Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

If you’re like most, you’ve been stunned by the news of the top two e-Scooter companies, both less than 2yrs old, raising hundreds of millions of dollars despite seeming regulatory concerns. Lime raised $250M from GV (formerly Google Ventures, who also invested in Uber) and word is that Bird Rides is raising something close to $150M from Sequoia. Too much money at Crazy valuations!! You scream. But there is sense behind the seeming madness.

Systems case for e-Scooters

The valuations aren’t crazy when you think about the ‘city’ use cases that these vehicles serve. Most urban areas/cities are getting increasingly more dense, especially compared to their humble spacious beginnings. Effective transport systems will need to efficiently use scare urban space. While we hail ride-sharing as a more efficient use of one of the transport modes, and we look forward to autonomous vehicles, we need efficient and affordable solutions for now. It’s this thinking that probably led Uber to acquire Jump bikes in a bid to build their own eScooters (I believe). The Segway was supposed to usher in this future but we know where that ended up. That it didn’t happen with the Segway does not mean it wasn’t supposed to. It was just ahead of its time for the use case it was trying to serve.

Analysis of the market

Short distance transportation use-case currently involves walking, taking a cab or driving. Looking at it from an innovation standpoint; this goes right at the ‘non-consumption’ side of providing a new service/product to customers who up until this point probably didn’t use ride-share for those short distance trips. On the broader spectrum, it is ‘disruptive innovation’ that replaces the ‘excess’ offering that ride-share provided to the consumers who got in a Uber/Lyft for a short hop.

For cities: For dense and walkable cities, it makes sense. For spread out and less walkable cities it makes sense, especially for short hops. As cities scramble to regulate the scooters, it’s less about how much of a nuisance they are and more about how much money can be generated. What about SF limiting the to 2,500 scooters across all licensed companies? This will change as we are at the start of the bargaining. With some folk even pushing for limiting to even less than 2500, the revenue/tax that could accrue to the cities from the ‘new Segway’ will ensure that those regulations change pretty soon. If you are Ron Conway (or GV) and you’ve invested in Lime, you’re waiting to ensure that the Mayor who comes in is business friendly (you have his or her direct line) and that the regulators won’t be as tough/stringent on scooters as they will be on self-driving cars etc. Cities are all looking for money from somewhere and this is an opportunity that will not regulate away. Throw in the congestion reduction and we have a winning proposition made stronger. Note: electric utilities also get the benefit of increased energy usage (load) due to eScooter charging.

For consumers: it’s cheaper than taking a cab/ride-share and more convenient than walking. It costs $1 to unlock and 15cents/min. For a short 10 block trip it costs ~$3. Compared to the waiting time and cost for a cab, it’s well worth it. While it might be inconvenient for residents who aren’t jumping on these scooters, human beings adjust pretty quickly and we will adapt to seeing them everywhere. The fact they are electric provide an easier transition into the electrified and sustainable transportation future promised by Tesla et al. They even work for dense emerging market cities where electricity, which is at a premium and will consequently stifle electric vehicle adoption, is not readily available.

For investors: Few markets exist where the scooters cannot be applied. The cost to the startups to buy or build these scooters are recouped within 3 months. Do the math and the valuations are not really crazy and those investors were quickly convinced: $20/scooter per day (less charging time), 5k scooters/city, 100% usage/day = $10k/day -> $300k/month ->$3.6M/yr for 1 city -> $100m/yr for 30 cities (they are also everywhere in downtown Austin now). Before you know it you have a unicorn…

For bike-share companies: bike-share companies raised a ton of money and regulation is stifling their chances at success. That being said, these companies were a proving ground for the short commute use-case that the eScooter market will now come to serve. Bike-sharing showed there was/is a ‘jobs-to-be-done’ still being unmet in this space. Not everyone is comfortable riding bikes on major city streets (I for one am not) but most can comfortably ride a scooter.

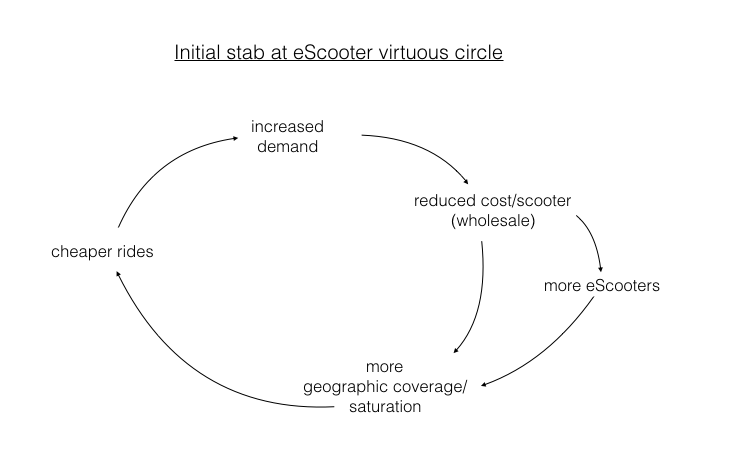

For the companies (Bird, Lime, Jump): With the revenue possibilities above it’s easy to see why these companies jumped into this market and are growing quickly. But what about the costs to manage the service (because it is a service)? The main consideration is hardware i.e. cost/scooter. Low-end scooters cost ~ $178 and high-end scooters cost ~$1200 retail. One can imagine the startups are paying less, that recouped just after 178 rentals or 1200 i.e less than 1 month of usage (taking out the time required to recharge) on the low version end.

A few weeks ago when I was in San Fran, I almost got hit by one of those scooters and, like everyone who doesn’t immediately see the opportunity, I complained about the idiocy and hubris of SF. Then I got back home to Austin, saw the eScooters zipping around downtown and realized I’d totally missed the use-case and that next big market opportunity. It’s an ‘Uber for x’ use case that actually replicates the growth possibilities of ride-share.

Borrowing from Bill Gurley’s ‘How to Miss By A Mile’

Borrowing from Bill Gurley’s ‘How to Miss By A Mile’

My one prediction for this article? You’ll be seeing a lot of these eScooters in your city.

Sign up for the Polymathic Monthly newsletter, it’s been called an “intellectual rabbit hole of goodness!”

The eScooter Market Opp Is Actually Worth All The Hype. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.