Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin mining and fraud are an unfortunate reality we must face as an industry. From things like Bitconnect to Butterfly labs to even Onecoin, there are a lot of scams and fraud floating around.

These schemes leave people high and dry with lost money and no product or service rendered. They play off of people’s greed and irrational expectations of gains, despite exaggerated promises of gains.

Ultimately, these schemes, sow seeds of distrust amongst users and attract ire from regulators in a fledgling industry where everyone is already walking on eggshells.

Before we delve in let’s break the categories down that these Bitcoin mining frauds fall into:

- Vaporware – Hardware that is being “sold” but is actually just an idea and not an actual creation being made or if it is made there is little to no value left in the hardware (e.g. Butterfly Labs)

- Cloud Mining – With the offering of shares and other constructs, it is easy to sell people digital units of basically nothing. By offering consistent returns this creates a false sense of security which typically end with exit scams (e.g. BitClub)

- Robo Trading, Tumblers and HYIPs – This model is usually a farce, claiming that there is a team or algorithm behind the scenes “trading”. From this activity, they give you a specific % daily gain (e.g. Bitconnect)

Vaporware

Although many consider companies like Bitmain to be evil corporations, a lot of people don’t realize how sketchy the mining scene was in the early days, 2010-2014 especially.

It was quieter times with less (almost no) mania like today with ICOs. The media was clueless and instead, you had probably what was similar to the early days of the web. This means mostly hardcore techies and enthusiasts but there were also cunning con artists and roving Crypto-hacker bandits trying to steal people’s coin.

Since many safeguards were not available it had a “darknet” like vibe where you weren’t really sure who or what was safe. For example, many altcoins were mostly scams in 2014, especially the anonymous cryptocurrencies.

The BTC mining and “investing” scene has had a subtle yet constant threat of scamming since the early days. Sadly, the masterminds behind such initiatives have only gotten more intelligent and crafty in their methods.

Hardware that doesn’t exist aka vaporware has been less common recently as there are now many more legitimate options for sourcing mining hardware like Bitmain or Halong Mining.

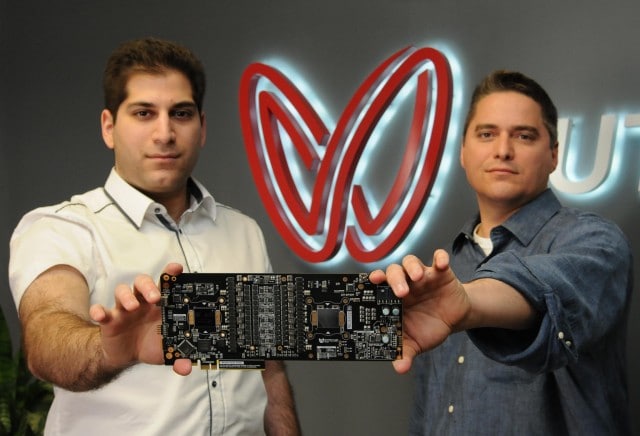

One of the first and most blatant vaporware scams was with Butterfly Labs. Butterfly Labs took customer funds, built machines, mined on them and provided them to customers when the mining profitability was basically worthless.

In 2016, this caused the regulatory hammer to come down in the form of a lawsuit:

“Butterfly Labs and two of its operators have agreed to settle Federal Trade Commission charges that they deceived thousands of consumers about the availability, profitability, and newness of machines designed to mine the virtual currency known as Bitcoin, and that they unfairly kept consumers’ up-front payments despite failing to deliver the machines as promised.

Under the terms of the settlements, Butterfly Labs and its part-owner and vice president of product development, Sonny Vleisides, and its general manager, Darla Drake, will be prohibited from misrepresenting to consumers whether a product or service can be used to generate Bitcoins or any other virtual currency, on what date a consumer will receive the product or service, and whether the product is new or used. The settlements also include monetary judgments that are partially suspended due to the defendants’ inability to pay.

“Even in the fast-moving world of virtual currencies like Bitcoin, companies can’t deceive people about their products,” said Jessica Rich, Director of the FTC’s Bureau of Consumer Protection. “These settlements will prevent the defendants from misleading consumers.”

Nasser Ghoseiri (left) and Sonny Vleisides (right) are the co-founders of Butterfly Labs

After receiving a fine and having to shut down the company, Butterfly Labs was over. But what recourse for the customers? Unfortunately, not a whole lot.

Since then, the market has higher intelligence and awareness of fair offerings, especially with the advent of legitimate ASIC suppliers.

Cloud Mining

While mining Cryptocurrency itself is absolutely not a scam, some constructs and services rendered by middlemen absolutely are. Cloud mining is where you are promised digital shares in a mining operation and provided “returns” for your investment. Although there are legitimate players in this space, there are also the tricksters.

Because there’s almost no way to prove that you are getting an actual spot in a data center, Cloud mining is a serious conundrum. Sure, you could verify that you are getting payouts in your wallet but in terms of the actual mining backend, the proof is dubious at best.

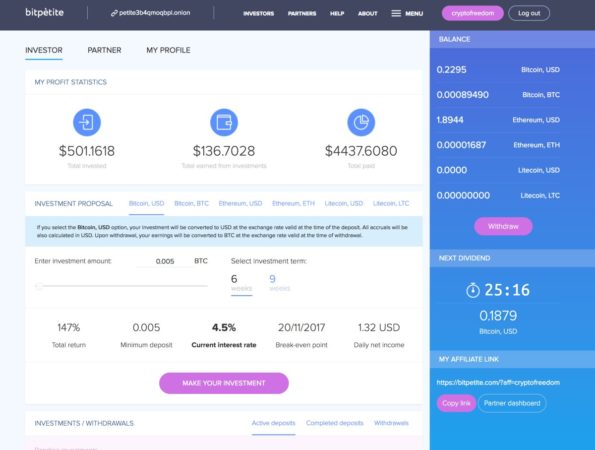

An example of a Cloud Mining scheme promising returns from your investment

How Cloud Mining Works

The premise of Cloud mining is simple, you purchase a given amount of hash power, often called “shares” which gives you access to part of the mining data center (similar to renting a room).

Typically, you are given a menu of a few cryptocurrency and algorithms options associated with mining. For example, Bitcoin (SHA-256), Monero (CryptoNight) or Zcash (Equihash).

In return for your purchased hash of the specific Cryptocurrency, you are then provided X amount of Cryptocurrency, sent to your wallet directly. You can use a profitability calculator based on current market price, difficulty and network hash rate, to determine what a payout would be.

Payouts can range in frequency depending on your customizations and can be hourly (if a high enough threshold is reached), daily or weekly.

This is one of the easiest scams to concoct as the entire construct of you buying digital shares from a company “somewhere over there” is a pretty dubious foundation for an investment.

Nonetheless, we have definitely seen some blatant scams intermingled with seemingly legitimate operations who provide a fair market value of products and services. This can make Bitcoin cloud mining frauds hard to detect for some investors struggling to filter through the noise.

Robo trading and HYIP schemes

These are one of, if not the most crafty Bitcoin scams of all. The reason for this is that these operations leverage fake yet well-working websites to woo users with good looking UI, rapid daily payouts, and withdrawals.

2017 seemed to have a large surge in High-yield Investment Programs (HYIPs) like Bitpetite, Davor, and the infamous Bitconnect.

Bitpetite, claimed to be a tumbler that would give you returns on your loaned crypto

The way they worked is you would set up an account which would have a wallet address (similar to exchanges) where you would send your coin to. Cryptocurrencies like BTC, LTC, ETH and even XMR were commonly accepted and denoted this balance once it was sent.

The platform through a dashboard would then show your investment as well as how much you earned from your investment. So if the platform promised 5% returns a day, your $100 investment would show a $5 worth of earnings in your account.

The premise of how these returns were earned include a variety of narratives such as Bitcoin mining and trading algorithms in place to even tumbling services. But most of the time that is all they are, stories to keep unknowing users happily running this con-machine.

The thing about these setups is the good ones run extremely smoothly and seamlessly which builds a false sense of trust among users who assume “well because it’s paying out, it must be legit”. The longer this charade goes on, the longer users feel more confident in this shaky investment.

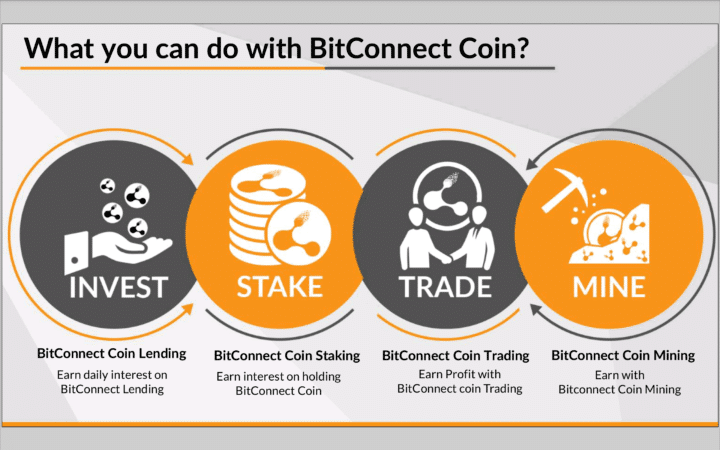

Bitconnect was a bit more complex but very similar to Bitpetite’s set-up

Bitconnect operated by allowing you to deposit in BTC which would then be exchanged for BCC (Bitconnect coin) which would then be used to invest in a robotic trading bot and algorithm. This “algorithm” would allegedly trade for you and earn approximately 1% a day on your investment.

There was a function where you could reinvest your profits which would increase the principal investment at work and would increase your payouts based on your increased amount invested.

This led to a whole boom in Youtube “millionaires” like Trevon James, one of the most well known Bitconnect shills. Eventually, Trevon James and a variety of other promoters of Bitconnect have been contacted by the FBI and SEC for a hearing.

This could be for potentially promoting what has come out to be a ponzi scam and appears to be a part of a larger investigation.

What’s really sad about Bitconnect, is the false sense of trust it created which caused people to do truly crazy things such as losing their life savings.

Final Thoughts

Although physical Bitcoin mining scams have been mostly eliminated, there are new more intelligent scams that have taken their place.

Vaporware dupes users with non-existent or worthless hardware (e.g. Butterfly Labs)

Cloud-based Bitcoin Mining offers digital mining data center shares and contracts promising consistent returns.

Robo Trading and HYIPs claim to use algorithms behind the scenes “trading”. From this activity, they give you a specific % daily gain (e.g. Bitconnect)

The good news is that many of these schemes are easy to identify.

Red flags include: guaranteed promises of gains and returns, specific %, referral or MLM style incentives behind the model and a website that mimics the look, feel and functionality of other proven scams offering similar gains.

It’s still a wild, wild crypto West so, be careful out there.

Image via: A detail of the Charles M. Russell painting “Big Nose George and the Road Agents.” JONATHAN BLAIR/CORBIS/GETTY IMAGES

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.