Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This month the International Monetary Fund (IMF) released a report on global monetary policy in the digital age which explains that “crypto assets may one day reduce demand for central bank money.” The IMF study was written after an IMF staff discussion that details that cryptocurrencies could someday lower the demand for fiat currencies by creating a shift from “credit money to commodity money.”

Also Read: Twitch Streamers Can Now Tip With Four Cryptocurrencies

Crypto Assets Will Eventually Be More Widely Adopted

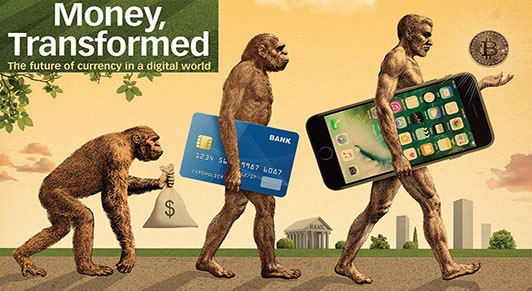

One thing is for sure the IMF has a lot to say these days about Bitcoin technology and other cryptocurrency solutions. More recently the Managing Director of the IMF, Christine Lagarde, has had a lot of positive words to say about digital currencies. Moreover, the IMF also showcased a picture of money evolving featuring a picture of a bitcoin which was displayed on the front page of the IMF website. Now the IMF has released a report written by a variety of IMF researchers who state:

We cannot rule out the possibility that some crypto assets will eventually be more widely adopted and fulfill more of the functions of money in some regions or private e-commerce networks.

This picture is displayed on one of the articles featured on the IMF website’s front page.

This picture is displayed on one of the articles featured on the IMF website’s front page.

A Payment Shift

The study notes that the global financial crisis and bank bailouts have “renewed skepticism in some quarters” of the world and there’s a possibility that digital assets can affect the traditional global monetary policies. There’s also talk of a “payment shift” within the study where cryptocurrencies could replace fiat in some regions.

“Such a shift could also portend a change in the way money is created in the digital age: from credit money to commodity money, we may move full circle back to where we were in the Renaissance,” explains the IMF report.

Economists continue to debate the origins of money, and why monetary systems seem to have alternated between commodity and credit money throughout history. If crypto assets indeed lead to a more prominent role for commodity money in the digital age, the demand for central bank money is likely to decline.

“Not so long ago, some experts argued that personal computers would never be adopted, and that tablets would only be used as expensive coffee trays, so I think it may not be wise to dismiss virtual currencies,” said the Managing Director of the IMF, Christine Lagarde in September of 2017.

“Not so long ago, some experts argued that personal computers would never be adopted, and that tablets would only be used as expensive coffee trays, so I think it may not be wise to dismiss virtual currencies,” said the Managing Director of the IMF, Christine Lagarde in September of 2017.

Competitive Pressure and the Allure of the Central Bank Coin

The IMF paper also details how banks should respond with competitive pressure and they should continue to solidify fiat currencies as a “unit of account.” Cryptocurrencies, however, have a hard time becoming a standard unit of account the IMF notes and this is because “valuation is largely based on beliefs that are not well anchored” which has made the majority of digital currencies quite volatile.

The researcher’s paper mentions that central banks could counteract with their own digital currencies. It goes on to say that the banks have many challenges and opportunities in this digital age but they must regain the public’s trust to remain relevant. “They can remain relevant by providing more stable units of account than crypto assets and by making central bank money attractive as a medium of exchange in the digital economy,” the IMF paper concludes.

What do you think about the IMF’s report and how positive this organization is towards cryptocurrencies? Let us know your thoughts in the comments below.

Images via Shutterstock, Getty Images, and the IMF website.

Want a comprehensive list of the top 500 cryptocurrencies and see their prices and overall market valuation? Check out Satoshi Pulse for all that hot market action!

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.