Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Crypto-Marketplace Series: Learn Where & How you can spend Crypto(5 part series — PART 1)

The use of crypto as an alternative currency is growing fast. Crypto credit card is yet another addition to the crypto community that is set to cause a major ripple in the world of real-life spending. With the new invention, cryptocurrencies are now more than just investments assets, they can be used as an actual currency for purchasing commodities.

If you are not well versed with crypto cards yet, today is your lucky day. Shortly, we shall review some of the top crypto credit cards that you should keep an eye on.

Think of it as just like any other debit card that you can use at an ATM or point of sale. The only difference here is that you draw from a cryptocurrency wallet instead of a bank account. So whenever you make a purchase using your crypto card, an amount of crypto coins you need is automatically exchanged for fiat currency, and sent to the merchant. Usually, the process is seamless and you won’t even notice it.

So, which Crypto credit card can you use?

Currently, and as you can see here, there are many crypto cards in existence. In this post we shall review a few popular cards. For each card we shall explore the technology behind it, fees, rewards and finally its availability.

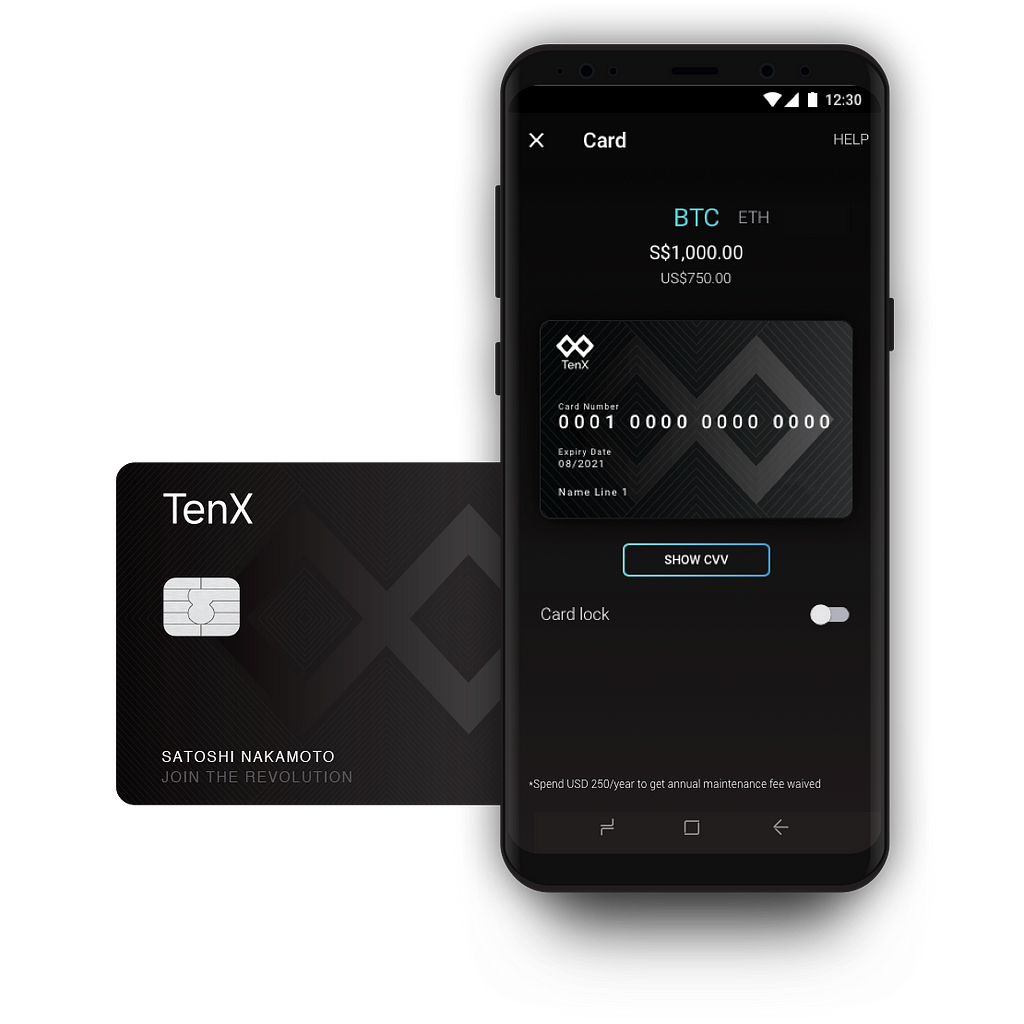

TenX

Technology: TenX is one of the commonly talked about. It has the largest market cap, and it is the first player to launch a product to the market. The Tenx card is developed on the COMIT network- a multi-asset, off-chain routing protocol that enables instant transactions.

Fees: Tenx is affordable. To order a physical card you be required to pay $15. However, the virtual card (yet to be available) will be much cheaper. It will only cost you $1.50 to activate. Also, there is an annual fee of $10 per card if you spend less than $1000 in 12 months. Not to forget a fee of $2.50 for every ATM transaction you make.

Rewards: According to the Tenx reward scheme, users will receive a 1% reward (in form of PAY tokens) for every purchase. As a PAY token holder, you will receive a further 0.5% share of the total network’s transaction volume, and this reward will be in Ethereum.

Availability: The Tenx card can be used in any country (out of the US) where VISA is accepted. Presently, the card supports Ethereum and Bitcoin payments. Dash and more ERC20 tokens will also be made available in Q2 of 2018.

Monaco

Technology: Monaco has the second largest market cap after Tenx. Much of her technology is proprietary. Monaco is built on Ethereum, and it integrates a mobile app and Visa-branded payment processor.

The project offers four kinds of cards, each with unique features, rewards as well as fees. Depending on the card you choose, you will be required to hold on the following amounts of your MCO tokens for a period of 6 months: Midnight Blue (0 MCO), Ruby Steel (50 MCO), Precious Metal(500 MCO) and Obsidian Black(50,000 MCO).

Fees: As we noted above, fees vary from one card to the next. And there are no monthly or annual charges. However, each card will be charged 2% ATM fee if the monthly limit is exceeded. And the monthly limits vary from $200 for the Midnight Blue card to $1,000 for the Obsidian Black. Also, you will be required to pay a 1% fee every time you buy cryptocurrency.

Rewards: Just as the fees, rewards also vary from one card to the next. While there are not cash back rewards for Midnight Blues, the other cards; Precious Metal, Ruby Steel and Obsidian Black have rewards of 1.5%, 1% and 2% respectively. All cash back rewards are made in MCO tokens.

Availability: The Monaco cards are yet to be made available. The team is expected to launch the cards, first in Asia, Europe, and then North America. To begin with, the cards will support Monaco tokens, Ethereum and Bitcoin.

TokenCard

Technology: TokenCard will close our list for today. It is also built on the Ethereum network. Combining the wallet app and the card, Tokencard gives users full control over their funds. It gives users the ability to choose how they would want each purchase split among the different coins that they have.

Fees: The Tokencard team has not yet indicated whether there will be an initial fee to issue the card. They are also yet to reveal their annual fee structure.

Rewards: Both the Tokencard whitepaper as well as the website is silent on the cash back rewards.

Availability: While Tokencard is not available yet, it is clear that the team has thought through it. The project roadmap indicates that the card will be available in a couple of months’ time. Currencies supported by the card include; Ethereum and ERC20 tokens.

Final word

When compared to conventional ways of trading crypto for fiat currency at exchanges, Crypto credit cards will offer many benefits. They include:

Freedom- You can spend your cryptocurrencies without having to worry about exchanges or exchange rates.

Universality-Similar to Visa and MasterCard, crypto cards are accepted almost everywhere. So you will not need to hunt for vendors who accept crypto.

Rewards- Unlike spending cash, most crypto cards offer reward schemes that you can actually benefit from.

All said and done, there is no doubt that merging crypto with debit cards is a powerful innovation for mainstream adoption. If you don’t have a crypto credit card yet, the options discussed in this article can be a great start for you. Try one and share with us your experience.

Keen to find out more about FundYourselfNow? Join our crowdfunding revolution conversation on our Telegram group, or follow us on Twitter.

Top Crypto Credit Card For 2018 And Beyond was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.