Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This week, I took a look at TRON, broke my cardinal rule, thought about your privacy (and how to invade it).

But first …

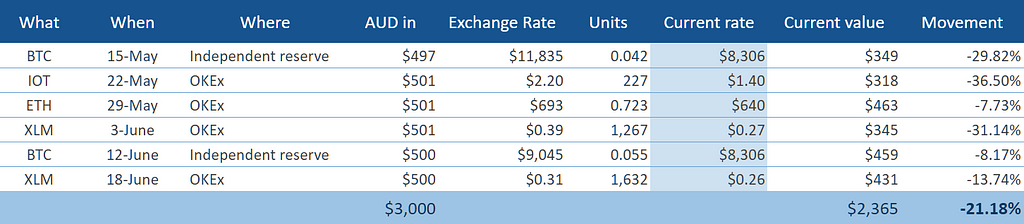

The profit check-in

The crytpo-sale continues, get in quick!

The crytpo-sale continues, get in quick!

Not much to say about that. Other than the new colours — ain’t it snazzy? I spent a great deal of time on that while gently weeping over the bottom right corner.

Now, I’m going to go and disappoint anyone who is all geared up to hear a long and thorough assessment of …

TRON

First of all, a disclaimer: I only spent about three hours researching TRON.

A week ago, I had decided that I would actually try and use TRON, to write my own little app. I was hoping that TRON would have a developer docs section on their website that would tell me how to use their stuff. But the “Technical Docs” button on their home page goes to a page with three pretty PDFs on it.

Eventually I found the docs, on a different site, and immediately lost interest.

I will tell you why, but first …

There’s going to be dozens of these ‘decentralised internet’s battling it out over the next decade or so. And they can’t all win.

So I’m looking at TRON and asking the question: do I think it’s the one that will prevail above all the others.

In my opinion, the winner will be the platform that the users want to use. And that will be the one with the best/most apps and content. And that will be the platform with the best/most developers. And the best/most developers will gravitate toward the platform with the following properties:

- The best developer docs

- The best developer experience (e.g. build tools, deployment pipelines)

- The best ecosystem (community help on Stack Overflow, Reddit, etc)

- JavaScript.

That last one may seem out of place. But I reckon when you pick a language to support, you’re not just selecting a language, you’re selecting the developers that you’ll attract to your platform. And if I was writing the next internet, I’d want to attract all the developers from the current internet.

So it stuck out like a sore thumb to me that TRON is all in with Java. Not JavaScript (like washing machines and machine guns, they share a word but are really quite different).

I’m not questioning TRON’s decision to go with Java, I’m quite sure there’s a very good reason. I also have no comment on the technical merits of the actual languages — I don’t want to start a whole thing about that.

What I am saying is that if there are several technically equal crypto-thingies, each trying to build the next internet, and one of them creates a whole new language, one of them uses Java and one uses JavaScript, my money’s on the JavaScript one — because that’s what the current internet is written in.

It’s also an objective fact that JavaScript developers are better dressers than Java developers.

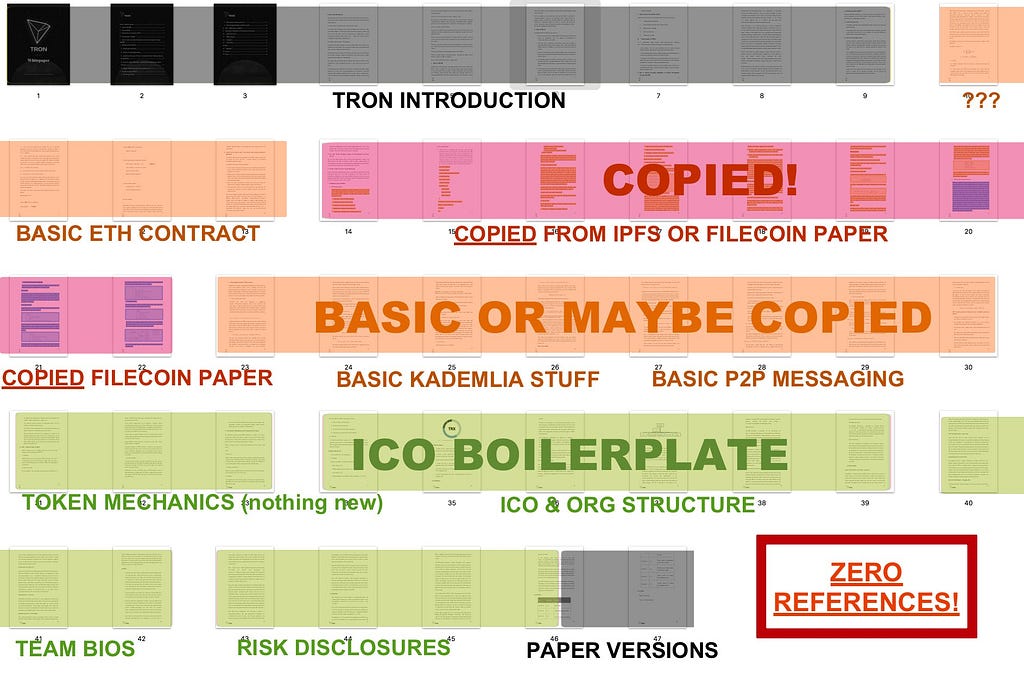

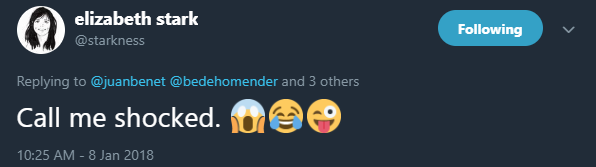

So there I was, not a all enamoured by TRON, when I stumbled upon the following, via Juan Benet (Mr. Filecoin):

In response, Elizabeth Stark (Ms. Lighting Network) said:

https://twitter.com/starkness/status/950146476671369217

https://twitter.com/starkness/status/950146476671369217

I was pretty sure she was not really shocked because of the faces that she made after what she said, and I was like well if starkness doesn’t like it, I’m out.

So there you go. Maybe TRON will become the greatest thing since sliced bread. Maybe Java is the language of the next internet. Maybe future communications will be honest and not riddled with typos like literally every other thing they’ve ever written.

But for now, I’ll leave TRON for others to play with.

The verdict

With a big red line through TRON, this week’s $500 must go to one of my previous choices (a rule I have fallen into).

Until recently, I saw Bitcoin as the version 0.1 of cryptocurrencies; too old and fat and expensive to play along with the NKOTB. Destined to fall by the wayside as more targeted and sophisticated offerings like Stellar and Maker took the stage.

But having delved deeper into the Lighting Network this week (I know, late to the party), I’ve learnt that Bitcoin can continue to be slow and fat and expensive yet still support thousands of transactions per second with low fees.

With a little help from the Lightning Network.

I think that’s neat.

So, this week’s $500 goes to good ol’, big fat Bitcoin.

Breaking my cardinal rule

This week I ran to catch public transport. I saw my ferry coming, knew that walking briskly wasn’t going to cut it, so broke into a run. This is something I’ve never done before; something I swore I would never would do.

This has nothing at all to do with cryptocurrencies.

This week in the news

The Australian Financial Review had a wonderful article entitled This is the final nail in the Bitcoin coffin — that was exactly as sensationalist as you have already deduced.

The article displayed it’s ignorance with such gems as declaring cryptocurrencies as “useless as a form of exchange” and claiming that they “are very slow”.

Sure, a cross-border bank settlement can take a week but it’s cryptocurrencies who are slow.

To be fair to the AFP, they were copy/pasting (so hot right now) from a report by the Bank of International Settlements, who’s mascot I present without comment:

In other news, I watched a video from the Head Honcho of Goldman Sachs who has no strong opinions either way about crypto. But I liked his sentiment that it’s not likely that our current iteration of how we transfer and store value is the last iteration.

I like this view of things. It would take a weirdo to argue against the prediction that something will come after our current system of cash/gold/banks. It may or may not be ‘cryptocurrencies’ and it may or may not be in the next few decades, but things won’t stay the same forever.

Of course, you and I know it will be cryptocurrencies and that it’s already happening. But don’t try telling that to a 70 year old white male in a dark pin striped suit, white shirt and red tie.

Akoin, by Akon, is going to build a Wakanda and be on every phone in the world by December, did you hear?

I present to you (again without comment) the flashy mockup that was so good they put it twice on the homepage:

Do you like grey? You’re going to LOVE the Akoin Digital Wallet

Do you like grey? You’re going to LOVE the Akoin Digital Wallet

I see now how they’ll have it ready by December.

Oh and they’re building a city. Like, a legit, steel and glass, non-virtual, reach-out-and-touch-it city sprawling out across 2,000 acres.

That’s twice the size of a 1,000 acre city!

And it’s only 5 minutes from Dakar airport, which will come in handy when you want to leave.

Now, if you know anything about building cities, you might think that this is the single dumbest thing you have ever heard, and that actually it’s surprisingly tricky to make a city.

Well, my friend, put your doubts behind you, because according to the website, “Akon Crypto City is now in developmnet” — badda bing badda boom!

(BTW that’s their misspelling of the word ‘development’, not mine. They don’t have time for attention to detail — they’re busy building a city.)

Now, some thoughts that I’ve had about some things this week …

Could Bitcoin be a step backwards for privacy?

Let’s fast forward 10 years and say that Bitcoin payment is as pervasive as credit card payments are today. To buy something from an online store, you simply deposit some bitcoin to their Bitcoin wallet address.

Obviously, that wallet address is public, so there is a known pairing between that retailer and that wallet address.

There is also a public record of your wallet address transacting with their wallet address (but no public record that ties you, the human, to your wallet address).

Next, along comes me, rubbing my greedy little hands together. (I’m wearing a pince nez at this point.) I start up a data-gathering business that maps wallet addresses to the retailers that own them. Easy enough.

I also build a map with every wallet address that has transacted with any of these retailers, and sell this data as a service.

If you send me a wallet address, I will tell you which retailers the address has transacted with (and when, and how much).

Now, you, the customer, go to Amazon to buy a pair of sneakers because you trod in some dog poo and you’re too rich for this shit. Amazon knows your wallet address from the last time you visited. They send your wallet address to my API and it comes back with the details of every other retailer you’ve interacted with. So now they know that you bought something for $79.99 from bobs-online-snake-emporium.com, and something for $29.99 from natures-medicine.com and so on and so forth.

My killer feature is that the retailer doesn’t have to pay for my service, instead they can send a little bit of info. So now Amazon can send me a wallet address plus the fact that it’s for someone in Arizona and they’ll get the results for free. Or maybe they send your sex, or estimated age group, and so on. I’ll get many such attestations from different consumers of my API, and so increase my levels of confidence that a particular metric is accurate for the human behind a particular ‘anonymous’ wallet address.

Next thing you know, Target knows that you’re pregnant before you do.

This can all be avoided if retailers and/or consumers create a new wallet address for every transaction (or maybe that won’t help) — or perhaps use a different technology that abstracts away the wallet addresses.

Anyway, I don’t think this is a tough problem to solve, I’m just rambling. Maybe I’m making the point that having a public ledger is — surprise surprise — a lot less private than keeping a ledger, um, private.

Next week

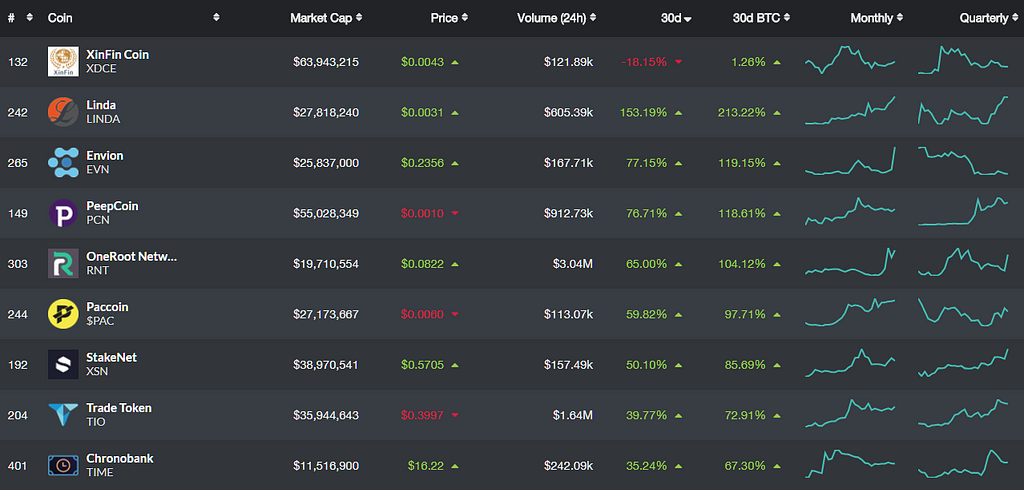

Albinas Uikis, I know I promised you in a comment that I would look into GET next week. But I have no honour, and thought I’d instead take a look at which coins were improving the most over the last few months, and in this overall negative soup, who were the promising little croutons.

There was lots of junk so I filtered for coins over $10,000,000 (also because I’m a wimp). There was still some junk with things like 24h volume of $30, so I filtered for more that $100,000.

Then I sorted by most improved over the last month.

www.livecoinwatch.com seems to have some problems with the first entry, failing to see that minus eighteen is indeed less than five hundred and twenty.

www.livecoinwatch.com seems to have some problems with the first entry, failing to see that minus eighteen is indeed less than five hundred and twenty.

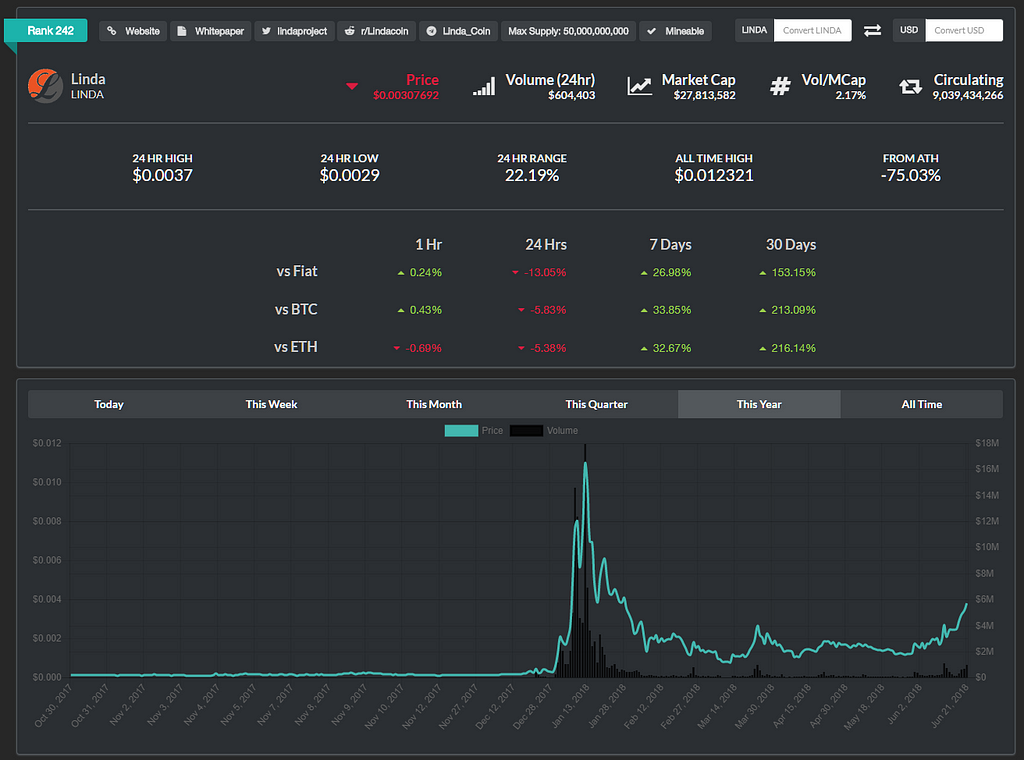

Then, for each of these I checked out their recent history. The majority of them had some sort of big launch or event recently and looked like this:

Congrats to everyone who got in early and lost lots of money.

Congrats to everyone who got in early and lost lots of money.

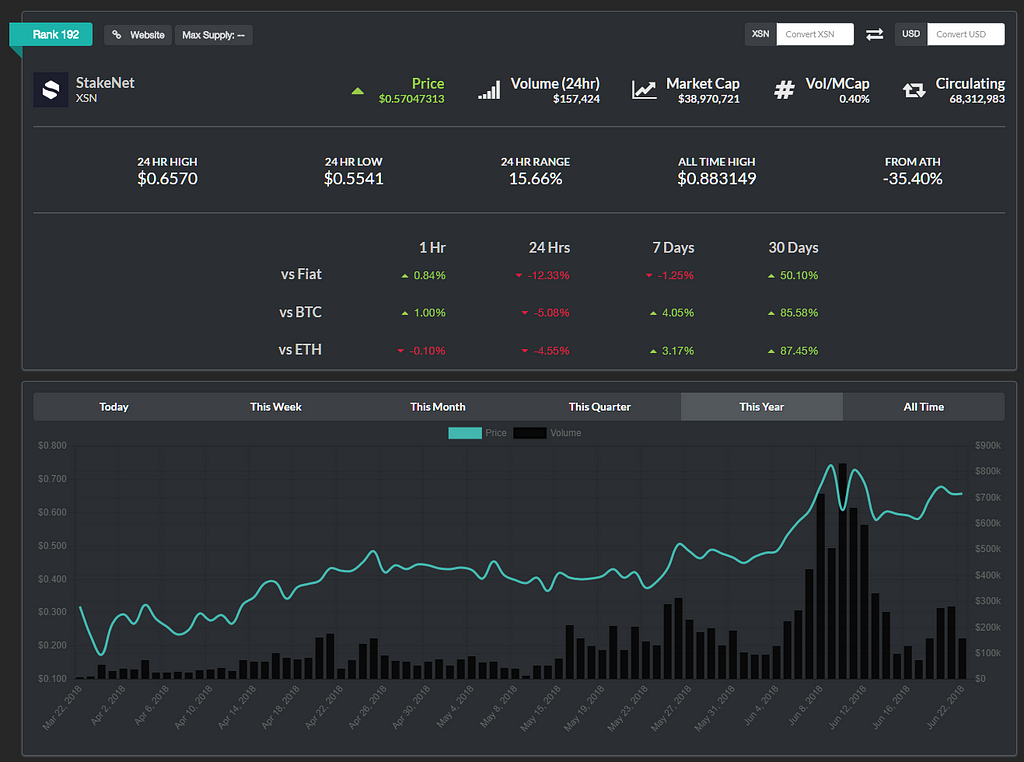

The first one down with a steady rise over the past few months was StakeNet:

https://www.livecoinwatch.com/price/StakeNet-XSN

https://www.livecoinwatch.com/price/StakeNet-XSN

That’s unusually steady, if you ask me — it doesn’t look like the behaviour of humans.

So, that’s what I’ll be looking into next week.

Hey, thanks for reading! Have you seen any cool looking birds recently? Tell me about it in the comments.

A crypto-trader’s diary — week 13; TRON was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.