Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What’s the Deal with Bytecoin?

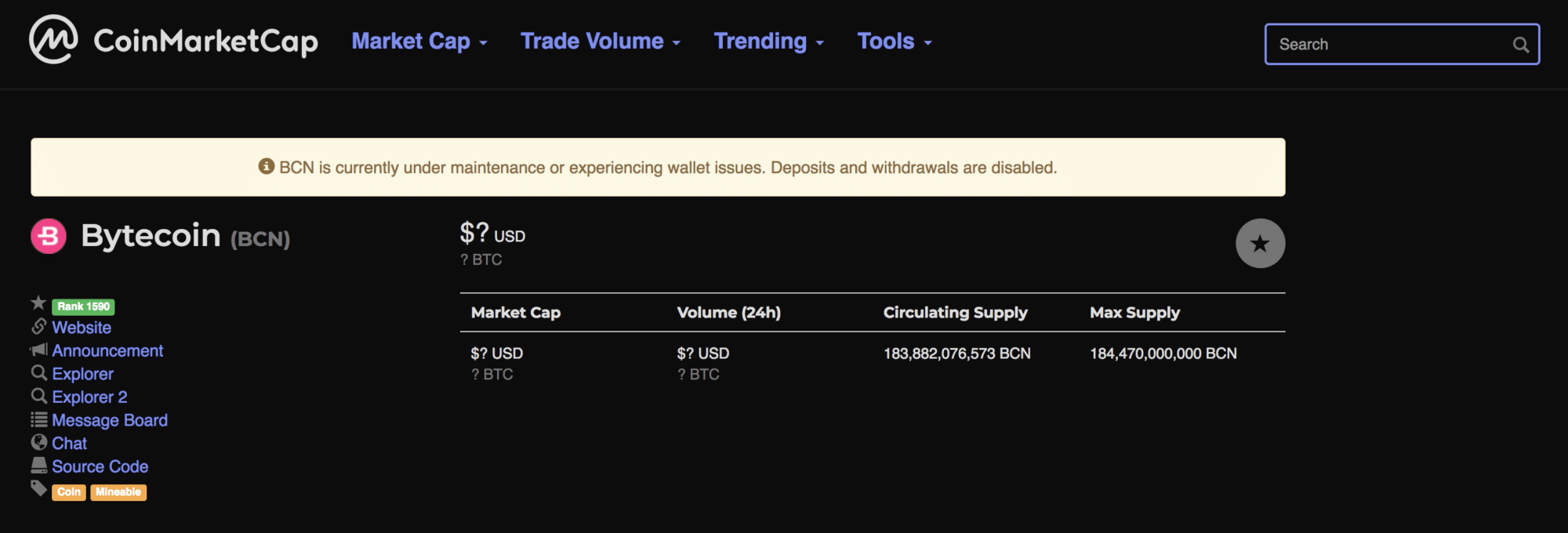

Bytecoin, the original CryptoNote currency that spawned several other projects, most notably Monero, is back in the news. After being added to Binance and Poloniex this week, the price surged a staggering 1000% on Binance before crashing back down a few minutes later. This price appreciation was followed by a near network-wide gridlock that shutdown the coin’s wallet and withdrawal/deposit access on all platforms. Since then, the price on both Poloniex and Binance has gone into free-fall. Traders and members of the crypto community are decrying the rise and fall as a pump-and-dump and the failure to move or trade coins as a scam perpetrated by the Bytecoin team, Binance, or both. CoinMarketCap shows no price for the coin currently, citing wallet issues and network maintenance. The official Bytecoin Twitter account released this statement regarding the outage during the time of the crisis.

Binance, HitBTC, and Poloniex all released similar statements, conveying that withdrawals and deposits were on hold until they resolved the network issues.

Before this week, Bytecoin’s trading volume across the several small exchanges it is available on was a paltry $8 million. Very little of the coin changed hands, which explains the rush of buying and selling upon its introduction to major exchanges. Two days later, the trading volume of BCN had rocketed to $600 million. Unfortunately for traders who had never heard of the coin (hint: most of them), many of them were caught in one of the more egregious pump-and-dumps we’ve seen this year.

As with nearly every pump-and-dump, wallet issue, or exchange service interruption, angry users flooded the exchange announcement with replies. Stories of lost funds, cries of insider trading, and links to endless support tickets regarding stalled transactions abounded from those who fell victim to the dump. Interspersed with these pleas of victimhood, though, were the trollings and celebrations of those who managed to profit from the pump.

The official Bytecoin Twitter account released this statement regarding the outage during the time of the crisis.

Binance, HitBTC, and Poloniex all released similar statements, conveying that withdrawals and deposits were on hold until they resolved the network issues.

Before this week, Bytecoin’s trading volume across the several small exchanges it is available on was a paltry $8 million. Very little of the coin changed hands, which explains the rush of buying and selling upon its introduction to major exchanges. Two days later, the trading volume of BCN had rocketed to $600 million. Unfortunately for traders who had never heard of the coin (hint: most of them), many of them were caught in one of the more egregious pump-and-dumps we’ve seen this year.

As with nearly every pump-and-dump, wallet issue, or exchange service interruption, angry users flooded the exchange announcement with replies. Stories of lost funds, cries of insider trading, and links to endless support tickets regarding stalled transactions abounded from those who fell victim to the dump. Interspersed with these pleas of victimhood, though, were the trollings and celebrations of those who managed to profit from the pump.

The Fix is In

About 24 hours later, the Bytecoin team released an update to the Bytecoin software and claims that all exchanges should now be able to integrate the new software to bring wallets back online (if you are running bytecoind, get the new software here). They deny allegations of collusion with Binance and hold that they have no control over price or trading activity on the exchange, apologizing to all users who lost funds during the wild price surge. The team released an official review of the network issue, citing a sudden influx of miners using outdated software as the source of the problem. This led to longer transaction times and aggravated a bug in the coin’s consensus code that brought the system to a crawl. No fork or split occurred, and no funds were lost. In the review, Bytecoin’s spokesperson highlights the major milestone that the addition of BCN to major exchanges is for the project, thanks users for their patience and understanding, and acknowledges the help of miners from the Monero community who offered to redirect mining power to Bytecoin to assist in stabilizing the network.A Questionable History

This is not the first time Bytecoin has had its legitimacy called into question. Released as far back as 2012, the early days of Bytecoin are a mystery and some (including Monero’s lead developer, fluffypony) claim to have proof that as much as 80% of the total BCN supply was pre-mined by a couple dozen unknown individuals before the software was released to the public. Fluffypony posted this theory to the Monero subreddit in 2015 with what appears to be proof, or at least sound logic. The complaint has haunted Bytecoin since, with very little price action or observable real-world use since then. More recently, Bytecoin was notably one of the only CryptoNote coins that failed to update its software to fix a security flaw discovered in the CryptoNight hashing algorithm, which may have permitted anonymous coin minting contrary to Bytecoin’s capped supply. Meanwhile, Monero and other major CryptoNote coins made changes with haste. Since the public disclosure of the vulnerability in May of 2017, this issue may have been addressed by the remaining CryptoNote coins but was not at the time of release, calling into question whether unknown attackers could have exploited these coins in the mean time.Does Bytecoin Have a Future?

Bytecoin hasn’t hung up its hat quite yet. They have a roadmap, semi-active development, and the team seems to be plugging along building what they claim to be a solid privacy coin. Now that BCN is listed on several large exchanges, we may well see Bytecoin live on to fight (or pump) another day. If the cryptocurrency space has taught us anything so far, it’s that traders, especially new traders, have short memories and are willing to buy just about anything based on a well-worded blog post and the promise of light (no matter how artificial) at the end of a tunnel. If you’re hodling BCN or simply watching the circus in amusement, keep an eye our for future shenanigans. We definitely will.Publication date

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.