Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This is how many would characterize Adam Smith's theory about why the invisible hand of the market makes us all better off. Those who break Smith down like that forget he wrote a book about morals for context. Looking at this week's stories, it wouldn't hurt if more of us read it.

Story One

Beast Mode

If you haven't heard of Mr Beast until now, you haven't missed anything important. The first time I came across him was in the local supermarket, where he was trying to sell shitty, overpriced chocolate under his brand. The second time was watching a YouTube video exposing his latest product, a pre-packed lunch for parents who don't know how to make a sandwich. The only reason I remember is because the product was moldy way ahead of its expiration date.

Memes

At the same time, Mr Beasts' expiration date might be drawing closer. The popular Youtuber, best known for brainrot content and luring people into doing embarrassing stuff for a cash prize, is now facing allegations of insider trading and being too closely involved with crypto scams.

A recent investigation by the Loocks crypto analyst team concluded that Mr Beast had made roughly $23 million from his crypto involvement since 2021. A large portion, nearly $20 million, stemmed from tokens he received from the Superverse team and then dumped after advertising it to his fans. Since that worked so well, he went on to repeat the pattern.

Takeaway: For Mr. Beast, clearly, attention wasn't all he needed. It's nothing new that KOLs use their fans as exit liquidity. It's just more appalling when someone who already has a million-dollar empire does it. Add to that selling crap to kids, and it doesn't paint a pretty picture of what greed does to a motherf*cker.

Story Two

In it for the tech

Know Your Meme

On October 24th, the centralized exchange Kraken announced they were launching an L2. "Great, another Layer 2 no one asked for, "- you might think. I did. There didn't seem to be anything new about it, and with Base's current lead in that realm, it didn't appear worth pursuing. Still, inkchain was announced as a new chain in the Superchain, another name for all the chains built with Optimism's SDK.

As Optimism fans celebrated this win, the mood shifted when it conspired that Kraken had received 25 million OP tokens from the OP Foundation. At the time of agreement, this amounted to 40 million dollars.

Ryan Watts, Growth Lead at Optimism, added that this was a grant aimed at supporting engineering efforts and driving transactions. Basically, Kraken only gets the money if enough activity happens on their L2, as if that wasn't a thing you could fake nowadays.

Giphy

Apparently, similar deals exist with other projects in the Superchain.

Takeaway: Knowing that Kraken got paid, who clearly aren't cash-stripped, makes you wonder... Maybe none of those big projects on OP is there for the superiority of the Superchain tech.

Story Three

EIGEN down bad

Not only in token price but also in advisors on its board. The hot copy-pasta on CT the last week was triggered by two Ethereum Foundation researchers who announced that they'd step down from their advisorship roles at Eigenlayer.

As a quick reminder, Eigenlayer is the protocol that brought the concept of re-staking to Ethereum. That means you can stake your already staked tokens again, and somehow this then allows other projects to tap into Ethereum's security.

A big brain, darling. However, when they hired two researchers from the Ethereum Foundation, controversy ensued. After all, the foundation is a non-profit, expected to maintain neutrality, and team members are expected to remain independent and impartial. Getting paid big amounts of EIGEN didn't square with that.

Drake and Feist, the researchers in question, have now drawn their conclusions and said they were sorry.

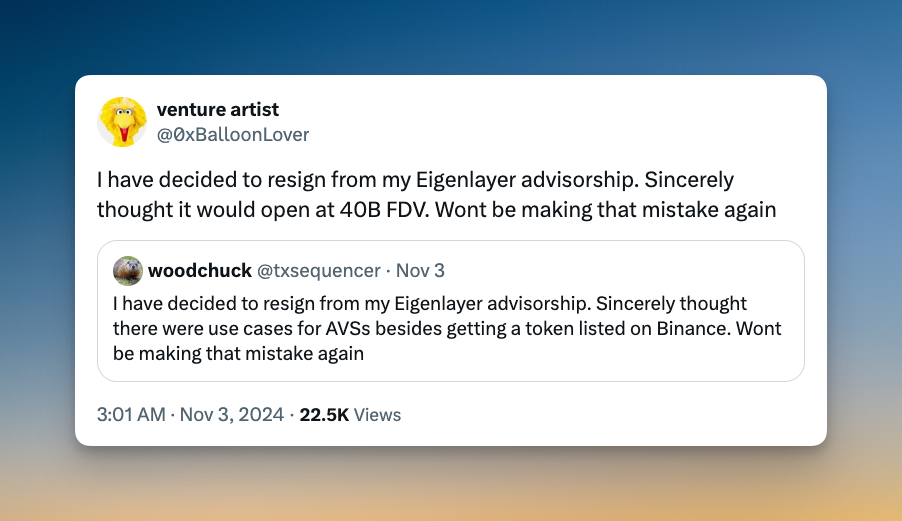

Tweeters were more cynical about the move.

X

Takeaway: Maybe the Ethereum Foundation needs to pay more. Idealism isn't enough anymore.

Fact of the week: We'll never know what Adam Smith would have made of the crypto markets. What we do know is that he was an avid reader with a library full of 1500 books. It's unsurprising then to find out that he did not come up with the term invisible hand but merely borrowed it from Shakespeares' Macbeth.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.