Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In today’s Bitcoin in Brief, regulators in Berlin have revealed that at least six German financial institutions are involved in cryptocurrency trading. Also, it has been reported that American universities have started investing in crypto hedge funds. The investments are on a limited scale but nevertheless indicate a growing interest from academic institutions. And, authorities in Belgium warn the public about crypto scams with a “Too good to be true” website.

Also read: Bitcoin in Brief Tuesday: Exchange ETF Action and Wozniak Wants Bitcoin to Rule World

Financial Authorities in Germany Find Six Institutions Trading Cryptos

At least six financial institutions in Germany trade cryptocurrencies, the country’s Federal Ministry of Finance revealed. The information emerged from an answer to a question filed by Bundestag member Thomas Lutze. The figure is based on findings of the German financial regulator Bafin, which supervises the financial sector and is also expected to monitor crypto trading activities. The banks involved were not named.

At least six financial institutions in Germany trade cryptocurrencies, the country’s Federal Ministry of Finance revealed. The information emerged from an answer to a question filed by Bundestag member Thomas Lutze. The figure is based on findings of the German financial regulator Bafin, which supervises the financial sector and is also expected to monitor crypto trading activities. The banks involved were not named.

There is no case registered with Bafin against financial institutions suspected of any breach of money laundering regulations, due diligence requirements, nor reporting obligations regarding cryptocurrencies, the Bundesfinanzministerium said, quoted by Reuters. Each such institution, which has permission to trade properties, also has the right to set up mechanisms allowing the exchange of bitcoin to euros and vice versa, the ministry noted.

The Finance ministry also said that the issuance of a digital central bank money is currently not an option in the Eurozone, “given the wide range of unresolved issues and significant risks associated with unclear benefits.” According to the report, the Federal government in Berlin does not see crypto-related risks to the stability of the financial markets due to the low market capitalization of cryptocurrencies and the limited interdependence with the financial sector.

East Coast Universities Invest in Crypto Hedge Funds

Academic institutions in the US have started making small investments into cryptocurrency hedge funds, according to a lawyer working in the industry. These universities are getting involved on a limited basis for strategic reasons, the founder of Capital Fund Law Group, John Lore, told Business Insider. “I can’t say the names because that’s attorney-client but we have people mostly on the East Coast that have begun doing investments in this space on a fairly modest basis,” he added.

The New York-based law group specializes in providing legal services to the hedge fund industry. According to Lore, at this point investors are putting in very small percentages of their net worth into these new funds. He doesn’t expect institutional investors, such as pension funds, to invest in crypto soon, with one notable exception – university endowment funds, some of which have already begun to invest on a limited scale. “We see academia as a tie between these somewhat young and enthusiastic fund managers and capital raising,” the lawyer said.

The New York-based law group specializes in providing legal services to the hedge fund industry. According to Lore, at this point investors are putting in very small percentages of their net worth into these new funds. He doesn’t expect institutional investors, such as pension funds, to invest in crypto soon, with one notable exception – university endowment funds, some of which have already begun to invest on a limited scale. “We see academia as a tie between these somewhat young and enthusiastic fund managers and capital raising,” the lawyer said.

Cryptocurrencies and the underlying blockchain technologies have seen a growing interest from universities. Leading academic institutions, such as Cambridge and Oxford, have introduced crypto and blockchain related courses. In December, the Belarusian National Technical University announced a diploma course covering cryptocurrencies, derivatives, and ICOs, as news.Bitcoin.com reported. In April, the Fundacao Getulio Vargas University in Sao Paulo launched “Brazil’s first Master’s degree in cryptofinance.” It has been reported that North Korea’s Pyongyang University is also offering educational courses on cryptocurrencies.

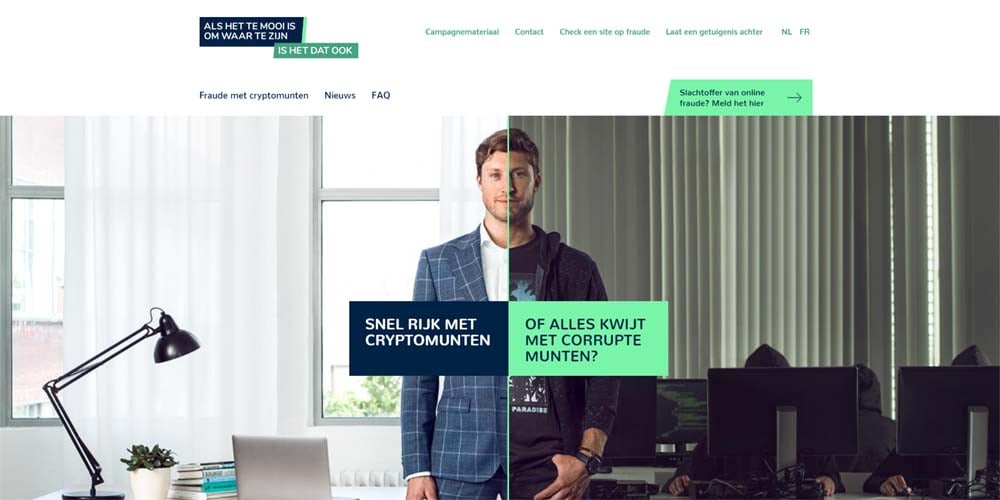

Belgian Regulators Warn About Crypto Scams with New Website

Financial authorities and regulators in Belgium have launched a website dedicated to warning the public about crypto scams and raising awareness about the associated risks. The move comes in response to substantial increase in interest towards investing in cryptocurrencies and related products. The site, temooiomwaartezijn.be (“Too good to be true”), can also be used to report suspicious offers and projects in the crypto space.

Belgians can find there useful tips on how to avoid fraudulent schemes. The site advises investors to make sure they know who they are dealing with, check if a project is registered as a scam and never share sensitive personal data. Regulators say people should always request clear and understandable information, take their time to critically evaluate an offer before accepting it and be wary of promises of excessive profits. “If the return seems too good to be true, it usually is. Profit is never guaranteed,” they warn.

Scam-related losses of almost €2.2 million have been reported to financial authorities in the country, with at least 118 victims having contacted Belgium’s Financial Services and Markets Authority (FSMA). Belgian regulators claim only 4% of the cases are reported. According to their estimates, the total financial loss from fraud related to cryptocurrencies amounts to around 130 million euros annually. In March, the financial watchdog published a list of 19 cryptocurrency trading platforms showing signs of fraud. Last month, the FSMA expanded its blacklist including more businesses reported by customers.

What are your thoughts on today’s topics in Bitcoin in Brief? Let us know in the comments section below.

Images courtesy of Shutterstock.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.