Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Take the survey at the bottom of the article to share how much you’d pay for an ad-free, data-privacy experience on Facebook. We will post the results on the Worthyt Twitter page.

Consumer-based payment models is a very fun space for me. As the co-founder of Worthyt, I find myself in a very exciting space that helps social media platforms and content creators earn revenue that is independent of advertising — namely, direct fan-based monetization. Users can send and receive micro-tips (as little as ten cents) on websites like Reddit, Twitter, and YouTube to support content they enjoy, on the platforms they enjoy! That’s enough business pitching, if you want to learn more you can download and try our Chrome Extension:

Anyway, when it comes to shaking up social media business models, obviously my mouth starts watering. And one of the biggest model-shakeups of the year was brought up recently with Facebook’s data-leak incident. During the Cambridge Analytica testimony, Mark Zuckerberg faced quite a barrage of interrogation that left viewers wondering if, he was, in fact, an alien.

Personally, I think he handled himself quite well for being the most notorious man on the planet during those few hours. That being said, one particular question struck a cord for many Internet users:

Would Facebook consider charging users for using social media?

Zuckerberg stated that the company would “certainly consider ideas like that.” In response, Internet figures like Steve Wozniak (co-founder of Apple for those of you living under a rock) mentioned that he actually liked the idea, and would prefer an Ad-free Facebook where he wasn’t worried about his personal data being monitored and sold off.

So, with the groundwork laid for such a possibility, the question now becomes what the model could look like, and how much a user would have to, in fact, pay for this theoretical Facebook Premium.

The Data

Facebook Revenue

First, let’s lay down some numbers to get an understanding of what we’re dealing with. In 2017, Facebook generated almost $40 billion in revenue worldwide. Also in 2017, it broke a user record, gaining over 2 billion users globally in June of that year.

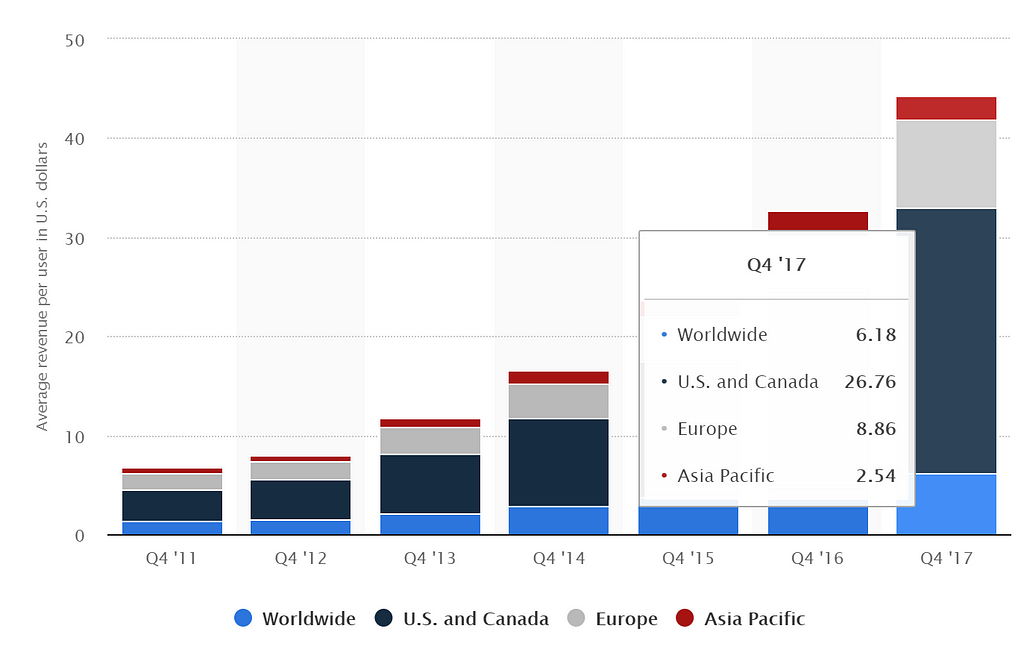

With the unarguable majority of its revenue in advertising, calculations conclude that each user, on average, brought $20 to the table for the social media giant. Average is misleading, though; countries in the Asia Pacific brought in about $2.50 per user, while users in the United States brought in over $26.00, a difference of over 10x.

Average Revenue per User, Q4 2017 — Source: StatistaUser Opinion

Average Revenue per User, Q4 2017 — Source: StatistaUser Opinion

Are we missing the bigger question, though? After all, we don’t even know if users are willing to pay for Facebook! Luckily, the guys over at Recode in partnership with Tulona did the heavy lifting for me to answer that question.

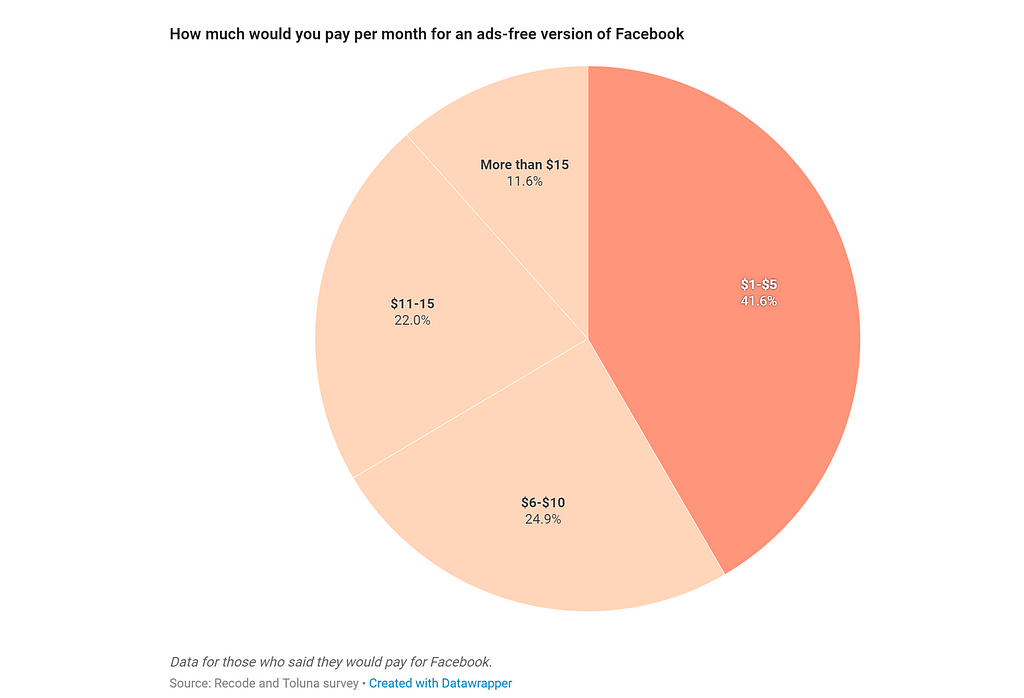

2017 Study of Facebook Users by Recode

2017 Study of Facebook Users by Recode

77% of users wouldn’t pay for Facebook even if they were given the option, while 23% would pay a monthly subscription fee. So out of the potential 2 billion+ users we know from the previous section’s data, only about 460 million would be willing to actually pay. But it doesn’t stop there.

Out of the 460 million, if the price was over $5 per month, a little under half of them (41.6%) would not pay. In other words, if an admission price of over $5 was enforced, Facebook would potentially only have 268.6 million users. So with all this data in mind, what options could Facebook pursue, and what would that look like for us (Facebook users)?

The Scenarios

With the pure subscription model, users must pay a fee in order to user the platform. While this model might not be popular, it is perhaps the more cold-turkey approach to cutting ties with advertisers and data-collection. Netflix, the famous United States based video streaming service, successfully uses this model for its users. Without paying, the user is unable to view any videos. But with this model, hypothetically, Facebook would immediately lose 77% of its users, leaving only 460 million possible subscribers.

To generate the same revenue it did in 2017, that would mean each user would have to pay $86.96 per year, or $7.25 per month. But $7.25 isn’t the entire picture; after all, if the price is over $5, about half of people who said they would pay would then argue that it’s too expensive and wouldn’t want to pay.

That means that only 268.6 million users would remain who would truly want to pay. But in this model, the price jumps to almost $12.50 per month! At that price, 33.6% of people are still willing to pay the monthly subscription fee. But this means we must recalculate yet again, resulting in a whopping $21.57 per month per user.

In that price range, according to Recode’s study, only 11.6% would possibly still be on board for a paid model. So, with the final recalculation, the remaining users would need to pay $62.50 per month, or almost $750 per year. For comparison, Comcast’s Xfinity service charges $49.99 per month for 100 mbps download in Boston, Massachusetts.

Even at the maximum $5 that can still take advantage of the full 23% of Facebook users that will pay, that only nets the social media giant $27.6 billion annually ($2.3 billion monthly), compared to its 2017 revenue of $40 billion. The revenue would drop by 31%. It’s unlikely for Facebook to run a business model that its stakeholders would be happy with through a pure-subscription service.

The Premium Subscriptions Model

Colloquial referred to as the ad-free experience, this model is frequently employed in many apps like Spotify or Hulu. Even Google’s video arm, YouTube, started a premium, ad-free experience, YouTube Red. But while these models sound like a sweet spot, even the popular music-streaming service Spotify only reported $5 billion in revenue in 2017. So while Facebook’s Pure Subscription model might be unsustainable for its investors, can it survive on a Premium Model? If so, how much?

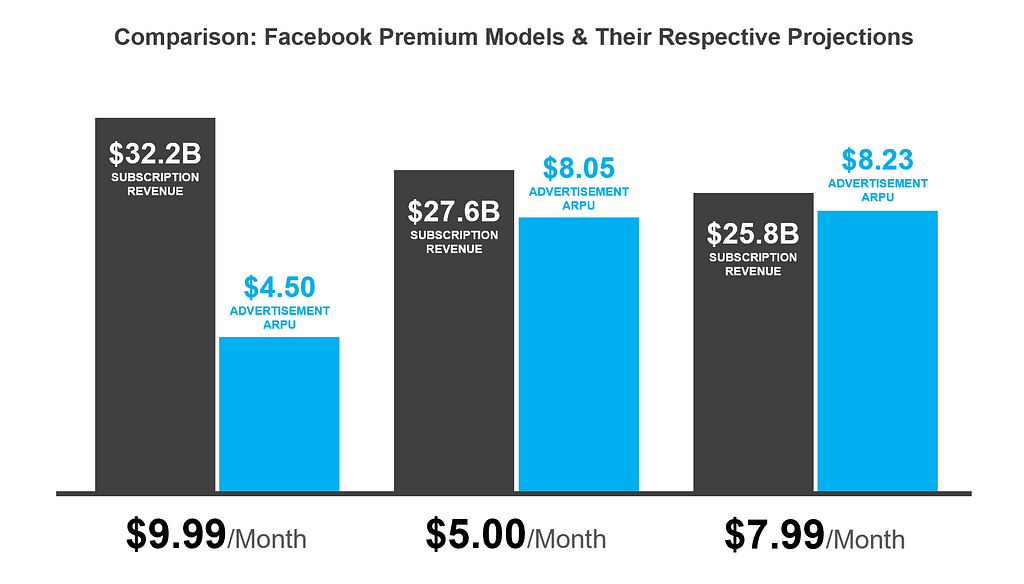

Well, consider the $5 subscription again, since $5 isn’t absurd in the realm of subscription models — Hulu costs $7.99, Spotify Premium costs $9.99, and YouTube Red (now referred to as YouTube Premium) costs $9.99 as well. From the previous analysis, we know that the subscription price would result in about $27.6 billion annually if only 23% (460 million) of all 2 billion users would be willing to pay it. With the remaining 1.54 billion free users, Facebook would still need to make up the remaining $12.4 billion with advertising.

This would mean that each user, on average, would need to bring in $8.05 in revenue per year, or $0.67 per month. That’s almost 60% less that each user would need to earn for Facebook. Perhaps that could correlate with 60% less advertising.

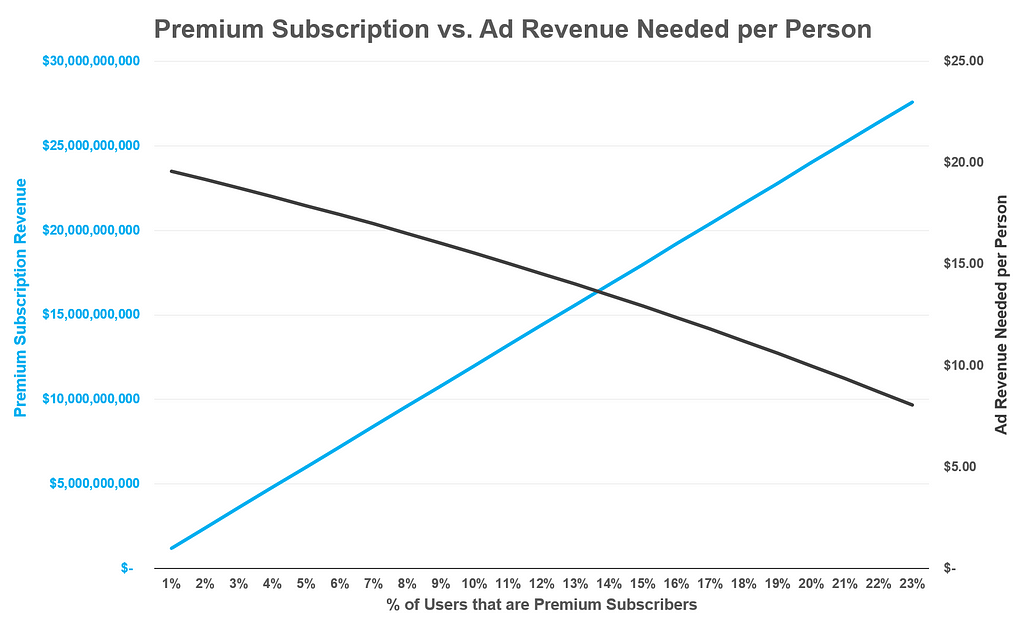

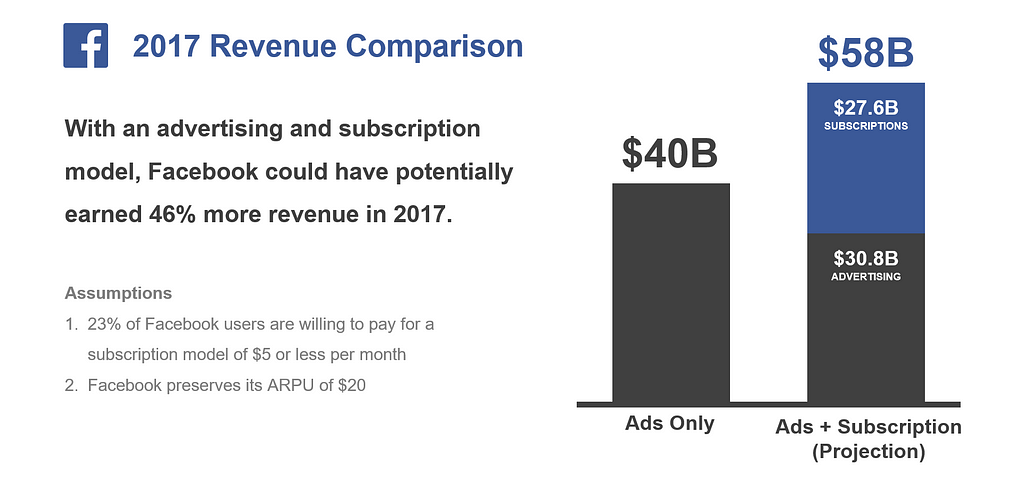

The chart and graph below illustrate the amount of advertising revenue needed to be brought in per person in 2017 based on the % of premium subscribers. While the Recode and Tulona study concluded that 23% of Facebook users would be fine with paying $5 or less for a premium subscription, I wanted to see what the economics looked like if the percentage was actually lower.

The chart and graph shows that even if only 10% of all Facebook users paid a monthly premium of $5, each remaining user would need to only bring in about $15.50 average revenue per user (ARPU) per year as opposed to $20, meaning 22.5% less advertising revenue per user.

On the other hand, if Facebook decided to preserve the existing free-user experience for unpaid users, which earns $20 ARPU, its advertising revenue would be $30.8 billion. Combined with the subscription model, it would have brought Facebook’s 2017 revenue to $58.4 billion, or about 46% more than it actually made.

An illustration of the 2017 revenue vs. 2017 hypothetical revenue based on my calculations

An illustration of the 2017 revenue vs. 2017 hypothetical revenue based on my calculations

A few other hypothetical numbers to consider can be some copy-paste numbers from other premium subscription models. Even at $10, Recode’s study showed that 58.4% of respondents who were willing to pay were willing to spend that much. At $7.99, which is what Hulu Plus costs on the low end, annual revenue on the Facebook Premium model would be around $25.8B, with an advertising ARPU of around $8.23 —slightly worse than the $5 model, if the conclusions of the Recode study are accurate. But at $9.99, which is what companies like Spotify and YouTube are charging for its premium services, the premium revenue can bring in $32.2B annual revenue for Facebook, with $4.50 ARPU for free users.

Based on these numbers, It seems that the premium model would be an interesting model to further explore for the tech giant. On the one hand, Facebook could lessen its dependency on advertising, and on the other hand, it could even potentially drive up revenue.

Please note that this is just a surface-level analysis based on publicly available information and survey assumptions. There are many other assumptions to consider that will affect the overall bottom line — for example, what percentage of Facebook’s audience is under the age of 18? That could potentially skew the relevant sample size that could pay for the premium service, as many individuals under 18 do not have an independent payment option (or do they? Do kids these days really have that? After all, I’ve seen kids with iPhones better than mine, so I guess it’s not too farfetched…).

Privacy as a Luxury

With Premium Subscriptions, while Facebook would make more money and premium users may feel more comfortable knowing their data isn’t being sold off or stolen by third parties, the absolute trust that your data and consumer profile will be stored safely with Facebook and not passed on may make users still feel a bit uneasy. Conspiracy theories abound debating whether or not Facebook steps beyond its boundaries to monitor users and collect data, including listening through the phone. While Facebook denies this, the very existence of this claim and others highlights a distrust in the social media giant in preserving user privacy.

Unlike in a Pure Subscription model like Netflix, where the platform abandons advertisements completely, the Premium Model would still likely require Facebook to collect data on 100% of its user base while only advertising to 77%. Some paying members may feel more secure knowing Facebook isn’t actively selling their data at scale, but there is still some discomfort in knowing that the data may be obtained some time illicitly or even under the table, if conspiracy theories prove true.

If Facebook were to release a $5 premium service for users, I doubt I would sign up for it. Even at $1, I just assume that, at this point, all of the sweet, juicy data that companies want on me is already sucked dry, and all that’s really left for me to protect is my worthless cherry pit. If Facebook were to release a $5 premium service for its users that somehow guarantees zero tolerance for any data tracking whatsoever (with such an airtight promise that even conspiracy theorists can’t find any cracks), then I might consider subscribing to it, as well as getting my future kids on board.

But with family in mind and the fact that the average American family size is 2.58 people (uh, what?), that’s $12.90 per month per family, or $154.58 per year. Will privacy become a luxury? Would you consider yourself part of the 23% of users that pay for an ad-free experience on Facebook? Take our survey below and see the results on the Worthyt Twitter page once they’re released!

Paying for Facebook was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.