Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

2017 saw a 200% increase in cyber attacks as seen in 2016. In the coming years, this number could climb significantly as customers are increasingly migrating to the digital medium.

You cannot let go of the convenience either, since from coffee shops to convenience stores plastic cards and mobile wallets are the accepted forms of currency. So, what can you do to keep your financial information secure online?

We will tell you how.

1. Shop Only From Trusted Websites

This should be common sense, right? Unfortunately, all our common sense and cautious thoughts fly away with the wind when we see a popup with an irresistible deal. While shopping online, remember one thing, if the deal seems too good to be real, it perhaps is not real too.

Hackers use the deal as a bait to collect your credit card information and personal credentials. Once they have pocketed your financial and personal information, they get to task to take over your accounts.

In fact, there are two specific types of eCommerce frauds that work in similar lines:

- Triangulation Fraud — Using a fake storefront to steal credit card information of the customer to make additional unauthorized purchases or to make wire transfers

- Merchant Fraud — The customer pays for the product, but, never receives the product!

If you don’t want to fall prey to these frauds and many other forms of international frauds, it is better to ensure that the store is a genuine one.

How to check if a website is trustworthy?

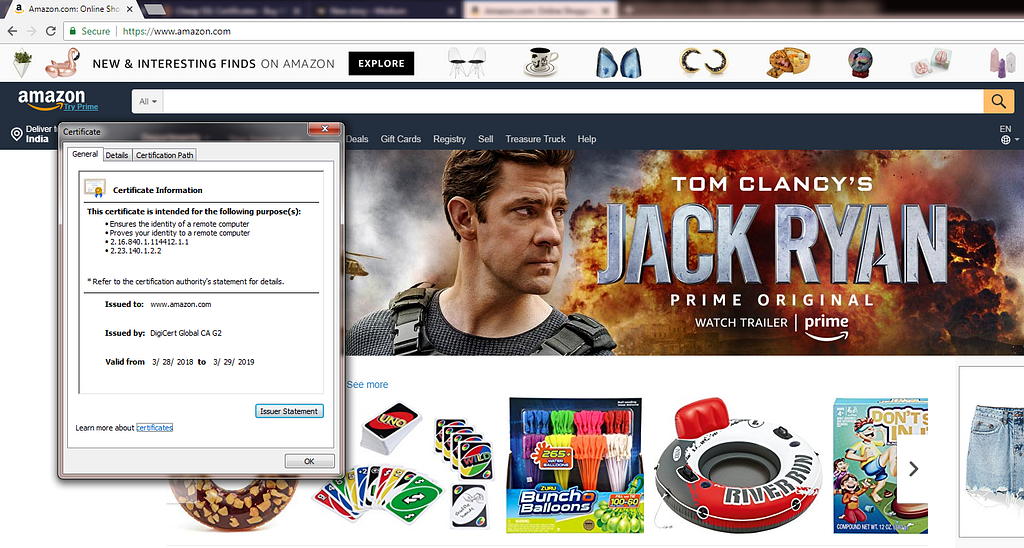

Look for HTTPS address bar. This is how Amazon’s HTTPS bar looks like.

Amazon Secure with HTTPS (SSL) Certificates

Amazon Secure with HTTPS (SSL) Certificates

Click on the green padlock symbol to see if the website is really the website you think you have landed on. The green padlock symbol and the address bar are part of the SSL certificate that encrypts the website from hacking and cybersecurity attacks. With a HTTPS bar, you at least know the website you are visiting is a real one.

2. Set Up Alerts For Online Transactions

What if someone took hold of your online banking credentials and found their way into your account? Well, you can always configure SMS and email alerts that will alert each time a transaction takes place. You can also set alerts for failed login attempts, which is an excellent way to track brute force attacks to break into your account.

If the transaction was not carried out by you or without your knowledge, alert the customer care of your bank immediately. If it is carried out using your credit card, request the bank to block the card until further notice.

But, how could you have lost or slipped your banking credentials to someone else?

Through phishing or maybe, you made the mistake of writing down the credentials somewhere.

3. Do Not Respond To Phishing Mails. Best Delete Them.

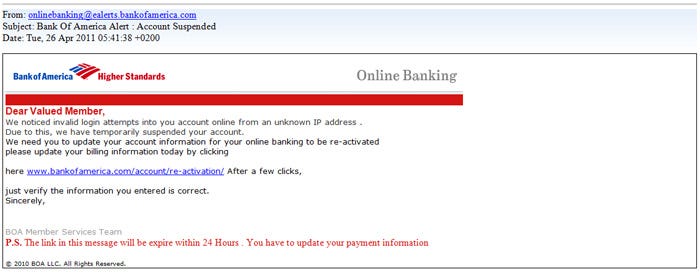

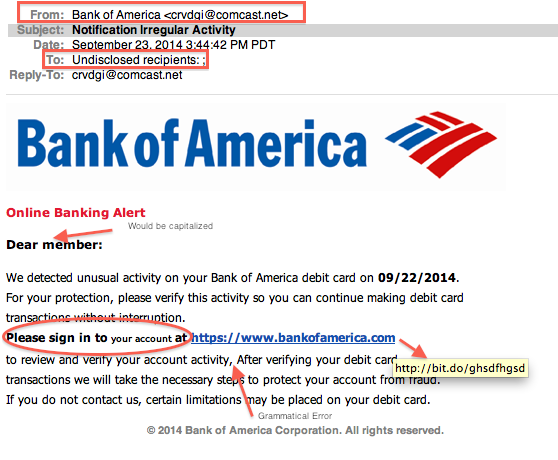

Phishing emails are sent by scamsters to take you to fake pages that look identical to online banking portals or membership sites. The sad part about phishing websites is that they look and feel exactly the same. For an untrained eye, the differences would be hard to spot.

Look for the sender email id, recipients, and where the links are heading, if any are embedded in the body of the mail.

The way out? Don’t respond to emails. If you have to visit a banking website, type in the address and log in directly.

If at all you have to visit through the link ensure that the spelling of the website, the sender of the mail are all true and genuine. Phishing emails look identical to originals, but can have some loopholes that can be spotted with some effort.

4. Do Not Write Down Your Login Credentials!

Your bank must have already highlighted you the importance of not storing, writing or recording your login credentials anywhere where it can be seen. Despite the efforts to create awareness, a majority of online banking users still store their login credentials in writing, and often in plain sight. If you really want to write it down anywhere, make sure it is written as a code that can help you memorize it, but, would be unguessable by someone else.

5. Keep A Track Of Your Credit Score

Do you know which is the best way to know if someone else is accumulating debts and credit card transactions on your behalf? Check your credit score. A credit score is a number that indicates your creditworthiness, or your capacity to repay your loan. The healthier your credit score, the easier it would be take a loan or mortgage in the future.

If you are someone with a healthy credit score, you can be a lucrative target for identity theft. Protect yourself from identity theft and other cyber security attacks by checking your credit score periodically.

6. Avoid Using Public Computers Or Wi-Fi

There is nothing called a free lunch. If you are getting free wifi, it could possibly be not secure at all. Or if you are using a public computer, like in a browsing centre to carry out your online transactions, be careful. Your cookies or even the entire browsing log could be used by hackers to find their way into your bank account. It is better you avoid using public computers or Wi-Fi so that your bank account and money truly remains yours and your only.

Final Thoughts

Your financial information and your personal information has enormous value. Hackers are always in the works to steal them to make profits. Secure yourself from the perils of online banking with the simple ways we have described.

6 Ways To Keep Your Financial Information Secure Online was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.