Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Do you want to get started buying and selling Cyptocurrencies? Are you using the best exchange out there?

In this post, I will discuss availability, ease of use, security, trading pairs offered, deposit/withdrawal methods and fees for some of the most popular exchanges.

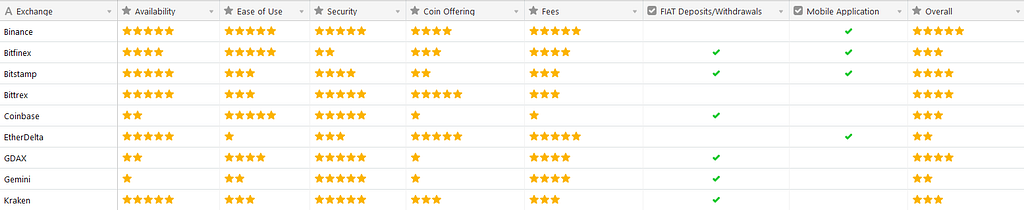

At the end of the post you can find my personal opinion on which exchange is the best depending on your situation and a ratings table pitting exchanges against each other.

Coinbase/GDAX

Coinbase was launched in 2012 and is one of the biggest and most reputable Cryptocurrency exchanges. It is available in 32 countries (including the US) and currently serves over 10 million customers.

Coinbase is very user friendly because it makes selling and buying digital currencies extremely easy. It also offers a mobile application for both iOS and Android which some people might find handy while on the go.

Coinbase offers 4 coins — Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC). It supports trading/purchasing with United States Dollar (USD), Euro (EUR) and the Great British Pound (GBP). It allows customers to deposit and withdraw FIAT via a bank transfer. Additionally, you can immediately purchase digital currencies using a debit/credit card. Digital currencies can also be deposited/withdrawn to/from exchanges or wallets.

Its transfer fees are reasonable, however, its trading fees are vastly more expensive than the competition. A detailed break-down of the fee structure can be found here.

Coinbase has not suffered any security breaches in the past. It also offers insurance on the FIAT and cryptocurrency deposits, which many other exchanges do not.

Coinbase also offers a fully fledged advanced exchange called GDAX. GDAX offers most features an advanced trader would expect from an exchange. It can be accessed with your Coinbase account. Transferring FIAT and cryptocurrencies to/from Coinbase is instant with no fees. One thing to note, GDAX offers different and better trading fees than Coinbase.

If you would like to read more about GDAX, how to use it and how to leverage its features for trading, drop me a message in the comments below or a tweet.

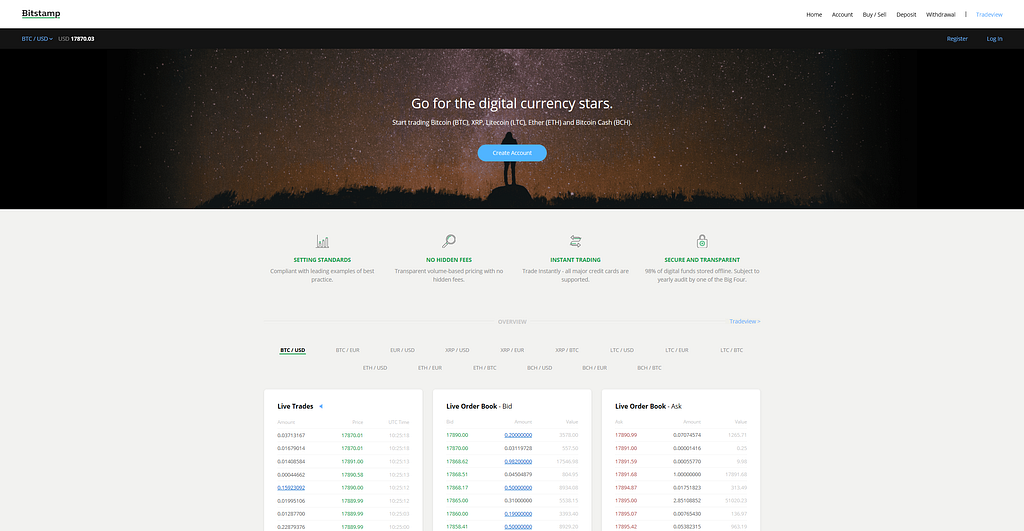

Bitstamp

Bitstamp is based in Luxembourg with offices in the US and UK, and is one of the oldest exchanges, having been established in 2011. It is available worldwide and boasts excellent customer support.

Bitstamp is relatively easy to use whilst also offering more advanced features via its Tradeview. A mobile application is available on both iOS and Android.

Bitstamp has a variety of coins on offer — Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) and Bitcoin Cash (BCH). It supports USD and EUR which can be used to purchase the coins previously listed, regardless of locale.

Just like Coinbase, it offers FIAT deposits via bank transfer, in addition to, immediate purchase of digital currencies via debit/credit card. It also allows cryptocurrency deposits. Similarly, it allows withdrawals via bank transfer, cryptocurrency as well as gold.

Bitstamp’s fees are slightly higher than the competition; you can find a more detailed break-down here. Personally, I do not mind the slightly higher fees in return for excellent customer service they provide.

Bitstamp has suffered one security breach in its 7 years of operation. On the 4th of January, 2015 it suffered a security breach in which 19,000 BTC were stolen which were worth $5.1 million at the time. No customer incurred any losses during this breach, with Bistamp taking the full loss on themselves. Bitstamp undergoes annual audits by one of the “big four”; you can find more details about this here.

Gemini

Gemini was launched in 2015 by the famous Winklevoss twins and is based in New York. It is regulated by the New York State Department of Financial Services (NYSDFS) and has the highest level of capital reserve requirements and banking compliance standards. Unlike others (which have a Bitlicense to operate in the US), it’s also registered as a New York State chartered limited liability trust company meaning they can deal with both institutional clients and individuals.

It is available in most U.S. States, Canada, Hong Kong, Singapore, South Korea and the U.K.

Gemini is not particularly user friendly, especially for beginners, one of the reasons being, it focuses on order-book depth rather than price chart. Unlike its competition, it does not offer any mobile application.

It only offers 2 coins and 1 FIAT currency —BTC, ETH and USD. You can trade both coins using USD regardless of region. It supports deposits and withdrawals via bank transfer and digital currencies.

Gemini offers very competitive transfer and trading fees — often these are calculated based on your trading volume.

Gemini is committed to very strict security practices and has not suffered any security breaches in the past. All customer USD deposits are eligible for FDIC insurance. More information about Gemini’s security practices can be found here.

Kraken

Kraken is another exchange to have stood the test of time, having been founded in 2011. It is based in San Fransisco and is the biggest exchange in terms of volume and liquidity for EUR trading pairs. It is available worldwide (including the US)

Kraken is not the most user friendly exchange out there, one of the reasons being that there is no price chart on the trading screen.

Kraken offers a vast amount of coins, including, BTH, BCH, ETH, LTC, Monero (XMR), Augur (REP) and many more. It also supports a number of FIAT currencies including USD, EUR, GBP, CAD and JPY. Kraken’s deposit/withdrawal methods include bank transfers and cryptocurrencies.

Its deposit fees and withdrawal fees are inline with the rest of the market. Kraken offers competitive trading fees on most trading pairs — a detailed fee schedule can be found here.

Kraken has not suffered any security breaches, however, it has been struggling with stability and performance issues over the past few months. These issues are especially notable during times where there is a significant increase in volume.

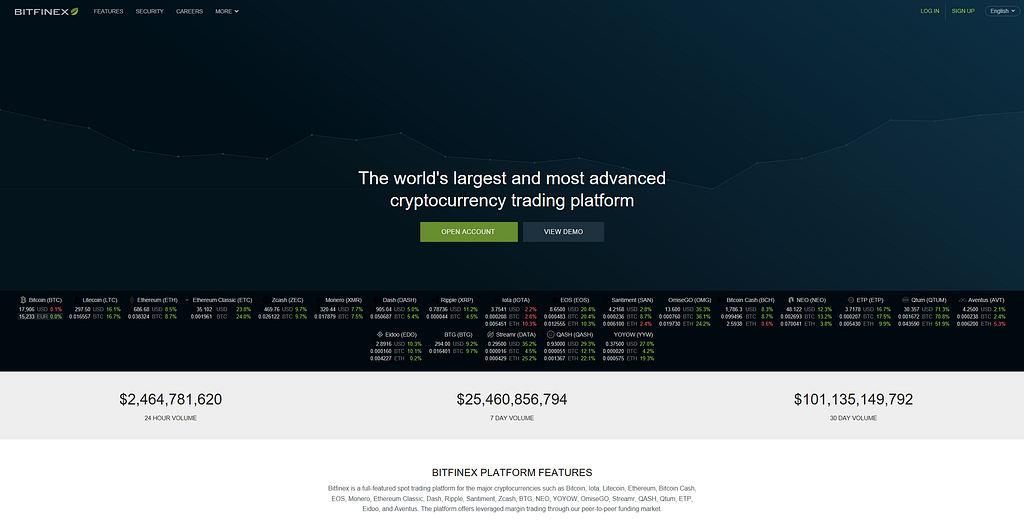

Bitfinex

Bitfinex was launched in 2012 and is the world’s largest exchange by volume for trading Bitcoin against the US Dollar. Ironically, it is available worldwide except for US customers.

Bitfinex is very intuitive to use and offers a number of advanced features (margin trading, margin funding, etc.). It also offers an extremely good iOS and Android application.

It offers a variety of digital currencies —BTC, BCH, ETH, LTC, IOTA, XMR, NEO and many more. You can deposit/withdraw using USD and EUR (via bank transfer), in addition to, cryptocurrencies.

Bitfinex offers extremely competitive transfer and trading fees. For more details check out their fee structure here.

Bitfinex has suffered two security breaches to date. The first one was in May 2015 where its “hot wallet” got hacked, resulting in more than 1,500 BTC (worth $330,000 at the time) to be stolen.

The second breach happened on August 2016 where 119,756 BTC were stolen (worth ~$72 million at the time). Bitcoins were taken from users’ multi-signature wallets (which were introduced after the 2015 hack) and the hacker’s withdrawal transactions were signed off by Bitfinex’s security provider (BitGo) without full security. This resulted in “generalised” losses for all customers amounting 36.067%. This was the second largest loss of Bitcoin history (the first being Mt. Gox). To read more about this incident, the Financial Times have written a great article here.

Bitfinex is also closely correlated to Tether (USDT) — a cryptocurrency pegged to the US Dollar. There are concerns on how well backed up USDT is and what relationship there is with Bitfinex. If you want to read more about this, Bloomberg has written an excellent article which you can find here.

Bittrex

Bittrex was founded in 2014 and its headquarters are located in Las Vegas. It offers over 190 cryptocurrencies for trading, making it one of the largest exchanges with regards to this. It is available worldwide (including US customers).

Bittrex sits in the middle of the pack with regards to user experience. It doesn’t excel in anything in particular but doesn’t lack in anything either.

Bittrex offers an enormous choice of coins to trade with — BTC, ETH, LTC, XMR, NEO, WAVES and many many more (~200 coins). Deposits and withdrawals need to be carried out in cryptocurrencies as Bittrex does not support any FIAT currency.

It is slightly more expensive to trade on Bittrex than the competition, but it makes up for this by offering coins that aren’t offered on many exchanges.

It has a clean record with regards to security breaches.

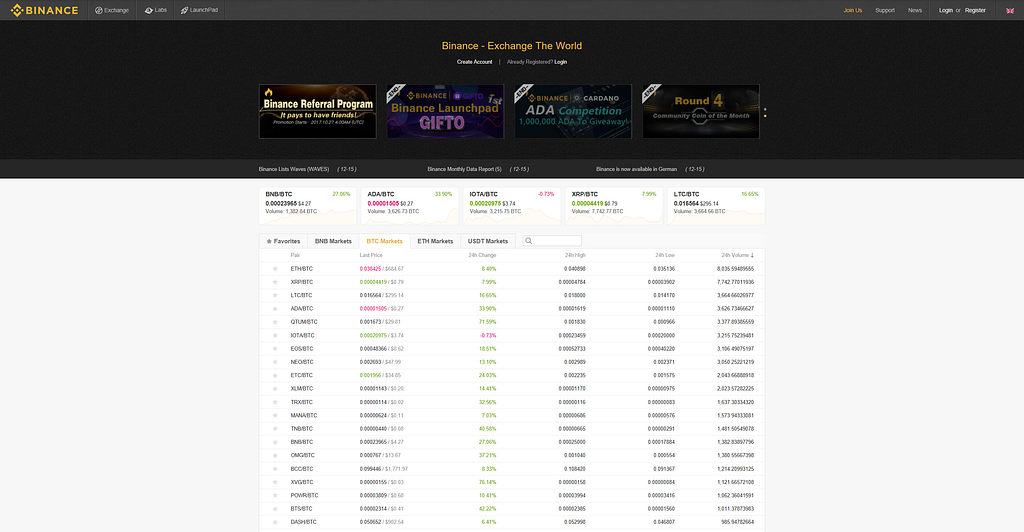

Binance

Binance is one of the newest exchanges in the cryptocurrency space. It was launched in July 2017 and has gone from strength to strength ever since. It is available worldwide (including US customers).

Binance is very user friendly and extremely fast. It also offers an iOS and Android application — the only mobile application of an exchange I use day to day.

As with Bittrex, Binance offers a huge amount of coins (over 90), including, BTC, BCH, ETH, LTC, IOTA, NEO and many more. FIAT is not supported on Binance, hence, all deposits and withdrawals are via digital currencies.

Binance offers very competitive trading fees . It also has its own coin (BNB) which can be used to reduce the trading fees by half (you need to buy BNB beforehand).

Binance has not suffered any hacks in its short lifetime.

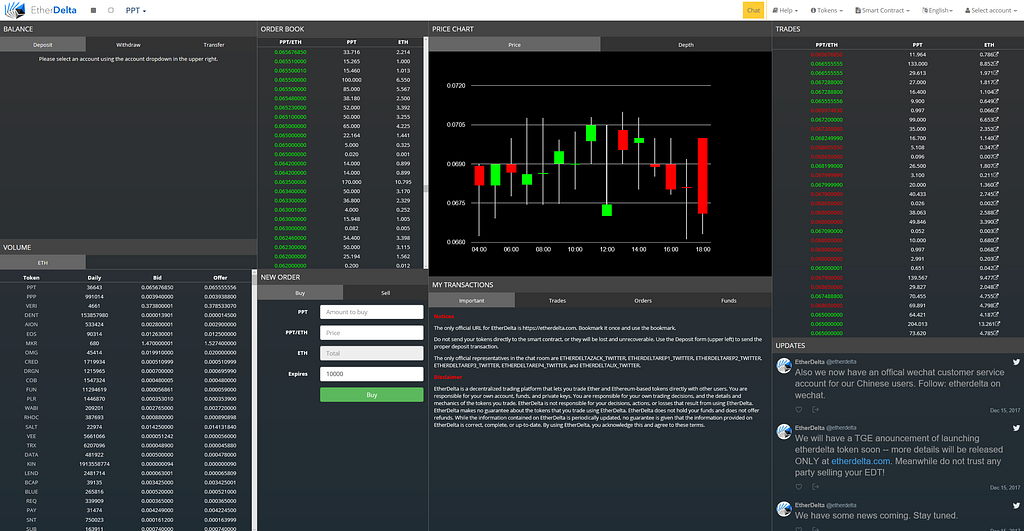

EtherDelta

EtherDelta is a decentralized exchange (DEX) meaning that there is no party holding customers’ funds but trades happen automatically and directly peer-to-peer. In EtherDelta’s case, the funds are held in a smart contract (on the Ethereum network) which you are solely responsible for depositing and withdrawing from. EtherDelta only supports ETH and Ethereum-based (ERC20) tokens.

Deposits and withdrawals can only be made using ETH or any ERC20 token.

EtherDelta is not particularly user friendly where many people have lost money because of this. For example, in this particular occasion, someone tried to buy 750 Kyber (KNC) for 0.007 ETH each. However, he/she ended up buying 0.007 KNC at 750ETH.

EtherDelta’s user experience has improved over time but still has a long way to go to compete with Coinbase and others.

The only fees that apply when trading on EtherDelta, are the Ethereum network transaction fees. These depend on how congested the network is, but are usually minuscule.

EtherDelta’s smart contract has not had any breaches to date. However, hackers have managed to leverage other methods to steal coins from users. One hacker used a fake smart contract and another hacker stole private keys from unsuspected users by injecting JavaScript to URLs which then redirected them to EtherDelta (as described by Robert Leshner here). Just yesterday, another hacker managed to hijack EtherDelta’s DNS configuration making it point to a malicious site instead.

Summary

If you made it so far, I congratulate you! I know this is alot to take in, but it’s vital to be aware of what exchanges are out there and what purpose they surve. I will give my personal recommendations and ratings below to help you make an easier choice.

- If you are looking to deposit/withdraw FIAT in/from exchange I would recommend Coinbase. If Coinbase is not available for you, I would advise to go with Bistamp.

- For trading coins not available on Coinbase/GDAX or Bitstamp I would highly recommend Binance. If Binance does not have the cryptocurrency you are looking to buy, then I would urge you to try Bittrex. If its not available there either and it’s an ERC20 token, EtherDelta is your last option.

Ratings I give for each exchange

Ratings I give for each exchange

Make sure you give the post your👏 50 claps 👏 and my blog a follow if you enjoyed this post and want to see more.

You can also show your support by donating to the following address:ETH: 0x4c7195E074cf0Ab6F77Bdb7C97Fd2567066Bb712

Disclaimer : All information and data on this blog post is for informational purposes only. My opinions are my own. I do not provide personal investment advice and I am not a qualified licensed investment advisor. I make no representations as to the accuracy, completeness, suitability, or validity, of any information. I will not be liable for any errors, omissions, or any losses, or damages arising from its display or use. All information is provided as is with no warranties, and confers no rights.

The Ultimate Beginner’s Guide On Cryptocurrency Exchanges was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.