Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Illustration by John Wu

Illustration by John Wu

For an investor to outperform the market, someone else must underperform. That is a simple arithmetic fact.

In a fair and regulated environment, investors have equal access to information. Winners and losers are determined by whoever can make a better prediction.

But cryptocurrency is the wild, wild west. Market participants don’t play fair and they can profit at the expense of others.

Here are the three types of traders that are kicking your ass

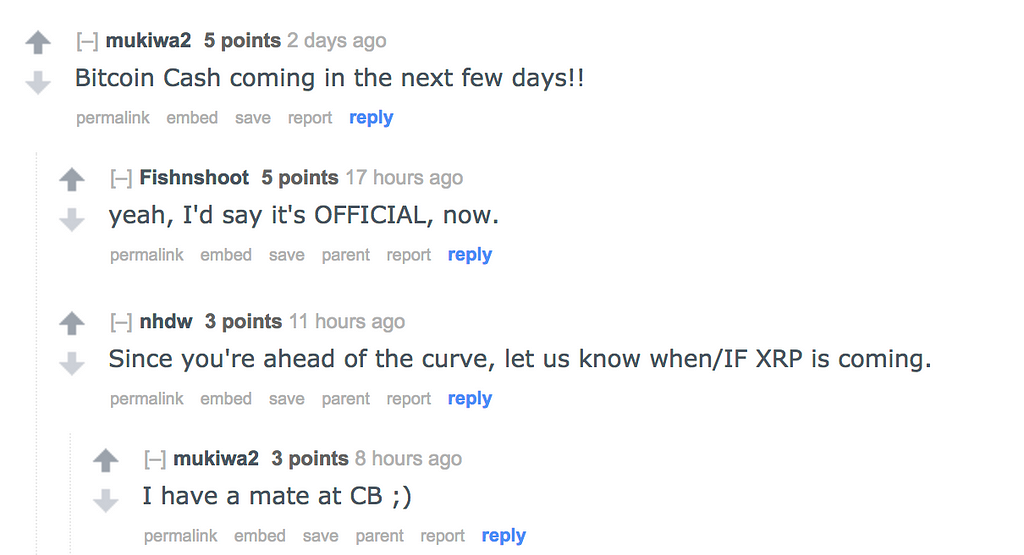

Insider Traders

Under Rule 10b5–1, the SEC defines insider trading as “any securities transaction made when the person behind the trade is aware of nonpublic material information.” Insider trading is illegal in almost all traditional markets. In a research paper published in 2010, Qin Lei found empirical evidence that insiders were able to consistently beat the stock market.

Over the last year, we’ve seen many high-profile cases of insider trading in the cryptocurrency market.

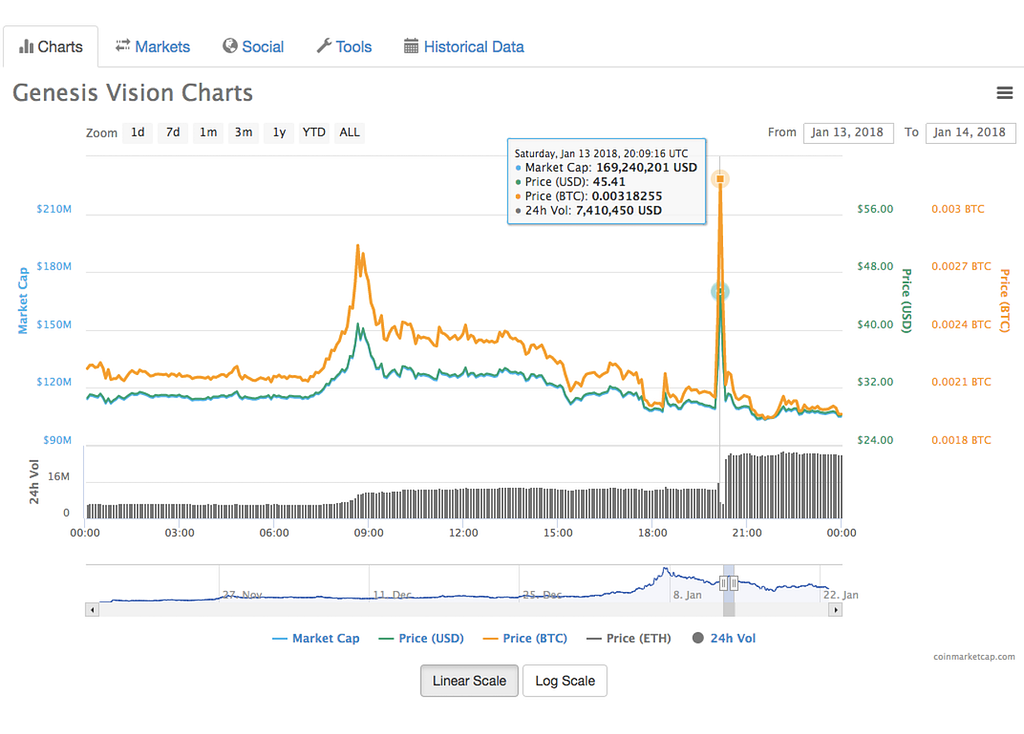

Coinbase — The Bitcoin Cash Incident

On December 19, 2017, Coinbase tweeted it would add Bitcoin Cash to its exchange. But before the announcement was made public, both the trading volume and the price of Bitcoin Cash suspiciously surged.

BCH pump before the announcement. Even trading on insider tips are considered a violation in traditional markets

BCH pump before the announcement. Even trading on insider tips are considered a violation in traditional markets

On March 1, Coinbase was hit with a class action lawsuit. The full court document is available here.

South Korea Financial Supervisory Service (FSS)

Even regulators are being investigated for insider trading. Korean FSS officials knew ahead of time that new cryptocurrency trading restrictions would be put in place. Yet, they still made trades before the announcement.

The chief of the FSS, Choi Hyung-sik, confirmed on Jan. 18 that trading violations had occurred. Despite being caught red-handed, another FSS official responded that there was technically “no code of ethics or conduct for virtual currencies and therefore difficult to issue any punishment.”

The examples mentioned above are just a few high-profile cases. Insider trading runs rampant in the cryptocurrency space. Very often, prices and trading volumes will pump right before an exchange announces a new coin.

To many, insider trading is no longer a surprise but rather something that “just happens” in an unregulated market.

Whales

A whale is simply a colloquial way to describe an investor who is able to manipulate markets by mobilizing large amounts of capital.

Most crypto investors treat whales like the boogeyman. They’ve never had a personal encounter, but swear that whales are responsible for large market swings everywhere.

In some cases there is strong evidence indicating that they are right. Recently, academic research has come out showing that large-scale price manipulation does happen. Here’s an example from 2013, where a single entity was largely responsible for pushing the price of Bitcoin from $150 to $1,000 in two months. Another paper that came out last week shows how large amounts of USDT was used to manipulate Bitcoin prices.

Here are a few techniques whales use to manipulate price.

Stop-loss hunting

Whales intentionally push the price down in order to trigger stop-loss orders. Then they turn around and buy coins from these stop-loss orders for cheap and wait for the market to recover.

This strategy works well for coins with low trading volumes and small order books. With enough coins, whales can push down the price by introducing a slew of market-price sell orders.

To show how this works, let’s imagine a scenario:

- There is a coin trading at $150

- There are 10 BTC of buy orders between $110 and $150

- There are 10 BTC of buy orders between $90 and $110

The goal is to drive the price down past $100, which may be a psychological breaking point for some people and therefore a likely place for stop-losses.

One can do this by:

- Placing a market sell order totaling 10 BTC, to drive the price down from $150 to $110

- Keeping the sell pressure on, as investors naturally start selling their holdings.

- Watching people’s stop-losses go off at $100 without their knowledge. This drives the price down further.

- Buying up all the stop-loss orders at $90 and under.

- Waiting for the market to recover before selling the coins.

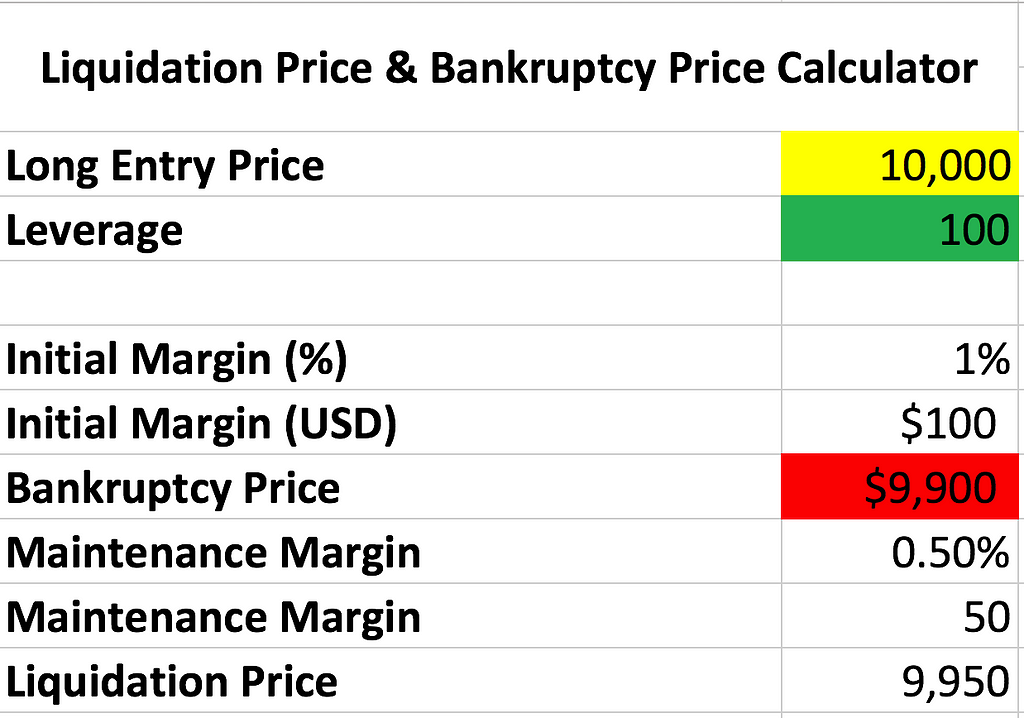

Short/Long Hunting

This is another form of market manipulation, but one that only exchanges can pull off.

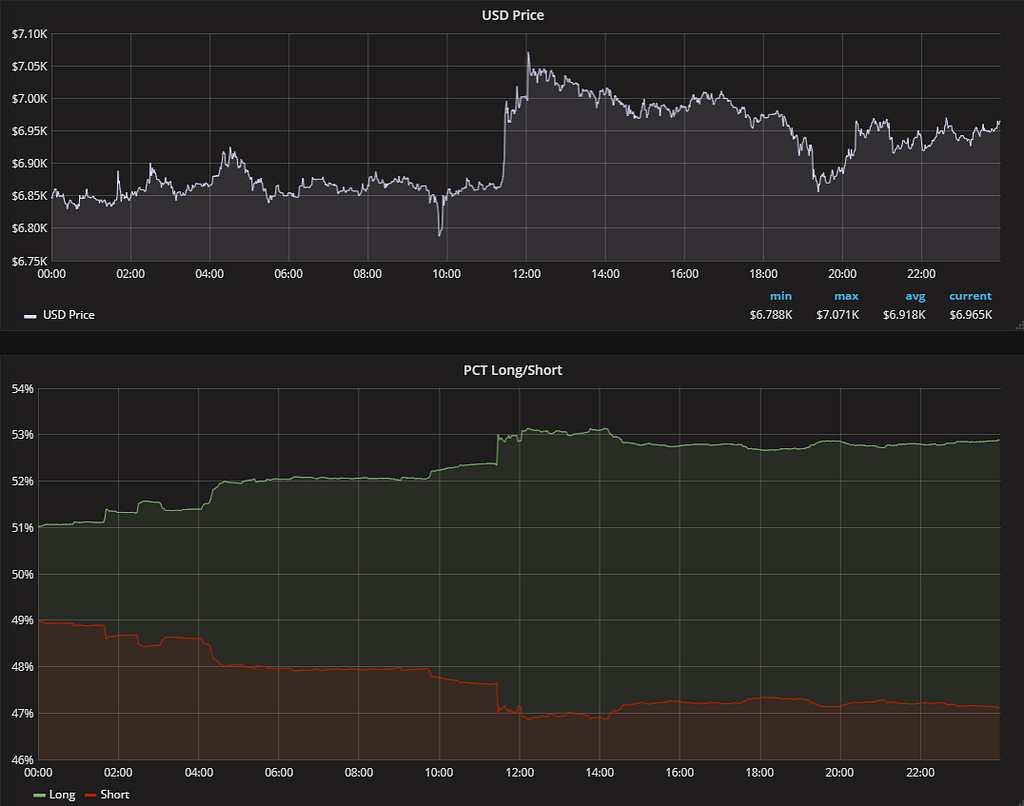

Let’s see how this works on Bitmex for BTC.

- A trader puts up $100 as margin for a 100x leveraged long position of $10,000.

- The bankruptcy price is set at $9,900 which is the market price minus the margin.

- However, Bitmex forces a liquidation if the price falls to $9,950, just $50 (0.5%) from the initial entry price.

- When the market price reaches the liquidation price, Bitmex forces a sell at the bankruptcy price ($9,900).

- At liquidation, investors lose their entire margin and pay the high fee at the 100x leveraged rate.

Prices are rounded to it easier to read

Prices are rounded to it easier to read

The price just has move slightly in the wrong direction to trigger a liquidation. When liquidations happen, the investor loses their entire margin and pays a big fat fee.

Because exchanges know exactly what prices will trigger these liquidations, they have both the capability and financial incentive to engineer price movements using bots.

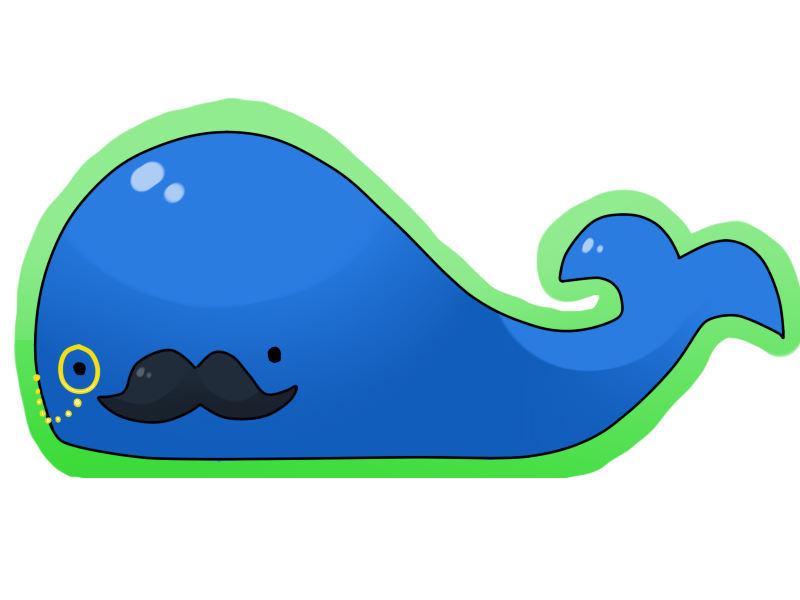

/u/arsonbunny finds it suspicious that low volumes and sideways movement are followed by a big burst of volume and a directional price movement. Often these movements coincide with massive amounts of liquidation.

/u/arsonbunny finds it suspicious that low volumes and sideways movement are followed by a big burst of volume and a directional price movement. Often these movements coincide with massive amounts of liquidation.

To be clear, there is no evidence implicating Bitmex. But it is suspicious that low volume trading periods are followed by a furious uptick in volume. When this happens, liquidation tears through leveraged positions, leaving traders with nothing other than a fistful of trading fees.

All credit to /u/arsonbunny for investigating this phenomenon.

All credit to /u/arsonbunny for investigating this phenomenon.

BitmexRekt tweets these liquidations in real time. You can follow them here.

Spoofing

Another common strategy whales use to manipulate the market is called spoofing. It means to bid or offer with intent to cancel before the orders are filled. The goal of spoofing is to send false signals to investors.

Here’s an example of using this strategy to profit:

- A spoofer places a large buy order right underneath a smaller buy order with the intention of sending a bullish signal to the market.

- After filling a few trades, *poof*, the spoofer cancels the entire buy order.

- When the price starts to rise, the spoofer starts to sell his coins.

This also works in the opposite direction. By placing large sell orders, spoofers can send bearish signals and lure investors into selling their cryptocurrencies at a discount.

Bitfinex’d investigates an entity known as “Spoofy” operating on the Bitfinex exchange.

Wash Trading

The last strategy we’ll cover is wash trading. In a wash trade, an investor takes both buy and sell positions. This may be done in order to:

- Artificially inflate trading volume in order to send a bullish signal

- Manipulate prices on markets with small order books

Usually wash trading is extremely hard to prove, as washed trades look very similar to real trades.

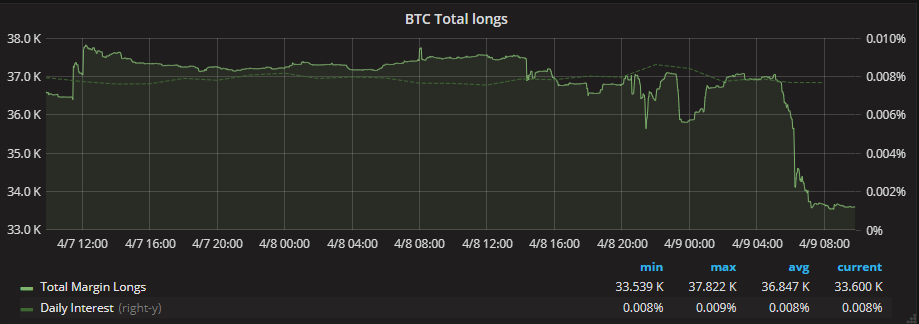

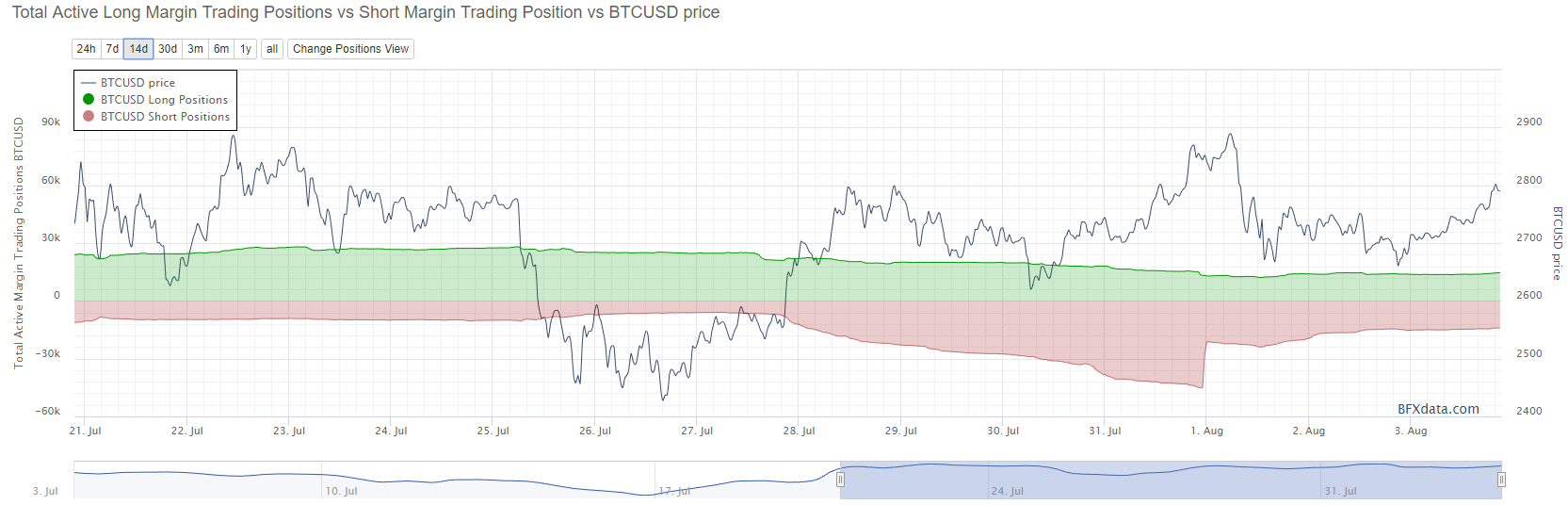

On July 27, however, Bitfinex unknowingly baited wash traders during the Bitcoin (BTC) fork to Bitcoin Cash (BCH). At the time of the fork, all BTC holders were to receive BCH commensurate with the amount of BTC they held.

To accommodate for BTC held in margin positions at the time, Bitfinex had to finesse the numbers. To quote the announcement:

BCH will be distributed to settled bitcoin wallet balances as of the UTC timestamp of the first forking block, which is expected to occur on August 1st, 2017.The token distribution methodology will be:- All BTC wallet balances will receive BCH- Margin longs in BTC/USD and margin shorts in XXX/BTC will not receive BCH- Margin shorts in BTC/USD and margin longs in XXX/BTC will not pay BCH- BTC Lenders will receive BCHDue to the net amount of BTC committed in margin positions at the time of the fork, the above methodology may result in Bitfinex seeing a surplus or deficit of BCH. As such, we will be resolving this discrepancy in the form of a socialized distribution coefficient. For example, currently, there are more longs than shorts on the platform, causing a distribution coefficient of ~1.091 (Meaning that for each qualifying BTC a user will receive 1.091 BCH). The actual coefficient will be calculated at the moment of the distribution.

These rules turned out to be game-able. Because Bitfinex did not charge BCH to open short positions leading up to the split, one could simply purchase 10 BTC and short 10 BTC. This way, you could collect free BCH without any exposure to BTC price volatility. If BTC drops, the shorts cancel out any loss. If BTC soars, the profits cancel out the short positions.

On July 27, there were more longs than shorts on the platform and the distribution coefficient was 1.091.

Credit to Bitfinex’d for this image

Credit to Bitfinex’d for this image

However, on August 1, the distribution coefficient moved to 0.7757.

Leading up to the fork, an enormous amount of short positions were created. And instead of prices going down, which is what usually happens when shorts increase so dramatically, prices actually went up.

To make matters even more dubious, shorts dropped by 24,000 on a single tick right after the fork.

The manipulation here was so obvious that even Bitfinex had to acknowledge it. They issued an official statement about the wash trading here.

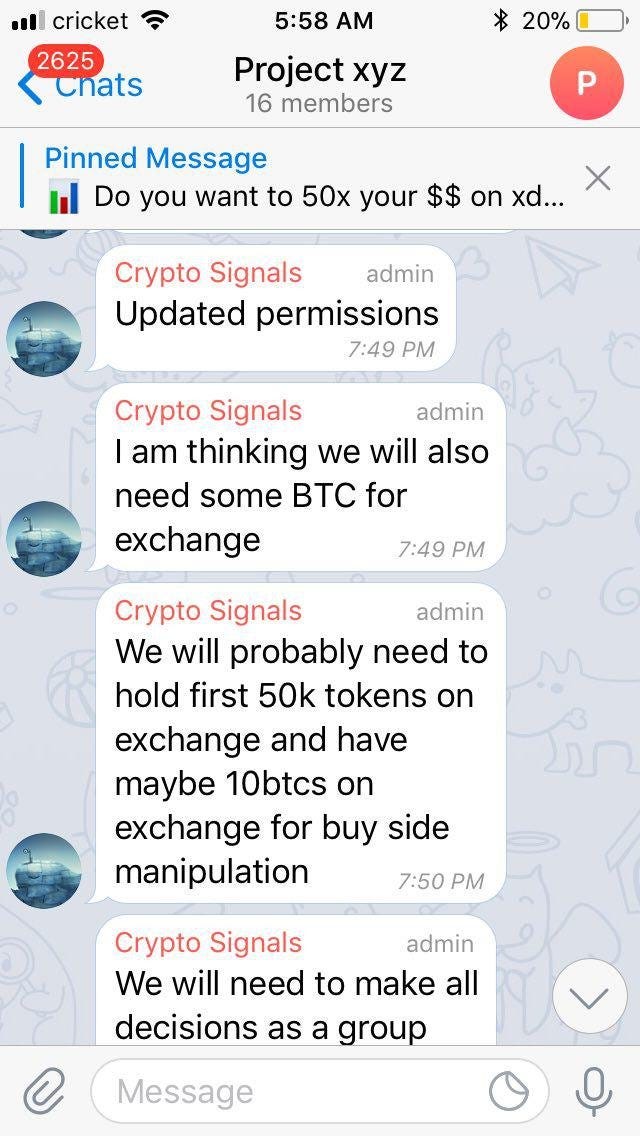

Pump & Dump Group Executives

So we’ve talked about insider traders and whales.

The final type of traders we’re going to talk about are the pump & dump group executives.

Pump & dump (P&D) is a form of market manipulation that involves purchasing a cheap asset, artificially inflating its price, and then dumping the asset a higher price.

The cryptocurrency market is rife with such groups. Here are just a few:

- Big Pump Signal (82,184 members)

- VIP Signal Strategy (24,138 members)

- PumpKing Community (11,124 members)

- Crypto4Pumps (13,954 members)

- AltTheWay (8,350 members)

Here’s how Pump & Dumps work

- P&D executives find a coin that is easy to manipulate and easy to sell. I.e. A coin with a strong community, advertising potential, small order book, and low trading volume.

- Executives secretly accumulate the coin over time while trying not to affect the price.

- These executives spread their pump signals to their inner circle members who pay upwards of $300 for the privilege of hearing early signals.

- The first wave of pumpers start shilling on signal groups. They tell gullible investors that a pump is about to happen because of “new website updates”, or “new partnership announcements”, generally whatever angle they can spin.

- As the price rises, the P&D executives start dumping their coins.

- Once the executives are spent, they spread the signal to their paid members to begin dumping the coin.

- The price starts falling and like a game of soggy cookie, the slowest players lose.

Example of a pump disguised as a “buy signal”

Example of a pump disguised as a “buy signal”

Credit to Cryptomedication for these images

Credit to Cryptomedication for these images

The reason I single out P&D executives is because they are the only ones that consistently profit. They have the most control and the highest amount of influence.So much so that members are willing to pay $300 for the privilege of being used as pawns. The buyers in signal groups are even worse off. They are falsely led into buying into a promising, undervalued coin, without any knowledge that it will soon be dumped.

So you’re telling me the game is rigged and I’m boned, what should I do?

The simple answer is to stop actively trading. The more you try to time the market, the more you open yourself up to opportunities of getting screwed over.

Speculative trading is a zero-sum game. In order for investors to outperform the market, they require others to underperform the market. In an unfair market, the average investor will more likely lose to people who have an unfair advantage and are gaming the market.

This is why I genuinely believe the average investor should just index the entire market. If you’re in it for the technology and the long-term growth, why bother speculating at all? Just hold a small piece of the entire cryptocurrency market. Indices has been proven to beat 95% professional traders in equity markets over a 15 year-period.

This is why I built HodlBot. It’s an easy way to diversify across the top 20 cryptocurrencies by market cap. It indexes 87% of the entire cryptocurrency market. Every week, your portfolio automatically rebalance so you’re always tracking the top 20 coins. It helps you get some quiet sleep while active traders lie awake, staring at their phones. You can read more about it here.

The best thing about a total market index is that it can guarantee market performance. Active trading, on the other hand, cannot.

I don’t meant to spread FUD by pointing out all the different ways traders are ripping investors off. I just want investors to know what exactly free and unregulated markets really mean.We’re not protected by the SEC or any other sanctioning bodies. While this comes with unbridled freedom and breathing room for rapid innovation, it also means all foul play is fair play.

It’s a brave new world out there filled with all kinds of splendor and danger. If you’re going to take your chances, please make sure you’re prepared.

The 3 Types of Cryptocurrency Traders that are Kicking Your Ass was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.