Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

There has been a lot of discussion about the value of Earn.com’s business (“Earn bitcoin by replying to emails and completing tasks”) the past few weeks as rumors of Coinbase purchasing Earn started to spread.

With Earn’s CEO, Balaji S. Srinivasan, recently announcing the acquisition by Coinbase, a lot of people are losing their minds over the reported valuation ($100 million per Recode) and what Earn represents today (an ICO spamming platform) vs. what Earn could represent in the future (cryptocurrency based wages — arguably the holy grail of adoption).

While this future sounds amazing, it’s been a long road for Earn to make it to today. Earn has an illustrious history of name changes (21e6 LLC, 21.com, and finally Earn.com), raising huge amounts of money while in stealth mode, multiple pivots, and near death misses.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Short history: 2013: 21e6 LLC - a bitcoin mining (farm) company 2015: https://t.co/0m54NkvE8z - VC-funded botnet, protocryptojacking with a pricey Raspberry Pi 2017: https://t.co/Oqo8YqTxGx - mechanical turk but only for lists and spam because nerds need: #earntoken https://t.co/EuciOguFcZ

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Balaji wrote a great piece about the “Turnaround” story and sale to Coinbase, while Tim Swanson filled in a lot of the gracefully omitted details in his post, “Is the Pitato why we can’t have nice things?” Both are great reads but don’t leave yet! I am just getting started.

I really love following Balaji and listening to his perspective on the space. However, I think Earn’s approach to cryptocurrency wages is wrong (well, it’s wrong at least for today). It’s wrong because is requires adoption by both the business and wage earner or service provider. What if payment only required opt-in by the wage earner? Easy enough? Kind of. Let me tell you why Earn is not the right approach today and why allowing employees to opt-in without changing their employers processes is a better approach.

Amazon Mechanical Turk vs. Earn

Amazon Mechanical Turk

Earn’s approach is essentially Amazon Mechanical Turk’s approach to creating a marketplace for a distributed workforce of people to perform the same tasks in repetition. “MTurk” as Amazon calls it essentially allows business to pay independent contractors around the world to perform large scale projects in a programatic way while still using real humans to complete the task (Think: CAPTCHA business model of using humans to train computer vision).

I say, “I’m a real boy” more often than I’d like to admit.Problems with MTurk = Payments in Amazon Gift Cards

I say, “I’m a real boy” more often than I’d like to admit.Problems with MTurk = Payments in Amazon Gift Cards

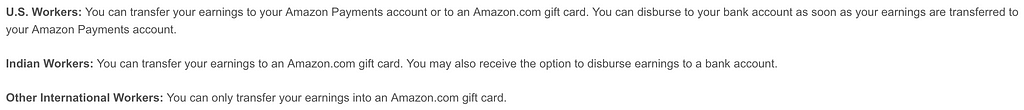

MTurk pays non-US citizens in Amazon gift cards (FAQ-How Do I get Paid).

How are you supposed to eat an Amazon gift card?

How are you supposed to eat an Amazon gift card?

This is a huge problem for people in non-US countries. They do not want the gift card. They want their native currency and the stuff they can buy with it (“stuff” really is a gross word, sorry). The solution to MTurk’s gift card problem? Purse.io, the one stop shop for all of your Amazon shopping needs. You name your discount (10–15% is average) and pay with bitcoin. Random person buys the goods for you with their gift card and receives the bitcoin as payment. Boom. That’s Purse’s entire business model supported by MTurk and Amazon gift cards (Don’t tell Andrew I gave a way the secret.). Side note: Purse is a also great service if you’re in the US. Use my referral code to support my bitcoin addiction.

Earn = MTurk + Bitcoin Wallet

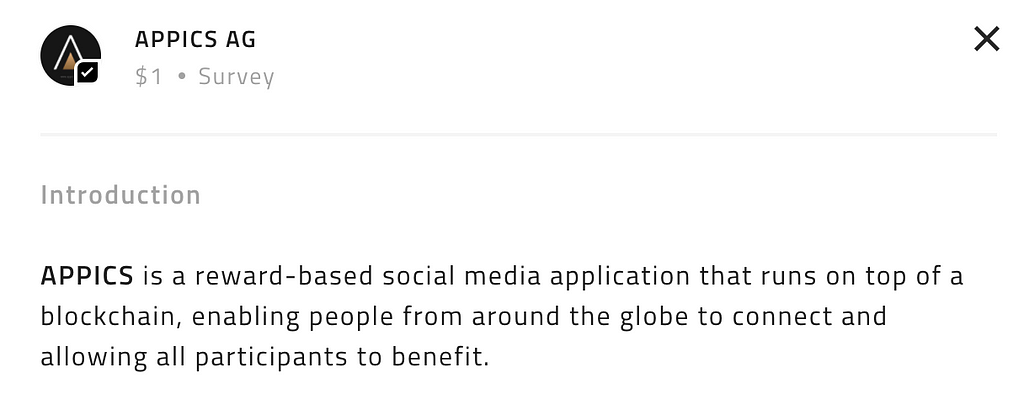

So, how is Earn different from MTurk? Earn strapped a bitcoin wallet on top and recruited experts and cryptocurrency enthusiast as early adopters for email based polls. The result? Spam emails from ICO’s pushing a social media platform built on STEEM’s blockchain.

Yes, really. This is the survey I got a week or so ago.

Yes, really. This is the survey I got a week or so ago.

While I appreciate the couple hundred bucks of bitcoin I withdrew from my my account a few weeks ago, the quality of projects has begun to wear on me and I’m bored / spammed out. I stopped answering messages and tasks a while ago. At the end of the day, I’m not going to make money by answering email-based polls or performing MTurk like tasks. I am running a business.

I’m not done with Earn. I’m just done with time based spam messages.

I’m not done with Earn. I’m just done with time based spam messages.

How do I earn cryptocurrency?

How do wage earners and businesses like Relayzero* earn cryptocurrencies?

*I recently launched Relayzero to seed invest and advise founders in the space. Building for the cryptocurrency space? Looking for seed investment or need help with blah, blah? I can help.

Crypto Buyer for Services + Goods = already solved problem

Kind of a solved problem — If you run a business online or have a location IRL (“in real life” for those embarrassed to ask), then there are a variety of solutions for you to accept cryptocurrencies as payment. You can setup a wallet to accept and hold cryptocurrencies online or IRL (if you ignore integration issues with POS, “point of sale” system for those who were blessed to never worked in restaurant or retail). Alternatively, you can use services to auto-convert the cryptocurrencies to USD to be able pay your bills and employees. This problem is solved if we ignore scaling and transaction fee related issues. Check out Bitpay or Coinbase Commerce as a few examples for auto-converting options.

Wage Earners — We need a solution.

But, what about wage earners?

How the heck do you get your employer or a business customer to pay you in your cryptocurrency of choice?

Most businesses are in the business of…running their business. They do not want to run a mini-cryptocurrency hedge fund to buy cryptocurrencies to pay employees or service providers while hedging against price changes and managing security risks. Business contracts are denominated in USD and salaries were negotiated based off of the same. Fluctuation in prices of cryptocurrencies and valuation methods make it very hard for businesses to use cryptocurrencies to pay for services. Not to mention, their payroll departments likely lack the technical sophistication to manage a private key for a bitcoin address with hundreds of thousands of dollars or millions of dollars in bitcoin in it to cover the monthly payroll. Enter audit problems and a lack of financial controls of one person controlling corporate funds. Where’s the multi-sig wallet? You get the point. Technically, it’s a mess for businesses to try to use cryptocurrencies for accounts payable. Then, from a practical standpoint, employers have to pay taxes on all income. Payroll providers like Gusto make this easy by automating all the calculations and tax payments. Running a special payroll for cryptocurrency earnings paid outside of your payroll is too much to ask most accounting departments. Additionally, All of these services integrate with accounting software and do not cause heartburn for executives. In short, payroll and accounts payable will continue to be paid in FIAT until there is a better solution in payroll and accounts payable for businesses.

The solution?

Wage Earner Opt-In Only

The way to get businesses to pay wage earners and service providers in cryptocurrency is to not ask the businesses in the first place. Educating businesses and getting them to change their ways is a waist of time. Wage earner-only opt-in can be done in two ways:

1The first way is for wage earners or service providers to just invest their dollars in their cryptocurrency of choice when the receive their payroll deposit.

Seriously, what a horrible solution.

Seriously, what a horrible solution.

Wage earners can just use their dollars to buy cryptocurrencies. They can do it manually or setup the auto-invest features Coinbase and other exchanges offer (Coinbase FAQ — Recurring Transactions). The problem with these approaches is that it encourages investment over spending and market timing over regular accumulation. The real question is, “How do we live in cryptocurrencies?”

2The second solution? Create account and routing numbers for cryptocurrency based deposit accounts. Business sends wage earner USD just like any payroll deposit. Wage earner receives cryptocurrencies in their wallet. Strap a debit card and bill pay for loans and leases on top for good measure. That’s your bridge technology while we wait for the rest of the world to wake up.

Yes, ‘dis legit. Want to know how? Contact me below.

/end

Like what you read? Want to learn more? You can pay me to answer emails at Earn.com here or you can donate to Manos Unidas, a non-profit that benefits special need schools in Peru. I’m the Chairman of the Board and I’m happy to talk to you if you donate. We are raising money for our newest project, Cafe Daria, that serves as a job training site for young adults with special needs.

Cafe Daria: Job Training Site for Young Adults with Special Needs

Manos Unidas Donation Wallets:

Ether: 0x383eFDbc8117A678ACFbD475312421B36FA13751

Bitcoin: 3211iFqVRHjCHMMPwb52jzWz2WwF3KALer

Bitcoin Cash: 1LHB7v6mv7mdkXEAtH6HkfCpRGnPkybNgf

Zcash (z-address available upon request): t1b7ZGH7gKnrkJrNca59yVbWaiUbi35r8sf

Litecoin: MCSQ2V27fmLmSL7qKkw5V64hWgbfqygMru

Dash: XpxmyQxgNT433aiQBDxijQSSBgxXj6ELaa

Earn.com — Not for Wage Earners was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.