Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In this week’s daily Bitcoin in Brief editions we reported about McAfee’s decision to stop shilling ICOs, crypto businesses’ involvement in the 2018 FIFA World Cup and much more. We also explored, in this week’s most commented-on article, a secret mathematical code that tantalizes the imagination of many bitcoiners.

Also Read: Exchanges, Payment and Wallet Firms Join EU Police to Fight Privacy

New York to Istanbul

On Monday, we reported that Xapo, the company providing wallet, cold storage, and bitcoin-based debit card services, has received a New York Bitlicense. The NY regulator said it has conducted a comprehensive review of Xapo’s operations, including the company’s anti-money laundering, anti-fraud, capitalization, consumer protection, and cybersecurity policies. With the license, Xapo will be authorized to offer a digital wallet and a vault service, and be subject to ongoing supervision. Additionally covered was a currency exchange shop in Istanbul that placed a bitcoin sign to attract the many shoppers and tourists that visit the Grand Bazaar every day.

All Because of Football

The 2018 FIFA World Cup and the involvement of crypto companies in the event were the main focus on Tuesday. Cryptocup is a blockchain-based game that allows football fans to make predictions and even bet on the matches. Gamers can create their own tokens, or golden tickets, used to make predictions for the 64 games of the championship. And gaming businesses are not the only ones trying to exploit the football fever. The web is full of sites with malicious content related to the huge event, including hidden crypto miners, according to a study by the antivirus developer ESET.

The 2018 FIFA World Cup and the involvement of crypto companies in the event were the main focus on Tuesday. Cryptocup is a blockchain-based game that allows football fans to make predictions and even bet on the matches. Gamers can create their own tokens, or golden tickets, used to make predictions for the 64 games of the championship. And gaming businesses are not the only ones trying to exploit the football fever. The web is full of sites with malicious content related to the huge event, including hidden crypto miners, according to a study by the antivirus developer ESET.

Day of Reckoning for ICOs

John McAfee’s decision to stop shilling ICOs was the top headline on Wednesday. The antivirus pioneer said he is no longer working with ICOs nor is he going to keep recommending them. The reasons McAfee gave for the move are “SEC threats” and that “those doing ICOs can all look forward to arrest. Additional stories included Bittorrent trying to reassure users it won’t cryptojack them to mine tron following the $120 million takeover over by Justin Sun, Binance’s latest venture in collaboration with the Malta Stock Exchange, a tether replacement getting VC backing, and Paris Hilton’s dad getting into crypto by selling a multi-million Mansion in Rome.

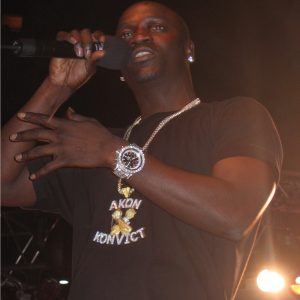

Akon Launches Akoin

Akon captured the headlines around the world on Thursday after he revealed the launch of his own cryptocurrency token called Akoin. The stated purpose of the project is to build a “real-life Wakanda.” The singer proclaimed: “I think that blockchain and crypto could be the saviour for Africa in many ways because it brings the power back to the people and brings the security back into the currency system. It also allows the people to utilize it in ways where they can advance themselves and not allow government to do those things that are keeping them down.” According to the project’s website, the “100% crypto-based” Akon Crypto City is being built on 2,000 acres of land gifted to Akon from the President of Senegal. It’s within 5 minutes of the new international airport, close to the coast and a short drive from Dakar, the capital city of Senegal.

Akon captured the headlines around the world on Thursday after he revealed the launch of his own cryptocurrency token called Akoin. The stated purpose of the project is to build a “real-life Wakanda.” The singer proclaimed: “I think that blockchain and crypto could be the saviour for Africa in many ways because it brings the power back to the people and brings the security back into the currency system. It also allows the people to utilize it in ways where they can advance themselves and not allow government to do those things that are keeping them down.” According to the project’s website, the “100% crypto-based” Akon Crypto City is being built on 2,000 acres of land gifted to Akon from the President of Senegal. It’s within 5 minutes of the new international airport, close to the coast and a short drive from Dakar, the capital city of Senegal.

Additional stories included an ICO mogul who bought land worth $19 million with bitcoin, and a massive trove of Coinbase customers’ complaints.

Oh No Nano!

On Friday we reported that a big problem was detected soon after the release of the Android wallet for free transactions altcoin Nano.

*ATTENTION* ANYONE WHO GENERATED A SEED USING THE ANDROID WALLET, IMMEDIATELY MOVE YOUR FUNDS TO ANOTHER WALLET DERIVED FROM A DIFFERENT SEED. *ATTENTION*

— Nano (@nano) June 21, 2018

Additionally covered was an ICO report that claiming that 17% of all funds are tokenized, 42% of all funds are based in the US, and the number of funds being founded has declined since 2017. Most crypto funds don’t publish their ROI, but of the 8% ICOrating could find numbers for, the median ROI this year is just 14% versus 600% in 2017.

Bottom Line: Bitcoin Will Recover

On Saturday we featured a few analysts predicting the price of bitcoin is about to recover. Govcoins, on the other hand, seem destined to die before they are even born. A high ranking representative of the Swiss National Bank’s management revealed that central banks around the world have become skeptical of introducing state-backed digital currencies. And according to local media in Venezuela, the country’s Superintendent of Cryptocurrency, has been fired by President Maduro after he failed to deliver on the promises to raise billions through the initial coin offering of the national oil-backed cryptocurrency, the Petro.

Mind Bender Code

The most commented-on article during the week covered the mystery behind the hash 00000000000000000021e800 – a series of numbers and letters has sent the cryptosphere into overdrive, sparking talk of quantum computing breakthroughs, time travel, Satoshi’s return, and the hidden meaning of bitcoin. To some, the appearance of so many zeros followed by 21 (a number synonymous with bitcoin’s total supply), is a near-impossible feat that signals intervention from another world. Light one up and join the mind blowing discussion.

The most commented-on article during the week covered the mystery behind the hash 00000000000000000021e800 – a series of numbers and letters has sent the cryptosphere into overdrive, sparking talk of quantum computing breakthroughs, time travel, Satoshi’s return, and the hidden meaning of bitcoin. To some, the appearance of so many zeros followed by 21 (a number synonymous with bitcoin’s total supply), is a near-impossible feat that signals intervention from another world. Light one up and join the mind blowing discussion.

This Week in Bitcoin Podcast

Catch the rest of this week’s news in the This Week in Bitcoin podcast with host Matt Aaron.

What other stories in the Bitcoin world caught your attention this week? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi Pulse, another original and free service from Bitcoin.com.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.