Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I don’t know if Ethereum will continue on to be as large of a market leader as it is today, but it’s definitely not going anywhere.

I’ve been getting a lot of questions on the interwebz about Ethereum lately. With competitors coming out of the woodwork, people are beginning to wonder if the King of the dApps is at risk of losing the throne.

“Will Ethereum go back up?”

“With NEO, EOS, QTUM, and more, will Ethereum last?”

“Why is Ethereum falling?

“ Do other altcoins competing with it mean Ethereum isn’t going to recover?”

Just because there are some younger and healthier princes in the castle, doesn’t mean they can dethrone the king.

Why?

Ethereum was the first platform token to allow the widespread creation of tokens. Before NEO, EOS, and other competitors could even get their white papers out — Ethereum already had several successful ICO’s launch on their platform.

One could bring up the MySpace vs. Facebook argument, MySpace was first too. No one knows what good ole’ Tom is up to these days. But as you’ll see in the charts below, the early mover advantage in this particular case brought the benefit of billions of dollars in support. If MySpace had hit the valuation that Ethereum has before Facebook launched, it’s hard to say how the battle would have turned out.

Another benefit of being a first mover is the developer community that Ethereum has built. By being first, and creating a project that was easier for developers to pick up and add to their toolkit, they’ve created a huge community of active developers constantly looking to improve the platform.

People tend to ignore just how rich and active the developer ecosystem for Ethereum actually is. The developer ecosystem is so rich, you have many people tackling the current big weakness of Ethereum. They also have the ambitious vision of blockchain scaling without any compromises with decentralization.Thanks to Ethereum’s active developer community, we have creative solutions to the scalability problem being implemented. — Oleg Sergeykin, PhD

Ethereum has superb documentation, and until another project can rival it in that sense, new developers will continue to flock to the Ethereum blockchain.

Not to mention the Ethereum Enterprise Alliance: supported and comprising of several well established and credible companies. Ethereum even has a strong B2B community supporting it.

They’re just claims.

While a lot of companies claim to be better than Ethereum, that’s all they are at this point, just claims. No one has put their money where there mouth is and really shown how their platform solves the scalability issues of Ethereum. EOS claims to be “Ethereum on Steroids”, that’s literally what E O S stands for. Yet their main net hasn’t launched, and there’s no proof in the pudding so far.

Not to mention the fact that 50% of the EOS supply is held by 10 wallets. It’s far from decentralized at the moment. With that large of a supply being owned by a small group, it’s ripe for manipulation, but that’s another story.

NEO released shortly after Ethereum. I see NEO as the closest competitor, but haven’t seen the volume of dApps necessary for it to really pose a threat.

Ethereum has billions of dollars in funding already raised through ERC20 tokens launching on its platform.

Ethereum created an onramp for anyone with a decent idea (and unfortunately a lot of people with bad ones) to create their own token. The advent of ERC20 tokens changed the game. Now anyone with a mild understanding of Solidity can tokenize practically anything.

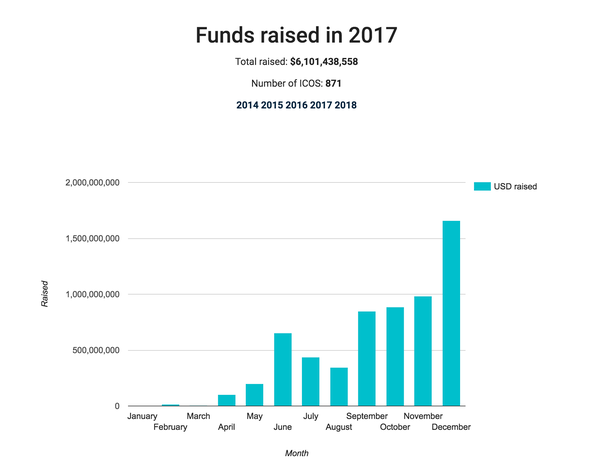

Ethereum is responsible for the ICO craze we saw in 2017, when coins were launching left and right. Sometimes raising 100’s of millions of dollars in funding. In 2017 alone, a total of $6,101,438,558 raised across 871 ICO’s.

Discord - Free voice and text chat for gamers

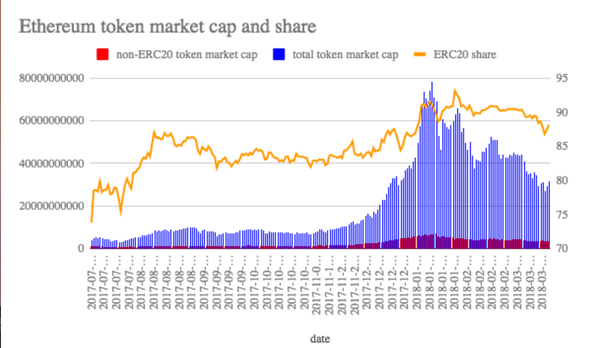

Ethereum and other ERC20 tokens account for 90% of the total token market cap.

Because it is so easy to generate ERC20 tokens, they make up the majority of the capital in the crypto market. If Ethereum were to fail, so would these coins.

While other platforms have different and, arguably, better ways of handling certain parts of the stack, the truth is that 90% of developers and businesses building new blockchain applications are going to do it on the Ethereum platform.This is a building effect. More developers means more projects, which leads to people making better Dev tools and learning materials, which creates better opportunities to create applications, which creates more developers and projects…. — Brian Schuster

I work with a blockchain accelerator: I know from first hand experience that when a team comes to BlockchainWarehouse to pitch their ICO or Token Sale, they’re always building their project on Ethereum. Even the ones who are going to develop their own protocol and blockchain like mesmr (who by the way are the only company I see being able to take serious shots at Ethereum) are launching their initial project on Ethereum while they build out their own blockchain.

At the end of the day, there is too much money invested in companies built on top of the Ethereum network for ETH to go anywhere, anytime soon.

— — — — — —

If you want to learn more about trading, technical analysis, or even just chat about the market

Stop by Cosmic Trading and say hello!

Discord - Free voice and text chat for gamers

Follow me on Twitter for musings on the market and blockchain

Reza Jates (@RezaJafery) | Twitter

4 Reasons Ethereum is Here to Stay was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.