Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

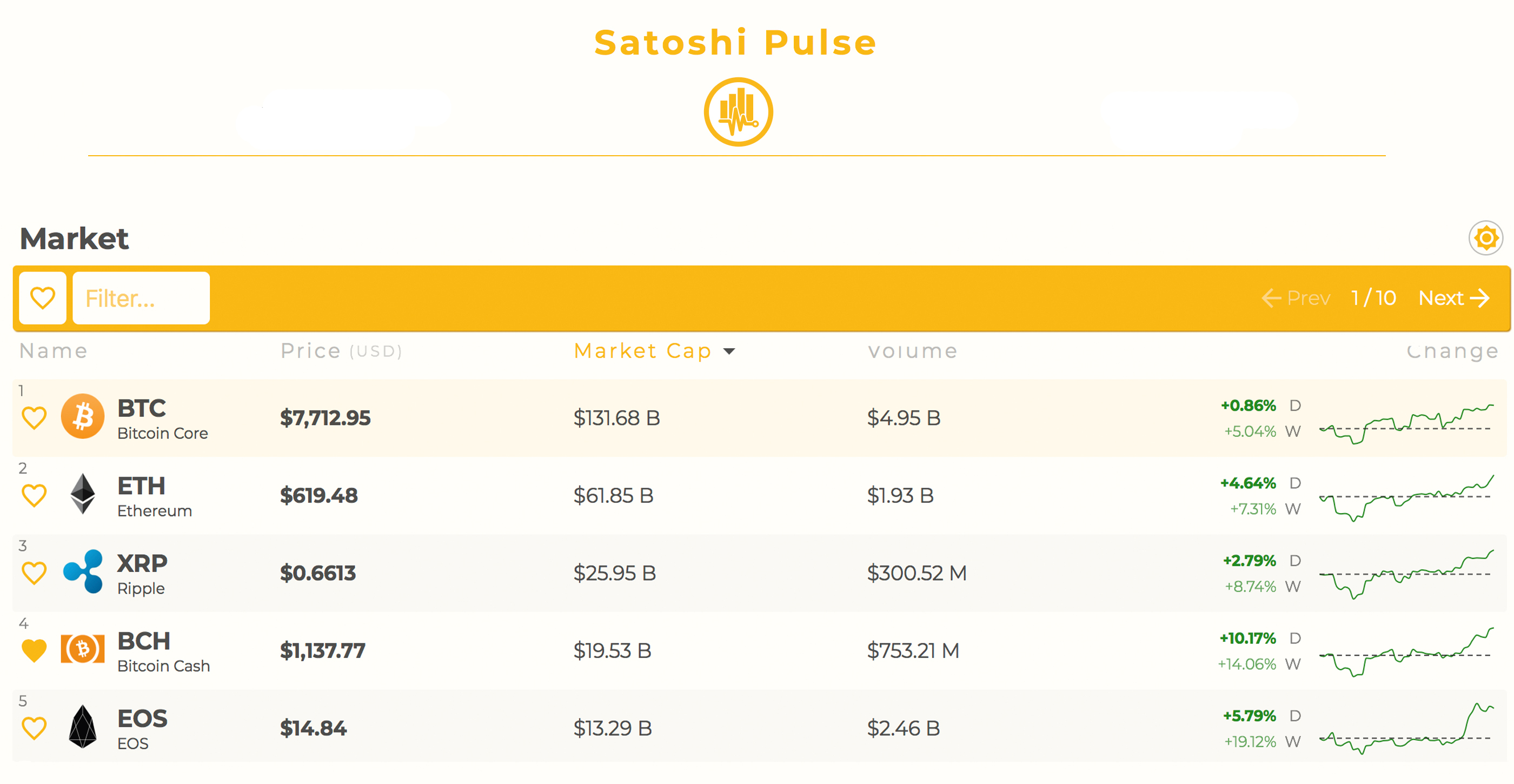

Cryptocurrency prices are making some headway today after suffering from a bearish onslaught last week. Since our last markets update the digital asset economy has gained $26 billion over the last five days. The price of bitcoin cash (BCH) touched a high of $1,160 earlier today but now hovers around $1,140 per BCH. Bitcoin core (BTC) values reached $7,790 per BTC but subsequently dropped to an average of $7,713 at 7am EDT.

Also Read: Devere Group Adds Bitcoin Cash and EOS to Crypto Exchange App

Cryptocurrency Markets See a Short Term Push Upwards

The question over the past few months is — How long will the cryptocurrency bear run last? A few weeks ago things were trending upwards showing signs of a reversal after digital assets lost considerable value after touching all-time highs. Today cryptocurrency markets are showing some deep consolidation as traders have been shifting positions in hopes of another bull run this year. However ever since BTC touched a high of $19,600 digital currency bears have been storming the markets and shorting them to profit from the downturn.

Bitcoin Cash Market Action

On Sunday, June 3, 2018 bitcoin cash markets are commanding an overall valuation of $19.5Bn and the decentralized currency has gained 10 percent over the past 24-hours. Seven-day gains for BCH show the digital asset has jumped upwards 13.9 percent in value. BCH purchasing volume has also increased and rests at $753Mn over the past 24-hours. The top five exchanges swapping the most bitcoin cash today include Okex, Huobi, Bitfinex, Lbank, and Binance. One BCH is roughly 0.1465 BTC and bitcoin core is the most traded pair with BCH today. BTC captures 40.8 percent of BCH trades followed by tether (USDT 28.9%), USD (17.7%), KRW (8.9%), and the EUR (1.3%).

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart on Bitfinex shows bulls are tiring out a touch from this morning’s upward push. Before the spike, the market appeared to form a deep consolidated diagonal formation as Bollinger Bands have been extremely tight. BCH buyers are currently facing resistance and the two Simple Moving Averages (SMA) indicate the path of least resistance may be towards the upside. The short-term 100 SMA is above the 200 SMA trendline but not by much. After this morning’s rise, the MACd still shows room for improvement and the Relative Strength Index (RSI) points to (71) overbought conditions. Order books show BCH bulls need to press past $1,185 to find smoother seas while on the backside there are foundations between the current vantage point and $925.

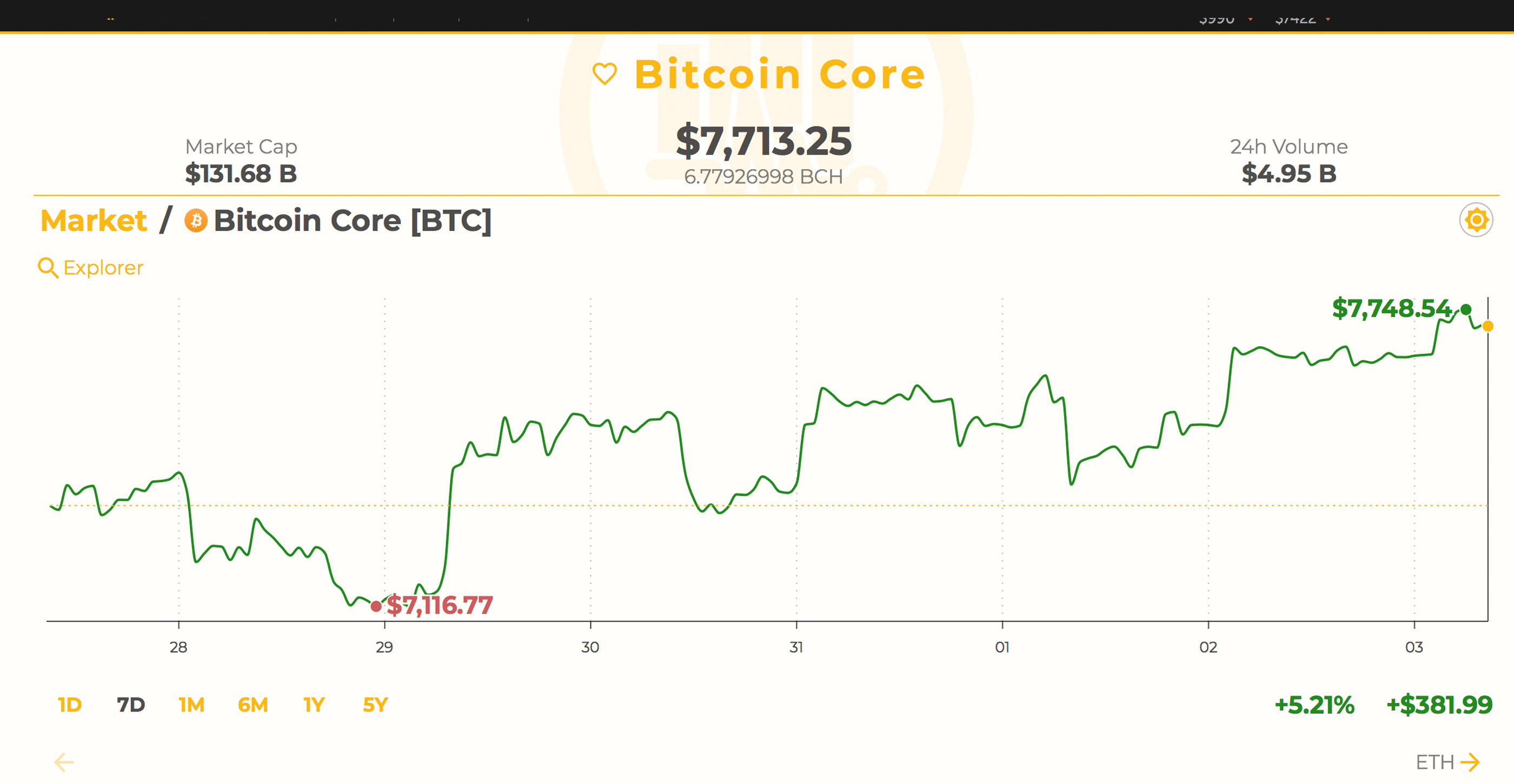

Bitcoin Core Market Action

Bitcoin Core’s (BTC) upwards action is slowing down right now after touching a high of close to $7,800 earlier this morning. The price of BTC is up 0.88 percent over the last 24 hours and 5.2 percent over the last seven days. Trading volume has increased only a little bit since our last markets update as BTC traders this Sunday are swapping $4.95Bn in trade volume. The top exchanges trading the most of this action are Binance, Okex, Bitfinex, Huobi, and BTCC. The Japanese yen today is the forerunning pair traded with BTC capturing 55 percent of trades. Tether (USDT 18.6%) follows the yen, and then the USD (16.3%), KRW (3.3%), and the RUB (2.3%). The Russian Ruble has sort of silently sneaked into the top five currency pairs position with BTC. Furthermore on the peer-to-peer exchange Shapeshift.io the top trade today is ETH for BTC.

BTC/USD Technical Indicators

Looking at the same 4-hour timeline for BTC/USD on Coinbase and Bitstamp show bulls are feeling exhausted after that last push. The cryptocurrency is holding just above the $7,700 region and resistance is piling up across exchange order books. The two SMA trendlines for BTC show similar action as the short term 100 SMA is just above the long-term 200 SMA. With this said we may see some more northbound action if bulls can manage to press through current resistance. MACd is meandering downwards indicating bears are attacking and RSI levels are around 56, showing conditions could go either way after the last spike. Order books are not too bad looking at the upside as bulls need to muster up strength to get past $7,900-8,100 in order to approach far safer and less bearish conditions. Looking down we can see that bears will be stopped at $7,200 and there are considerably sized walls through $6,600 as well.

The Top Digital Assets Today

Cryptocurrency markets in general throughout the top positions are seeing gains today. The second highest market capitalization commanded by ethereum (ETH) has seen a 4.6 percent increase this Sunday. The price of ethereum has gained 7.3 percent this week in total and the price per ETH today is $619. Ripple (XRP) values are up 2.7 percent as one XRP is averaging around $0.66 cents per token. The token EOS which just launched its mainnet is up 5.7 percent this Sunday and 19 percent this week. One EOS is priced at $14.84 per token at the time of publication.

The Verdict: Skepticism Remains

The upswing has added a touch of positivity throughout the cryptocurrency trading environment as markets managed to hold steady at current levels. But many are still skeptical of the current direction and we are most definitely not outside the bear market just yet. Currently, the verdict is traders are skeptical after losing optimism the past three weeks, but some believe the next step is to move upwards as most markets have triple bottomed this year.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.