Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

No matter the nature of your involvement in the blockchain and cryptocurrency space, every manager, consumer, founder, investor, and enthusiast should understand the speed at which businesses will start implementing blockchain based solutions to improve efficiency, security, competitiveness or completely overhaul how their consumers and shareholders interact within their business ecosystems. To understand this at a macro level, we can explore where the technology currently stands on the S-Curve of adoption.

While many primarily associate the blockchain with Bitcoin and other cryptocurrencies, the potential for this technology to transform how businesses run and operate is often overlooked. Adoption of decentralized ledger technology has the potential to revolutionize how businesses innovate and utilize their on-premise or cloud capabilities, both at an Enterprise and a retail level.

The following article gives an overview of blockchain’s speed of adoption analyzed under established business and consumer adoption frameworks.

Where Are We Now?

The S-Curve Of Technological Adoption

The process of adoption over time is typically illustrated as a classical normal distribution or “bell curve”.

Everett Rogers Technology Adoption Life-Cycle Model

Everett Rogers Technology Adoption Life-Cycle Model

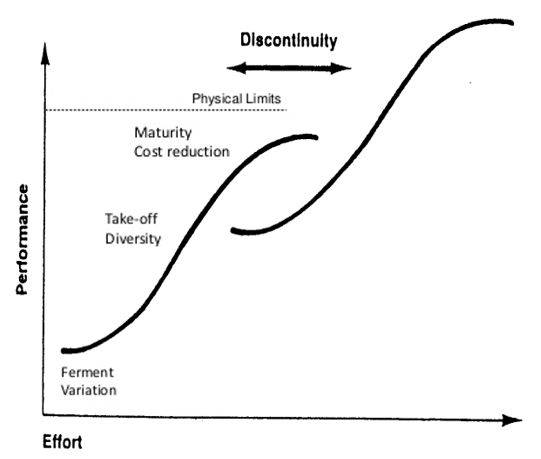

Nevertheless, a helpful supplement to this depiction would be to consider technological performance as a function of effort, and not limit it to time.

“The S-Curve of technological improvement of a new technology describes its improvement performance against the amount of effort and money invested in this technology”[1], and therefore describes how the life-cycle of a technology will end due to learning curves, the law of diminishing returns and other factors.

Throughout the 20th century every major mass-market technology that was near-universally adopted has exhibited some form of an S-curve, as indicated in the chart below. S-curves are becoming more compressed as technology advances, leading to more pronounced vertical growth adoption phases.

Although blockchain has emerged in a stadium of aggressive competitors and rapid technological improvement, there is still much room for improvement in the foundations of the technology.

Let’s investigate where blockchain currently stands along the S-curve:

How Foundational Technologies Take Hold“Blockchain technology is not disruptive technology, it is foundational innovation. It has the prospects to create new foundations for both our economic and social structures.”

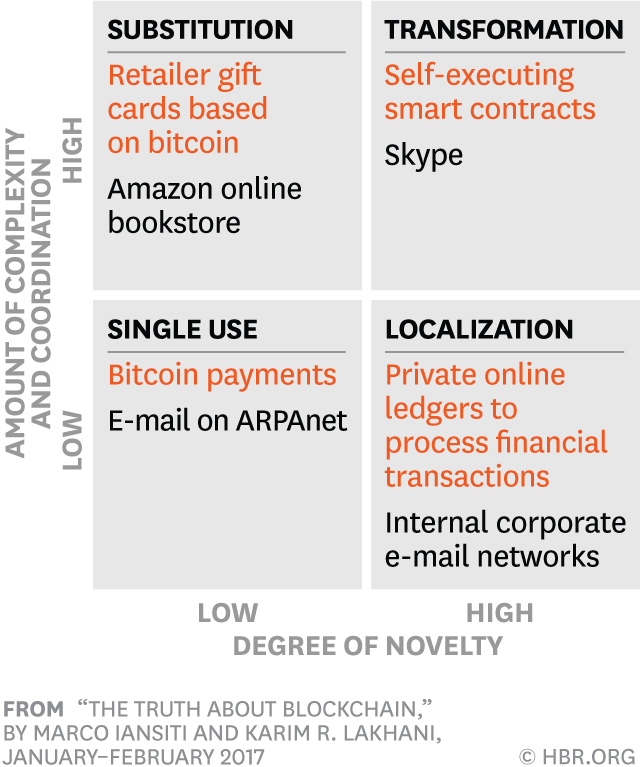

In a recent HBR Issue, Marco Iansiti and Karim R. Lakhani develop a helpful framework detailing the four stages of adoption a foundational technology goes through. They explore novelty and complexity, as the two dimensions businesses must tackle to transform their technological environment:

The early stages of a foundational technology begin with single use, low novelty and low coordination applications. Applications are highly focused on simple solutions. Great examples include email as a replacement to phone calls, or Bitcoin as an alternative payment method circumventing the current financial system’s limitations.

Step 2 — Localization

At this stage of high novelty yet low complexity, developments are usually comprised of a small network of firms coordinating the use of new applications that can radically change how firms operate. In the case of financial institutions, this may apply to how they trade, settle, and process transactions. These innovations are “high in novelty but need only a limited number of users to create immediate value, so it’s still relatively easy to promote their adoption.”

In the near future, we will see more businesses develop single-use applications to create greater process efficiency through private blockchain networks, but it will take time for them to substitute entire business operations.

Step 3 — Substitution

Innovations in the Substitution stage require large amounts of coordination as they aim to replace entire processes deeply embedded within institutions. Resolving the complexity of coordinating amongst various stakeholders requires time.

The adoption of email in the corporate world provides a great example. Twenty years since it became popular, email is still recognized as a necessary, but hard to manage tool. It has substituted the fax, the telephone, and the office memorandum; but critics and users are fed up with the tool abound.

Step 4— Transformation

Finally, transformation depicts high novelty and high complexity as a result of involving many actors such as government, business, and consumers. The authors point to legal, social and political implications as standards are built and agreed upon. As evidenced by the skepticism and even lack of knowledge about blockchain in government, business, and consumers; this technology is definitely not at this stage.

🤔 A first conclusion from the HBR framework: Enterprise blockchain adoption is currently at the localization stage; high in novelty but very limited.

A Recent IBM Study Confirms The Localization Stage

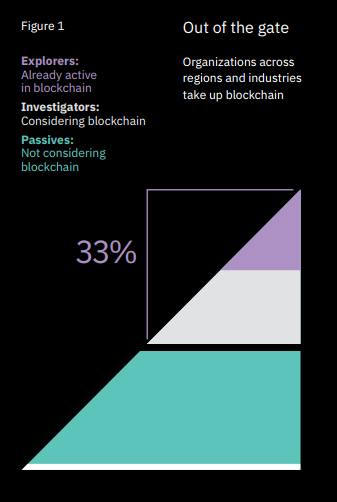

IBM’s Institute for Business Value recently conducted the largest global C-suite blockchain study [2], surveying close to 3000 C-Suite executives from 80 countries and 20 industries, seeking their perspective on the Blockchain.

Three ways blockchain Explorers chart a new direction — IBM Institute for Business Value

Three ways blockchain Explorers chart a new direction — IBM Institute for Business Value

They classified respondents into three groups: explorers, investigators, and passives. Explorers (early adopters), who are actively involved in blockchain development made up 8% of respondents across industries. (The study found that this group turned out to be the most distinct group of organizations in terms of competitive positioning they have surveyed in 15 years of C-suite primary research. They are more often leaders in their industries, as measured by revenue and profit growth, as well as by innovation). Investigators (early majority), who are considering but not ready to deploy blockchain solutions made up 25% of respondents. The remaining respondents qualified as passive (late majority & laggards) adopters, 67% were not even considering blockchain solutions.

These results confirm the localization stage Iansiti and Lakhani propose. Looking back at the S-Curve of adoption, these findings align with the S-Curve of adoption and place blockchain technology on the verge of drawing in the early majority:

Blockchain technology in Rogers Everett’s Diffusion of Innovation

Blockchain technology in Rogers Everett’s Diffusion of Innovation

The potential of this technology has pushed a low number of visionary early adopters, who view the technology as a “trust accelerator”, to embrace the technology, while the early majority still remains curious but skeptical.

Understanding where we stand in the technology adoption curve may help decision makers gain perspective on their concrete strategy and timeline for action. Of specific interest, as has been for electricity, the telephone or the internet, the S-Curve and identifying the current positioning of blockchain along the graph could heed the lessons of past successes and failures. It seems we stand at the brink of the chasm, with the early majority peering into the space. This idea certainly seems reinforced by the rising interest of the mainstream media, enterprise businesses, and institutional investors, all whom have dipped their toes but have not yet made the jump. My next article will explore what it will take for them to do so.

Thanks for reading! If you liked it, please support by clapping 👏🏻, sharing the post, commenting below or following my Twitter page:

Kevin Nielsen Garcia (@KevinNielsen94) | Twitter

“The blockchain’s full transformational impact will play out over decades rather than years, because such innovations must overcome many barriers, — technological, organizational, governance, political. The impact of blockchain could well be enormous, but its full transformational impact will take a considerable time.”— Irving Wladawsky-Berger, Is Blockchain Ready to “Cross the Chasm”?

- Forward Together: Three Ways Blockchain Explorers Chart a New Direction. IBM Institute for Business Value, 18 May 2017

- Team, Editorial. “Blockchain and the Technology Diffusion Cycle.” Finextra Research

- Schilling, Melissa A. and Melissa Esmundo. “Technology S-curves in Renewable Energy Alternatives: Analysis and Implications for Industry and Government.” Energy Policy

- Rogers, E. (1962) Diffusion of innovations. Free Press, London, NY, USA

Mass Blockchain Adoption: Are We Even Close? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.