Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I have an idea of how the cryptocurrency market moves. This is based on my personal experience of discovering and learning about cryptocurrencies, and from reflections on past events in the space.

Other people would predict market movement using technical patterns, sentiment analyses, or fundamentals, and they might be right. I choose to use a more qualitative approach, and perhaps our methods are correlated to some extent.

Photo by Seth Doyle, Unsplash.

Photo by Seth Doyle, Unsplash.

The cryptocurrency market moves in a cyclical fashion. It moves in tandem with the state of development in blockchain and distributed ledger technology (DLT). Duh, all markets move in cycles, and technology advancements trigger price movement. What are these stages? Allow me.

Stage 1: Discovery

The first step would be when someone encounters Bitcoin or any other cryptocurrencies for the first time. It is usually met with some bewilderment, a ton of confusion, followed by some scepticism.

What is this thing? Some form of universal currency? A technology to cut out the middleman? It sounds like it could work, but how exactly? Is it just hyped up? How can a volatile cryptocurrency even be used as money?

This is the stage where newcomers are bombarded with so much information and jargon that most people would rather give up. For those who have dug deeper, they were probably motivated by the prospects of exponential returns on their investments. For some, it was the applications of the technology but for most, they progress to the next stage because they bought some coins.

Investor’s Mood: Intrigued, confused, sceptical, doubt, greed

Stage 2: Learning

After you own some cryptocurrency, you want to find out more about what you are investing in. It might also have been the technical applications that led you to this stage where you learn why exactly it is called a “blockchain”, what mining is, or what hard forks are.

You start pondering and understanding these jargons — decentralised, distributed, scalability, interoperability, immutability. You might start telling friends and family about it but you will struggle to explain these terms simply and they will struggle to understand.

Decentralisation means having no centralised institution. Scalable means more people can use it. Immutability means it cannot be changed. So on and so forth, but telling them the literal meaning does not help them in understanding what exactly this whole phenomenon is about!

You are excited about the prospects of learning and understanding the technology and different coins better. You realise that the more you know, the more you do not know. There is always something new to discover, something novel to stimulate your learning journey.

Investor’s Mood: Inquisitive, overwhelmed, excited, more greed

Stage 3: Plateau

You have read whitepapers one after another. Everyone is trying to blockchain something. They are using the distributed ledger to cut out the middleman or they are trying to resolve the problems of scalability and interoperability in one way or another.

Everything starts to appear repetitive. So this is what the blockchain hype is about. And then, what is next? When “moon”? When “Lambo”?

Occasionally, you will come across a cryptocurrency with an entirely novel concept. You will be stimulated again, only for a while, because you soon realise that there are many other barriers to overcome before that cryptocurrency can come to fruition.

Investor’s Mood: Monotonous, boring, habituated, disappointment to an extent of becoming unaffected by market changes

Stage 4: Innovation

A period of stagnancy does not signify a period of non-development. Work is still being done by companies and organisations who have raised funds, mostly through ICOs (Initial Coin Offerings). Partnerships are being forged, new use cases are being piloted, there is still growth.

This is the stage when most developers are no longer concerned about how different they are from other cryptocurrencies. Investors are also less worried about the price fluctuations. We will do our work, and let the result show for itself. Who cares if the market is on an up or down cycle? Just HODL!

This stage can last for as long as it takes for something groundbreaking to surface. It is the time when new ideas are being tested and experimented on, and everyone generally accepts that cryptocurrency is still a work in progress. HODL people, HODL!! We’re mooning soon!

Investor’s Mood: Some curiosity, learned helplessness, occasional surges of excitement that is killed off quickly

Stage 5: Breakthrough

After many months of incubation, there is finally a breakthrough. A whole new application or a solution to a major plaguing issue has been worked out, which would change the way that people think about cryptocurrencies

There is a newfound sense of euphoria and a renewed state of excitement at the prospects of the discovery. This would bring us back to Stage 1 and 2, where there will be more to discover and learn about yet again! It is the mark of a new cycle!

Investor’s Mood: Surprised, overjoyed, invigorated, enthralled, somewhat cautious

The Relationship Between Stages and Market Cycles

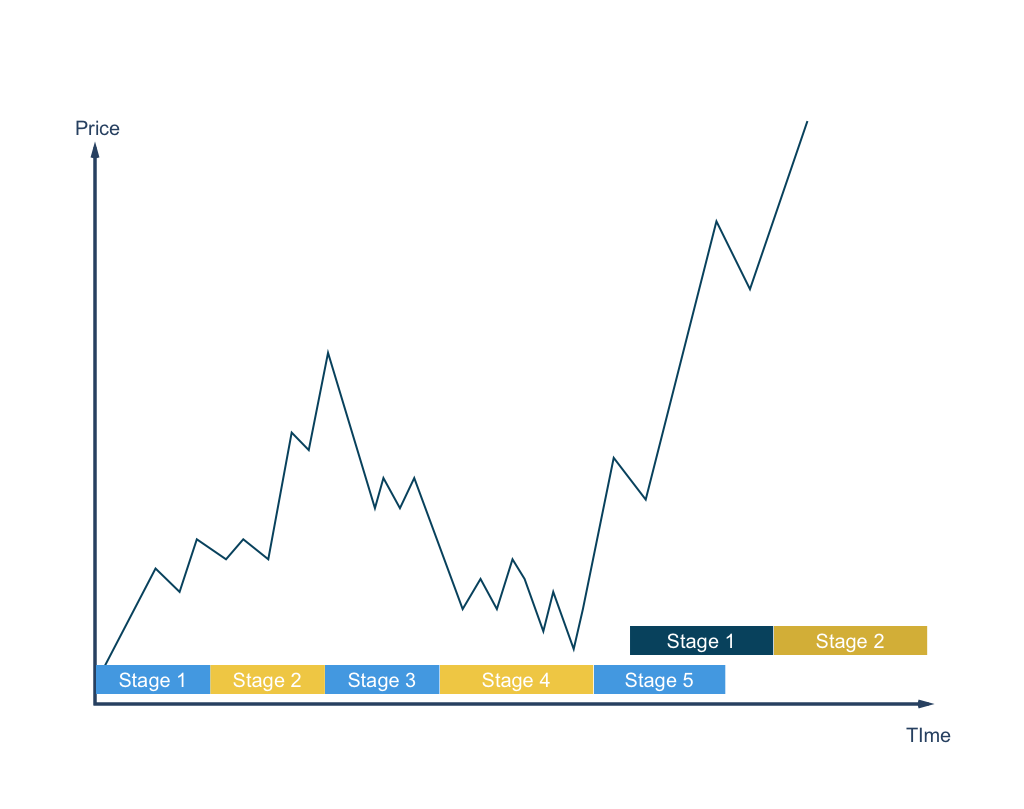

Relationship between the 5 Stages and price movements in the markets. (Hansel, 2018)

Relationship between the 5 Stages and price movements in the markets. (Hansel, 2018)

Stages 1 and 2: As the market faces an excited state of discovery and learning , it is on a general upward trend. There will be negative sentiments to put off the growth, but the upwards movement is somewhat unstoppable.

This is also when institutions, the media, and invested individuals will become cryptocurrency champions, telling others how good and how big this technology will be. Sometimes, their influence can be so strong that it causes prices to soar to the moon.

Stages 3 and 4: Then the market will be met by a phase of stagnancy or even reversal as the hype dies down. The uninformed investors start exiting the market as there appears to be no sign of further growth. The informed traders would have already made some strategic and profitable exits.

As the downward momentum perpetuates, more investors make a beeline for the exit. Manipulators on the other hand keep prices low so as to bring prices to new lows when they can make new entries again. Some minor innovations could trigger a slight reversal in sentiments and in the markets, but nothing too major to cause a significant uprise, not until the next breakthrough.

Stage 5 (and next Stage 1): The groundbreaking move will be bigger than the previous rise. This is when there is an extreme change that will beget even more positive sentiments and attract a whole new set of investors on top of the existing ones. That is why the market cycles grow bigger than ever, and the “bubble” continues to balloon.

With DLT, the technology is constantly developing and evolving. Similarly, the market is a mere reflection of this pattern, constantly cycling through these 5 stages. This has been evident from historical price patterns.

2009–2015: When Bitcoin (BTC) was first conceived as a “peer-to-peer electronic cash transfer”, it took some time to get the code out. It took some time to get miners, to the first two pizzas being bought for 10,000 BTC, to the launch and spread of the word of Bitcoin along Wall Street. Then the hype died down, BTC prices fell from almost $1,200 in 2013 to $200 levels in 2015.

2016–2018: The next big breakthrough was when Ethereum (ETH) gained popularity because of its smart contract capability. Prices were not that wild at the start when things were still being figured out. It was only after the hard fork with Ethereum Classic (ETC), followed shortly by the Bitcoin Cash (BCH) hard fork that generated a lot of interest and momentum in the cryptocurrency space. This was further propelled by the massive increase in ICOs. ETH went from $10 in January 2017 to $1,200 in January 2018, before falling back to $400 levels in April 2018.

Learning From History

Every time something groundbreaking is introduced into this space, the market follows with an almost-insane hype and euphoria. You can argue that market makers capitalise on these sentiments to profit, often overhyping the prospects of cryptocurrency, only to kill off the momentum at new all-time highs.

This was evident from how they capitalised on the BCH hard fork, the CME and CBOE futures contracts, and the minting of new Tether. Or you can be optimistic about it, and see them as perpetuating real innovation and weeding out the people who follow blindly or hop onto the bandwagon.

We are now in the stages of Plateau and Innovation. Market sentiments are weak but it is not the end of the market. If you are following the space closely, you will see that there are constant developments.

I see three potential breakthroughs for the next uprise.

- Cryptocurrency becomes a usable form of money. Its usability improves, price volatility decreases, and it is increasingly accepted or adopted globally. However, if breakthroughs would be followed by rising prices, then cryptocurrency will not become less volatile. If prices continue to fluctuate wildly, cryptocurrencies will unlikely be adopted or accepted widely. I believe stability will happen in time, but not anytime soon. Coins to watch for this uprise: BTC, ETH, BCH, NANO, XRP.

- Cryptocurrency as oracles. The concept of oracles stem from predicting outcomes and optimising actions with these predictions. Picture a ground-up way of collecting a massive amount of data, turning this data into meaningful information, and making data work for us. However, this field is very much in its infancy. There is a huge potential but development and trials are still being conducted, so it may not come that soon either. Coins to watch for this uprise: AE, IOTA.

- The rise of truly decentralised institutions. Even though people are embracing decentralisation, the irony is that we are still buying, storing, and trading cryptocurrencies on centralised exchanges. Decentralised exchanges (DEX) are already working and coming to fruition. Although they may not be entirely interoperable, they do service major coins and can possibly reduce price volatility in the market significantly. Coins to watch for this uprise: ZRX, KNC, WAVES, BNB.

There are many other utility tokens with viable business models. It makes sense to invest in them for capital appreciation and I do have holdings in some of these tokens. However, I feel that there must be a major implementation like a structural or fundamental change in order to trigger the next uprise of the cryptocurrency market.

The rising tide lifts all boats. I am sure that many other cryptocurrency tokens will follow the tide, and generate good returns. Just look at the rise in prices of XRP, ADA, XLM in December 2017 and you will see how they have ridden along this wave.

While looking at the cryptocurrency market and the developments in DLT, I am looking for the breakthroughs that will cause the tides to rise. We want to find and join the revolutions that can create an exponential price growth like BTC rising from $10 to $1200 (before crashing back to $200) and ETH rising from $10 to $1400 (before crashing back to $400).

As many others before me have said, we are only in the infancy of the technology. DLT and its application will still grow, as will the cryptocurrency market. It is only a matter of when.

I write about cryptocurrencies regularly. These articles help to consolidate my thoughts as I work on a book titled Prospering In The Decentralised And Distributed Economy. Follow me if you would like to read more of such articles, or sign up for my mailing list if you would like to be the first to read my book, thank you!

Other Articles:

My Secret Strategy to Maximise Altcoin Returns

The 5 Stages of Crypto-Technology Development was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.