Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Digital assets are seeing some recovery today on May 29, as cryptocurrency bulls are attempting to press market prices higher. Cryptocurrency values dropped pretty low this weekend once again after being unable to hold steady earlier last week. Bitcoin Cash (BCH) weighted price values are averaging $975-986 at press time, gaining 5.3 percent over the past 24-hours. Bitcoin Core (BTC) values are around $7,420-7,460 per coin, and have seen an increase of around 2.4 percent during today’s trading sessions.

Also read: The Exahash Era: SHA-256 Mining is a Significant Achievement in Computer Engineering

Crypto-Markets Rally Back on Tuesday, May 29 — But Will the Gains Be Short-Lived?

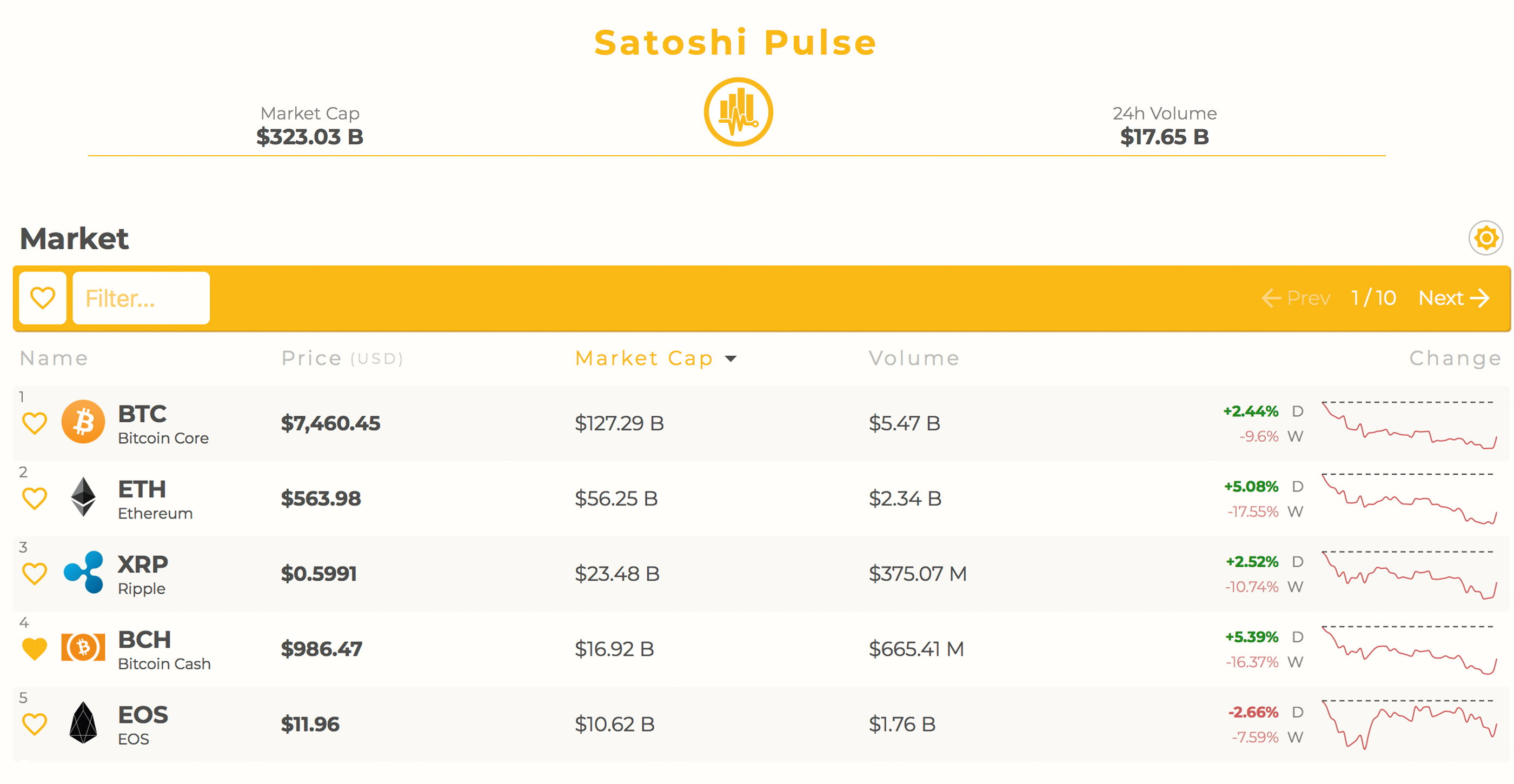

Today we’re seeing a bit of a minor cryptocurrency rally after prices dipped to significant lows yesterday across the board. There’s definitely been a slight surge in purchasing as on-balance-volumes (OBV) showed a great divergence towards lower levels yesterday. At the moment the entire cryptocurrency market is hovering around $323 billion USD and 24-hour volume is around $17.6 billion. This shows that over the last 30 days the entire cryptocurrency economy has lost $106 billion USD in value. The May 29 minor recovery taking place today is testing major resistance across most digital asset market action, and the next day or so will decide where market values are headed.

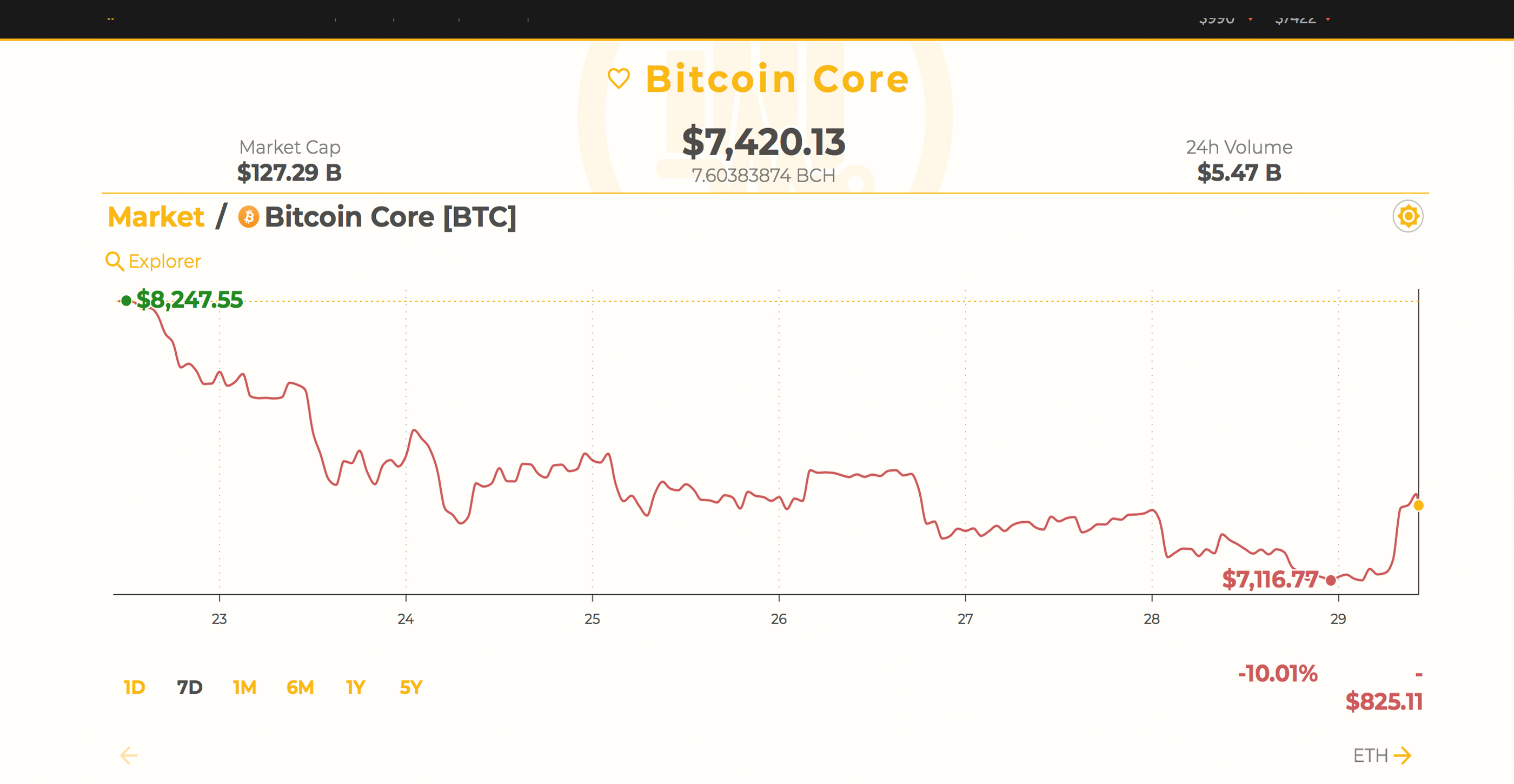

BTC Market Action

Bitcoin Core (BTC) markets are showing a bit of a comeback this Monday morning gaining around 2.4 percent. 24-hour trade volume has increased to $5.4Bn since our last markets update which has helped push the current rally. The top exchanges today swapping the most BTC are Binance, Okex, Bitfinex, Huobi, and Bitflyer. The Japanese yen commands the top position today traded with BTC capturing 53.9 percent. This is followed by other pairs traded with BTC by the USD (20.4%), tether (USDT 16.1%), KRW (3.5%), and the EUR (3.4%).

BTC/USD Technical Indicators

Looking at the 4-hour BTC/USD chart on Bitstamp shows BTC bulls are attempting to push through some major resistance. Currently, the two Simple Moving Averages (SMA) still show the longer-term 200 SMA above the 100 SMA trendline. This indicates the path to resistance is still looking towards the downside, and today’s intraday traders may feel like shorting at certain vantage points above this region. RSI levels are around 53 right now and meandering higher, indicating today’s rally could keep pressing onwards. Today’s trading sessions also show that BTC bulls need to surpass the 50-week Moving Average (MA) in order to see a more affirmative bullish signal. Right now order books on the upside have heavy resistance from the current price level to $8,100, and after that things are a bit smoother. On the back side, books show that bears will see resistance around $6,900 to $6,300, and if the market goes below that then things will look uglier.

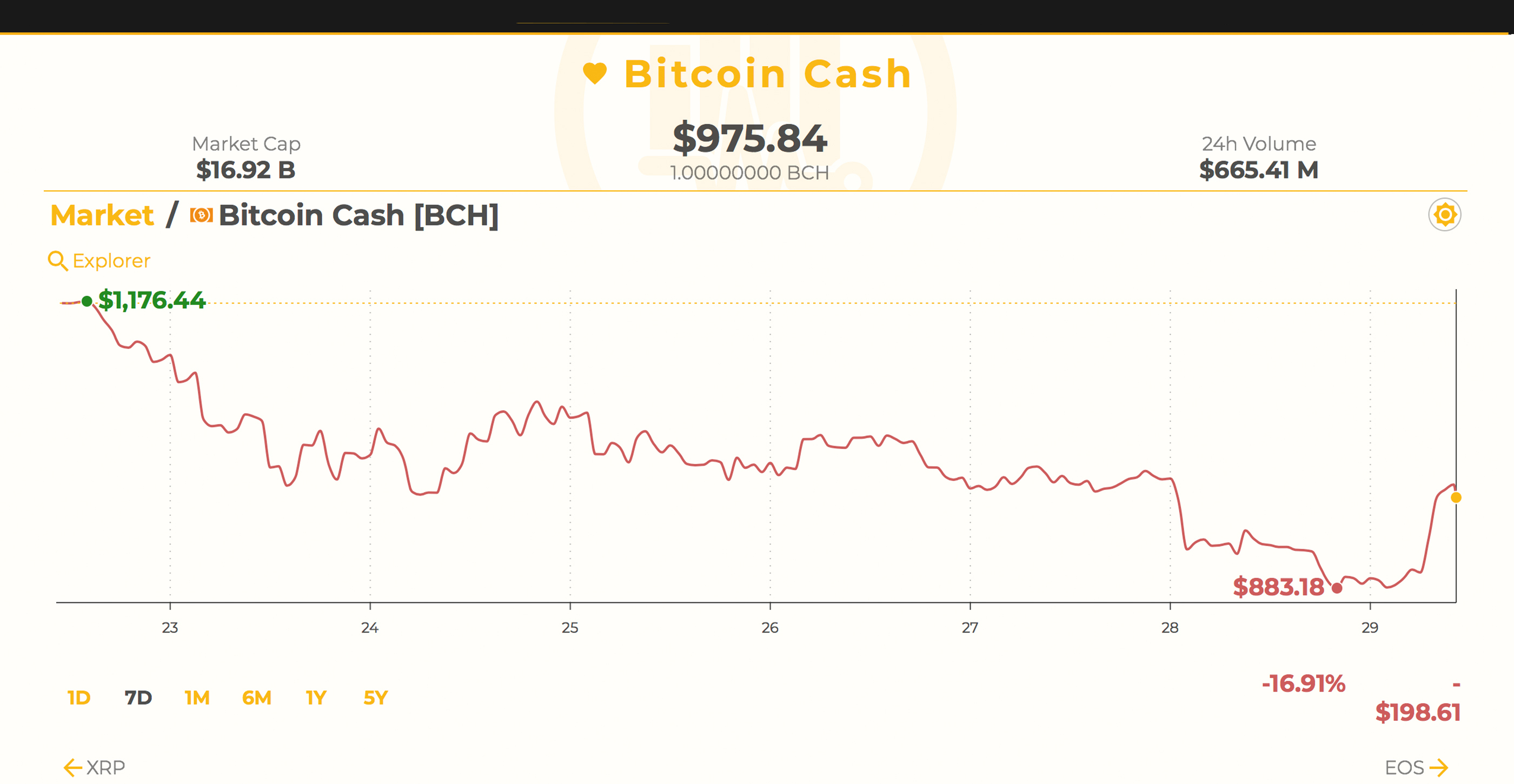

BCH Market Action

Bitcoin Cash (BCH) market action is seeing some bigger gains today, jumping 5.3 percent in value over the last 24-hours. BCH trade volume at the moment is $665 million amongst the world’s top exchanges. Today the trading platforms trading the most BCH include Okex, Hitbtc, Bitfinex, Huobi, and EXX. On the peer-to-peer exchange, Shapeshift.io, the most popular trade today is Dash for Bitcoin Cash swaps. BTC is the dominant pair with BCH on May 29 encompassing 39 percent of all trades. This is followed by tether (USDT 27.4%), USD (20.8%), KRW (8.7%), and the EUR (1.4%).

BCH/USD Technical Indicators

4-hour BCH charts show bulls are pushing hard against resistance and have made some progress today. However, the 200 SMA is still well above the short-term 100 SMA, indicating when resistance is met there may be a downside break again. Unfortunately, other indicators reveal the same thing as the RSI oscillator at 75.9 shows overbought conditions and the MACd looks to be retreating as well. Order books show if buyers managed to press past $1,025 then there will be smoother seas up until $1,145. On the back side, it looks pretty decent for foundations and support between now and $885, but from there it won’t look pretty like we said in the aforementioned BTC charts.

The Top Five Cryptocurrency Markets

A majority of the top cryptocurrency markets are seeing gains today and are in the green. The second highest valued market capitalization is still Ethereum (ETH) as prices hover today around $563 per ETH. Ripple (XRP) has shown some improvement as well seeing 2.5 percent gains with one XRP averaging $0.59 U.S. cents per coin. Lastly, the coin that’s been a forerunner this past couple of weeks, EOS, is seeing decent market losses on May 29. EOS is down 2.66 percent and the price per token is around $11.96. The downturn is likely due to the Chinese-based firm, Qihoo, releasing data on serious security “vulnerabilities” tethered to the EOS platform.

The Verdict: The Song Remains the Same

During our last markets update the overall verdict was “uncertainty,” and unfortunately this short-term outlook still remains the same. Enthusiasts and traders throughout forums, social media, and Telegram trade groups still are skeptical of a significant reversal at this time. One of the biggest reasons being — Trade volume is just not as strong as it was weeks and months ago, and its been growing weaker. On a more positive note, cryptocurrency development continues in full swing and there have been a lot of optimistic announcements made over the past three weeks about growing infrastructure and new investment vehicles. Right now cryptocurrencies are at major resistance levels, and whether they’re surpassed or not will show a clearer indication of where the cryptocurrency economy is going from here.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.