Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

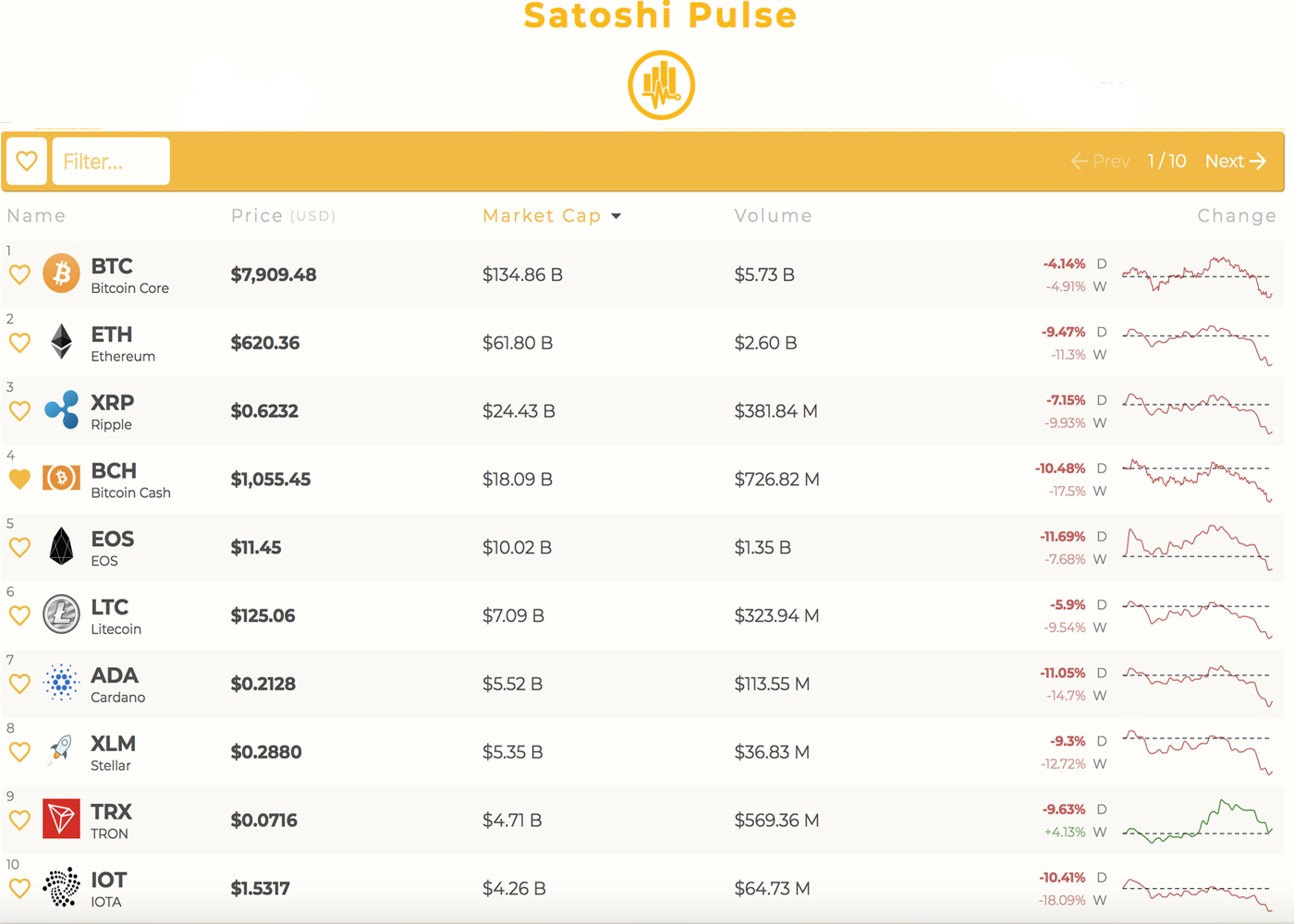

Over the past few days, cryptocurrency markets have been losing steam as many digital assets have lost a good amount of value. Most coins are down anywhere between 3-15 percent over the past 24-hours. Bitcoin Cash (BCH) values have dipped 10 percent over the last day and prices hover around $1,055 today. Bitcoin Core (BTC) prices are under the $8K zone losing 4.1 percent today as BTC values average around $7,909 at the time of publication.

Also Read: Bank in Argentina Launches BTC Settlement Services

Stormy Weather Continues to Dump on Crypto-Markets This Spring

Last spring and more specifically in May of 2017 digital currency markets were on fire but this year is a whole different story. Cryptocurrency markets are not doing so well today as every single coin among the top 50 largest valuations are in the red showing losses. The overall market capitalization of all 1,600+ digital assets is around $345Bn today and 24-hour trade volume hovers around 17.8Bn. Trade volume pales in comparison to two weeks ago when cryptocurrency daily trade volumes where much higher. For instance, BCH 24-hour volumes today are around $722Mn when two weeks ago it was about $2Bn+. The same goes for BTC as its daily volumes used to be around $8-9Bn and now the metric stands at $5Bn during today’s trading sessions.

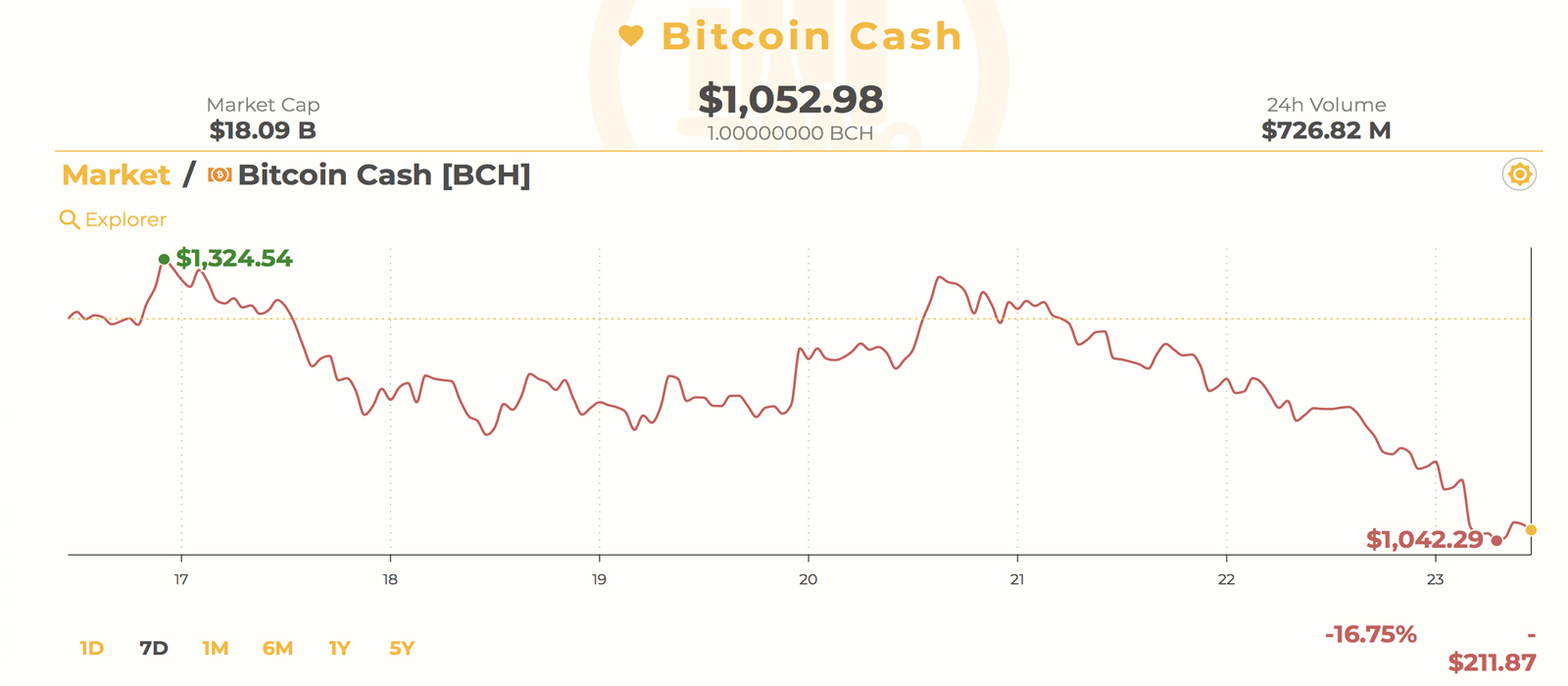

Bitcoin Cash (BCH) Market Action

Bitcoin Cash values have dipped a good eight percent today, and roughly sixteen percent during the past seven days. The top exchanges today swapping the most BCH include Okex, Hitbtc, Bitfinex, Lbank, and Huobi. The top three currencies on these specific trading platforms traded for BCH includes tether (USDT), BTC, and USD. Today the most traded pairs with BCH is BTC by 39.3 percent, Tether (USDT 24.7%), USD (20.5%), KRW (10.3%), and the EUR (2.3%). Ethereum, the Japanese yen, and Waves are also capturing decent percentages of BCH trade volume on May 23.

Bitcoin Cash values have dipped a good eight percent today, and roughly sixteen percent during the past seven days. The top exchanges today swapping the most BCH include Okex, Hitbtc, Bitfinex, Lbank, and Huobi. The top three currencies on these specific trading platforms traded for BCH includes tether (USDT), BTC, and USD. Today the most traded pairs with BCH is BTC by 39.3 percent, Tether (USDT 24.7%), USD (20.5%), KRW (10.3%), and the EUR (2.3%). Ethereum, the Japanese yen, and Waves are also capturing decent percentages of BCH trade volume on May 23.

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart on Bitfinex and Bitstamp shows bulls are attempting to regain some upper ground this morning after the dips. As we mentioned during our last markets update the two Simple Moving Averages (SMA) trend lines were about to cross hairs and this happened earlier today. The 100 SMA is now below the longer-term 200 SMA indicating the path to resistance will likely be on the downside. The Relative Strength Index is meandering in the middle showing some consolidation taking place and uncertainty towards the next big move.

MACd shows similar sentiment as the indicator is hovering around -23 but shows room for improvement. Order books on the upside show BCH bulls need to press past big sell walls between $1,090-1,160. On the backside if bears manage to bring BCH down there is decent support between $950-1,000 at press time but if that resistance breaks things could drop much lower. Presently it looks like bears won’t get prices that low in the short-term, but these ranges are not out of the question.

Bitcoin Core (BTC) Market Action

Bitcoin Core (BTC) prices are below the $8K region after holding above this zone for a couple weeks. Now prices are hovering around $7,927 per BTC and markets are down 4.6 percent during the last seven days. Daily trade volume is weaker than usual as traders are only swapping $5.6Bn worth of BTC during this morning’s trading sessions. The top exchange today trading the most BTC is Binance followed by Bitfinex, Okex, Huobi, and Bitflyer. The Japanese yen is the most dominating pair today with BTC at 55 percent and followed by the USD (19.8%), Tether (USDT 15%), KRW (3.7%), and the EUR (3.2%).

Bitcoin Core (BTC) prices are below the $8K region after holding above this zone for a couple weeks. Now prices are hovering around $7,927 per BTC and markets are down 4.6 percent during the last seven days. Daily trade volume is weaker than usual as traders are only swapping $5.6Bn worth of BTC during this morning’s trading sessions. The top exchange today trading the most BTC is Binance followed by Bitfinex, Okex, Huobi, and Bitflyer. The Japanese yen is the most dominating pair today with BTC at 55 percent and followed by the USD (19.8%), Tether (USDT 15%), KRW (3.7%), and the EUR (3.2%).

BTC/USD Technical Indicators

Looking at the 4-hour BTC/USD chart on Coinbase/GDAX and Bitstamp shows buyers are stepping up their positions this morning. The two SMAs have also crossed paths during the earlier morning BTC trading sessions as well with the short term 100 SMA now below the 200 SMA. This also indicates bears currently have the reigns and they may take the dips further in the coming hours if resistance above $8K cannot be broken. However, RSI levels show oversold conditions and this shows a bounce back may be in the cards today as well.

Looking at order books shows much less resistance on the BTC/USD side in comparison to the BCH/USD side. Bulls only need to muster past the $8-8200 zone to get to higher regions but things become more difficult between $8,500-8,750. On the back side buy orders show solid foundations between $7,400 and $6,900 but after that things don’t look so hot. Overall chart patterns show it’s unlikely prices will get below the $7,400 region anytime soon, and bulls are fighting back with some success at the time of publication.

The Verdict: Stormy Weather and Uncertainty is Slowly Breaking Optimism Down

Overall most coins are feeling the losses and trying to regain some of the upper hand. Litecoin (LTC) and Ripple (XRP) are two coins who have managed to take less of a beating. Another market oddity today is the BTC/ZEC cryptocurrency fork called Bitcoin Private (BTCP) which is up 13 percent over the past 24-hours.

Top 24-hour trade volume coins today are Tether (USDT), Ethereum (ETH), EOS, Bitcoin Cash (BCH), and Tron (TRX). The losses today throw another black cloud on enthusiasts and traders hoping for long positions to pull through this spring. However, for cryptocurrency traders, it has been nothing but stormy weather with a few brief instances of sunshine here and there. Positivity is lessening and people are definitely more skeptical this week than the past three weeks prior.

Where do you see the price of BCH, BTC, and other cryptocurrencies headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.