Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This week I looked on the bright side, dove down to rank #334 to shuck an Oyster, and had another idea.

But first, the public ridicule that is …

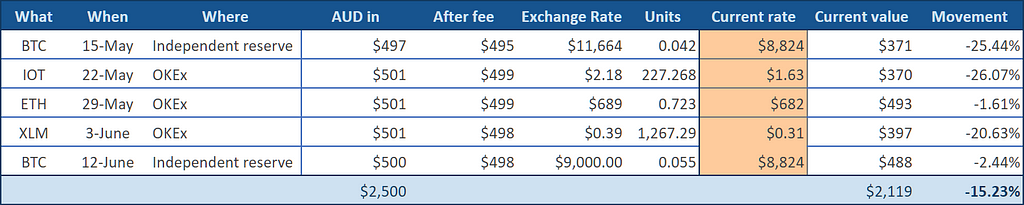

The profit check-in

Only down by 15%, not bad after this bloodbath of a week.

When I see news that the price of bitcoin has tanked (and thus the market, more or less) I actually, for-real, have the gut reaction “oh that’s cool, I’ll be buying cheap this week”.

I never knew I could be so rational.

It was a stroke of luck that I forgot to buy my $500 worth of bitcoin last weekend, so bought a few days later at a nice 10% discount.

Anyway, years from now when we’re all rich, none of this will matter; we’ll all be taking golden showers!

Now, on with the show…

Oyster coin

Must you forever be painting, my little meercat?

Must you forever be painting, my little meercat?

Oyster coin wants to get rid of ads on the internet; I think we’re going to get along just fine.

Let’s dig in.

The premise

Man, it’s a bit confusing. This, from their homepage, is less than helpful: “Website visitors contribute a small portion of their CPU and GPU power to enable users’ files to be stored on a decentralized and anonymous ledger”.

It uses CPU and GPU to store files? Do I misunderstand how computers work?

They really need a diagram, or at least a concise, hyperbole-free description so interested parties don’t need to read the white paper to actually see that they’re not just making things up.

From what I can gather, here’s how it all hangs together:

- Someone wants to store some data in the cloud.

- This person pays money to a thing called a ‘broker node’ to store that data.

- The broker node keeps half the money for itself.

- The broker node then takes the data and ‘hides’ the other half of the money in with it, and sticks it all in the IOTA tangle.

- Since the IOTA tangle is leaky (by design, data won’t stay in there forever), it requires effort to re-submit the data to the tangle periodically. This work is farmed out to ‘web nodes’.

- A web node exists because a website operator put the Oyster ‘web node’ script in their page to make money (replacing ads).

- A web node uses the CPU of you, the website visitor, to do proof-of-work that re-submits the stored data to the tangle (just like they said on the website).

- The web node earns the money that was ‘hidden’ in that data, which it sends to the owner of the website.

It’s like a game theory amusement park.

I’ve provided this in graphic form, which I hereby give the Oyster team permission to copy/paste into their website, provided that it’s right at the top.

I searched for “IOTA logo” and thought the cushion looked nice. You can buy one here.

I searched for “IOTA logo” and thought the cushion looked nice. You can buy one here.

This is one of those win-win-win situations where everyone has an incentive to play along, and everyone gets something out of it.

Wonderful.

But I don’t think it will work.

Oyster vs the competition

Oyster, like all cryptocurrencies, start their website with the claim that “X is broken” (of course it is). This time, it’s advertising that broke, and they go on to say that “Advertisements have always been a fundamentally weak proposition”.

OK wait a minute, that’s rubbish.

Backing up a few steps … as a web developer, I have a love/hate relationship with ads; on one hand they often pay my salary, and I know the internet would be like a half-abandoned mall without them.

On the other hand, intrusive ads suck. Flashing ads are annoying. Too many ads slow a website down, they use up bandwidth, they drain battery, and they can mess up an otherwise good design. And for the record, I use an ad blocker just like any sane person.

But I think Oyster talking down the advertising revenue model smells like an effort to get the general public excited in their offering (“Do you hate ads? We hate ads too, and we’re going to fix that! Check out our new cryptocurrency”).

But the people that will make or break Oyster aren’t the ad-hating general public. They are the people that currently run ads on their website. And only one thing matters to these people: “can I make as much money from Oyster as I can from ads?”

If Oyster are saying that ads are a weak proposition, then their proposition better be pretty strong. So, that’s how I approached my assessment of Oyster: as a competition between it and their advertising adversaries.

Specifically, the question I want to answer is: can a website operator make as much money from the Oyster model as they can from the advertising model?

If the answer is “yes”, then I’m quite sure Oyster will be the next big thing and I’ll buy a $500 bucket of their coins before the sun sets.

If the answer is “no”, then I can foresee only one fate for them.

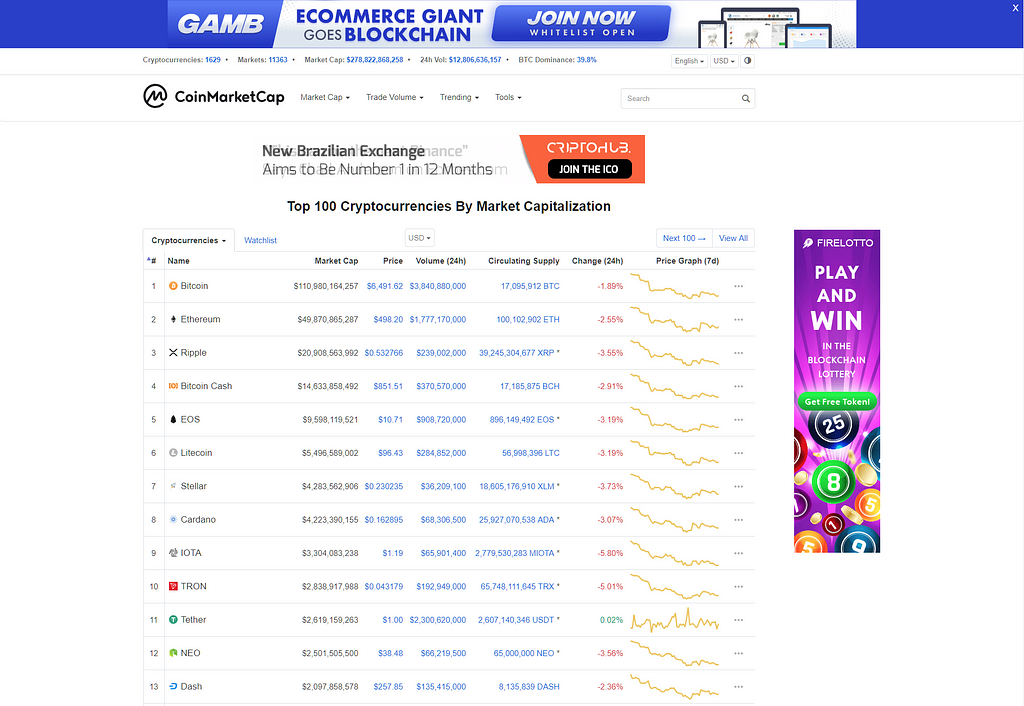

I’ll use coinmarketcap.com as an example, since most of you have probably used it, and they’re not yet a hated corporation, so perhaps some empathy will be fostered in the hearts of the ‘everything should be free’ crowd.

I have no idea how many people work on coinmarketcap.com, but let’s say they’ve got a few new features in the works and have a modest team of 10 people. Assuming it costs about $100k per year to hire and house a human, we’re looking at a website that costs one million bucks each year to run.

Surprising? Not surprising?

I’m going to start talking monthly, so let’s divide that number by 10 (which I’m pretty sure is how many months there are) and say they’ll need to make $100,000 per month to stay afloat.

(It’s the formula that matters, you can tweak the variables to your heart’s content later.)

Let the comparison begin …

Making $100,000 per month from ads

I’ll assume that they make about $2.50 per 1,000 visitors in ad revenue — a rough guess. At this rate, they’ll need 40 million visitors a month to make their budget, which is suspiciously close to this estimate.

Well that was easy. Visitors × revenue per visitor.

40,000,000 ×($2.50 / 1000) = $100,000 Ads. Slightly annoying, but together we’ll survive.

Ads. Slightly annoying, but together we’ll survive.

As far as ads are concerned, coinmarketcap.com have struck an OK balance. They’re animated and therefore annoying, but there’s only three, they load after the site content, and the page doesn’t continually jump around. And on mobile there’s just one at the top.

I give them a 6/10 for responsible advertising.

Making $100,000 per month from Oyster

Now, let’s say that coinmarketcap.com want to use the super-simple Oyster script instead of ads.

All of the money in the Oyster system comes from people wanting to store data. And since the money coming from these storage users is split evenly between web nodes and broker nodes (who actually store the data), this means $200,000 needs to flow into the Oyster system in order for our crypto-collating friends to make their $100,000.

Let’s say it costs about $4 to store one terabyte for one month. By comparison, Sia coin is $2 and Google/Microsoft/Dropbox are all $10.

(FYI the Oyster price fluctuates slightly — it’s currently 1 PRL for 64 GB for 1 year, or 1.3 PRL for 1 TB for one month, which is $5.92 today — but I’m going to say $4).

We need our storage users to spend $200,000 in storage fees (each month), which means they’ll have to store 50,000 terabytes at $4 each.

So our formula is: terabytes × cost-per-terabyte-per-month / 2.

50,000 × $4 / 2 = $100,000

Remember, that’s divided by two because only half the money goes to web nodes (the other half goes to broker nodes who provide the actual storage space).

50 petabytes! That’s a crap tonne of storage that must be utilised to fund one little website.

For a comparison, after two years in operation, Sia — another storage coin — is storing 0.193 petabytes.

Imagine you wanted to support, say, 200 websites of this size. You’d need to find users wanting to store ten million terabytes, or 10 exabytes, which happens to be exactly what XKCD calculated all of Google’s storage capacity to be.

To fund 200 websites.

As a squirrel once said when asked about his favourite snack: “that’s nuts”.

I could probably stop here and call the whole operation untenable.

But I won’t.

Now imagine you’re the storage user. You can either pay for storage in a system where your data is stuck into some decentralised data store like with Sia, for $2 month. Or you can go with Oyster, who will store your data in a leaky tangle that requires a whole lot of CPU processing just to keep your data stored. So that’s $2 to the people with the hard drives and $2 to the people with the CPUs to keep the data in the tangle.

Why would you do that?

There’s more …

From the Oyster whitepaper: “Data is stored on the Tangle in ~1 KB parts within the transaction payload”, and according to IOTA, each transaction requires proof-of-work for about 30 seconds. 30 seconds for each kilobyte?

So, how many CPU seconds would it take to process the transactions required to store the data required to keep coinmarketcap.com in business?

(50,000,000,000 KB x 30) / 60 / 60 / 24 / 365 = 27,000.

So, just 27,000 years.

Once a year.

I have a life rule that goes like this: whenever I look at some situation and think well that’s dumb, I first try to assume that there’s something I’m not understanding. (I sometimes miss subtle details — I just leaned today that Anthony Hopkins and David Attenborough are two different people.)

I have a nagging feeling I’m saying something embarrassing above and missing something obvious, because it seems unlikely that the whole Oyster team have not considered these things and that I’ve just broken the case wide open after a few hours of thought.

So if you don’t know any better, please take what I say with a grain of salt. And if you do know better, please correct me — as gently as you see fit — and I will fix my mistakes immediately.

(Particularly with the transactions/proof-of-work. I’m guessing there must be more than 1 KB per transaction, or multiple transactions in a bundle and it’s the bundle that requires the 30 seconds of PoW, or that the PoW time can be reduced (a private tangle with a low MWM?). Otherwise even the test scenarios that save a mere 5 MB would be having problems.)

Maybe it’s all explained in the last fifth of the first whitepaper that I couldn’t bring myself to finish.

And there is one last doubt I have. Let’s say coinmarketcap.com decide to try out Oyster. And they do. And it’s a success.

What’s their motivation to remove their ads? Remember they’re still making $100,000 a month off of those ads, and they’re not so bad that they’re having any real negative impact on user experience. So why would they decide to forgo that money?

We shouldn’t expect an organisation to be altruistic any more than we should a bitcoin node — and in our heart of hearts we know they’ll keep the ads.

And the websites with really bad ads are more likely to keep those ads even if Oyster works, because they’re jerks.

Conversely, the sites that care about their users’ experience are the ones that ‘advertise responsibly’ and aren’t much of a problem.

So really, even if they do succeed, Oyster aren’t going to bring about the demise of pesky internet ads.

Wait, there’s one more concern, that isn’t related to the technology:

That’s a pretty solid downward slope from $1 to a quarter of that (oh I just realised why the Americans call 25c a quarter!)

The above chart is for Oyster Pearls (PRL) — that’s the currency that will be pegged to the cost of storage.

So, PRLs aren’t the multi-year investment choice; what I’m really interested is the new (like, have only existed for a few weeks) Oyster Shells (SHL).

Let’s hope the SHL chart is not as depressing…

But! There’s good news. This is their price when not listed on any decent exchanges. They’re working hard at this and I reckon there’s brighter days ahead for them once the barrier to entry is lowered and a wider range of ad-hating investors can have at it.

The Dapp meshnet

There’s actually a lot more to Oyster than just the ad-revenue-replacement stuff. They want to be a whole meshnet of peer-to-peer communicating devices.

I have a whole lot of questions about this as well, but if the incentives aren’t there for website operators to supply web nodes, none of it is going to happen.

If my concerns over feasibility are undeserved, and Oyster takes off, then I’ll revisit the whole system then.

Other reviews

There’s not a lot out there explaining the intricacies of Oyster, but I came across two things I would like to share.

First, this awesome review of Oyster. My favourite part, describing the current state of affairs, is this:

“Commercials intervene in users’ close to home rights and occupy consideration from their substance.”

You said it, brother.

He goes on:

“Also, there at present is no capacity benefit that is user-accommodating and mysterious”

After this, I kept hunting.

Normally I’m left cold by YouTube cryptocurrency reviews where people literally just read through a coin’s website — and that’s the whole review.

But this one made my day — the dude is reading through the Oyster site, as you do, and appears to malfunction when parsing the word ‘intrinsic’.

I wouldn’t normally make fun, but he hit the upload button.

The verdict

I’m torn on Oyster, in essence. I love the concept. I love the idea of funnelling money from some other place into the pockets of website operators so that we can do what we do, and pay our bills, without adding shitty ads to our beautiful creations.

I half-hope that my negativity above gets sternly corrected and that the Oyster model really can replace the advertising model. It would literally change the face of the internet.

But until corrected, I just don’t think the numbers can back up the concept.

So this week, I’m chucking another $500 into my week 10 sweetheart, Stellar.

Dumb idea of the week

CameraCoin.

This uses the IOTA tangle as a way to make money off your IOT device — specifically, a camera attached to the internet. You might have a webcam pointing out your bedroom window toward the beach, or be a shop owner with a surveillance camera out the front of your building, or have a dashcam on your dash.

CameraCoin lets you make the feeds from these cameras available online. That way, if someone wants to see what the surf is like, or the police want to watch footage of a particular place and time, or some third reason that people may want to sell webcam footage that I haven’t thought of, it can all be done in one handy place.

I just need to make up a reason that this needs to be decentralised and have its own currency.

One last thing

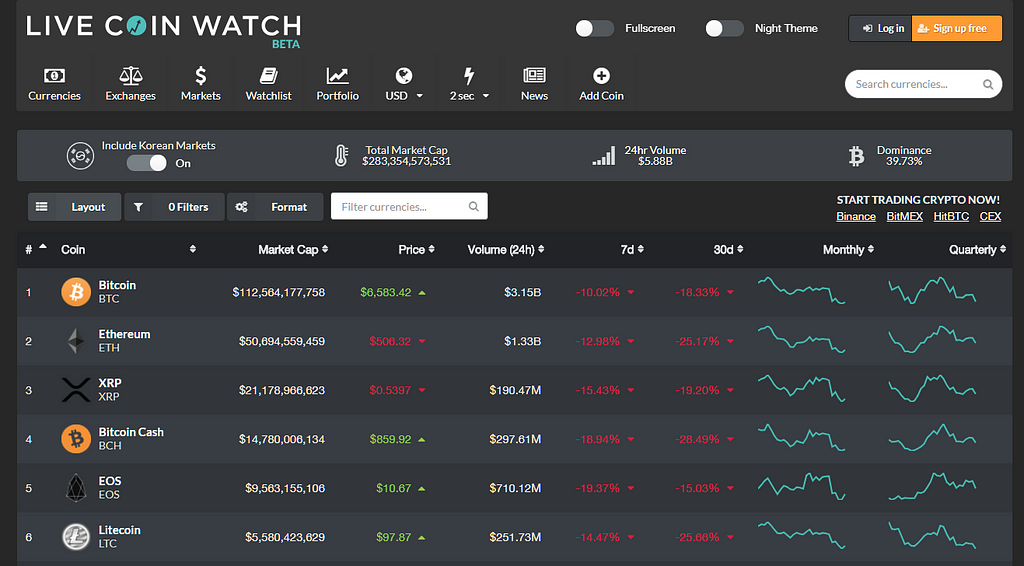

After writing all of the above with the example of coinmarketcap.com, I learned about Live Coin Watch.

It’s mostly the same but you can configure what columns you want, (I’ve never cared about 24hr movement).

And of course, dark mode.

Next week

Hmm, I don’t know. Maybe Tron?

Yeah, Tron.

Hey, thanks for reading, and the next time you see a dog, pat it!

A crypto-trader’s diary — week 12; Oyster coin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.