Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Words Can’t Bring Me Down, But Prices Can

Sticks and stones may break my bones, but downward selling pressure will bankrupt me.

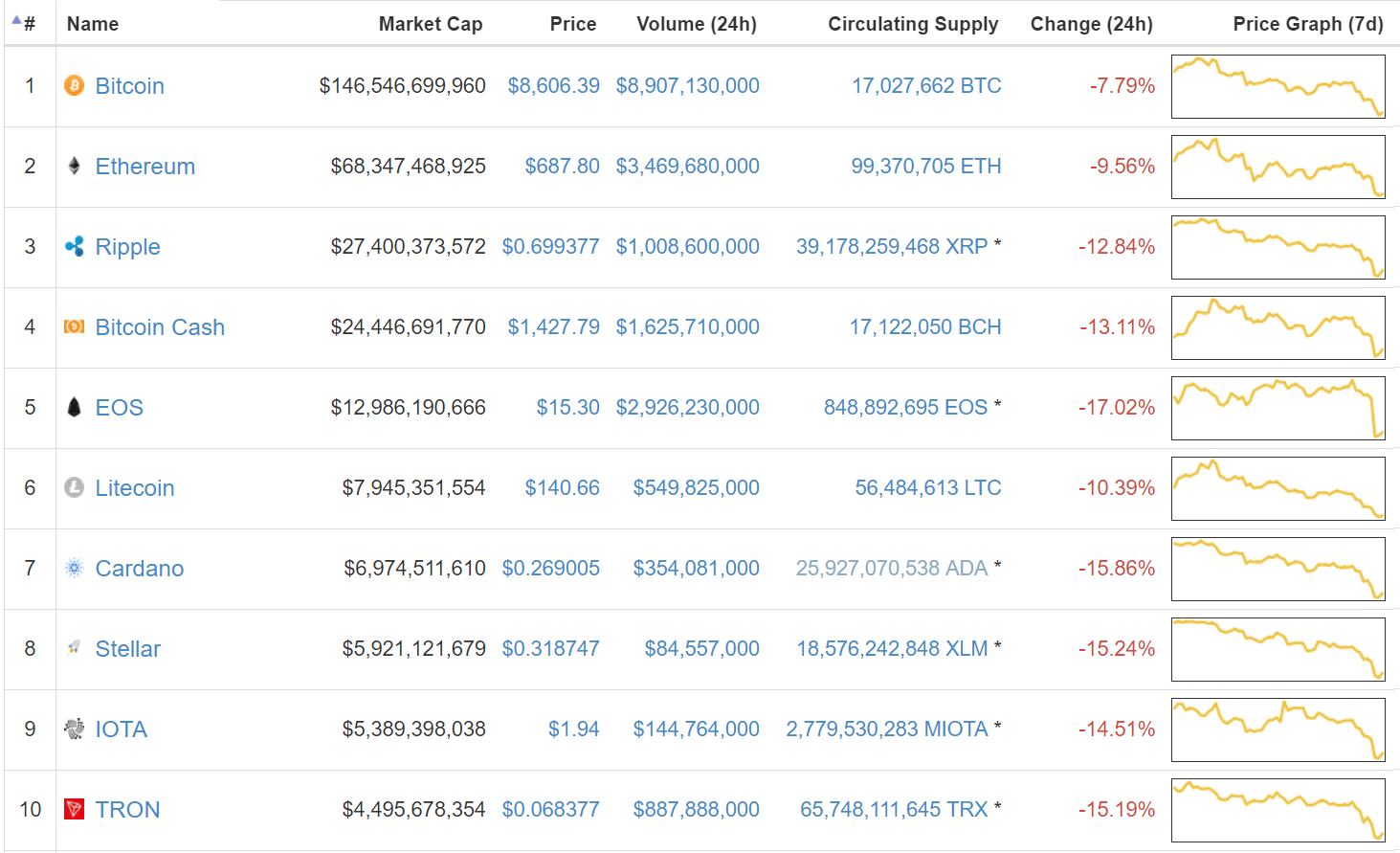

After Bitcoin failed to break a key resistance level at $10k, the market has been struggling to find resistance. It’s been falling consistently since Sunday, and at the moment, it appears as though we’ll be closing out the week with a red candle. With crypto’s total market capitalization at $392bln, a 14% decrease since last Friday, the odds of seeing that long red candle on the weekly are high.

Given trends with bull-traps in this year’s bear market, we could be in for a bit of a plummet. Or this could be merely a correction from the positive price action we’ve seen recently. Either way, keep an eye on Bitcoin for potential support levels in multiples of two ($8,400, $8,000 $7,600, etc.) and approach the market with a bit of healthy reserve–if we break too far below $8k, it could mean a week more of red.

Bitcoin: At $8,610, Bitcoin has broken it’s nearly month-long streak of weekly gains, posting a 10% loss since last Friday.

Ethereum: Ethereum is fairing even worse, down 16% on the weekly with a price tag of $680.

Ripple: Fairing worst of all, Ripple, sitting at $0.69, has lost 30% of its value over the week.

Domestic News

Colorado Legislature Says Yes then No to Legislation that Would Provide Guidelines for Identifying Tokens as Securities: The bill, HB 1426, passed without a hitch in Colorado’s House, but the Senate had other plans for the legislation. After passing a vote in favor of HB 1426, the Senate called for a re-vote and the bill was struck down 18-17. If passed into law, the bill would have distinguished between utility tokens and securities tokens; the former, tokens for things like CryptoKitties, would be considered “collectible stamps,” while any tokens that are distributed for financial gains would be deemed securities. The legislative summary for the bill reads as follows: “The bill defines ‘open blockchain token’ and exempts certain open blockchain tokens from the definition of ‘security’ for purposes of the ‘Colorado Securities Act’.”

Meanwhile, West Virginia Just Used Blockchain for Its State Elections, a First for the US: Colorado may be washing its legislative hands of blockchain, but on the other side of the country, West Virginia is getting its hands dirty. As polls closed on May 8, West Virginia’s government received a portion of its tallies from Voatz’s blockchain voting platform, making it the first US election to record votes using the technology. The option, which was treated as a trial run for now, was open only to deployed military personnel, absentee voters, the spouses and dependents of either group, and registered voters from Harrison and Monongalia counties.

Bloomberg, Novogratz’s Galaxy Digital Capital Team Up to Launch Crypto Index Fund: Billionaire investor and crypto capitalist Mike Novogratz’s Galaxy Digital Capital and Bloomberg are launching a joint cryptocurrency index fund. Known as the Bloomberg Galaxy Crypto Index, the fund will follow the prices of Bitcoin, Ethereum,, Ripple, Bitcoin Cash, EOS, Litecoin, Dash, Monero, Ethereum Classic, and Zcash. Both parties are hailing the index as the crypto market’s “first institutional grade benchmark.” While the original Bloomberg report indicated that the index will be open to Bloomberg clients, it did not disclose whether or not the index would be open to investors outside of Bloomberg’s clientele, be they accredited or not.

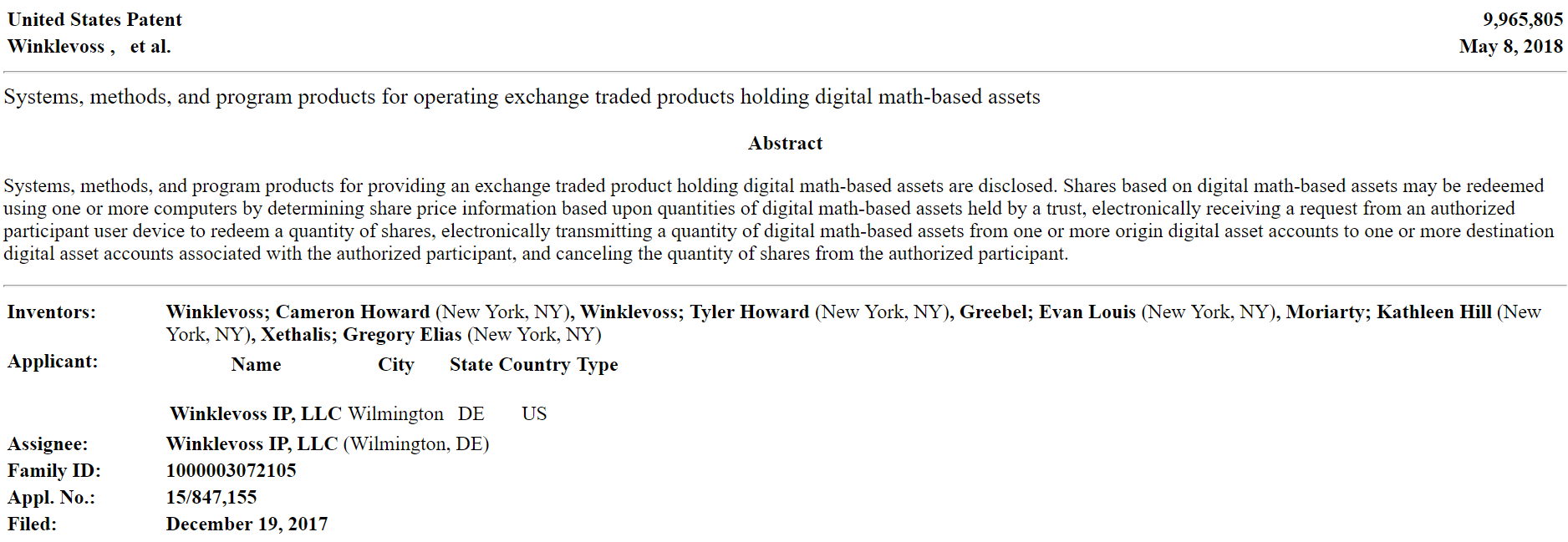

Winklevosses Secure Fifth Patent as Institutional Players Tighten Grip on Market: Filed in December of 2017, the US Patent and Trademark Office awarded Winklevoss IP a patent for “[systems], methods, and program products for operating exchange traded products holding digital math-based assets.” Basically, the patent grants the Winklevosses the lisence to transact exchange-traded products (ETPs) using cryptocurrencies (likely tokens).

Robinhood Raises $363mln in Series D Venture Capital Round: They say that the people who made the most money during the 19th-century gold rush were those who sold shovels. Well, Robinhood must have some pretty shovels, because it attracted $363mln in funding in its series D venture capital round. The funding, contributed by DST Global, Iconiq, Capital G, Sequoia Capital, and KPCB, has the trading company valued at $5.6bln. Robinhood plans to use the capital to expand its cryptocurrency trading service, currently available in 10 states, to the whole of the US.

New York Stock Exchange Parent Company Wants to Introduce Bitcoin Trading to Wall Street: The Intercontinental Exchange (ICE), an Atlanta-based company that owns the New York Stock Exchange, is reportedly planning its own cryptocurrency trading platform. If established, the exchange would allow institutional clients to trade Bitcoin using swap contracts, derivatives that would allow banks to hold contracts for the prices of the cryptocurrency and settle trades with next-day payments. These swap contracts would give the exchange complete regulatory protection under the CFTC’s trading laws, and the exchange itself would be the first traditional financial exchange to directly trade Bitcoin if it were to come to fruition.

Facebook Looking into Blockchain, Creates Exploratory Group: Mark Zuckerberg and the team at Facebook don’t want cryptocurrency ads on their website, but that doesn’t mean they aren’t looking into the technology for Facebook’s benefit and development. David Marcus, the head of Facebook Messenger and a Coinbase board member, posted on his personal Facebook page that he’s “setting up a small group to explore how to best leverage blockchain across Facebook, starting from scratch.” Zuckerberg came out publicly in January in favor of weighing blockchain’s application for Facebook’s services, stating on his own personal page, “I’m interested to go deeper and study the positive and negative aspects of these technologies, and how best to use them in our services.”

What’s New at CoinCentral

The Top Five Largest Mining Operations in the World: If data is the new oil, then operations like these are the new drillers and oil rigs.

GDAX vs. Binance Exchange Comparison: One has fiat options, the other has become the world’s go-to for altcoins, but both consistently rank in the top five for daily volume.

Fluidity Summit 2018: Blockchain and the Future of Finance: Part of NYC’s blockchain week, the Fluidity conference will feature such figures as Mike Novogratz, Bill Lubin, and other prominent voices in the crypto-sphere.

Boost VC’s Adam Draper on Blockchain as a Startup Superpower: Following in this father’s footsteps, Adam Draper is bullish on blockchain.

What’s In A Block Anyway? | An Introduction to Block Explorers: Find yourself lost in a maze of nonces, hashes, and wallet addresses when using block explorers like etherscan? There’s a map for that.

What Opportunities Could Blockchain Create for Intellectual Property (IP)?: Copywriting and patents on the blockchain–sounds pretty logical to us.

Cryptocurrency Mining’s Drain on the GPU Supply: As mining becomes more popular, graphics card manufacturers are having to reckon with keeping gamers, their traditional customer base, happy as GPU prices rice.

Papua New Guinea is the Newest Kid on Deregulated Economic Block(chain): Smaller nations are approaching crypto as their opportunity to stimulate growth, and Papua New Guinea is no exception.

Yes, the Blockchain Can Be Hacked: Sorry to disappoint, guys, but be it network interference or a 51% attack, blockchains can be compromised.

What Should Charities Know Before Accepting Bitcoin Donations?: We’re all for crypto charity, but before you add Bitcoin as a donation option, there are some factors worth considering.

Why Blockchain Technology is the Answer to the World’s Banking System Woes: Wait, I thought we were trying to avoid banks–right, guys?

Hundreds of Websites Hit with Coinhive Software, Visitors Mine Monero Unawares: Troy Mursch of Bad Packets unraveled a network of over 300 sites that were infected with Coinhive, a software used to browser mine Monero.

NYSE Parent Company Plans on Bringing Bitcoin to Wallstreet: NYT Report: The Intercontinental Exchange, the New York Stock Exchange’s owner, is allegedly working on its own Bitcoin exchange.

7 of the Coolest Things You Can Buy with Bitcoin: Cruises, apartments–hell–even a college diploma, and those are just the unconventional things.

At the Source: Exploring the Blockchain Realm of Github: Take a dive into Github’s nooks and crannies with our exploratory guide.

Mainframe to Airdrop $1 Million MFT to Raise Money for Charity: Airdrops have become the new hot way to circulate currencies, and now, they’re being used for philanthropic means.

Questions Loom as Bytecoin Pumps 1000% with Major Exchange Listings, Dumps after Network Trouble: Was it a pump and dump, was it a scam? As these questions remain, here’s what we know.

Who is Adam Back? About the Blockstream CEO: In the latest of our industry-mover profiles, we look at Adam Back and his work at Blockstream.

Binance vs. Bitfinex Exchange Comparison: See how two of the world’s most popular exchanges stack up against each other with our latest comparison.

What is a Cryptocurrency Mainnet: With dozens of mainnets set to launch this spring and summer, we’ll see how many of these projects were worth the speculation.

Cryptocurrency News from Around the World

Blockchain Standards in the Works for China, Expect them by 2019, Officials Say: The words “China,” Bitcoin,” “blockchain,” and “ban” have appeared in the same headlines and/or sentences more times than we’re willing to count, but just cause the media says it, doesn’t make it so; ’cause if the Chinese government and anti-crypto sentiments have become synonymous with each other, someone forgot to tell that to Chinese politicians. According to local reports, policymakers are formulating a blockchain standards committee and working group. The Blockchain and Distributed Accounting Technology Standardization Committee, as it’s called, is being created to “give the industry some guidance,” Li Ming, director of China’s Blockchain Research Office, told Xinxua’s Economic Information Daily.

Take the Money and Run: Iranians are Using Crypto to Move $2.5bln Across Borders: Allegedly in response to the US’s exit from the Obama-era Iran nuclear deal, Iranian’s are using crypto to move money out of the country to the tune of $2.5bln, according to Mohammad Reza Pourebrahimi, Iran’s economic commission chairman. Uncertainty over the nuclear deal’s future, which has backing from a host of international governments, has caused the Iranian rial to plummet over the last half year, losing a quarter of its value. With interest rates rising, foreign exchange dealers under the government’s heal, and a devaluing national currency, Iranians have turned to Bitcoin and the like as they’ve become strapped for reasonable methods to move their finances. “For now it seems like Bitcoin is literally the only way to get money out of the country… but with the rampant inflation of the rial a lot of people won’t be able to afford it,” one source told Forbes.

First Release of Casper Hits Github, Welcomed Progress Following Months of Silence: The much anticipated initiative to revamp Ethereum’s consensus mechanism is showing signs of life after living in the shadows of media obscurity for a few months. On May 8, Danny Ryan, Casper’s lead developer, committed the first version of the protocol to Github, adding that “v0.1.0 marks us more clearly tagging releases to help clients and external auditors more easily track the contract and changes.” On Reddit, he announced to the community that “[more] than just the research team is using the contract now — auditors, client devs, etc — so we wanted to start issuing clearer versioning and changelogs to help everyone stay organized.”

Canaan Creative, China’s 2nd Largest Mining Manufacturer, Is Going Public in Hong Kong: The South China Morning Post reported this Wednesday that Canaan Creative plans to launch an IPO in Hong Kong. Originally planned for the US, the IPO would be the first public offering by a blockchain company in the city if it were to come to pass. According to a source familiar with the matter, Canaan Creative hopes to raise $1bln from the sale.

Whitehat Exposes Hacking Operation that Infected over 300 Websites with Coinhive Mining Software: Adding to crypto’s vernacular of buzzwords, cryptojacking is a clunky, unsavory combination of syllables that’s even more unsavory in practice, and it’s become an increasing topic of concern for ccybersecurity. In the most widespread instance of the practice to come to light, Troy Mursch, a security researcher at Bad Packets, unearthed a hacking campaign that infected 348 websites with Coinhive, a software that enables website visitors to contribute computing power to mine Monero through their browsers. The operation, since dismantled, affected websites for the San Diego Zoo, the government of Chihuahua, Mexico, Lenovo, and UCLA, among others.

We've seen countless examples of how cryptojacking malware steals your CPU resources to mine cryptocurrency. In my latest blog post, I explain how monitoring with #PRTG can help mitigate this threat.https://t.co/f7FNoy03Xl

— Bad Packets Report (@bad_packets) May 11, 2018

Australian Government Weighs Blockchain for Supply Chain Trading: In an address to the Joint Committee on Trade and Investment Growth, Australia’s Department of Home Affairs (DHA) made a point to pitch blockchain, among other emerging technologies like IoT hardware and AI, as a solution to effect greater transparency and efficiency in Australia’s trade supply chain.”The majority of traders are trusted and interact in a secure and transparent supply chain,” a spokesperson for the DHA stated. “Intelligence and risk assessment capabilities and revenue collection are improved by new and emerging technologies, such as blockchain, that would improve the veracity, validation, and analysis of intelligence and trade data.”

European Exchanges are Pushing Legislators for Regulation, Greater Legal Clarity: Executives from London’s eToro and Austria’s Bitpanda exchanges are asking for more, not less, cryptocurrency trading regulations from European governments. “We’d be happy to have regulations, so we know where we stand,” Eric Demuth, Bitpanda’s co-CEO, told Bloomberg. “The benefits of regulation are clear. An appropriate framework would serve to both protect consumers, and ensure the longevity and legitimacy of the industry itself,” stated eToro’s Managing Director, Iqbal Gandham, echoing Demuth’s call to action. Adequate KYC and anti-money laundering laws could give credence to a market often marked by its darkweb origins, paving the way for mainstream acceptance, both executives believe.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.