Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Thanks to those of you who have forwarded and shared Global Coin Research, we really appreciate it and we hope you like the focus topic for this week. I’ve gotten readers expressing interest on a variety of topics, and many are keen to learn more about Bitmain, as the company announced their plan to IPO this past week. This is my attempt to do a simple KPI analysis to measure the strength of the business and provide some valuation thoughts on the company.

Note: I may be biased here, but while I was doing research on Bitmain, I realized the company is SOOO undercovered despite how large of a role it plays in the cryptocurrency world. Here is an example. When i googled “Bitmain revenue”, the first 2 articles from February this year both claimed that Bitmain is making more profit than Nvidia. Supposedly Bitmain saw “$3- $4 billion in operating profit in 2017, whereas Nvidia, founded 24 years ago, made about $3 billion during the same period.” But from the recent Bloomberg interview directly with Jihan Wu, Bitmain’s revenue was $2.5bn in 2017. One metric is operating profit, the other is revenue, that is a HUGE gap. So for now, I’m trusting the Bloomberg number, unless you hear a new number, please let me know 😂.

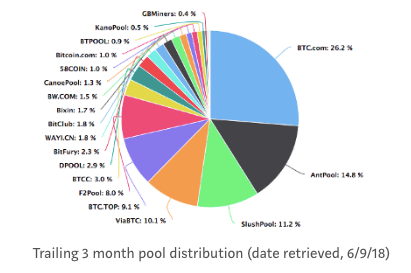

A very quick intro on the company for those unfamiliar, Bitmain was founded by Jihan Wu and Micree Zhan in 2013 and the company is currently headquartered in Beijing. The company is the world’s dominant producer of cryptocurrency mining chips, the ASICs. Additionally, Bitmain’s AntPool and BTC.com collectives control more than 40 percent of the world’s Bitcoin mining power per BTC.com.

Based on the data points I’ve collected along with some pretty conservative assumption, I’m estimating that Bitmain’s revenue per employee is ~$2mn, if not more. This is higher than that of Google and Facebook, which is around $1.8mn and $1.6mn, respectively.

I previously reported in a past newsletter that the second largest bitcoin mining company, Canaan Creative, was also looking to IPO, and that they had an average revenue per employee of Rmb 5mn or ~USD $700k in 2017. Total 2017 revenue was Rmb $1.7bn with 243 employees. When I initially learn about these metrics, I was very impressed with the company’s sales efficiency. As a reference, the largest Chinese tech company Tencent made about ~$755k per employee based on their year- end 2017 numbers, Alibaba’s sales efficiency was even less.

When I looked at Bitmain after the Bloomberg’s interview article came out, I almost jumped out of my chair. Bitmain’s revenue per employee is almost 3x that of Canaan’s. It’s likely to be $2mn or well over.

Here’s my simple math. Quartz did a detailed coverage on the company in August 2017, and mentioned then that Bitmain had about 700 employees then. Now, we make an assumption that the company goes through a really aggressive growth in headcount for the rest of 2017, a scenario in which Bitmain grows its employees from 700 people in August to 1400 people in December (I’m not even sure if it is realistically feasible to hire 700 people in 4 month, or historically any tech company have done so, but I would not be surprised if the Crypto companies have set that precedence). Bitmain’s annual revenue was $2.5bn in 2017, so simple calculation would tell you that’s equivalent to about $1.8mn per employee. This is likely a conservative number, given my aggressive headcount growth assumption, so I’m rounding that up to $2mn. So please note, this is an extraordinary sales efficiency.

Note: While I recognize looking at purely one metric is not indicative of the entire health of the business and can lead me down to many false assumptions, I do think that sales efficiency is an easy to understand KPI that speaks to the moat of the company. Given that we don’t really have much information about Bitmain until it actually files, this math allows for an simple exercise to conveniently compare companies.

On the cost side, Bitmain benefits from market dominance and economies of scale. It may already be enjoying comparable margins to Canaan, if not better. For example, being the second largest miner may require Canaan to spend more money on marketing, and have less negotiation power with its suppliers. Once Canaan’s filings become available and the company goes public as early as next month, we will be able to get a sense of Bitmain’s margins.

Note: In the meanwhile, if you are interested in taking an educated guess. I’d defer you to the hardware experts. Jimmy Song has attempted to calculate how profitable Bitmain is. He evaluates the margins of some of Bitmain’s major business streams. Specifically, he estimates the cost of production of the most popular and representative miner rig (S9) to be roughly $500. S9’s retail cost is ~$1200, which then implies a 60% gross margin. He also estimates the cost of mining for Bitmain to be ~$430 per BTC. Assuming a Bitcoin price of ~$7036, which was at the time when I did the analysis, 95% of gains would go directly to the bottom line.

Now, it’s hard to calculate the business’s margins more precisely because we don’t know how revenue is split by business lines. Bitmain’s main business lines are 1) sales of Bitmain’s mining machines, 2) renting out its mining rigs and 3) mining bitcoins. Assuming the highest gross cost business is producing Bitmain’s mining rigs, we should then expect gross margin to be greater than 60%, assuming Jimmy’s above estimates and assumptions are correct. On the SG&A side, I would imagine that research and development would make a significant percentage of revenue. I wouldn’t be surprised if sales and marketing was 10% of revenue or less, given Bitmain’s brand has already been recognized by the market.

On to valuations. Once Canaan goes public, we will be able have a benchmark for Bitmain’s valuation multiple. I’m genuinely excited to see and monitor what multiple the market would give to Canaan, because that is a good starting point to understanding how much institutional investors believe in cryptocurrency long term. This is even more true for Bitmain. Bitmain’s IPO will be at least 10x larger than Canaan’s, it will be even harder for institutional investors to ignore. Investors who otherwise wouldn’t have wanted to will have to understand bitcoin and cryptocurrency to gauge the valuation of Bitmain. Additionally, Bitmain’s sale of its AI chips will start at end of this year, which I am very optimistic about as a new, stable revenue stream and growth driver for the company (you can read more about the AI chips in the Quartz article).

Note: I’m optimistic about Bitmain’s AI chips. Some folks have initially scoffed at them and believe that Nvidia or Intel is going to eat these guys’ lunch. However, I want to stress that recent Chinese trade policies is hugely favorable for Bitmain. After the ZTE trade war feud between the US and China, the Chinese government has been increasingly pushing for China’s own developed chips. I’m certain that Bitmain will benefit from this.

So I’m overall very optimistic about Bitmain’s future. It’s IPO will likely be a successful and remarkable one. It’s growing size and relevance in the chip and hardware industry will make it impossible for some remaining skeptics to ignore Bitcoin and cryptocurrency.

Bitmain’s message to Wall Street- It’ll be too hard to ignore bitcoin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.