Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockchain technology is providing the payments industry with the unique opportunity to upgrade their efficiency and security while lowering operating costs significantly. The immutable and unalterable nature of this revolutionary technology makes it ideally suited to handle the demands of the payment processing sector. There has already been considerable effort put forth by major financial firms to integrate this game-changing protocol into the industry.

Already, the major credit card firms, Visa, Master Card, and American Express are working towards implementing a blockchain-based system to improve their current business models. The advantages of blockchain technology are clear. At this point in adoption, companies that fail to join the “blockchain” train will get left at the station. In other words, blockchain technology could soon be the new standard for the payments industry and if all goes as planned; the transformation could happen much sooner than you think.

6 Ways Blockchain Changes Payments

Blockchain technology is transforming business on a global scale. The payments industry is benefiting greatly from the integration of these two economic sectors. The demand for blockchain-based services has grown so much over the last 5-years that blockchain providers such as HEFFX are flourishing in the market. HEFFX provides companies easy access to blockchain-based protocols. Since its inception, this firm has seen steady growth as the benefits of a blockchain business model become better understood in the marketplace.

1. Increased Security

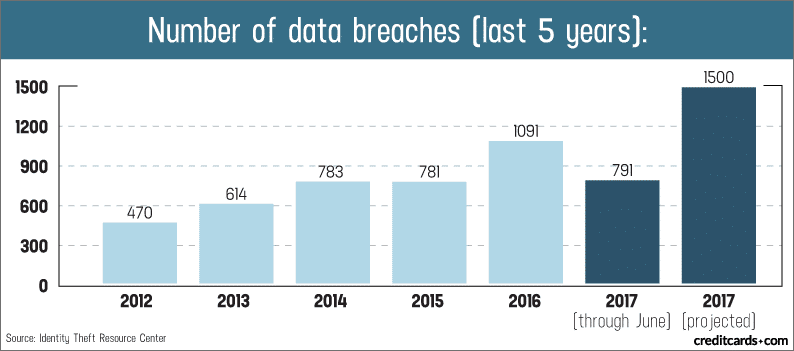

Cybercrime has become a plague to the internet over the last decade and analysts are predicting over $6 trillion in losses to be incurred by 2021. Payment processors hold a lot of responsibility for protecting personal data and blockchain technology could help to keep your information safer in the future.

Chart Showing Data Breaches of Credit Card Information

Blockchain transactions can hold an incredible amount of details including the date, time, amount, account profiles, smart contract agreements, and the list goes on. All of this information could be used to verify your transaction and confirm your purchase.

2. Verification Services

Taken a step further a blockchain personal identification system could be integrated to allow for the authenticity of a payment’s sender, or receiver, to be confirmed. Payment companies such as VISA report billions in stolen revenue due to unauthorized transactions every year. By switching to a blockchain-based system, they could eventually eliminate much of the fraud encountered due to hacking and identity theft.

3. Computer Breaches

Blockchain technology is nearly impossible to hack because of the decentralized nature of the technology. A hacker would need to attack thousands of computers at the same time to alter one piece of code on the blockchain. This makes it very cost-prohibiting for a hacker to choose this course of action. Companies can gain additional client trust by selecting a blockchain-based business model.

4. Cross-Border Payments

The global economy is shrinking. Today, it is common for corporations to have to send large amounts of capital internationally. Such cross-border payments can be an extremely cost prohibitive due to exchange rates and third-party verification fees associated with transferring large sums to a different country. While these fees can be troubling for corporations, they can be debilitating for an individual attempting to send funds internationally.

Thankfully, the peer-to-peer nature of blockchain technology eliminates the need for any third party verification systems. A company can send $1 million worth of Ethereum just as quickly as an individual could send $10. The streamlining capabilities of the technology are undeniable and precisely what the payments sector needs to curb the excessive waste the current business model possesses.

International Money Transfers

5. Cost Effective

A traditional fiat currency transaction can require the involvement of over 30 different third-party processing and verification systems. Each one of these firms adds a small fee to the transaction. A business model that incorporated blockchain technology could eliminate all of these fees while providing a more secure solution to the industry.

6. Blockchain Transaction Times

Not only is sending fiat currency expensive but it is also slow. Depending on the amount and destination of your funds, you could be waiting for over a week to receive your money. Considering that the average blockchain transaction takes under 20 seconds, the winner is clear. Firms such as the African-based processor BitPesa allows companies to send money via the blockchain without the delays found in traditional fund transfers.

Growing Adoption

Blockchain is the #1 emerging technology of our time and all aspects of our financial sector will be changed thanks to this upending-technological advancement. There is already a slew of cryptocurrencies that focus primarily on providing solutions to the payments industry. You can expect this list to grow over the coming years as the market continues to develop.

When speaking on blockchain integration into the payments sector, one would be remiss if they didn’t, at least briefly, touch on Ripple (XRP). Ripple is a real-time gross settlement system that was specifically designed to provide banks access to the benefits of blockchain technology with affordable implementation cost. It has become hugely popular since its release in 2012. Over the last year, Ripple has managed to secure partnerships with some of the largest financial institutions in the game including 61 Japanese banks, Santander, and MoneyGram – to name a few.

Ripple is Helping Financial Institutions Enter the Blockchain Market

Upgrade the Current Business Model with Blockchain

Given the continued success of platforms such as Ripple, it is easy to see the direction in which the payments industry is heading. Investors and financial institutions alike can benefit from the advancements brought to the payments industry through the integration of blockchain technology. Already there are numerous Ripple-like coins gaining momentum in the sector.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.