Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Blockchains and cryptocurrencies were originally designed to remove the need for central authorities. However, centralized exchanges (CEX’s) like Coinbase contradict this value and put control back into the hands of companies that function similar to banks.

As well, in the past four years, hackers have run off with billions of dollars worth of cryptocurrency, successfully targeting industry leaders such as Bitfinex, Poloniex, and Bitstamp. And, on many of these trading platforms, users sometimes wait months to have their accounts verified in order to start trading.

Needless to say, CEX’s come with major issues and risks. Among security threats, heavy fees, looming geographical regulations that threaten to shut them down, and other factors, it’s apparent that such exchanges offer a subpar product. In the eyes of the crypto community, decentralized exchanges (DEX’s) are the answer to many of their counterparts drawbacks.

What Exactly is a DEX, & How is it Different From a CEX?

There are many different types of decentralized exchanges, but a simple way to explain a DEX is as a platform that facilitates the peer-to-peer (P2P) trading of cryptocurrency from one wallet (that gives you control of your keys) to another. Instead of giving funds to a CEX, you give them to an escrow-like service such as a smart contract (used on the Ethereum blockchain) that conducts the transaction.

Essentially, DEX’s remove the need for a third-party. Benefits include skipping the Know Your Customer (KYC) verification process, avoiding withdrawal/trading limits and heavy fees, and mitigating the risk of someone hacking the exchange and stealing your tokens.

CEX systems like Coinbase require you to trust a single entity to protect your funds/information and properly execute trades. With an IOU style system in place, you only ever control your funds when you withdraw them into a private wallet.

Using a DEX ensures you’re always in control of your private keys and therefore your coins. Because CEX’s don’t give you your private keys, you are essentially relying on the faithfulness of its employees to properly manage your funds.

Mt. Gox is the classic example. Hackers and the misappropriation of funds led to investors losing over $450 million altogether. Users lost their investments, and the CEO went to jail.

Moreover, single points of failure in centralized systems put users at risk of being unable to access their accounts, making them wait for the issue to be resolved. Because DEX’s use a decentralized system, there is no single point of failure, and operations can continue to run smoothly in case of events such as natural disasters or maintenance updates.

It’s obvious DEX’s outperform their centralized counterparts. So, who are the movers and shakers revolutionizing the way we trade cryptocurrency? Let’s take a look at a few companies making DEX’s a reality.

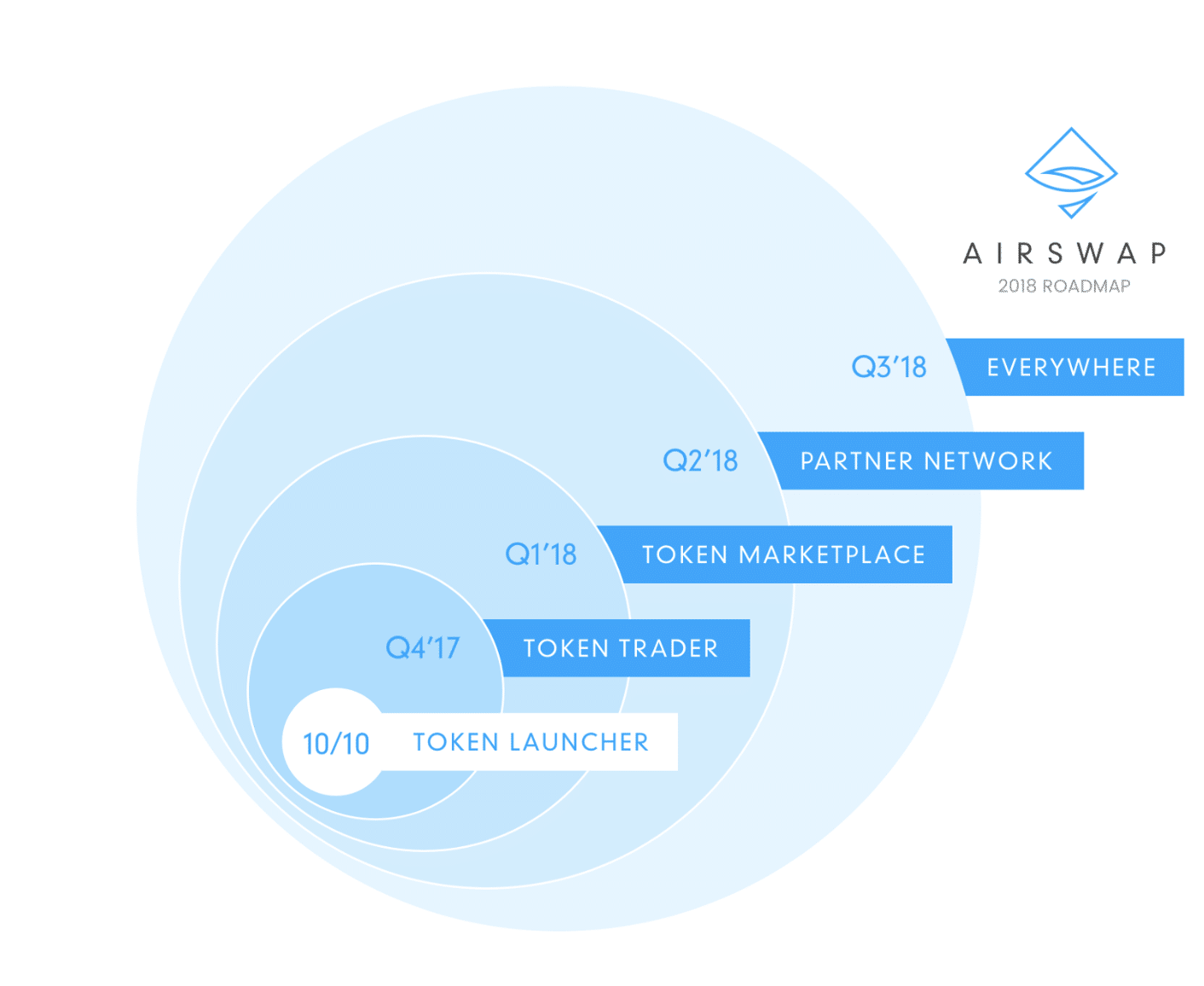

AirSwap

Brooklyn-based startup AirSwap is a decentralized, P2P trading platform in which the core interaction is held privately between two people off-chain. Running on the Ethereum blockchain, anyone (despite geographic location) can use the trading platform and settle transactions on-chain.

Airswap is unique in that it doesn’t use an order book. Instead, it uses a system called “intent to trade.” By avoiding the order book system in which buy and sell orders are displayed to all users, AirSwap removes the market manipulating practice of frontrunning. Ultimately, trading becomes fairer and particularly favorable to market makers.

Because AirSwap runs on the Ethereum blockchain, ERC20 tokens (which are more suitable for P2P transactions because they all use the same transfer protocol) are able to be traded by a “maker” and a “taker”. The maker displays which tokens they are willing to trade on the “indexer” and the taker fills the order. With the help of an “oracle” that uses APIs to aggregate prices, the maker and taker can negotiate a fair price.

The only requirement to announce a trade on the indexer is that a maker must hold AirSwap tokens (AST), which gives the token its value. Beyond purchasing AST tokens for announcing intents to trade and to pay gas prices, there are no fees.

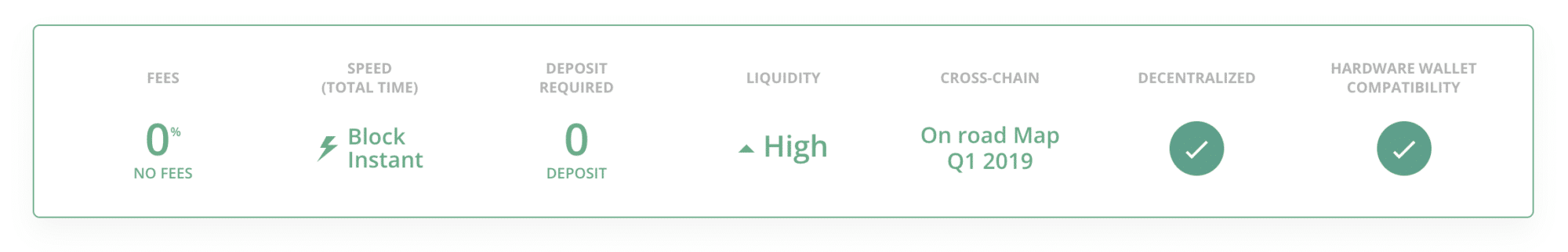

Kyber Network

Like AirSwap, Kyber Network follows an Ethereum-based protocol and removes order books. Unlike AirSwap, it offers instant liquidity by leveraging multiple reserves. And, instead of negotiating privately P2P, Kyber Network users know the conversion rate beforehand and then decide if they want to proceed with the trade.

It also offers payment APIs from which merchants are able to accept any ERC20 token and have it automatically converted in the cryptocurrency of their choice. So, if a merchant sells a shirt and wants to receive ETH, but the customer wants to pay in Tronix (TRX), the merchant will receive ETH upon the customer’s purchase of the shirt with TRX.

Since there are no fees on the exchange besides the gas cost, the Kyber Network and “reserve contributors” (mostly market makers) are able to receive profits from a spread. Third party reserves are managed by “reserve managers” who can set their own price for the token pairs they support.

The “Kyber Contract” enables the best rate from all the reserves to be used for each transaction. To ensure reserve managers don’t take advantage by implementing false exchange rates, off-chain and on-chain mechanisms are in place to detect dubious activity and stop unfair transactions from occurring.

In order to gain profits from the spread on the platform, reserve contributors need to purchase the Kyber Network Crystal (KNC). A small amount of KNC from each transaction are removed from the contributor’s reserves and sent to the Kyber Network platform. After covering operational expenses, the remaining KNC collected are burned, which increases the value of KNC.

In the future, the team plans on introducing advanced financial tools such as options and forwards. They also plan on implementing cross-chain trading, allowing for cryptocurrencies on two different blockchains (like bitcoin and ether) to be exchanged without the need for a third party.

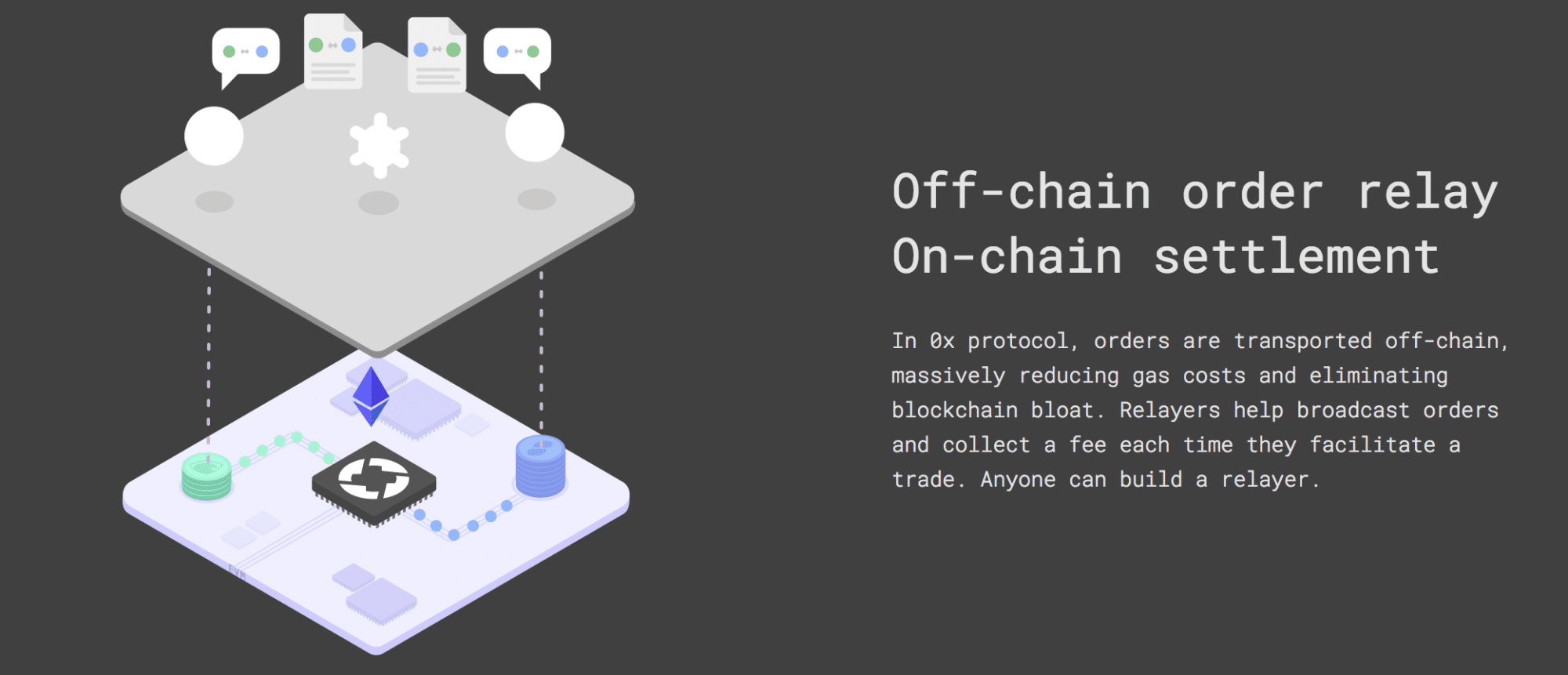

0x

Founded in 2016, 0x follows an open-source, permissionless protocol that provides the architecture for the development of DEX’s using smart contracts. Basically, it allows anyone to operate a DEX, a feature its founders believe is needed in the future of mass tokenization and current interoperability between DEX’s.

Like AirSwap, 0x goes off-chain when matching trades and goes on-chain for ERC20 transaction settlements. Unlike AirSwap, 0x uses an order book and not an indexer. The way its protocol functions, it seems that 0x is tailored more towards quicker orders/smaller transactions while AirSwap is tailored more towards market makers.

As well, 0x lets anyone (most likely going to be developers) be a relayer. A relayer hosts order books publicly or privately to match makers and takers (known as broadcast orders) off-chain, incentivized by charging fees in 0x’s native currency (ZRX) for their services. Those who hold ZRX are also able to vote on the governance of 0x, further bringing value to the ZRX token.

Point-to-Point orders enable makers to generate and send orders through basically any communication medium, such as email or Facebook messenger, to a specific taker. The taker receives the order and then decides if they want to cryptographically sign (fill) it or not. Security is guaranteed as only the taker’s designated address is permitted to take the order.

Using the Point-to-Point method allows makers/takers to bypass relayer fees found in broadcast orders. Right now, the 0x team has a product called 0x OTC, a P2P DEX in which ERC20 tokens can be traded without a relayer.

Waves

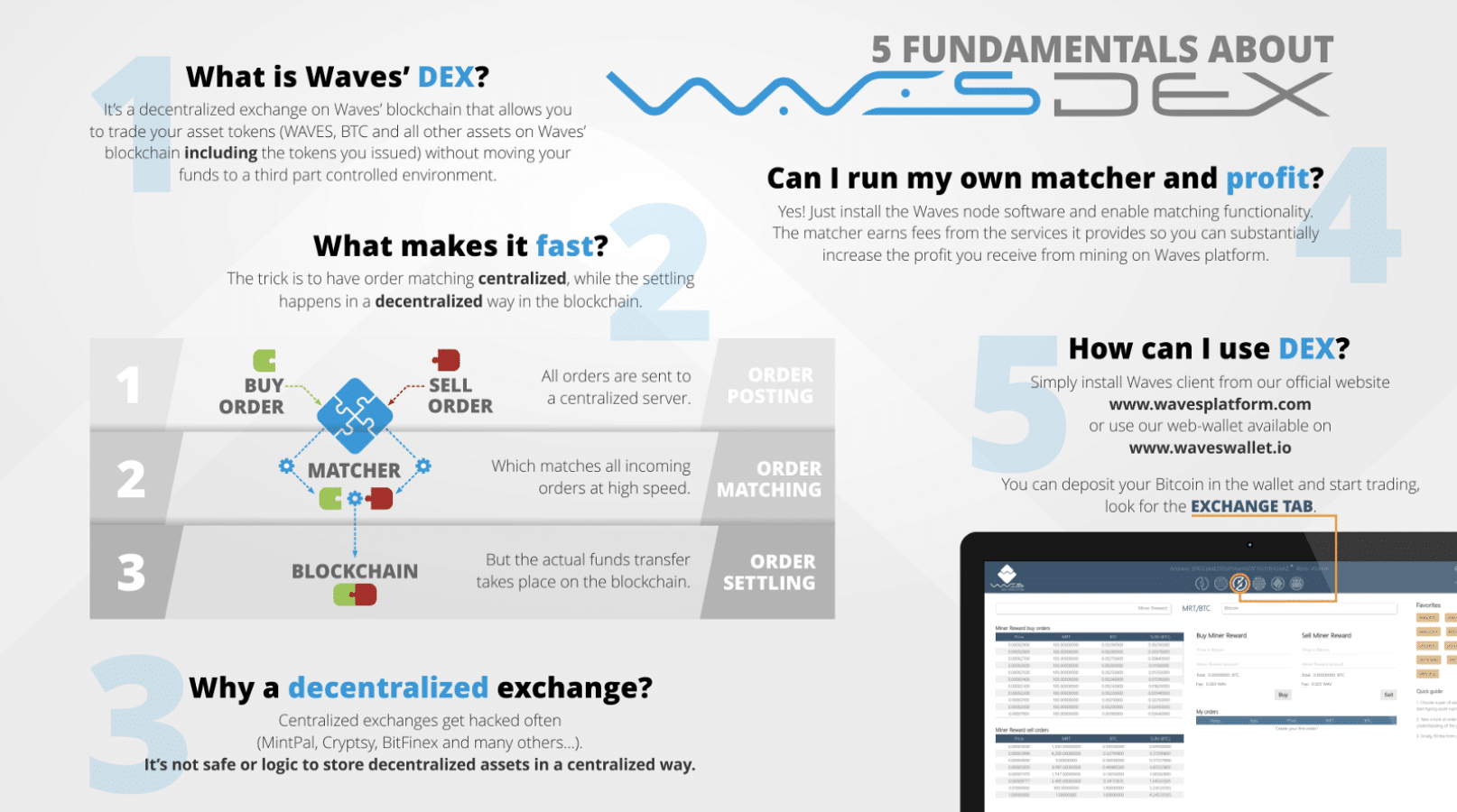

A big selling point of Waves’ DEX is that it allows users to not only trade cryptocurrencies but also offers gateways for withdrawing and depositing fiat currencies such as the US dollar, the Euro and Turkish Lira. As most crypto traders know, there are few exchanges that offer users to go in and out of fiat like Coinbase and Gemini allow. Yet, these CEX’s come with high fees for their lucrative services. Waves offers a low cost, fixed fee of 0.003 WAVES per transaction, regardless of size.

Like AirSwap, Waves protects users from frontrunning by concealing orders. Using “matcher” nodes, orders are paired off-chain in a centralized server and then executed on the blockchain for an added layer of security and fairness.

Looking to make passive income? Waves can help you earn interest through mining. According to their site, “Waves use a Proof-of-Stake algorithm in which the WAVES you own (or that have been leased to you) reflect your mining power. The more you own, the higher your chances of processing the next block and receiving the transaction fees as a reward.”

However, you need a minimum of 1,000 Waves for this feature. The other way to earn passive income with fewer funds is by utilizing their “Leased Proof-of-Stake (LPoS)” protocol, which enables users to lease any amount of WAVES to a node.

Last but not least, the Waves DEX enables you to create your own custom token and then trade it in a trading pair with any other Waves token. According to their website, no technical skills are necessary for a user to create the custom token in as little as a minute.

Honorary Mentions:

- EtherDelta

- Future OmiseGo DEX

- Future Binance DEX

Conclusion

When it comes to DEX’s UX design, they still have plenty of work ahead compared to CEX’s. As well, CEX’s trump DEX’s in their ability to accept fiat currency, customer service, and generally high liquidity.

However, the lack of account verification wait times or deposit/withdrawal limits, user anonymity, low fees, borderless structure, enhanced security, and 24/7 uptime are just a few of a long list of advantages of DEX’s.

Taking the recentness of blockchain technology and more particularly DEX’s into account, one should consider the massive strides accomplished in the industry. With what they intend to accomplish, banks and middlemen could be a thing of the past. Remember, DEX’s are a work in progress, and the future towards decentralized economies is underway.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.