Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As referenced to in one of my previous posts, my never-ending frustration regarding fraudulent ICOs led me to an innovative project called Blockhive, and immediately, I was hooked on reading what they had to offer.

The Blockhive team believes that there is a need for an alternative to ICO due to the following shortcomings. The token economy is based on the demand, and sometimes selling tokens doesn’t make sense because the token has no real function for your business.

While the term ILP certainly sounds a bit daunting, its a fairly simple concept to grasp, and utilizes smart contracts in their full glory.

As opposed to an ICO, the ILP raises funds for businesses in the form of a crypto-loan, and legally binds borrowers and creditors in via a smart-contract.

In fact, at the end of going through Blockhive’s white-paper, I tried to reason with myself as to why wasn’t THAT the procedure for conducting ICOs.

There’s a reason why traditional loan agreements are a problem.

Procedures. Hundreds of time-wasting, paper-based procedures.

When issuers pay interest and principal, they need to know the KYC and bank account of the Creditors.

When Creditors wish to transfer their rights to others, the issuer needs to know the amount of the loan, the date of transfer, and the KYC of the new Creditor.

Herein comes Blockhive, which offers a legally binding digitized loan agreement, called an Initial Loan Procurement (ILP).

With this innovative loan structure, companies can now procure loans that they needs to expand its ecosystem while allowing creditors to earn interest from the money they have loaned.

All KYC information and transactions are recorded on blockchain, and all money transactions will be automatically executed via smart contract.

How? Using the Future Loan Access Tokens (FLAT) - HIVE.

Distributed to creditors when they commit to an ILP, and receive 1 Hive token per €0.045 value of the loan agreement they signed.

A total of 1 billion HIVE tokens would be issued by Blockhive, all to be used for funding projects.

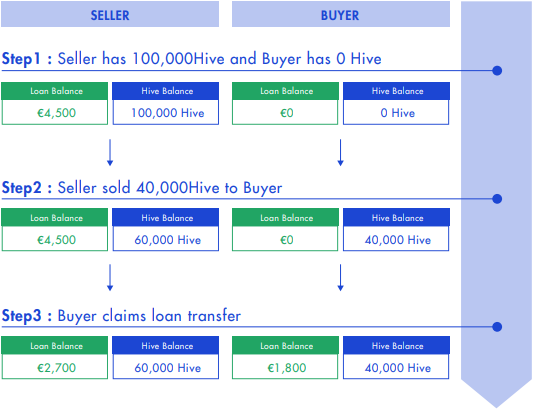

Here’s a gist of how it works —

As shown, HIVE is embedded with a logical, step-by-step process which considers balances, and interest pay-outs.

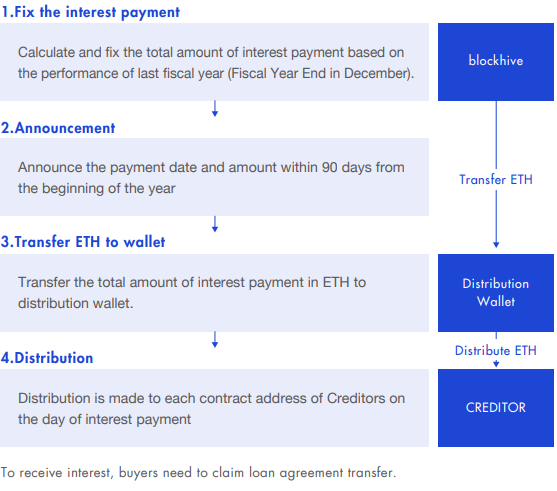

As yearly interest, Creditors will receive 20% of profits generated by the blockhive community using the platform.

Interest is paid in ETH.

From the blockhive whitepaper -

If project A generates profit of 2,000 ETH and project B generates profit of 3,000 ETH, total profit is 5,000 ETH, and the total amount of interest is 1,000 ETH (5,000 ETH x 20%), to be allocated via smart contracts to Creditors.

Thus, Blockhive greatly succeeds in providing an integral feature to the cryptocurrency market —

A token which adds value.

Take part in the Blockhive ILP

To me, Blockhive is an iteration of the ICO, and represents a path where the industry might go in the future.

It is a first test case of this new funding method.

For all related check out the site here — https://blockhive.ee

HIVE Tokens- A New Approach To Token Utility was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.