Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As most have heard by now, GitHub, the preeminent web-based software versioning and collaboration community revered by a growing base of 28 million developers worldwide, was recently acquired by Microsoft. While there is a substantial amount of concern and uncertainty as to the fallout of this acquisition, given that Microsoft just spent $7.5 billion dollars for a platform that generates roughly $130 million dollars annually while swapping leadership, two things that are for certain is that Microsoft cannot afford to leave GitHub to its own devices in order to grow organically nor do they intend to do this.

For starters, it’s important to acknowledge that every move is a power grab with publicly traded companies, nothing more, and Microsoft is not an exception to this with their acquisition of GitHub. Once any company is funded by emotionally uninvested people seeking individual wealth without any individual responsibility such as this though, the wishy-washy stuff that we see is done is strategic, not intrinsically and their stated values tend to be more consistent with that of propaganda than an accurate depiction of what they truly represent. As such and regardless of what anonymous Taylor Swift fan accounts and other zealots have to say about this acquisition, mergers and acquisitions are no exception to this, if not the standard, and metrics such as return on investment (ROI), future earning potential, and inherent risk tends to rule these discussions, not how much of a Carebear the company is. Obviously, there may be a few publicly traded companies that can walk the line, but do not fall prey to mistaking the outliers for the mean; we can go into the science behind this in another post.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Microsoft didn't buy GitHub planning to make money showing advertisements to code communists, I promise you.

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Although many scoffed at how much Microsoft overpaid for LinkedIn, which was acquired for roughly $30 billion @ $60/user which still generates roughly 10x more revenue than GitHub at roughly $1 billion dollars annually, they are paying $267/user by acquiring GitHub for $7.5 billion dollars which only generates $130 million dollars annually. Had they paid this much for LinkedIn, they would have had to pay over $120 billion dollars. Further, LinkedIn is also operating at a 4% annual rate of return, which is far under the 7% minimum that investors generally like to see in publicly traded companies, but still more than twice that of GitHub at the moment which is at an approximated 1.7%. By the numbers, Microsoft’s GitHub acquisition makes the LinkedIn acquisition seem as brilliant as a moon landing without the intention of monetizing it heavily.

While 7% may seem arbitrary, at a certain point your money is better off in the bank collecting interest if the payoff is less than 7%. If they left GitHub unchanged though, they would operate at a paltry 1.7% annual rate of return which is roughly 4x less than the same ROI minimum as LinkedIn and would take Microsoft 57 years to see a return on their investment as opposed to the 30 years it would take to see a return on LinkedIn. Needless to say, this is not at all tenable from the perspective of investors without significant changes that result in significantly more revenue. Unfortunately, there are MANY more ways to make these products worse as opposed to making them better and Microsoft has proven that they cannot even improve their own products, let alone someone else’s, and past failed acquisitions serve as a stark reminder of this inability.

In short, Microsoft also has to make significant changes in order to boost GitHubs revenue to at least equal that of LinkedIn from the perspective of ROI, presumably from $130 million annually to $300 million annually, as a hedge against their investors calling for a management exodus, but ideally they should be around $525 million. In order to accomplish this though, Microsoft is most likely going to try to use GitHub as a sales pipeline for Azure, but even this isn’t a guarantee as Azure and most of Microsoft’s other products are not effective in markets that are not dominated by their partners, which are responsible for 95% of their commercial revenue, and tend to fall on their face in free markets above the influence of their aforementioned partners. Even worse, marketing becomes less effective as the intelligence of its object increases or the awareness of the tactics increases, especially if they are well-aware of the tactics being leverage which many in this industry are as they build the tools used to employ these very tactics. Needless to say, such approaches probably won’t work so well on GitHub users.

Instead, Microsoft is most likely going to try to change GitHub in a manner that makes it incredibly easy to sandbox from GitHub in Azure while streamlining their ability to go-live while giving them a massive platform to work within; hence why they’ve been leg-humping Linux for the past year. However, when considering that it’s Microsofts’ stated goal is to look for opportunities to entrench their solutions and increase switching costs, not productivity, don’t be shocked if developers don’t fall for it as they are painfully aware of this and do not even develop for Microsoft platforms anymore for reasons such as this. Because of this development approach, Azure is also designed to function in the same manner, is significantly more expensive than its competition long-term as a result, and the people that build these solutions are paid a lot to be well-aware of this; all developers and engineers do is save people money, mass, and time.

On top of this, these same changes have to roll out in a manner that does not alienate users that are historically and philosophically opposed to Microsoft as a record label and a crew on top of convincing them to spend more money while simultaneously attracting new users. But that’s fine, all they have to do in order to earn their trust is to let GitHub grow organically, but how can anyone rationally expect this when they’re already changing hands and being lead by the former head of Xamarin? It almost goes without saying, but the CEO position didn’t change hands to leave the company unchanged, so we can just drop the notion of Microsoft leaving it alone at this juncture.

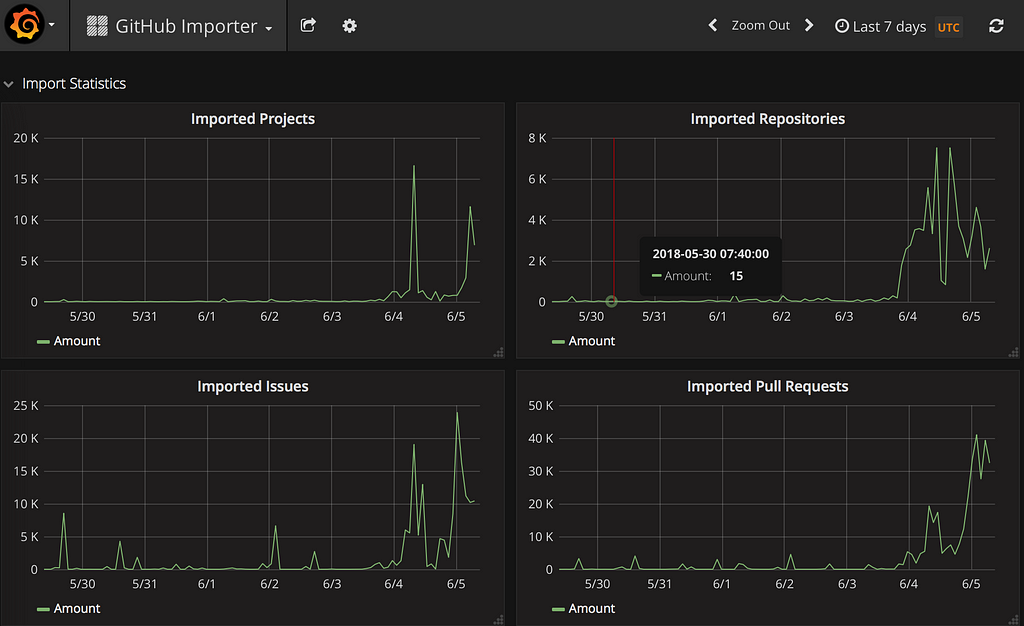

Grafana Gitlab GitHub Importer Stats: https://monitor.gitlab.net/dashboard/db/github-importer?orgId=1

Grafana Gitlab GitHub Importer Stats: https://monitor.gitlab.net/dashboard/db/github-importer?orgId=1

As if the cost per user, ROI, or Microsofts’ propensity to turn everything into a dumpster fire isn’t enough of a red flag, the risk involved with buying such a massive platform is astronomical when giving their user-base a closer examination. As a web service, GitHub happens to be valued almost entirely by its user base and this user-base, which is a community is built around open source, tends to run in opposition to companies such as Microsoft. As such, the risk of a platform abatement is HUGE and GitLab, a chief competitor of GitHub, is already seeing a MASSIVE spike in projects, repositories, and requests migrating over from GitHub upon the mere rumor of this acquisition, let alone its announcement. Even worse for Microsoft, we should even expect to see more competition in this market in the near future. Because of this, their cost per user and risk should increase while the potential ROI dropped even lower than what is stated above and isn’t exactly a good omen while the ink is still drying on this deal; not good.

None of this matters though if users break for GitLab or some other service that has not been invented yet regardless of what Microsoft does to GitHub just by virtue of being who they are; and for good reason. Although Microsoft has a terrible track record with acquisitions, horrifying competent developers and botching great ideas has been their modus operandi for decades now. Because of this and based on the initial migration to Gitlab, I do not think a Ballmerite doing his best impersonation of a hip guru is enough to sway developers to deny the fact that Microsoft is losing relevance every day and just a monopoly trying to make moves consistent with any monopoly.

Microsoft and The Octosition was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.