Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This week, I transferred some money, investigated Litecoin, had a lot of opinions about things, and bought some ether.

In previous weeks, I did this.

The fiscal check-in

- Total invested so far: $1,000 (bitcoin/IOTA)

- Current value: $863

- Profit: :(

The joys of moving money around, a bedtime story

Last week I told you I put $500 into IOTA. That was a bold faced lie.

I hadn’t actually got around to transferring the money yet, so, since we last spoke I have gone through the amazing process of buying an altcoin.

First up, I wanted to pick an exchange that supported IOTA and also a crap load of other altcoins so that I wouldn’t have accounts scattered all about the place. On coinmarketcap.com, I went to the markets tab for IOTA to see which exchanges had decent volume.

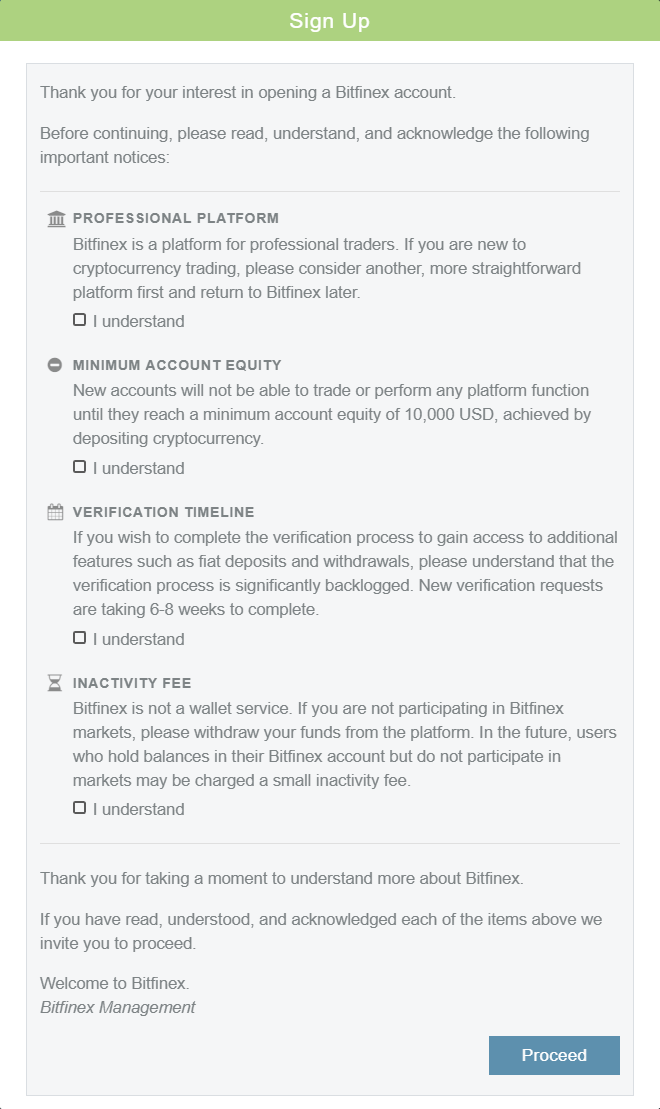

After much research into all the top exchanges, I liked the cut of Bitfinex’s jib so I went to sign up.

This is the page with which I was presented:

Next I tried OKEx. I’d never heard of them, but they’re actually the largest exchange. In the world. I guess because they don’t service the USA they’re not often written about in the sorts of places I read.

The first step was to read through the terms of service and privacy policy. Just kidding who cares. I signed up and all was well in the world.

Then the next day their servers were down for maintenance which wasn’t great but 10 minutes later I could see my account again.

Oh another thing, I’m a fan of long passwords, but OKEx are not. I created my account with a long password, I guess 70 characters or so (“Who’s a pretty girl? Caroline’s a pretty girl. Yes she is, yes she is.”), but when I went to sign in again later, I discovered that they have a max 32 character limit on the input field where the password goes.

So I had to go through the whole password reset process.

For the love of god, developers, let people use long passwords. The length doesn’t matter to you unless you’re storing them in plain text, right?

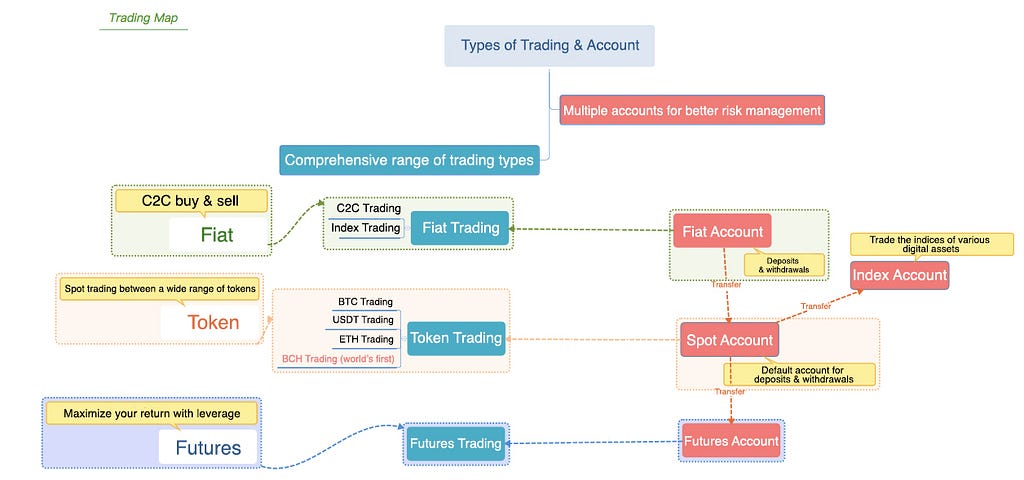

One last thing about OKEx … I would like to share the the best diagram I’ve ever seen. It claims to explain Trading & Account Categories.

Yes, I see, it’s all so clear now.

Yes, I see, it’s all so clear now.

It explains the path you can take to go from not being confused to being confused.

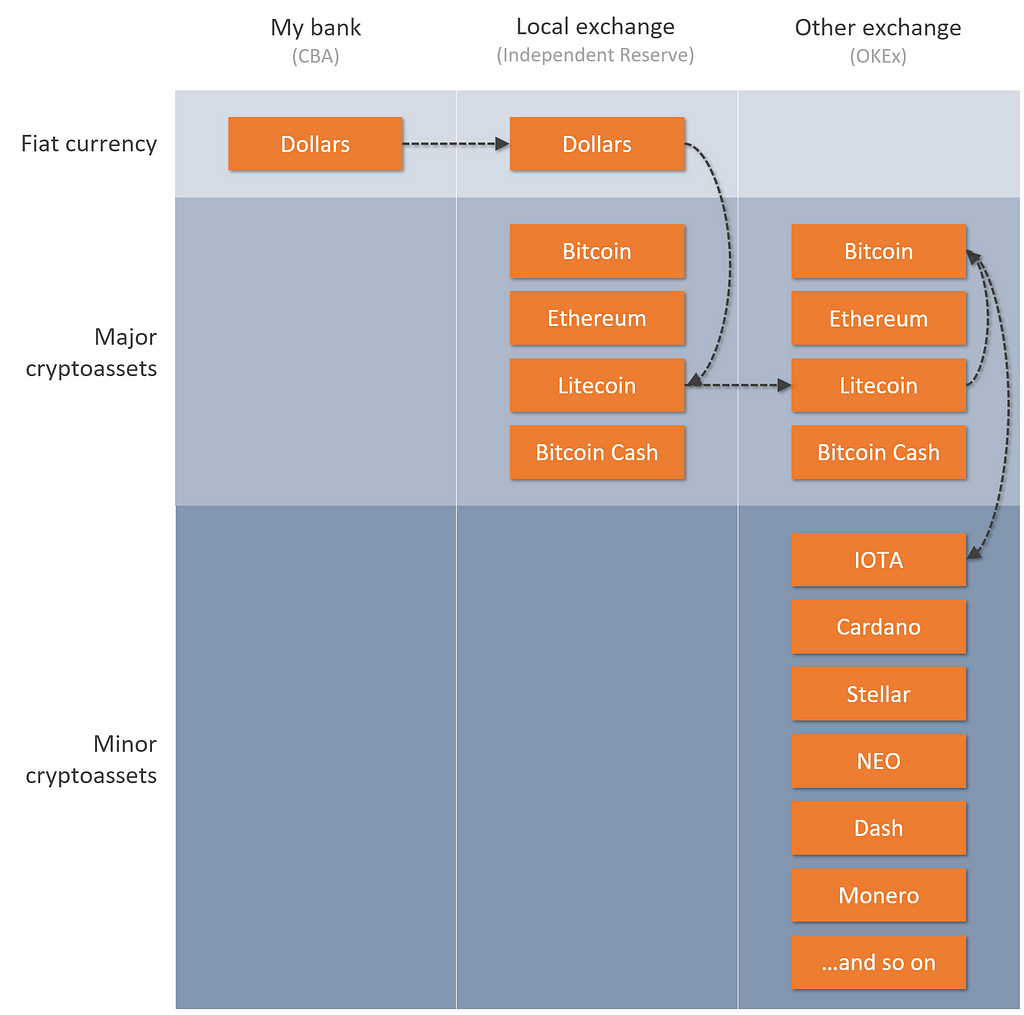

Well, the confusing-diagram game is made for two players, so here’s my attempt to pictureify the process of getting money from the safety of my bank account into the hands of unknown entities with questionable security practices residing in China and/or Malta:

Transfer money in these five easy steps.

Transfer money in these five easy steps.

I started with a good old fashioned electronic bank transfer from my Australian bank account, in AUD, to the ‘local’ exchange (by which I mean, it’s in Australia).

(Shout out to Independent Reserve, their support response and transfer times have been outstanding so far, including responding to queries on weekends.)

Then, on the local exchange, I made a ‘trade’, buying litecoin with AUD.

Then, I went to OKEx and clicked ‘deposit’ in the litecoin section, which gives me an address, then I went back to the local exchange and clicked ‘withdraw’ next to my litecoin balance. This asks for an address, which I give it, then I take a deep breath (even though it’s just a 0.1 LTC trial run) and hit go.

I wonder how much money is lost by people accidentally transferring bitcoin to a litecoin account? I have an idea, why don’t those big strings of letters and numbers always end with the coin code, like 43b52063cd84097a65d163-LTC. This way, you’d know you’ve at least got the right currency. The transaction would be rejected if the suffix is wrong and the suffix would of course be stripped out before actually submitting the transaction.

FYI I picked litecoin as the vehicle to drive from the local exchange to OKEx because I thought I was being clever by dodging the ‘high’ bitcoin fees. (Bitcoin is $1.30, Ethereum is 55c, Litecoin is 14c, and BCash is 12c).

Well … I should get an alarm that goes off whenever I get the feeling I’m being clever, because just after making this transaction (like, 12 seconds later) I learned that I can’t go from LTC to IOTA on OKEx.

No no, only ETH or BTC can be turned into IOTA. So I went from LTC to BTC, and then from BTC to IOTA, although I should have gone via ETH so I could have dipped my toes in yet another currency.

That initial $500 whittled down to $460 by the time the dust had settled. I don’t know what’s fees and what’s because the price dropped between when I went from AUD to LTC, then LTC > BTC > IOTA.

I will refine this as I go. Next time I will:

- Check first how I can get into an altcoin on OKEx. I think ETH is a good bet because I can go from ether in my local exchange to ether on OKEx then straight into pretty much any coin.

- Record the amount of coin I send vs the amount that ends up in the account to see what fees are actually happening.

- Record the time taken, out of interest.

Now on to the Coin Of The Week …

Litecoin, and why I’ll pass

For some reason, I see Litecoin as a friendly coin. Maybe that’s because its father — Charlie Lee — seems like a genuinely nice guy. His goal with Litecoin wasn’t to change the universe, he just wanted to improve Bitcoin in a few areas he thought needed improvement.

So I have nothing against Litecoin, I just don’t think it’s going to perform better than other coins over the next few years. The reasons I think this are:

- It’s differentiation from Bitcoin is that it’s faster and has lower fees. But lots of coins are even faster and have even lower fees.

- From 12 to 24 months ago it outperformed Bitcoin, but in the past 12 months, it under-performed Bitcoin.

- It’s the silver to Bitcoin’s gold, I’ve heard. But I don’t think the earth has silver because it needs silver — it’s just the way the electrons fell. So I don’t see that the cryptocurrency space necessarily needs a runner up in the general purpose cryptocurrency space.

This marks the first time I’ve thought I’m clever enough to actually make a prediction about the future in the cryptocurrency space, which should probably be setting off alarm bells.

But if I learnt from my mistakes, I would never have bought my eighth cockatoo, who’s a real charmer. This one’s for you, Caroline.

Anyway, since Litecoin positions itself (sort of) as a consumer-level cryptocurrency (with a list of places it can be used on their site), I’ve been thinking about the distinction between corporate-focused cryptocurrencies and consumer-focused ones.

Which eventually lead me to ponder the question …

Do cryptocurrencies even make sense for consumers?

I have great faith that crypto-stuff is going to rock the corporate world, where it solves clearly defined problems, such as the costs and time involved in cross-border transactions.

But I’m not so sure if it’s going to rock the world of consumers.

I’ve heard of people buying pizza with bitcoin, and I’ve heard that litecoin is faster, so it’s better suited to consumer purchases. And up until this week, I’d assumed that this made sense. But does it?

I mean, are there actually people who want to go to the supermarket and pay for their cereal and shampoo with litecoin? Or pay their lawn care professional in monero?

I don’t understand how or why this would happen.

How?

If, for example, 7–Eleven decided to accept litecoin, but still accept payment in local currency, then I assume that the prices on the shelves would be static and displayed in the local currency (a bottle of water would be $2 all day every day), but I could pay in litecoin at the current exchange rate.

So I’d pick my bottle of water and a Snickers and go to the counter and say “I’d like to pay with litecoin”.

The clerk would sigh a deep sigh and … then what? Present me with a screen with a QR code that I scan or something? Then I scan that and see in some app that it’s going to transfer 0.016874 LTC to 7–Eleven Corporation. Or maybe I’ll pay with my TenX litecoin card (pronounced ten ten).

Then what? I wait 2.5 minutes for a single confirmation?

Why?

Why would the average consumer want to get paid in USD, transfer it to an exchange, buy some LTC, then transfer LTC to a shopkeeper, who will sell it for USD in order to pay their employees/rent/taxes/etc in USD and let the cycle begin again.

Even for the cryptocurrency enthusiast, when you’ve done this 200 times and the fun of converting fiat to crypto has warn off, what’s the incentive to keep doing it? Is the guy that bought a pizza with bitcoin still buying every pizza with bitcoin all these years later?

From an investment perspective, I think enthusiast enthusiasm can prop up the value of a cryptoasset in the short to medium term. But if the general public don’t adopt a cryptocurrency, I reckon the shine will wear off and the price will fade.

The current state of things

Before writing the above, I made an effort to find articles explaining exactly how a consumer-level cryptocurrency-for-goods transaction would take place. What I found was people comparing crypto to a maximally archaic version of reality, but not a lot comparing it to the status quo.

Here’s a quote from this silly article trying to big-up a Utopian future made possible by cryptocurrencies:

“The year is two-thousand-something-big, and it’s the day your taxes are due. But you don’t file them. Instead an algorithm automatically makes a withdrawal from your electronic wallet, in a currency called Fedcoin.

It’s the digital version of those crunchy bills you only vaguely remember from many years ago, back before the central banks began taking paper cash and redeeming it for fedcoins. Over the years, you’ve seen less and less hard currency. You don’t need it anymore, not when you can walk into a local bank, verify your identity, and set up a wallet on your phone. Sure, you still have a few dollar bills. But they are tucked away as souvenirs.”

That article is from April 2018, even though it sounds like it came from an episode of The Jetsons.

I thought, for [my idea of] fun, I would describe the current state of affairs, but try and make it sound futuristic:

The year is two-thousand and eighteen. I go to work each day and do work. At the end of the week digital currency is transferred directly from my employer’s digital wallet into my digital wallet. My taxes are automatically taken out and transferred into the government’s digital wallet, and my retirement money goes straight to my fund’s digital wallet. No more paper payslips!

My phone bill, gas bill, car insurance are all periodically and automatically payed via transfer from my digital wallet into the appropriate company’s digital wallet. Adios, balancing the chequebook!

When I want to buy groceries with my digital currency, I simply tap a credit-card sized card against a machine in the shop and the digital currency is transferred from my digital wallet into the store owner’s digital wallet in a matter of seconds. Fumbling in my pockets for coins is a thing of the past!

And if I prefer not to use a card, I even have the option of tapping my phone or even a watch against the machine to pay. The future!

What’s more, the card comes with a number on it that I can type into a website and the proprietor can transfer money from my digital wallet into theirs, then send me the goods. No more carrier pigeons with cash wrapped around their little legs!

And hold onto your hat … if someone gets a hold of this digital wallet number and buys things without my knowledge, the issuer of my digital wallet will cover the cost and give me the money back, no questions asked. They’ll even voluntarily and proactively call me to let me know something suspicious has happened. No more duels in the street and protracted vendettas!

And if the issuer of my digital wallet goes bankrupt, the government will give them free money just to keep them in business! What a world!

Even something as big as my mortgage payments are extracted right out of my digital wallet without any interaction on my part. Amazingly, even when money is sitting in my digital wallet, it is offsetting the interest paid on my digital home loan. How do they do it!

If I want to make a purchase at a legacy vendor (one without digital wallet capabilities) I can convert my digital currency to physical currency at one of about a million machines anywhere in the world. I just stick that very same card in a slot and press some buttons. The machine will take money out of my digital wallet and turn it into physical currency. Sorcery!

And even if I’m caught in a bind in a different country, these magical machines will convert my digital currency to the physical currency of whatever country I’m in. No more special favours in foreign lands!

Now, I love to hate the banks, and the government, and any poppy taller than me, but all that’s pretty good if you ask me. The greed of the banks, combined with competition, combined with a loss leader strategy, results in a highly polished system that’s free to use, or close to it.

If not entirely free, it’s cheaper than crypto. I make a few transactions a day (coffee and a sandwich), or 60 a month, or 720 a year. With Litecoin transactions at 13.8 cents each, that’s exactly $100 worth of yearly fees. I could get some serious bells and whistles on my bank account for that kinda money.

So, while I’m happy to be proven wrong, (and would love to hear the counterpoints) my thoughts on the matter are this: I don’t think there’s a strong use-case for consumer-focused cryptocurrencies.

(Maybe with the exception of Monero. I don’t really have any strong opinions about it, but Monero is great because it makes it easy for an anonymous benefactor to send money to ISIS to fund the suicide bombing of a popular tourist spot, or streamline the steps a troubled youth has to go through in order to die from a heroin overdose, and it’s super handy when trafficking those humans that you absolutely positively need to ship overnight. But hey, law abiding citizens like you and I will be able to buy a pair of socks online without the government spying on us, and that’s totally worth the unintended, unfortunate and apparently unforeseeable side effects that the Monero makers have facilitated/condemned. It’s not their fault though: funds don’t kill people, people kill people. Like I said, I don’t really have any strong opinions on the matter.)

OK moving on. One of the things I looked at when assessing Litecoin was its performance against Bitcoin. In the process, I did the same for the other altcoins in the top 10 …

Altcoin performance (vs bitcoin)

I chose to look at the last three months (mid-February to mid-May 2018), because it has been a relatively sideways market these past few months.

In each chart, the y axis is a percentage, so shows how much better or worse, as a percentage, the coin is doing relative to bitcoin (not relative to USD).

#2 Ethereum — down 15%

Ether dropped down by 40% then back up to about 15% below.

#3 Ripple — down 30%

Ripple is down about 30% on where it was three months ago.

#4 Bitcoin Cash — about the same

BCash, AKA “I can’t believe it’s not bitcoin”, was worse, then was better, and now is just about where it was three months ago.

#5 EOS — up by 50%

Finally an altcoin that’s kicking Bitcoin’s butt. It went as far 140% and has settled back to about 50% above where it was. Good on ya, EOS.

#6 Litecoin — down by 26%

Now, the reason I’m here… Litecoin is in a fairly pronounced tumble. Of course, you should never be fooled by just one chart and indeed the 1 year chart tells a different tale.

Nevertheless, this is down about 26% compared to Bitcoin over the last three months.

#7 Stellar — down 15%

Stellar meanders around before finishing up about 15% below where it was in February.

#8 Cardano — down by 30%

Dropped quite a bit, down over 50%, and is now down 30%. I must learn about Cardano one of these days.

#9 TRON — up by 50%

Good one TRON, up 50% on bitcoin over the last three months. No doubt because of the name.

#10 IOTA — about the same

IOTA bounced down to 40% below bitcoin and 20% above it, and is now roughly where it was three months ago.

It’s perhaps interesting/confusing to note that Bitcoin is down (relative to the USD) 15% in this time frame, and from what I can work out, altcoins tend to magnify whatever Bitcoin is doing.

So I wonder, if Bitcoin was up 15% vs the US dollar over the last few months, would all of the altcoins be performing better than Bitcoin?

Now, are you sick of me being a negative nelly yet? I do apologise for the ranting, I’ve been listening to a lot of Lady Gaga recently and she makes me really mad. I think that might be coming through in my writing.

Anyway, I’ve had some …

Thoughts on decentralisation

I was listening to a podcast about Bitcoin from some time in early 2017. They were talking about the Bitcoin Unlimited vs Bitcoin Core nonsense, and it got me thinking about the damage that’s done by having no central decision maker.

I can’t think of one successful company that had no one in charge. Or country, or netball team, or anything, really. It seems to me that over and over again human nature has proven that without a chain of command ending in some central point, things just don’t work well.

As a newcomer to the world of crypto, I look at all the fighting and think, wow, decentralisation isn’t working here.

And then I think a bit more and realise that actually, something like Bitcoin isn’t really decentralised, because the domain is in someone’s name. And someone owns the GitHub repo, and not just anyone can make these decisions. Some people have more sway than others, but not in a useful, structured way.

So if something isn’t really decentralised, why not be not-decentralised in a more organised way? Of course keep the data decentralised, but maybe centralise the management.

Anyway, I was thinking about this, thinking I was the first person to ever have such amazing thoughts, when I opened my phone to read about Stellar.

Ah, right, I see, that’s exactly what they’ve done.

And I think this comes back to the consumer-corporation-continuum from above. I reckon many enthusiasts want decentralisation, no matter what. Consumers maybe want decentralisation a little bit or just don’t care.

But corporations do not want decentralisation when it comes to management, because ideals are less important than knowing that the buck has somewhere to stop.

Anyway, I wonder if a cryptocurrency that doesn’t have a centralised management team is vulnerable to infighting and is at a disadvantage to competitor coins that do have a chain of command when it comes to deciding the future of the coin.

This week’s $500

I got most of the way through the week before deciding to pass on Litecoin. So rather than pick a new coin to half-research, I thought I’d just go for a no-brainer: Ethereum.

Next week: Stellar

From what I’ve read so far, I’ve got a bit of a crush on Stellar. This week I’ll try and wrangle some special-alone-time with her.

Thanks for reading. Adios!

A crypto-trader’s diary — week 9; Litecoin was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.