Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Back in December, I reviewed a suite of ‘smart tools’ designed to help cryptocurrency traders minimize risks and maximize profits. Five months later I decided to revisit the platform to see if they had anything new to offer…

If You’re Not Innovating, You’re Stagnating

When it comes to crypto, few things are as disappointing to me as when a really promising project launches and comes out of the gate really strong, only to fizzle out a few months or a year down the road.

3Commas, which launched in September 2017, has managed to avoid that pitfall and just continues to get better and better. The platform boasts more than 22,000 active crypto traders and a daily trade volume of more than $6 million.

Speaking about the platform’s spectacular growth, 3Commas CMO Mike Goryunov said:

We continue to build win-win collaboration with our customers and as I can see it’s the main reason of our success.

The reason for the platform’s growing popularity, of course, is the wealth of tools and features it offers that has resulted in active traders making an average monthly profit of more than 15%.

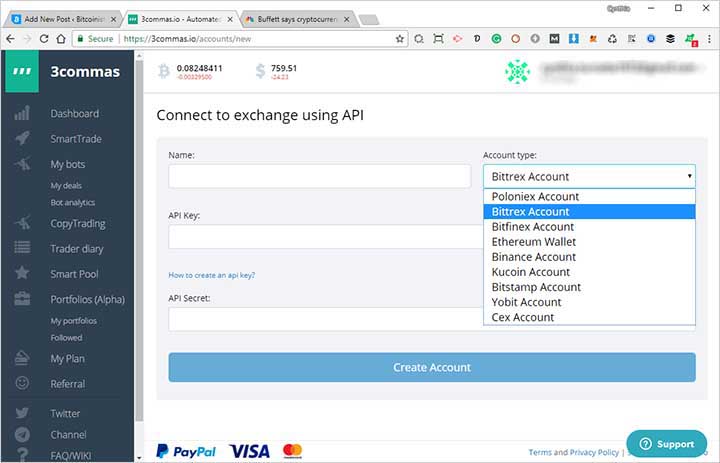

More Exchanges Than Ever Before

When I previously reviewed 3Commas, the platform integrated with Poloniex, Bittrex, Bitfinex, Binance, and any Ethereum wallet. Since then, the developers have added integration with:

- Bitstamp

- CEX

- Kucoin

- YoBit

The team is in the process of adding support for Huobi as well, and a little bird told me that support for HitBTC and Bitmex will be coming online soon after.

Automated Trading Bots

The best trading tools are the ones you don’t have to babysit 24/7 and 3Commas has rolled out a new tool that makes my little guppy-sized crypto trader heart sing with joy. After much anticipation, the team has released its Automated Trading Bot tool and the reaction from the community has been overwhelmingly positive.

For those who are unfamiliar with the concept, a trading bot is a piece of computer software that executes trades over and over again based on pre-determined parameters that the trader configures.

The problem with most trading bots is that they are either difficult to use – especially for new traders – or they just plain don’t work the way we expect them to. 3Commas has solved both problems with a trading bot that is both easy to use and reliable in its performance. Results may vary, of course, but on average the trading bot generates a daily profit of around 1.5%. Detailed analytics on the bots’ performance are available on the 3Commas website.

Moomin Papa has created a terrific video explaining how 3Commas’ Automated Trading Bot works, but here it is in a nutshell:

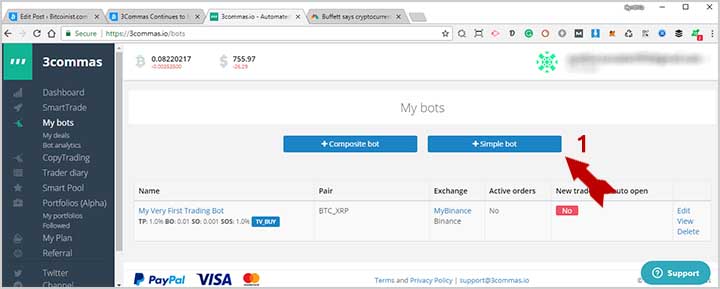

Step 1: Choose which type of bot you are creating

3Commas supports two types of trading bots – simple and complex. A simple trading bot only involves one trading pair while a complex trading bot involves multiple trading pairs. For the purposes of this article, I am only focusing on simple trading bot creation.

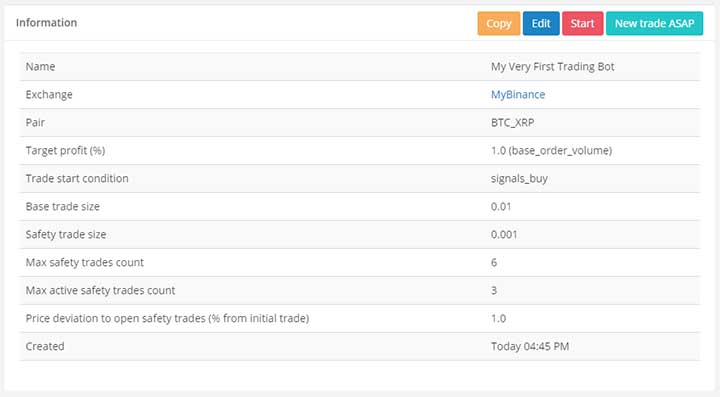

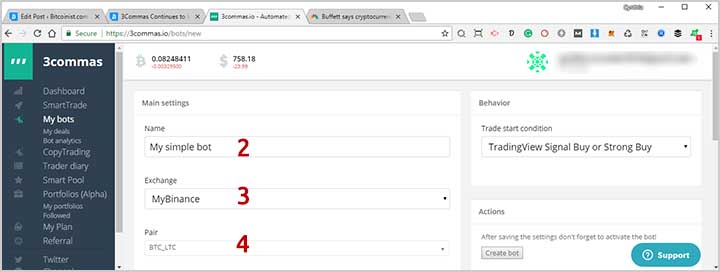

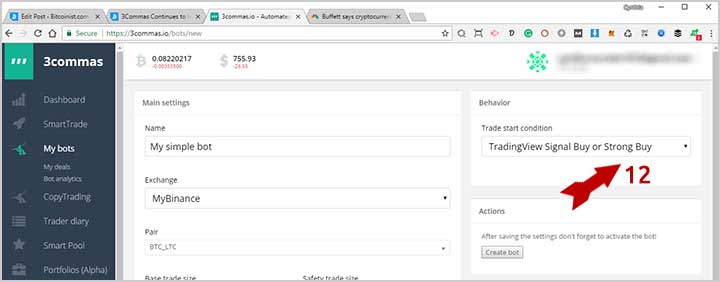

Step 2: Name your bot

Naming your trading bot will help you remember which bot is trading which pairs. This is especially useful if you will be creating and running several trading bots.

Step 3: Choose your exchange

Tell your trading bot which exchange it will be trading on. It can be any exchange that you have added to your My Exchanges dashboard.

Step 4: Choose your trading pair

Select the trading pair you want your bot to buy and sell from the drop-down menu.

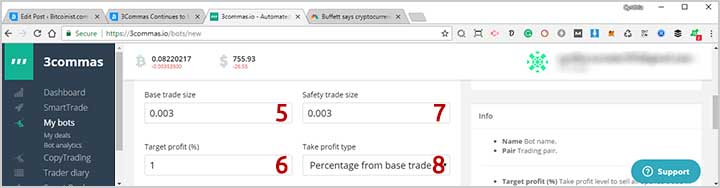

Step 5: Set your base trade size

This is where you tell your trading bot how much BTC, ETH, etc… you will be using in your initial trade.

Step 6: Set your safety trade size

This step is completely optional, but it lets traders ‘buy the dip’ in a safer, more controlled way. For example, let’s say my trading pair is XRP/BTC and I buy Ripple for $0.82 per token. If the price drops below my original purchase price, safety trades will let me buy more XRP with whatever amount of BTC I have my safety trade size set for.

Step 7: Set your target profit

This tells the trading bot when to sell and is set in percentages. Let’s say I set my target profit for 2%. If my trading bot initially purchased Ripple at $0.82 per token, when the price hits $0.8364, the bot will automatically execute a sell order.

Step 8: Choose your Take Profit Type

The trading bots support two Take Profit types – percentage from base trade and percentage from total volume.

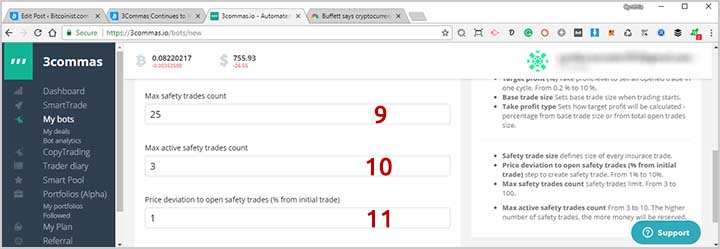

Step 9: Max safety trades count

This step is optional (unless you have set a safety trade size) and tells the trading bot how many safety trades it is allowed to make before stopping.

Step 10: Max active safety trades count

Similar to Step 9, this step tells the trading bot how many active safety trades it can have in progress at any given time.

Step 11: Price deviation to open safety trades

Set as a percentage, this step tells the trading bot when it can start executing safety trades. For example, if I set it to 2, then when the price of Ripple drops 2% below my initial trade price the trading bot will begin executing safety trades.

Step 12: Trade Start Conditions

This step tells the trading bot when to make that initial trade. You can choose from TradingView Signal Buy or Strong Buy, TradingView Signal Strong Buy, Manually, or Open New Trade ASAP.

That’s all there is to it. Twelve steps may seem like a lot, but in reality, you can configure your first trading bot in just a few minutes – even if you’ve never set one up before. That’s the beauty of this tool – it’s easy enough for beginning traders but still robust enough to satisfy more experienced traders as well.

Are you ready to test drive 3Commas’ Automated Trading Bots for yourself? Visit 3commas.io and sign up today.

Are you a 3Commas user? Have you checked out their Automated Trading Bot? How does it compare to other trading bots? Let us know in the comments below.

Images courtesy of 3Commas

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.