Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Mt. Gox, once the world’s largest crypto exchange, has executed a substantial Bitcoin transfer, raising questions about potential impacts on Bitcoin’s market.

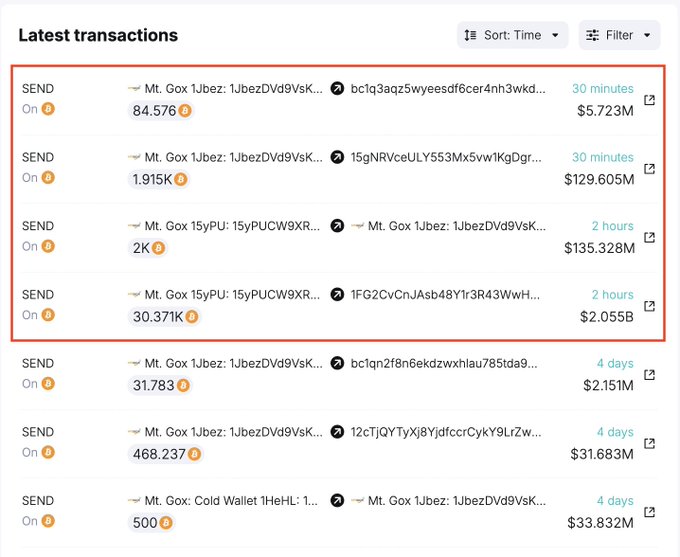

Following a series of movements by the exchange’s wallets, approximately $2.44 billion in Bitcoin (BTC) was relocated, sparking speculation of impending creditor repayments.

These transfers come as BTC touches an all-time high of $81,858, leading market observers to question whether this movement could introduce downward pressure on prices.

The transfers highlight ongoing repayment activities, with creditors of the now-defunct exchange anticipating a partial recovery of their funds, which could influence BTC’s short-term price dynamics.

Significant BTC transfers by Mt. Gox intensify speculation of repayments

According to Arkham Intelligence, a Mt. Gox-linked wallet sent roughly 27,871 BTC ($2.24 billion) to a new wallet and 2,500 BTC ($200 million) to a cold wallet on Sunday evening.

This marks the latest in a series of large transactions by the exchange.

These movements, alongside Bitcoin’s soaring valuation, hint at an upcoming distribution of Mt. Gox’s remaining assets to its creditors, many of whom have been waiting over a decade for repayment.

In recent days, Mt. Gox has transferred 30,371 BTC, a notable shift after months of minimal wallet activity.

Historically, movements from Mt. Gox wallets have indicated forthcoming repayments to creditors through exchanges like Bitstamp and Kraken.

Past instances suggest that any sudden influx of Bitcoin onto these platforms could lead to heightened volatility.

Market watches BTC for potential sell pressure from Mt. Gox creditors

SpotOnChain, another analytics platform, reported Mt. Gox’s transfer of 32,871 BTC over the last four days, with 296 BTC (approximately $20.13 million) moving to crypto exchanges like OKX and B2C2.

Spot On Chain

@spotonchain

·Follow

🚨 Mt. Gox transferred another 32,371 $BTC ($2.19B) to 3 new wallets in the last 2 hours.

Over the last 4 days, Mt. Gox has transferred out a total of 32,871 $BTC ($2.22B). Among these tokens, 296 $BTC ($20.13M) was moved to #B2C2 and #OKX.

Currently, there remain 12,006 $BTC…

7:20 AM · Nov 5, 2024

71

Reply

Copy link Read 4 replies

While the bulk of Bitcoin has remained within new wallets, the portion reaching exchanges has raised concerns among traders about possible liquidity impacts, especially if a significant amount of Bitcoin is liquidated.

This movement draws attention as creditors may choose between selling their reclaimed Bitcoin or holding it.

Market watchers are keenly observing these wallets, given that a sell-off by Mt. Gox creditors would add considerable liquidity, potentially influencing BTC’s price in the short term.

Mt. Gox’s $9.4 billion Bitcoin legacy and potential market impact

When Mt. Gox collapsed in 2014, it held around $9.4 billion in Bitcoin, which creditors have been seeking to recover ever since.

In July, the exchange returned 41.5% of its Bitcoin holdings—approximately 59,000 BTC—to creditors, many of whom decided to retain the asset.

With Bitcoin’s value appreciating more than 8,500% since Mt. Gox’s shutdown, creditors now face substantial profits and decisions about whether to hold or sell.

The recent activity has reignited concerns over whether these distributions could apply downward pressure on BTC’s market price.

Nonetheless, historical repayment rounds have seen a majority of creditors opting to hold rather than sell immediately, suggesting that the impact on BTC’s price could be moderated by holders with a long-term investment outlook.

Mt. Gox’s remaining holdings raise questions

Despite recent transactions, Mt. Gox still retains over 44,000 BTC in reserve, positioning these assets as a potential influencer in BTC’s market movements.

Analysts argue that any major sell-offs would create a ripple effect, possibly amplifying short-term volatility, particularly in the current high-value environment for Bitcoin.

As a series of major BTC transfers continues, the market’s focus remains on Mt. Gox’s strategy for the remaining assets and how future repayment plans could affect prices.

With significant BTC holdings potentially entering circulation, investors remain cautious, wary of the potential impact on BTC’s trajectory if these assets are liquidated en masse.

While Mt. Gox’s transfer of BTC to various wallets has stirred speculation, the ultimate impact on Bitcoin will largely depend on creditor actions.

If creditors choose to sell significant amounts, it could temporarily affect BTC prices; however, many analysts suggest that the bulk of creditors may hold their assets given the rising value of Bitcoin.

This restraint could mitigate drastic price drops, though ongoing monitoring is essential as Mt. Gox’s remaining holdings await potential distribution.

With Bitcoin at record highs, Mt. Gox’s recent BTC transfers have placed the exchange back in the spotlight, sparking debate over possible market impacts.

While significant, these movements represent a fraction of Bitcoin’s daily trading volume, and whether they significantly influence BTC’s valuation depends on creditor decisions.

Given the delayed nature of repayment processes and creditor hesitancy to sell in previous rounds, the market may absorb this potential liquidity without a substantial price shift.

The post Mt. Gox transfers $2 billion in Bitcoin: will repayments impact BTC prices? appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.