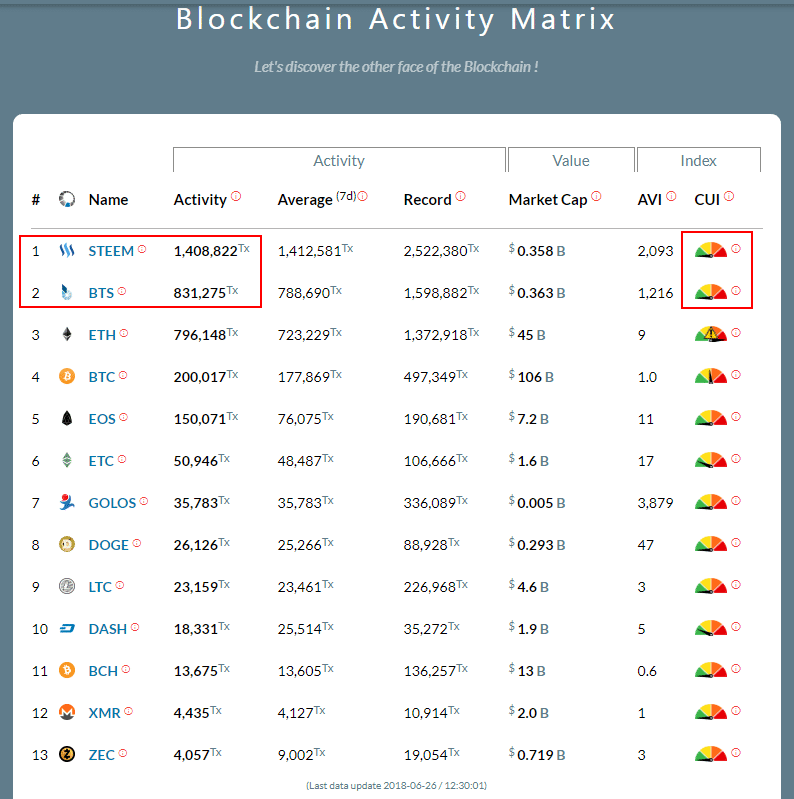

Despite some very valid criticisms of Delegated Proof of Stake, there are already a number of projects out there proving themselves in real-world applications. Blocktivity lists an interesting matrix showing the top 13 cryptocurrencies by network activity:

Courtesy of Blocktivity

The top 2 cryptocurrencies are Delegated Proof of Stake networks. And Dan created both of them. Also, note that both networks still have plenty of available capacity compared with Ethereum.

The source of this data is not particularly clear and we leave it up to the reader to make of this matrix what you will.

While scalability and security often take front row seats in these debates, something that doesn’t get nearly enough attention is adoption. What good is a cryptocurrency network which is theoretically perfect but no-one uses?

Final Thoughts: Delegated Proof of Stake

Blockchain consensus is a breakthrough technology for humanity. Centralized money systems have been abused for thousands of years. We finally have a way to change that.

Cryptocurrency is introducing a radically different approach to organizations. One of its major goals is to empower users of a network and not just the shareholders, as in traditional companies. Delegated Proof of Stake consensus focuses its efforts on improving scalability while sacrificing some elements of decentralization.

Which method will rise to the top? It appears there’s no one-size-fits-all solution. But, for now at least, Delegated Proof of Stake is here to stay.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.