Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Note 1: This article is advocating for early preparation (not early exits). Fortune favors the prepared. Why leave money on the table?

Note 2: We are organizing the first ever Exit Masterclass in London (Jun 5), Paris (Jun 12), SF (Jun 19) and NYC (Jun 22). Learn from successful CEOs, bankers, VCs and M&A execs on how to maximize outcomes.

In the world of startups, the talk is often centered on:

- The number of startups

- How to scale up

- Unicorns

- IPOs

Yet, an important topic is missing: Exits. Especially M&As, since they are the vast majority.

- Exits fertilize the ecosystem. Founders get rich (or save face), investors get returns. All this builds know-how, visibility and encourages more founders and more investors to join the game. I was told several times that Israel’s impressive startup scene was built this way over time. Small acquisitions, in particular, provide an important safety net and contribute to the healthy recirculation of talent and capital.

- Millions before billions. The focus on unicorns makes it almost shameful to aim for less. It is not only ridiculous but also very damaging: entrepreneurship is often a career, and experience builds step by step. Even Elon Musk took a few shots. In addition, going for binary results is ok for VCs, but much less so for founders, who are often all-in.

- The job of founders is to build optionality. Should you go for more funding / M&A / IPO (including small cap) / Equity Crowdfunding / ICO? If you don’t understand your options and haven’t prepared, you won’t have choice.

Exits is when founders and investors get paid.

Along the life of our fund, SOSV, we had several — the most recent being JUMP Bikes, sold to Uber for a fairly large sum.

Yet, if information on how to fundraise is quite widespread today, there isn’t as much on how to exit, and most founders do not wise up early enough.

How early should founders start building optionality?

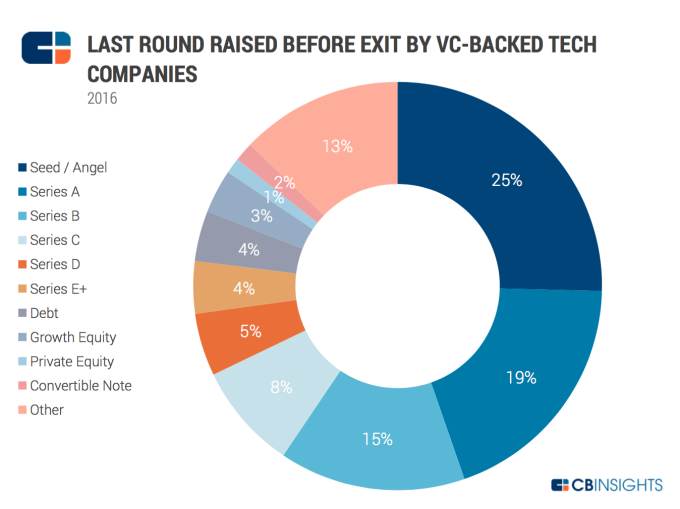

Well, most exits are M&As (CB Insights reported 3,358 total tech exits in 2016–3,260 M&A, 98 IPOs — so M&As are 30x more common), and take place before series B. So prep time starts after seed or A!

Prep time for exits starts after a seed or series A round.

Such preparation will not only help you exit better, but also build a better company over the long run (if you stay independent).

Why Prepare Early?

A few simple reasons:

- Most exits are M&A,

- Most M&A happen early (60% happen at series B or before),

- M&As are done with corporate development execs who do this all day,

- IPOs are done with bankers who do this all day,

- Most founders have zero experience in exits,

- On top, bankers / agents sometimes advising founders are like realtors who help you sell your house: they are more incentivized to sell, and sell fast, than maximize the price. Finally, you are a one-time customer, while buyers (corporates, or banks in the case of IPOs), might be repeat ones. Guess who bankers should keep happy the most? (unless the bank is planning to sell you wealth management services afterward, but they might not be that organized yet)

If with this you are not convinced that you had better educate yourself, I don’t know what will.

Investors Control The Narrative

Otherwise IPOs wouldn’t be called exits, since founders (or later executives) stay on. Even with acquisitions, there is often a lock-in period of 1–2–3 years.

So who’s exiting? Generally, private investors.

The semantics are telling about who’s controlling the conversation (same as when an IPO ‘pop’ is considered a success, while it means the company left money on the table).

What (and When) to Learn?

If you don’t want to botch an M&A opportunity, or leave money on the table, there is much to do in terms of:

- Generating offers (engaging regularly with potential buyers to be aware of their strategic directions, and for them to know about you)

- Making sure your house is in order (processes, IP, executive team, communication, contracts, etc.)

- Negotiating

- Playing offers against each other (or against VC or IPO options — so-called ‘double’ or ‘triple track’)

- (and more)

To avoid scrambling in excitement and panic, and making a mess, you want to do that way before an offer arrives.

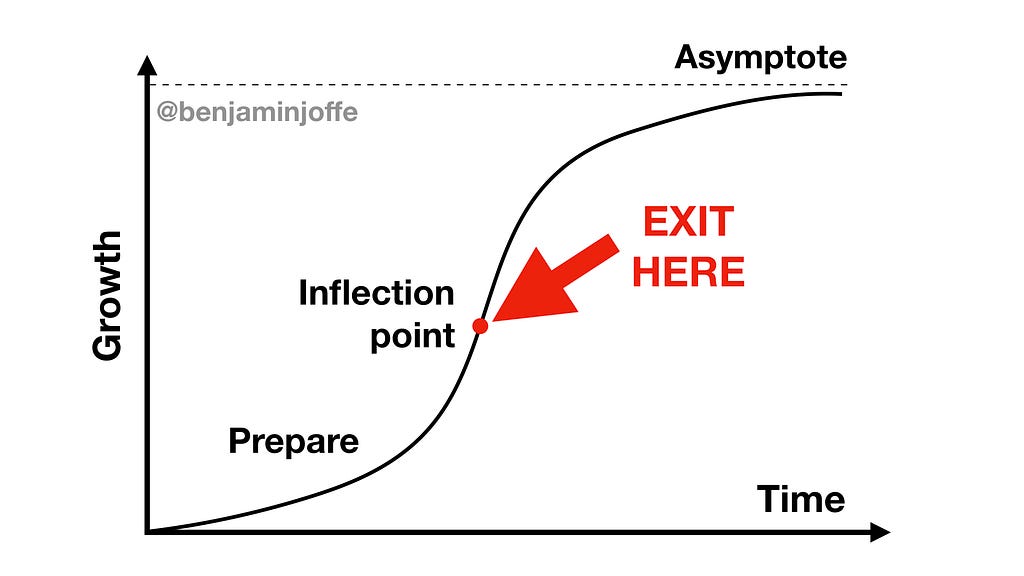

The best timing for a sale is when you have lots of momentum. The maximum momentum is around the “inflection point”.

Maximize outcome near the inflection pointThe best timing for a sale is when you have lots of momentum. The maximum momentum is around the “inflection point”.

Maximize outcome near the inflection pointThe best timing for a sale is when you have lots of momentum. The maximum momentum is around the “inflection point”.

At that point, growth slows down. Take a hard cold look at the business. Can you find a way to change that? Otherwise being part of a bigger company might move up the asymptote. The right company will pay a hefty premium for this.

IPOs are a minority of exits, but allow you to keep steering the boat. They transform your stock into currency and give access to a different class of investors. They come with the downside of reporting, scrutiny, and emotional ups and downs for your team and yourself.

Types of M&As

Tech, team, customers… acquisitions come in various flavors. Different buyers want different things. How would you pitch your company to Google? To Coca-Cola? Adjust the pitch according to their business and strategy.

How would you pitch your company to Google? To Coca-Cola? Adjust the pitch according to their business and strategy.

In some cases, a market consolidation might trigger a series of acquisitions. I heard of a company which was bought a week before an earnings call so that the buyer would be able to announce something new.

Also, VC, M&A, IPO can sometimes be run concurrently. AppDynamics was acquired by Cisco for $3.7B right before a planned $2B IPO. Talk with your banker. Note that bankers generally only take deals that (1) have a very high chance of closing (2) are above a certain amount (due to their cost structure)

On Selling Early

As mentioned above, most exits happen early (80% at series B or before). Why? Reasons could be numerous:

- Can’t raise another round (market changing, etc.)

- An opportunity comes by (market consolidation, etc.)

Despite all the whoohaa about unicorns, one has to remember a few things:

- Don’t forget to become a millionaire before becoming a billionaire (even Elon Musk too a few steps). Your experience and “bankability” could help you start a much better company later on,

- 5 years of (high-risk) hard work is easier than 10 years of (higher-risk) hard work,

- If you end up raising multiple rounds (Series H, anyone?) there will be lots of overhanging preferences (= millions to pay to investors first) and lots of dilution. It is not uncommon that startups selling for many millions bring little and sometimes zero to its founders. In those cases, they would have been much better off selling years earlier when they had a much larger share.

50% of $100M is the same as $5% of $1B but much more achievable. Eventually, it comes down to momentum, market and risk.

Note that as investors, we do NOT advocate selling early, we are in favor of maximizing the outcome. Founders selling for too cheap too early make us sad.

Eventually, it’s a balance of risks and rewards. While there is a close alignment between founders and investors, it is also true that founders have much more on the line than VCs. Still, and beyond a particular company, we see the long-term potential of people.

Exit Masterclasses

To help raise awareness within our portfolio of over 700 startups, we started to have conversations.

After running several successful roundtables earlier this year, we are organizing four events in June — in Paris (June 5), London (June 12), SF (June 19) and NYC (June 22) — where startup founders can learn about exits from successful founders, bankers, VCs and more.

You can find the agenda and RSVP here.We’ll share our new learnings later on!

Why Founders Need To Prepare For Exits was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.