Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

How crypto could bring one of the most important concentrations of power the world has ever seen.

How crypto could bring one of the most important concentrations of power the world has ever seen.

The more I think about crypto, the more I get scared about our future.

On the one hand, cryptocurrency seems like a libertarian dream. The technology allows transacting money — or anything of value — over the Internet without any third parties involved. Crypto is all about empowering individuals. Projects like Bitcoin are open source, permissionless, borderless, censorship-resistant and beyond the control of anyone. They put the existence of banks into question and hint at a world of radical self-governance.

On the other hand, cryptocurrencies could also be used by governments to gain terrifying power over the population. More than they ever had in history.

How is that possible? Consider FedCoin: the idea of a centralized cryptocurrency built by a government and meant to replace its currency.

Cryptocurrency = Programmable Money

Since Bitcoin, the most important innovation in crypto is arguably the creation of Turing complete projects like Ethereum. These are like Bitcoin, but they add an important feature: they can perform any computation.

Because these cryptocurrencies can run computer code, it’s possible to build and distribute applications on them. These are called smart contracts, and they are absolutely revolutionary. In short, they allow us to program money.

For governments, being able to program money is one of the best things that could happen. Why? Here are a few examples:

1. Automating Taxes

Imagine a world where the US government replaces the dollar with FedCoin. Then, they program the entire tax code directly into the money.

In this world, every time you get paid or spend money, taxes are automatically deducted from the transaction. You no longer need to hire an accountant at the end of the year. Everything is calculated in real time through smart contracts. Crypto could make accountants as irrelevant as self-driving cars will make bus and cab drivers irrelevant.

Think of all the wasted time this could save. US citizens spend about 6.1 billion hours per year dealing with taxes, leading to about $233 billion in productivity loss. Automating taxes would save considerable time and money for you and me, and even more for businesses and the government itself.

2. Automating Distribution of Money

Beyond taxation, FedCoin could also automate the redistribution of money.

Say a politician promises to invest 10% more money in education. Rather than those being just empty words, he could program it directly into the blockchain. Then, every time the government collects taxes, 10% would be automatically redirected to the Department of Education. With FedCoin, you would no longer need to trust politicians. You could trust the code itself.

The same could go with any other distribution of money. Need to give a stimulus payment? No need to send physical checks tough the mail, and no need to worry about people fraudulently trying to steal the money. You could do the whole thing with a single line of code.

3. Transparent Government

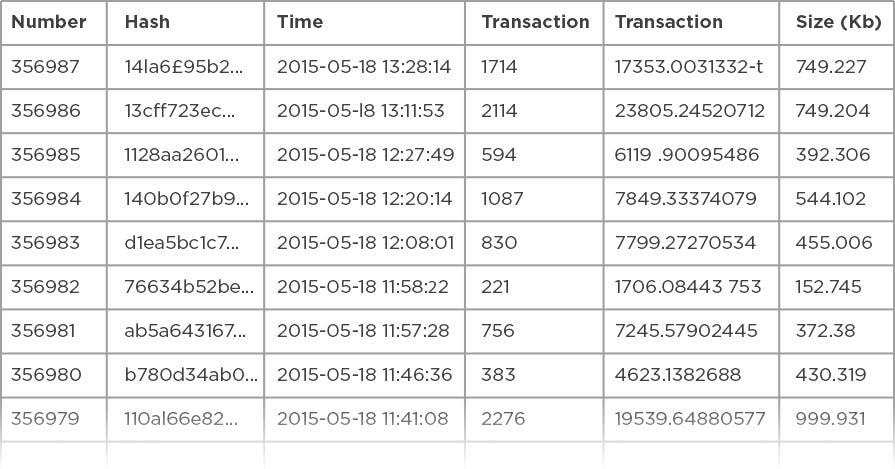

FedCoin could also make the government a lot more transparent. One of the biggest misconceptions about crypto is that transactions are anonymous. With the exception of privacy coins, they’re not. It’s the opposite. You can go on bitcoin.org today, download Bitcoin’s blockchain and see every transaction ever made on the network. By design, every Bitcoin transaction is public.

Bitcoin’s blockchain is essentially a public spreadsheet. You can browse it at blockchain.info.

Bitcoin’s blockchain is essentially a public spreadsheet. You can browse it at blockchain.info.

If FedCoin was to be built that way, anyone could access the blockchain, look up the government’s address and see exactly how the politicians are spending our money.

Considering the US government has lost the trace of 21 trillion dollars in the last 20 years (that’s trillion with a T — just about as much money as the entire national debt), more transparency would be very welcome.

The Bitcoin Bankruptcy Problem

Crypto could make the government finances incredibly more efficient and transparent. So what’s so scary about it? Consider the following:

A brain wallet allows you to carry your money in your head. Literally.

A brain wallet allows you to carry your money in your head. Literally.

Imagine you borrow $1,000,000 from your bank and use it to buy Bitcoins. Then, you put them into a secret personal wallet. You destroy any traces of the private key, except for the 12 words mnemonic phrase you have memorized. Now, the only way to access that borrowed money is in your brain.

Then, you go back to your bank, declare bankruptcy and refuse to pay back the loan. Normally, the bank, the court, and the government would team up to seize everything you have so they can hopefully get the money back.

Only now, because the money is mathematically encrypted on the blockchain, there’s nothing they can do. That million dollar is yours forever.

You can do this today. I’m dead serious. I’m surprised there’s hasn’t been a famous case of someone doing it already. Granted, if you were to do that, you should probably leave the country forever. Otherwise, you would most likely be charged fraud and put in jail for a very long time.

The point is: cryptocurrencies are above the law. For governments, this is a huge problem. If everyone starts doing reckless things like defaulting on loans or stop paying their taxes entirely, the system could collapse. There’s no way they would allow it.

So what happens when a government wants all the benefits of programmable money but doesn’t want to lose control over it? The solution is simple:

- They create FedCoin and use it to replace the national currency.

- They code a backdoor access for themselves. That way, they can freeze or seize people’s funds when they try to cross them.

- In all likelihood, they would probably ban Bitcoin, Ethereum, and every other open cryptocurrency they can’t control. Oh and while they’re at it, why not ban cash as well. They can’t control it either, and cash is the easiest way to commit crimes.

If FedCoin happens, politicians will inevitably give themselves absolute control over the money.

If FedCoin happens, politicians will inevitably give themselves absolute control over the money.

With FedCoin, if you try to commit fraud, governments won’t need to go through the courts and the banks to seize your money. They could do it at the press of a button. If this doesn’t scare you, ask yourself the following question:

What if Hitler had FedCoin?

Imagine if, in 1943, Hitler had absolute control over all of Germany’s money. What if, at the press of a button, he could have frozen the money of half of the German population? History would have played out very differently.

Or consider the Chinese’s Social Credit, a new program where everyone is given a score between 350 and 950, just like your credit score. Except the score isn’t just about the quality of your finances, it’s about your entire value as a citizen.

Under this program, when you do something wrong, your score goes down. It can be jaywalking, not paying back a loan in time, committing a crime, or just being friends with someone with a low score. When your social score goes down, so does your quality of life.

If you’ve seen this Black Mirror episode, you know how this ends.

If you’ve seen this Black Mirror episode, you know how this ends.

In China, a low social score means limited access to finance, higher interest and tax rates, and even slower internet speed. If it goes too low, you can’t send your kids to private school or from buying plane and train tickets anymore. The point is to make life for you and your family as miserable as possible if you don’t behave exactly as the government wants.

With FedCoin, the money itself would prevent you from buying things if your score is too low.

With FedCoin, the money itself would prevent you from buying things if your score is too low.

This might sound like a dystopian nightmare, but this is happening right now. The Chinese government is ahead of its goal of implementing the system nationwide by 2020. Even weirder, most people seem to enjoy it so far, because the program offers perks to those who behave nicely.

It’s easy to imagine how social credit could take a dark turn under a corrupt government. Once implemented nationwide, nothing prevents them from ruining your score if, say, you go to the wrong protest or vote for the wrong party. Social credit is leveraging money to become the ultimate system of control.

I bring this up because it seems to me that FedCoin is the missing ingredient for China to implement such a system nationwide. With it, all the social credit rules could be coded directly into the money.

Given that, it’s no surprise China started working on its own Fedcoin since 2016. They also started clamping down on other cryptocurrencies by banning ICOs, crypto mining, and foreign exchange trading. I bet China will be the first country to launch FedCoin, and social credit will be a core feature.

The Coming Crossroad

Digital money is inevitable. It might happen in 10 or 100 years, but at some point, most currencies in the world will be digital. The benefits are just too great.

The problem is, as money becomes digital, it gives those who control it increasingly more power over the rest of us. Today, digital money allows banks and governments to track every single transaction you do. They get to decide who can receive and spend money, and who can’t. If you cross them, they can freeze or seize your money at the press of a button. None of those things were possible when money was simply cash. Programmable money will make all of this much worse.

That’s where cryptocurrencies come in. The point of crypto is to get the convenience of digital money without anyone having to be in charge. Governments are increasingly exploring the idea of FedCoin. They want all the benefits of Bitcoin except for the last part where they have to let go of their control over money. They are missing the entire point.

Technology can be used for both good and evil. Nuclear can power millions of homes, but it can also destroy them. Cryptocurrency is no different.

As a society, we’ll need to decide how we want to use this new technology. Do we want a world where we have an open, global, decentralized, permission-less monetary system? A currency of the people, by the people, for the people. Or do we want a world where governments are in charge of digital money, with the potential for massive abuse and oppression down the road?

These are the questions that we’ll need to face in the coming decade.

Please hit 👏 if you enjoyed or learned from this.

Want to learn more about crypto? Check out these other mind-bending stories of mine👇

- Today I Became a Trillionaire

- People are spending $millions on digital cats and here’s why it makes sense

The Terrifying Future of FedCoin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.