Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

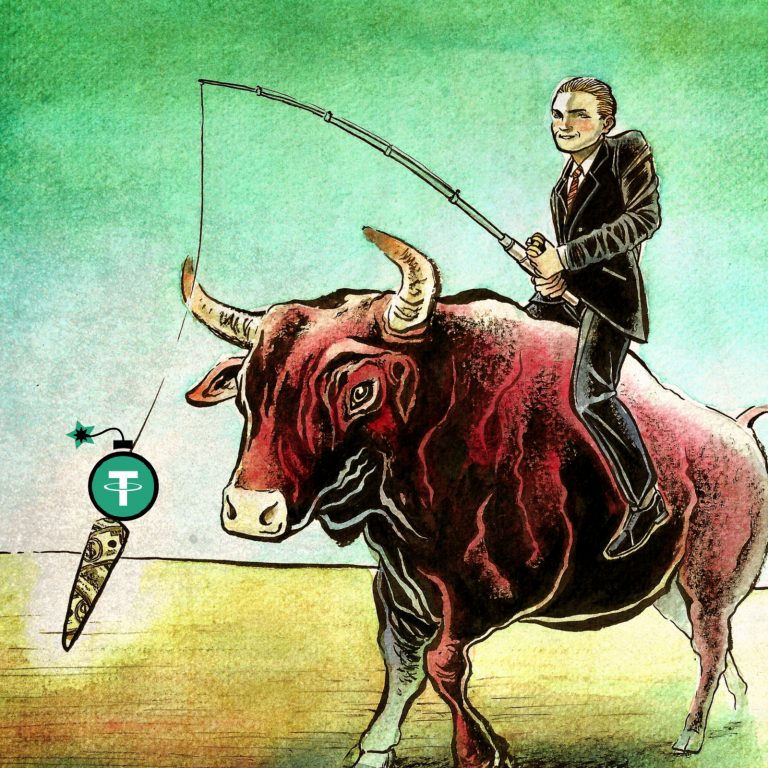

Tether is back in the news thanks to a new report alleging it played a pivotal role in bitcoin’s mega-bull run last year. This isn’t the first time the dollar-pegged stablecoin has been blamed for market manipulation, but is the most compelling evidence to date that 2017’s record highs may not have been entirely organic.

Also read: Ripple CEO: Bitcoin Controlled by Chinese, Absurd to Think it Could be Primary World Currency

How Untethered Is Bitcoin?

“Is Bitcoin Really Un-Tethered?” runs the title of a provocative new research paper published today. Its authors have taken an algorithmic investigative approach, using blockchain analysis to determine the extent to which timed release of tethers into the cryptocurrency ecosystem may have served as a tool for artificially inflating prices. Long-time tether critic Bitfinexed has been alleging as much for months, and successfully persuaded a portion of the cryptocurrency community that tether-led market manipulation was rampant.

“Is Bitcoin Really Un-Tethered?” runs the title of a provocative new research paper published today. Its authors have taken an algorithmic investigative approach, using blockchain analysis to determine the extent to which timed release of tethers into the cryptocurrency ecosystem may have served as a tool for artificially inflating prices. Long-time tether critic Bitfinexed has been alleging as much for months, and successfully persuaded a portion of the cryptocurrency community that tether-led market manipulation was rampant.

At the time, though, when BTC was hitting new all-time highs virtually every day all through November and December, most traders didn’t care; they were too busy watching their portfolio go up. But in the sober light of 2018’s enduring bear market, tether’s ability to influence the price of BTC is of major concern. If it transpires that last year’s record prices were the result of manipulation then without tether’s support, the prospect of bitcoin hitting another all-time high is remote. In fact, with BTC currently languishing below $6,500, even five figures feels like a long way off.

Tether Consistently Pumps BTC, Claims Report

The abstract to the report by John M. Griffin and Amin Shame states: “We find that purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices…such heavy Tether transactions are associated with 50% of the meteoric rise in Bitcoin and 64% of other top cryptocurrencies…These patterns cannot be explained by investor demand proxies but are most consistent with the supply-based hypothesis where Tether is used to provide price support and manipulate cryptocurrency prices.”

The abstract to the report by John M. Griffin and Amin Shame states: “We find that purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices…such heavy Tether transactions are associated with 50% of the meteoric rise in Bitcoin and 64% of other top cryptocurrencies…These patterns cannot be explained by investor demand proxies but are most consistent with the supply-based hypothesis where Tether is used to provide price support and manipulate cryptocurrency prices.”

This flies in the face of a previous study which found little correlation between tether printing and BTC price increases. “[The author’s] testing does not support the claims that BTC prices are moved by USDT printing — although, Ivanov explains, his statistical analysis doesn’t necessarily fully disprove tether manipulations,” we wrote in February. The author of that report conceded, however, that only a complete audit of tether would settle the matter once and for all.

Not everyone is convinced that prices increasing following tether printing is proof of manipulation

Not everyone is convinced that prices increasing following tether printing is proof of manipulation

Tether Rises to Claim 12th Spot by Market Cap

For a cryptocurrency whose price is designed to stay constant, at $1 a token, tether has been on the rise recently. It recently leapfrogged dash and monero to claim 12th spot in the cryptocurrency charts based on market cap. This feat is due to the decline of the cryptocurrency market in general, which currently stands at $273 billion. As the markets continue to bleed red, tether, together with other stablecoins, forms one of the few safe harbors.

Bolstering the findings of today’s report into tether is the revelation that cryptos such as ether and zcash also pumped following the release of tether, with the green candles often breaking out on USDT exchanges first. When Bitfinex stopped issuing tethers for a while earlier this year, the cryptocurrency breakouts also ceased. At 66 pages, and complemented by meticulous charts, citations, and algorithmical analysis, the authors of today’s report have produced the most comprehensive tether investigation to date.

The report finishes: “Overall, our findings provide substantial support for the view that price manipulation may be behind substantial distortive effects in cryptocurrencies. These findings suggest that external capital market surveillance and monitoring may be necessary to obtain a market that is truly free. More generally, our findings support the historical narrative that dubious activities are not just a by-product of price appreciation, but can substantially contribute to price distortions and capital misallocation.”

Do you think tether played a part in inflating prices last year? Let us know in the comments section below.

Images courtesy of Shutterstock, and Tether.

Need to calculate your bitcoin holdings? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.