Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockchain projects and decentralized applications (Dapps) typically revolve around one cryptoasset. The payment, utility and security functionalities of are bundled together; but what if they weren’t? A single token model makes funding, development and user experience easy. However, in a world of infinite and programmable digital assets, this would be only scratching the surface of what is possible.

We are experiencing an explosion of token engineering, cryptoeconomic primitives, token building blocks and design patterns. Token building blocks still center around the use of a single fungible token (FT), but with emerging markets for non-fungible tokens (NFTs) and crypto collectibles, the world of blockchain based games and applications is about to get rocked!

In this post, I explore the design of multi-token economies. I will show how permissionless innovation, building on top of single token economies today can expand value for the underlying asset. Finally, I will share hypotheses for how multi-token economies can capture more value from permissionless innovation, creating more open, trustless and valuable economies.

Coins, Alt-Coins and Tokens

Coins get boring after a while… This guy needs a cape! 😉

Coins get boring after a while… This guy needs a cape! 😉

A coin is the native unit of a blockchain network like Bitcoin. It is a scarce fungible asset representing work done in the past in exchange for utility; in the case of Bitcoin, that utility is securing the network through Proof of Work. Alt (alternative) Coins are native units of other blockchain networks and may represent different forms of utility (dns names, storage, compute). These can be fungible or non-fungible units. Tokens are typically units of digital scarcity issued on top of existing smart contract blockchains like Ethereum.

There are standard interfaces for Ethereum representing fungible tokens (ERC-20 standard) and non-fungible tokens (ERC-721 standard). A standard interface means that wallets, exchanges and applications only need to implement one code library in order to view and interact with all tokens that use the standard. This increases the speed of development, leading to faster iteration cycles, better user experience and increasing adoption of cryptoassets by the masses. 👌

For the rest of this post, I will be talking about tokens and projects built on Ethereum.

Permissionless Innovation

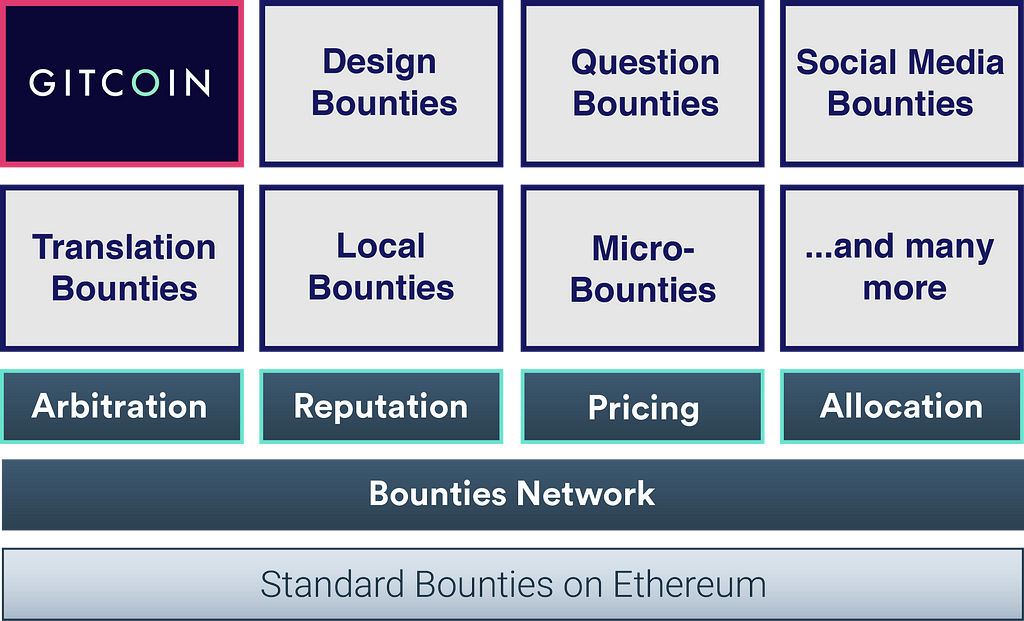

Gitcoin (depth-first) and Bounties Network (breadth-first) have integrated! CO this post.

Gitcoin (depth-first) and Bounties Network (breadth-first) have integrated! CO this post.

There is nothing stopping an application or game from utilizing the token of any blockchain protocol project. Gitcoin, a service for rewarding the completion of Github issues and growing open source software, does just that, by allowing blockchain developers to post bounties denominated in their protocol’s native token. Gitcoin is providing an extra “work for tokens” utility to potentially any fungible token on the Ethereum blockchain. Standard interfaces like ERC-20 and the open source nature of the Ethereum blockchain make this type of permissionless innovation possible. Cheers to Gitcoin and Bounties Network for increasing the utility of everyone’s tokens.

Another type of permissionless innovation can be found in the basic interfaces and experiences built on top of existing token economies. Wallets, block explorers and exchanges are providing a basic user experience (UX) layer for tokens.

NFTs economies like Cryptokitties also saw an explosion of different experiences built on top of their unique on-chain tokens. Games like KittyRace and KittyFamily spawning the KittyVerse are increasing the overall value of hodling (holding) Cryptokitties and therefore the value of the Cryptokitty economy. A team led by Maciej Olpinski at Userfeeds.io are building social experiences on top of NFT economies, also increasing the experiential and perceived value of the underlying assets. A nice summary of NFT economies and permissionless innovation in a gaming context can be found in this post by Tony Sheng of Decentraland.

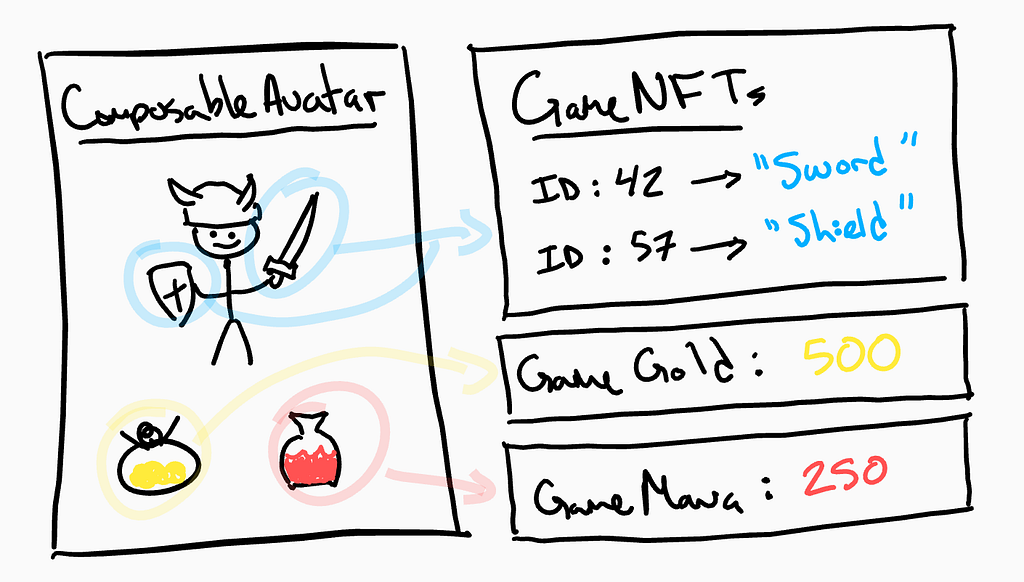

Composable game avatars and objects. Maybe not all from a single game studio 😉

Composable game avatars and objects. Maybe not all from a single game studio 😉

Asset composition is a type of permissionless innovation that can be done on-chain. KittyHats has done a good job of creating a permanent on-chain mashup of unique pre-existing NFTs and newly minted ERC-20 tokens. By sending a KittyHat token to a particular Cryptokitty, the hat will forever remain with the cat. I proposed, Composable Non-Fungible Tokens (ERC-998), to provide the Ethereum Community with a standard interface for the composition and decomposition of tokens into complex assets.

Lastly, Cryptogoods is brilliantly externalizing unique tokens, turning the perceived value of digital scarcity into rare and unique real world utility. By owning an NFT, only you control the rights to print a unique design on real items from t-shirts to coffee mugs. A powerful concept.

Summary — Permissionless Innovation

- Interfaces for on-chain utilities of tokens (Ex: wallets)

- New on-chain utility of FTs (Ex: Gitcoin)

- New on-chain utility of NFTs (Ex: KittyRace)

- New off-chain, “layer-2”, network utility of NFTs (Ex: Userfeeds)

- Composable on-chain utility for NFTs (Ex: KittyHats, Composables)

- Externalized real world utility for NFTs (Ex: Cryptogoods)

Problems with Centralized Crypto Economies 🤔

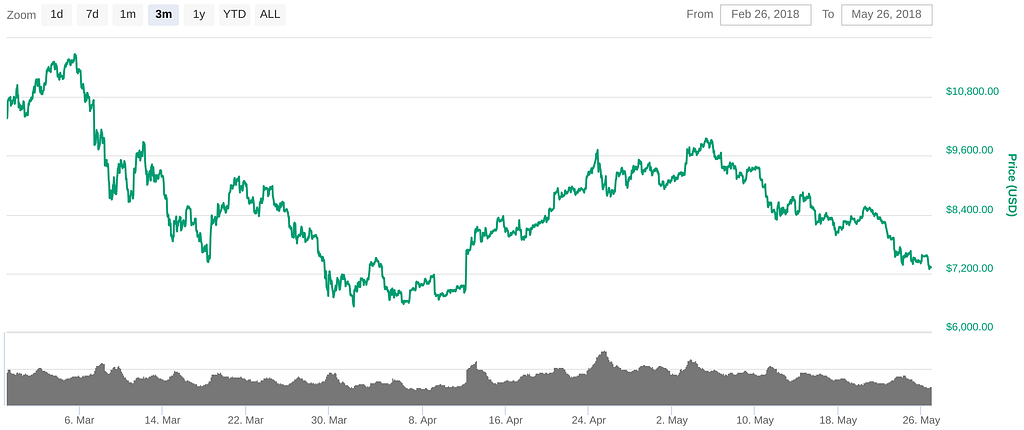

Let’s use some fairly large assumptions and say most fungible token projects based on a single token model are offering utility, i.e. project governance, Token Curated Registries (TCRs), etc… The idea being that token value will increase with network effects or enhanced utility. Speculators can also rush in, invest early in a token and sit idle, waiting for others to put in the work necessary to produce a desired price. At this point… can this token also function as a form of payment? Not likely. It will face the same volatility issues as bitcoin. No one wants to spend bitcoin because everyone is afraid when they do, the price will go up.

Bitcoin. 3 months of price. Would you pay for groceries with this asset? Or invest in it?

Bitcoin. 3 months of price. Would you pay for groceries with this asset? Or invest in it?

Most single token projects are bundling all their functionality into a single token. As stated in the introduction, this makes funding, developing and marketing the project to retail investors easier, but the economics simply won’t work.

Remember those smart investors? The ones who got in early and are going to kick back idle and let the “users” of the network do all the work and increase the value of the token? How does a project, centered around a single development team of perhaps 5–25 people, reach user adoption levels large enough to justify token demand that will outstrip supply and thus increase price? Even as a speculative asset, most single token projects are centralized and dependent on the actions of a founding team.

The Cryptokitties Apocalypse

What is a non-fungible token (NFT) anyway? It is a unique ID that can be owned and transferred. Perhaps it has some on-chain utility functions or game mechanics. Transactions record the usage of on-chain functionality. NFT economies are typically launched by a development team offering the first user interface and artwork for the assets. This is the state of the art today. Sounds pretty good so far…

Eternal Cuteness… and Darkness 😈

Eternal Cuteness… and Darkness 😈

What if I told you the Cryptokitties team is planning on upgrading all the kitty artwork tomorrow? The unique ID you own on the blockchain points to an image of a cat you’ve come to know and love, and now will be gone forever 😭, replaced by a different artistic rendition. Subjectively you find this change to be a net negative, analogous to Facebook arbitrarily switching all their emoji designs; what the what?

The siring (breeding) algorithm, the main game mechanic allowing you to produce new rare and valuable kitties, is also centralized and intended to be “secret”. As with most secrets on the blockchain, eventually someone looks at enough transactions to get to the bottom of it. What if the Cryptokitties team decides to upgrade the siring algorithm to increase secrecy or difficult of siring? This upgrade stands to make your existing set of kitties less desirable for siring. Overnight, your investment is in the toilet 💸.

Is this the “KittyVerse” we want to live in?

Where the perceived and speculative value of our cute and cuddly collectibles can be shattered in an instant? Greg McMullen has a more detailed breakdown of the Cryptokitties ownership conundrum.

Summary of Problems with Centralized Crypto Economies

- FT centralized go to market, user adoption and protocol upgrades

- FT utility, speculation and payment bundling

- NFT centralized issuance and upgrades

- NFT artwork property of and controlled by?

- NFT game mechanics controlled by?

Enter Multi-Token Economies

😍 80s memes! Found at PhotoFunia

😍 80s memes! Found at PhotoFunia

Perhaps we need a form of on-chain governance over both FT and NFT projects in order to have some predicable value for hodlers (token holders) and reduce reliance on centralized issuers. Brian Flynn introduced this concept in his post, “Decentralizing the Minting of Non-Fungible Tokens”. In the following sections, I will share some designs for multi-token economies that I hypothesize are more open and valuable, by aligning the incentives of hodlers with growth of the centralized issuer and brand. Speaking of brands, remember FUBU from the 90s? It’s time for a crypto reboot:

FUHBUH — For us hodlers, by us hodlers 😆

First things first, we have to start thinking in multi-token economies.

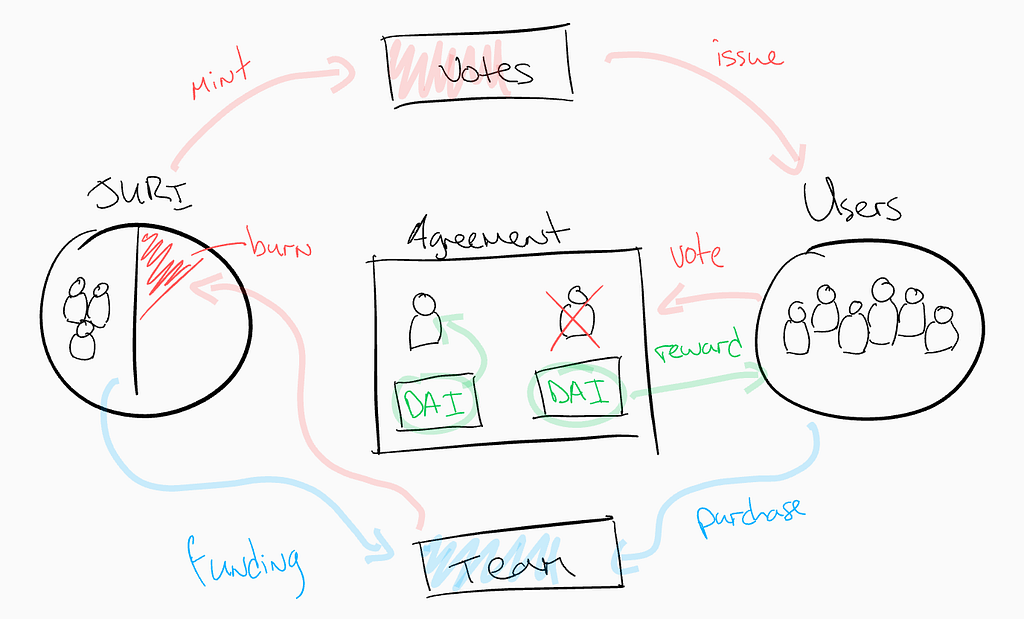

1. Un-bundling the Fungibles

Imagine a protocol for settling disputes between parties such as Kleros or SageWise. What follows is a hypothetical example, I am not affiliated with these projects. A dispute resolution protocol may have a single token, the JURI and raise some funds for the project by selling some amount of JURI in a token sale. The protocol goes live and users join. They begin staking JURI in an escrow agreement to ensure they can take a dispute over the agreement to arbitration. JURI is used for, you guessed it, jury selection and voting on disputes. It’s also paid out when the dispute is resolved. Can you see any problems with this approach? The value of JURI is tied to user adoption and network effects. No user would want to stake JURI if they felt it might go up in value during their escrow period due to a large influx of new users, who also need JURI tokens to... you get the idea.

What if we separated speculation of JURI from utility?

In the example above the protocol token JURI is broken into 2 parts: JURI and VOTE. There’s no dressing it up as a utility token… JURI now represents a security and investment in the protocol. It can even represent voting rights and other boring security token functionality 😴 (sorry Stephen). VOTE is a utility token available for purchase, with a limited supply. There is also a third token, but it’s not part of the project; DAI is a stable token that exists on Ethereum and can skirt the volatility issues of escrowed funds. Here’s how things go:

- The team sells X% of the JURI to investors raising $X

- Team builds great platform, users adopt

- Users stake DAI in agreements, used only when dispute occurs

- Disputes occur

- Other users purchase vote tokens to vote and win DAI rewards

- Team burns some portion of JURI in exchange for minting VOTE

- Users use VOTE, disputes settled, DAI rewarded

- JURI becomes more valuable for investors who hodl

This design is far from perfect, but it illustrates some points. JURI only becomes valuable after the project is in use. This is analogous to Apple shares only becoming valuable after they’ve sold a ton of iPhones. Also, if VOTE is available for purchase from the team during growth, go to market and iterative development phases. The team will have a steady source of funding; this also means they can probably raise less money in the JURI token sale and award VOTE to other development teams building applications on the JURI/VOTE protocol.

This can’t go on forever though. There will be no more JURI to burn and VOTE cannot be minted infinitely, or it would be worthless. I do not know the correct Schelling point or cryptoeconomic parameters for this design. However, if the network achieves exponential growth, the effects may be: VOTE demand increases exponentially with users wanting to use the platform to vote and win DAI rewards; The price of VOTE could stay fixed, while the amount of JURI burnt could be less; This could allow for the value of VOTE to remain somewhat stable and linearize a runaway JURI value due to exponential burning.

JURI hodlers could also stake a portion of their JURI to be burned for VOTE, liquidating their investment directly into the multi-token economy of the project. This could all be governed by JURI holders, their votes and the team as the primary stakeholders. Again, there are several assumptions in this example that must be proven out by proper mechanism design, experimentation, simulation, testing and more.

Sorry, there’s no token sale for JURI 🤣

2. Linking Fungibles to Non-Fungibles

NFTs and crypto-collectibles are going to be a huge deal, for good reason. They are more dynamic than their real world counterpart the baseball card. Cryptokitties proved this with the siring of two NFTs to produce a third unique kitty. No matter how hard we try, we’ll never smash two baseball cards together and create a third. However, as mentioned, there are issues with centralized issuance and management of NFT economies like Cryptokitties. How might we decentralize the control of a game mechanic like siring two cryptokitties?

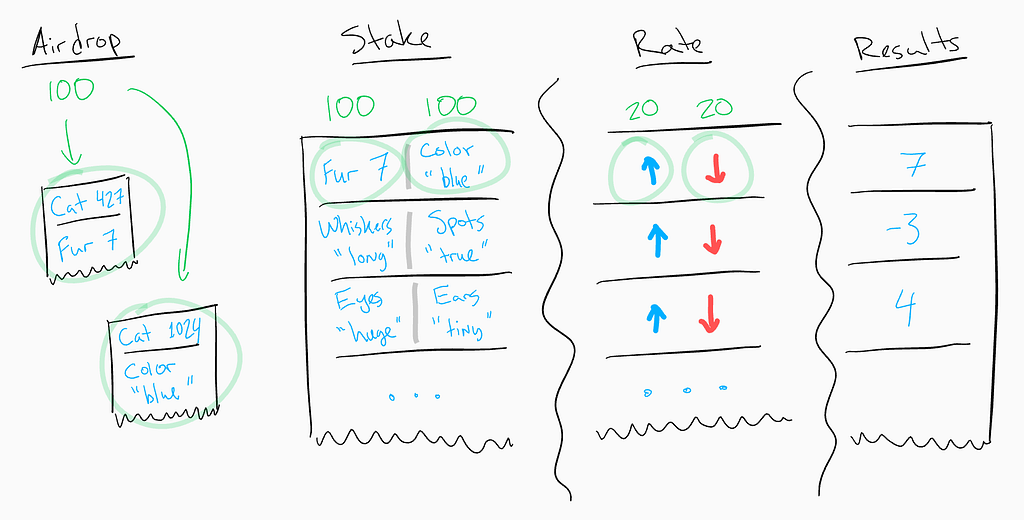

Decentralizing the Cryptokitties genetic algorithm using a Combinatorial + Graded TCR

Decentralizing the Cryptokitties genetic algorithm using a Combinatorial + Graded TCR

One way to accomplish this is by using a Token Curated Registry (TCR). In order to allow Cryptokitty NFT hodlers to stake on the TCR, they’ll need some KittyCoin. There will not be an ICO for KittyCoin, but it could be airdropped to all original purchasers, from the initial release, i.e. not bred kitties.

Essentially, KittyCoin is a finite supply token used only for staking and upvoting favorable genetic pairings of, “cattributes”, the Cryptokitty attributes that generate the finalized artwork. By allowing the NFT hodlers to also hodl a fungible token governing the major game mechanic responsible for minting new NFTs, we’ve created an extremely rare, influential and valuable token for the Cryptokitty economy. Nice! 👊

Here’s how this might play out:

- Original Kitty NFTs receive KittyCoin in airdrop

- Users stake KittyCoin to list genetic pairs in a combinatorial TCR

- Users also stake KittyCoin to rank the pairs in a graded TCR

- Finite supply KittyCoin, now staked, has reduced circulation

- New NFT cattributes are based on pair rank and some randomness

- Therefore, NFTs with favorable cattributes for breeding are more valuable

Now that’s a decentralized multi-token economy. 👌

3. Permissionless Innovation — Again

As mentioned previously, a project like Gitcoin brings value to the tokens of other projects by providing “work for tokens” utility; allowing anyone to create bounties for GitHub issues in other project’s tokens. The more on-chain utility and off-chain experiences a token has, the more potential value the token economy can have for users. Now here’s where things get a little nuts…

The ideal multi-token economy is an Infinite Game. A mindset of, “play nice with others”, creating a virtuous circle of token minting, utilization and value creation. Tokens can incentivize creative developers to grow the economy by creating new NFTs, utility or off-chain experiences. Here are some permissionless innovation tips and ideas:

- Make tokens standard, extensible and composable

- Mint, compose and utilize existing tokens

- Generate new tokens by composing with existing tokens

- Decentralize control of token mechanics, with a TCR

- Incentivize creatives contributing to new tokens

- Design open source code and APIs to increase token utilization

- Tokens for off-chain experiences to monetize their work

Wrapping Up

Countless projects have been launched on the Ethereum blockchain, with a majority of them relying on the, “one token to rule them all”, mindset for their token economy. Funding, security, utility, payments… It’s never been easier to create multiple forms of digital scarcity, so why are we wrapping everything up in one asset? Non-fungible tokens are in their infancy today, but due to their unique nature they stand to create an incredible wave of gamified digital assets and permissionless token economies. Those that try and capture value too soon or too naively, will find themselves swimming upstream, applying business models that are fundamentally antithetical to the permissionless nature of blockchain technology. Aligning the incentives of all stakeholders in your vertical for infinite value generation, can only be accomplished by pushing the limits of multi-token economies.

Matt is passionate about open and decentralized blockchain solutions that solve real world problems for real people. Get in touch:

medium.com/@mattdlockyertwitter.com/mattdlockyerlinkedin.com/in/mattlockyer

Designing Multi-Token Economies was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.