Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

- BlackRock’s Bitcoin ETF, IBIT, broke its daily trading volume record with over $4.2 billion on November 7, 2024, following Trump’s election win

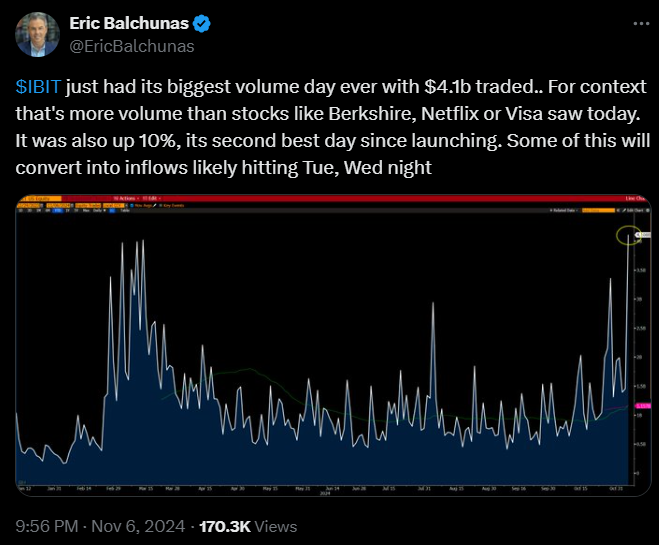

- The Bitcoin ETF’s trading volumes surged significantly, with a notable spike after October 11, signaling growing market interest

- The ETF’s strong performance reflects increasing institutional attention on Bitcoin, confirming the asset’s rising popularity in traditional markets

The result of the 2024 U.S. presidential election also set records in terms of Bitcoin ETF trading volumes, particularly BlackRock’s. I think that the fact is that interest in BTC suddenly increased a lot, not only from the markets, and since the conditions for new records were in place, they didn’t take long to arrive.

BlackRock’s Bitcoin ETF Record

BlackRock’s spot Bitcoin ETF, IBIT, was launched on January 11th of this year. On the very first day of trading, it recorded trading volumes above one billion dollars, while in March, when BTC hit its previous annual price highs, daily volumes nearly reached 4 billion dollars.

In my opinion, this shows how fast the market can shift when something big happens.

New All-Time High in Trading Volume

Yesterday, however, it surpassed 4.2 billion dollars, a new all-time record for daily trading volumes of IBIT.

Moreover, just a few minutes after the opening of yesterday’s trading session, it had already surpassed one billion dollars in daily trading volumes, so I think this record was triggered precisely by the election results, which came before the opening of U.S. markets.

Growing Interest Leading Up to the Election

However, it’s worth noting that it had already surpassed 3 billion dollars on October 29th, which confirms that the attention of traditional markets toward Bitcoin had already been high for a few weeks. Personally, I believe the momentum was building even before the election results were known.

For example, on September 25th, the daily trading volumes of IBIT were below 500 million, and even on October 9th, they were just above 600 million.

Turning Point: October 11th

The turning point came starting on October 11th, when the possibility of a Donald Trump victory began to spread. It seems to me that this shift in sentiment definitely helped spark the latest surge in interest.

Conclusion: Bitcoin’s Future Linked to Global Events

In conclusion, the results of the 2024 U.S. presidential election accelerated investor interest in Bitcoin, leading to new records in BlackRock’s ETF trading volumes. I think that with the continued increase in market attention, Bitcoin’s future seems increasingly linked to global political and financial events.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.