Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This week, I changed my name game, thought about private key splitting, and took a while to work out what Stakenet is.

That’s right, rather than the unwieldy and incorrect prefix of “A crypto-trader’s diary, week x;” I’ll now just be calling the title whatever coin I looked at that week. And thanks to David Smooke for teaching me how to do that little heading above the main heading.

Now …

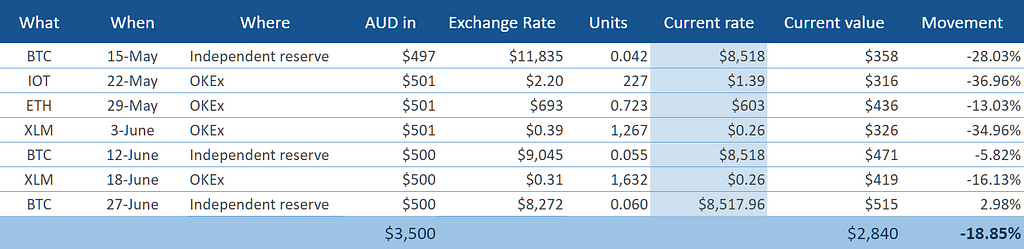

The profit check-in

That’s better than last week! I’d like to say that I rarely even think about the price, but I must admit to checking at least five times this week. I will aim to do better next week.

Stakenet

Ladies and gentlemen, I present to you my first car, from a few decades ago, affectionately known as the piece of shit.

It was $400 worth of Japanese luxury, and to this day, is the image I recall when I see the letters PoS.

So, when I began researching Stakenet, starting with their article Stakenet (XSN) Blockchain Architecture Part 1, I laughed out loud at the opening sentence:

Stakenet is a trustless PoS blockchain

Maybe I’m the only one to find that funny. Let’s talk about Stakenet now.

It took me a while to understand what Stakenet actually is, or does.

All these other cryptoassets I’ve been reading about are reinventing the internet or want to disrupt the way I store files or re-imagine how I monetise my website.

It wasn’t until I’d read for quite a few hours that it dawned on me: Stakenet is, at its core, just another cryptocurrency.

More specifically, it’s just another proof of stake cryptocurrency.

But there’s something a bit special about this particular proof of stake cryptocurrency: it’s taking that proof of stake mechanism and tweaking it a bit, so that you can stake your coins while they’re safe and sound in cold storage.

The manner in which they achieve this also happens to open up some other interesting possibilities. But first you might be thinking …

Remind me, what’s proof-of-stake?

Both proof-of-work and proof-of-stake are consensus mechanisms — they allow you to trust people you don’t know to update a blockchain without you having to worry that they’ll create incorrect transactions (and thus steal money).

The difference between proof-of-work and proof-of-stake is kinda like the difference between tug-of-war and a seesaw.

With proof-of-work (or tug-of-war) you have to constantly exert energy in order to stay in the game. And if someone was to get too much power, they could overpower all the other players.

As a result, the total power consumed by the game is a lot. Like, iceberg-melting amounts of electricity. It’s insanely wasteful — particularly in the current climate — but defendable unless there’s a better way.

If proof-of-work is like tug-of-war, then proof-of-stake is like sitting on a seesaw. It’s basically a game that rewards being fat (it should totally be called proof-of-steak).

But unlike the fat kid seesaw-champion, your heft isn’t measured in weight, it’s measured by how many coins you have. (I guess in a way, they both reward skin in the game.)

With proof-of-stake, a bad actor (by which I mean nasty person, not Helen Hunt in Twister) can pretty easily overpower the other nodes in the network by buying up lots and lots of coins, thus increasing their stake. Eventually they’ll have millions and millions of dollars invested, and be ready to attack. But if they do, the price will plummet, and they’ll lose all their money.

In other words, the thing you have to do in order to attack the network is to put yourself in a position where you are the one who has the most to lose if the network is attacked.

It’s a neat bit of game theory.

If you want an enormous amount of detail, Ethereum is implementing PoS and has a great PoS FAQ that I haven’t read.

And what makes Stakenet special?

Usually, you have to leave your coins online in order to ‘stake’ them — to prove that you have them. But Stakenet have come up with a way to allow a third party to stake your coins on your behalf, called a masternode.

Masternodes are always online, and take a split of the block rewards for staking on your behalf.

I’m a bit fuzzy on the details, but they also allow ‘cross chain proof of stake’ which allows you do ‘earn’ one type of coin from staking another type of coin. This comes about because masternodes can come up with their own services — things you can do with your XSN. So a masternode might say hey, you’ve got some XSN, I can stake it for you while you keep it in cold storage and I’ll split my block rewards and fees with you but I’ll pay in Bitcoin.

I have no idea why someone would want this, but this model of allowing masternodes to effectively become services is intriguing.

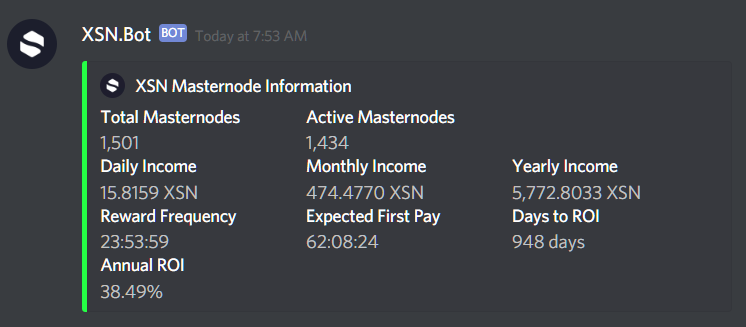

Normally when I hear things like this my reaction is: sounds interesting in theory, show me the numbers. Well, you can imagine my delight when I leaned they’ve got this neat little bot on their Discord server that shows the current stats for the network:

1 XSN is more or less half a dollar

1 XSN is more or less half a dollar

That’s great! I suspect 38% ROI is too good to be true in the long term, but from what I understand, whenever a contract is created between an average user and a masternode, it calculates how to split the rewards, to keep a balance of how profitable it is to be a masternode.

It’s currently 6pm on a Sunday and I’ve been writing this most of the day, and stakenet.io just came into existence about half an hour ago — I think it’s meant to be their marketplace — there’s probably going to be things in there that aren’t in this article.

Another big thing that’s coming is their decentralised exchange, DEX. I’m not super excited, because it doesn’t exist yet. But still I figured it was worth a mention.

I wish I had a bit more time researching all this, because:

- I feel like I’m not doing it justice

- I’m taking their word for it, I didn’t see enough detail for this not to be a leap of faith

But, just because I’m light on the details, shouldn’t stop you from at least reading pages 11, 12 and 13 of the whitepaper (there’s pictures). That’s, in my opinion, the meaty part.

Say some negative things so we know this isn’t paid for

OK, I will.

There are so many typos in their communications. OMG so many. It’s easier to count the words that aren’t typos.

And it’s not just their Medium posts (I counted thirty in the article linked above), their whitepaper has more typos than every other whitepaper I’ve read combined. And their brand new 1-hour-old stakenet.io is riddled with mistakes, right there on the home page.

I can only hope that their lack of interest in the correct order of letters and symbols doesn’t spill over into their code.

I know not everyone cares about this stuff, and I’m probably more picky than most, but compared to something like Stellar or Filecoin, all the Stakenet communications seem a bit second-rate.

I think a relatively inexpensive marketing activity would be to apply a little polish in this area.

OK, I feel this is a bit mean, but the guy in the bottom right window in their YouTube videos … he kind of plays the role of someone just learning about Stakenet while the main dude talks and he really lays it on a bit thick: “Oh really, it can do all that?! WOW that’s really, really incredible, oh this is just amazing stuff, I’m blown away, amazing. Incredible. I can’t say that enough! So amazing.” I haven’t seen acting like that since the last time I saw Twister. I think I actually sprained a muscle in my cornea from rolling my eyes so hard.

But, there’s a silver lining. I’m guessing some other people made similar comments, because in the next video they directly addressed the fact that some people thought they sounded ‘shilly’. They seemed mortified and emphasised that this isn’t what they were about and that people should do their own research, yada yada yada.

It was a classy reply and it raised my opinion of the whole operation.

Also, who could stay mad when Hannah shows her gorgeous face in the videos.

Hey look, I accidentally stopped being negative, even when I was trying.

And that’s seriously all the negative I’ve got — some dude being more enthusiastic than my sensibilities approve of.

As usual, I googled “the problem with stakenet” and “stakenet is a scam” and “why stakenet will fail” and so on, but came up with nothing. In fact, I couldn’t find a single negative article, other than one Reddit post saying “I don’t get what this coin actually does”, which is exactly how I felt.

The verdict

Well, obviously I’m a big ol’ fan.

So this week’s $500 will be going from my bank to my local exchange, to some dodgy exchange in a barn that trades XSN, then out of the dodgy exchange into a locally installed wallet, then backed up by photographing the private key with a film camera, and finally, inserting the roll of negatives into my stuffed Patagonian Mara.

Whatever happened to the original PoS?

Thanks for asking. There were some geometry-related complications after the photo shoot that resulted in reduced mobility for my little wannabe rock bouncer.

Some say she’s still there to this day, now inhabited by a family of wallabies that sometimes pretend like they’re driving a rally car.

OK, so that was Stakenet! I’m glad I stumbled across something down in the coinmarketcap ranks that looks really promising. It will be interesting to see if TPoS will become the way things are done by future coins.

Now, some thoughts on some things …

Put your whitepapers on Medium!

This is for all cryptocurrency makers. I know when you make a PDF it feels like a real academic paper, but it also can’t be read on a phone (without squinting/rotating), it can’t be shared on Twitter, and you can’t see what people highlight to get feedback on what the public like and what they don’t (or when people politely point out typos).

Particularly if your whitepaper is like Stakenet’s, and actually quite readable, I imagine that only good things can come from people being able to spread the word about your coin by tweeting a link to it at the click of a button.

So everyone, by all means keep your PDFs, but copy paste that text into a Medium post too, what have you got to lose?

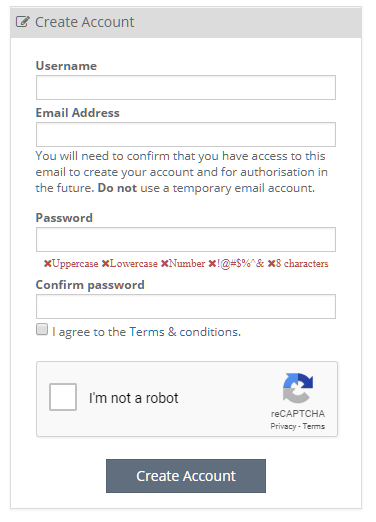

Exchange review: Cryptopia

In order to get my money into XSN, I will need to go via one of the few exchanges that trade it. Cryptopia is the biggest, with a whopping $60k/day volume.

I have signed up, which has given me reason to comment …

Here’s another company that should be really good at security, but gets the basics wrong.

This allows the world’s dumbest password — P@ssword1 — but doesn’t allow this masterpiece: Boop the snoot is what I do and you can chew a piece of shoe!

I’d be willing to bet my favourite coffee mug that the person who came up with these password restrictions is not a person who is an expert in security. At best, they were an expert in 1990 and now work from home 3 hours a day and fill their remaining time tending to their carrot garden.

Honestly people, just use zxcvbn.

If I was an exchange hacker, I’d be shortlisting exchanges based on how archaic their password requirements are, as a way of targeting those with sub-par security skillz.

Also, a username? What? Why? Who has usernames any more?

Hey, a mildly related side note: reCAPTCHA v3 is currently in beta and it runs in the background. It should generally be able to work out if you’re a robot or not without you even knowing that it’s running on the page. Isn’t that neat?

After finishing West World this week, I went to the reCAPTCHA test page just to make sure that I wasn’t a robot.

Thoughts on backups

Can someone tell me if the following is a stupid idea?

Say I have a private key and I want to back it up. It’s just a long string of numbers and letters, right? So I can put it on a memory stick, ya? But, I don’t want it all on one stick, so I could make three copies of it, and remove 1/3 of the characters from each one.

For example, if the private key was E9873D79C6D8, then I could create three backup strings from that.

Backup 1: ____3D79C6D8Backup 2: E987____C6D8Backup 3: E9873D79____

I could put the three backup strings on three memory sticks and spread them about geographically. Then I would only need two of the three backups in order to re-generate the whole private key, and no memory stick on it’s own has any value.

Could this be a feature of a wallet? So I could export my private key in chunks. And I could decide how I wanted to split it up, like “two of three” or “three of five” or whatever.

Now I sit back and wait for someone to tell me that this is the way everyone already does it.

Next week

I might take a look up the top end of the charts next week. Dash or Neo or Monero or one of these ones I keep hearing about but have never actually looked into. It will be a fun surprise for all of us.

Thanks for reading! I hope you took the time to Google Patagonian Mara and liked what you saw. If you didn’t, then ask yourself this: do you really want to go the rest of your life without ever seeing an animal that’s half deer half rabbit?

Stakenet coin: the next big thing, probably was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.