Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Dogecoin has witnessed a major rally over the past month and the crypto community is now anticipating that the industry’s first meme coin will hit the $1 mark this season. However, the journey might not be a smooth ride.

DOGE has consolidated since August this year trading between the $0.094 to $0.14 range.

The token finally managed to break out of that range after Tesla CEO Elon Musk proposed the creation of the Department of Government Efficiency—abbreviated as D.O.G.E.—following his endorsement of Donald Trump’s 2024 presidential campaign just months before.

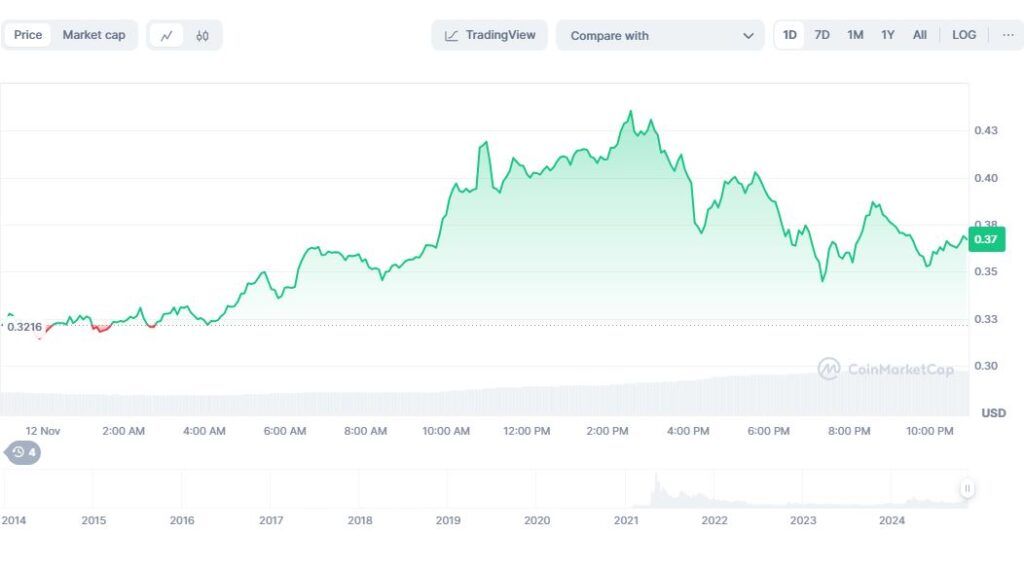

Consequently, following Trump’s win, DOGE rallied and managed to hit a six-month high of $0.43 on Nov. 12, while its market cap crossed the $60 billion mark.

When writing, DOGE was up over 22.5% in the past 24 hours but faced a correction due to Bitcoin’s dip, reaching an intraday low of $0.34 as Bitcoin slipped from its all-time high of $89,805 to $87,222.

With the elections now over, Bitcoin remains a key driver of altcoin rallies; however, in Dogecoin’s case, increasing demand from retail investors has also contributed to its recent momentum.

Data from Santiment shows that over the past month, 75,000 new wallets holding less than 100,000 DOGE have appeared.

Meanwhile, large holders have trimmed their positions by a net 350 wallets, though 108 of these wallets re-entered the market as DOGE crossed above $0.40.

Price targets for DOGE

Traders and analysts alike remain highly confident that the meme coin can breach past the highly coveted $1 mark this bull season.

According to analyst Kaleo, DOGE’s recent rally is currently in its early stages and the token could move towards the $1 mark after it manages to find its footing above the $0.50 resistance level which the meme coin is yet to retest.

Source: CoinMarketcap

Veteran trader Peter Brandt expects Dogecoin to reach a new all-time high soon, as he confirmed the token had broken out of a multi-month descending channel and strong price accumulation.

Another bullish case for DOGE was presented by market commentator Trader Tardigrade, who highlighted that Dogecoin recently surpassed its previous highest monthly close.

Based on historical patterns, Tardigrade noted that when DOGE achieved similar milestones in the past, it experienced gains of +1000% over 8 months and an impressive +8000% surge within just 4 months.

This historical precedent suggests that if DOGE follows a similar path, it could be set for substantial gains in the coming 4 to 8 months, with potential price targets in the multi-dollar range if the momentum sustains.

Similarly, analyst Ali Martinez noted that DOGE could test the middle or upper boundary of a long-term ascending channel it had bee, putting potential price levels at $2.40 or even $18 if bullish momentum remains intact.

Correction expected

However, analysts also agree that a price correction is necessary before the token’s next leg up, as this pullback would help establish a healthier support level, allowing the rally to sustain over the longer term.

When writing, DOGE showed strong upward momentum, with its price well above the 50-day and 200-day moving averages on the daily chart.

However, the RSI was at an elevated 91.23, indicating overbought conditions and suggesting there’s a high likelihood of a short-term correction or consolidation.

In a separate post, Martinez also shared a similar outlook, noting that the TD Sequential indicator was flashing sell signals for Dogecoin on the 4-hour and 12-hour charts with another signal forming on the daily chart.

As such, he is confident that a price correction is due for the meme coin before it resumes its upward trajectory.

The post Will Dogecoin hit $1? appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.