Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This is the second installment of a long form essay — or short book — outlining my macro perspective on how the emerging crypto ecosystem fits within the greater context of biological, cultural, and economic evolution. I intend to publish each installment weekly, over a period of 3–4 weeks. Afterward, I’ll release the content in its entirety, with additional notes and research materials, in e-book form.

If you haven’t already read the first installment in this series, you should read it before continuing with this article, as each installment builds upon earlier concepts.

Money and Utility: The Margins of Value A Japanese pearl diver on the hunt for oysters. Does she create, or seek, value?“To understand the limitation of things, desire them.” ― Lao Tzu, Tao Te Ching

A Japanese pearl diver on the hunt for oysters. Does she create, or seek, value?“To understand the limitation of things, desire them.” ― Lao Tzu, Tao Te Ching

The first installment in this series ended with a series of questions underscoring the difficulties that arise when we attempt to pin down precisely what money symbolizes:

Why does specifying the relationship between symbol and value remain elusive?Why do our monetary symbols remain so detached from the more concrete notions of value in the everyday world of human actions?Why are their symbolic mappings more like those of “love” than those of a chair?

The simplistic answer to these questions, as framed by most economists, is that money is a tool used to represent, compute, transact, and store economic value over time. But this definition has always troubled me, as it relies upon the a priori abstraction of value as something best represented homogeneously — as if for the sake of efficiency we must inevitably discard the cornucopia of unique values held within each of us. For expedience, economists say, we must pack our human values into singular numerical prices. Yet the majority of economic literature says little of worth about why we should — in the first place — treat our human values in this manner.

After all, each individual faces a unique set of constraints as they move throughout the world, and each of us must apply our own values to an unpredictable series of life events in a way that increases our chances of satisfying our own path-dependent needs and desires over time. We may of course generalize these paths, but only to a point. Past this point we begin to feel a sense of detachment between money and our perceived reality; the aforementioned illusion of representation begins to come unglued. Furthermore, the psychological schism between abstract monetary symbols and our perceived reality widens as symbols fail to keep pace with the exploding complexity of our lived experiences. And as the schism widens, those consumed by its depth feel skepticism concerning the system of value representation itself (market capitalism), and many begin to despise its pervasive totems of value (monetary symbols).

But this is nothing new. The motif of value’s inherent contingency crops up throughout the history of recorded human thought, dating at least as far back as Plato and Aristotle. For example, in Aristotle’s Politics, he notes that too much of a good thing can become a bad thing, contingent upon circumstance:

External goods have a limit, like any other instrument, and all things useful are of such a nature that where there is too much of them they must either do harm, or at any rate be of no use.

Two millennia later — confronted by a rapidly evolving industrial world and struggling to retrofit existing theories of value onto a fundamentally novel economic reality — Adam Smith once again surfaced the timeless problem of value’s contextual subjectivity with his Diamonds and Water Paradox:

The things which have the greatest value in use have frequently little or no value in exchange; on the contrary, those which have the greatest value in exchange have frequently little or no value in use. Nothing is more useful than water: but it will purchase scarcely anything; scarcely anything can be had in exchange for it. A diamond, on the contrary, has scarcely any use-value; but a very great quantity of other goods may frequently be had in exchange for it.

Yet this only presents a paradox if one assumes that goods or services possess some inherent value outside the physical and social systems in which they’re embedded. In practice, the value of goods and services depend — in a phenomenological sense — upon the specific circumstances, needs, and psychological states of market participants, in addition to the overall energy required to bring them to market. This ambiguity regarding value’s singular source eventually found itself co-opted by political factors, and evolved into the Labor Theory of Value, which concluded that the value of a thing hinged mainly upon the labor invested in producing it.

But as economic theories will, the Labor Theory had its weaknesses. Richard Whately — a 19th-century British economist — demonstrated one such weakness by inverting the labor-centric perspective, and highlighting the cyclical relationship between the perceived value of goods and the extent to which these perceptions drive behavior:

It is not that pearls fetch a high price because men have dived for them; but on the contrary, men dive for them because they fetch a high price.

Though this once again begs the question: why do the pearls fetch a high price in the first place? It seems we’ve traveled a circular path back to where we began, and again must confront the eternally frustrating question: what is value?

To avoid the impossibly complex task of centrally calculating why all humans value the things they do, relative to their unique life situations and value systems, we coined the word utility, and ascribed to it the amount of value encoded by a market participant’s willingness to sacrifice one thing for another. In this manner we defined our way out of the circular trap discussed above, and (at least temporarily) skirted the utopian temptation to pursue the omniscient calculation and centralized planning of complex economic systems.

And so today we make constant sacrifices to one another in the form of money. Economists call the specific amount of money we’re willing to sacrifice to one another for each additional unit of a good or service its marginal utility. For example, if I’m hiking through the desert and I’ve run out of water, the initial marginal utility of one water bottle far exceeds that of a diamond. Furthermore no amount of diamonds changes the equation, as a diamond won’t quench my thirst. I’d happily pay for as much water as I could carry, past which point its marginal utility drops to zero. Alternatively, if I’m well-hydrated and safely ensconced within a society that uses diamonds as symbols of access to other scarce resources — or am involved in a relationship in which my partner expects such a gift as a token of commitment — the marginal utility of a diamond far exceeds that of water. Beyond this first diamond, however, the marginal utility of more diamonds becomes highly contingent upon a number of other variables — namely one’s interpersonal negotiation skills and tolerance for loneliness…

In any case, by introducing marginal utility we sidestep the apparent circularity of value, and gain a functional definition of monetary value that encapsulates the differences in perceived value which arise from one’s unique circumstances. This abstraction alleviates inconsistencies within our economic formalisms, but given our present purpose only drives the question of fundamental value one layer deeper into humanity’s behavioral substrata. One then ponders why pieces of paper or metal that embody this monetary value represent a sufficient sacrifice — from the perspective of the owners of goods or providers of services — to justify parting with one’s possessions or labor? Why would someone give you something that you can enjoy now (food, water, property, jewelry) in exchange for abstract tokens of value?

One reason might be their ability to use those tokens to purchase other goods or services — absent here and now — at a future time and place. But this story is merely descriptive, and takes for granted the collective knowledge necessary to encode such an idea within the minds of a collective’s individuals. How did societies come to learn and appreciate the self-organizing power of this behavioral pattern? To answer that question, and to furthermore understand money’s importance as an evolutionary paradigm shift, we must dig deeper into the sub-structure of how humans first came to accept symbols of value in place of concrete goods or services. And for that we’ll need to hop into our time machine and travel further back than any of our economic, philosophical, or historical texts can take us: to the emergence of humanity itself.

Evolution, Trade, and the Emergent Abstraction of Value For the evolutionary psychologists an explanation that humans do something for “the sheer enjoyment of it” is not an explanation at all — but the posing of a problem. Why do so many people find the collection and wearing of jewelry enjoyable? For the evolutionary psychologist, this question becomes — what caused this pleasure to evolve?— Nick Szabo, Shelling Out: The Origins of Money

For the evolutionary psychologists an explanation that humans do something for “the sheer enjoyment of it” is not an explanation at all — but the posing of a problem. Why do so many people find the collection and wearing of jewelry enjoyable? For the evolutionary psychologist, this question becomes — what caused this pleasure to evolve?— Nick Szabo, Shelling Out: The Origins of Money

Money-like collectibles are nearly as old as humanity itself. Let that sink in for a minute. Our ancestors used physical objects — shells, bones, knotted cords, etc. — to represent and abstract the concepts of value long before any large-scale civilizations entered the scene. This cuts against the grain of common knowledge, which purports that money emerged from transactional barter systems. But evolutionary anthropologists question the idea that barter — as described by 18th and 19th century economists like Smith — ever existed as a primary mechanism of exchange amongst pre-agrarian societies.

Rather, these early societies embedded the exchange of valuables within the connective psycho-social tissue of shared memories and values, and stored their record — in holographically distributed fashion — within the brains of the community. Such systems of exchange were deeply entwined and in touch with the specifics of cultural and geographic necessity, and provided a mechanism for tributary relationships and socially-computed reciprocity. For example, we possess no evidence that humans living in small-scale arrangements ever engaged in purely transactional behaviors such as trading 3 pigs for 1000 bananas within a market. Instead, informal mechanisms of tracking contribution and reciprocity across time prevailed. For example, when a community member encountered the misfortune of an unsuccessful hunt, those in possession of excess bananas would cut them some slack (edible credit, so to speak), as they remembered the delicious pig roast provided by the hunter last month. In other words, we haven’t always abstracted our economic reality away from the social landscape in which we’re eternally embedded. Yet eventually we did. Why?

Many in the crypto — and broader tech — community are already quite familiar with the answer: scaling issues. In the case of early value representations stored in human memory, scaling issues were rampant. Human memory is fundamentally limited. Its encoding mechanisms are fuzzy (telephone game), not very durable (we forget things), and prone to catastrophic failure events (death, or the occasional head trauma). Also, reliance upon memory is subject to the incentives of those doing the remembering, who might conveniently mis-remember the deliciousness of your roast pig when you later come around asking for bananas. How to solve these issues?

We did what large-brained humans do best: we created abstractions to represent, and tools to solve the problem at hand. Instead of relying purely upon our memories, we began to exchange pieces of bone from rare prey, traded aesthetically pleasing stones, or tied knots into complex arrangements representing meaningful events. It’s critical to understand that while this level of abstraction provided a tremendous degree of utility, it remained closely bound to the specific values, aesthetics, and traditions of a given society. However, as we started to encode information into these systems rather than storing it in our minds, a degree of separation began to emerge between the complex landscape of our internal representation of lived experiences and the increasingly externalized mechanisms of representing, storing, and exchanging symbols of value.

This process of separation is crucial to later arguments, so I’d like to unpack it a bit further. Let’s say that two people, Alice and Bob, lived together in an early tribe of homo sapiens sapiens. They use their memories to keep track of their history of reciprocity (i.e. how many nice things have we done for one another in the past?). One day, Bob approaches Alice, who’s lounging comfortably on her favorite geologically-manufactured recliner eating some of the berries she found earlier in the day. Bob didn’t have quite so much luck, and is feeling rather peckish. Let’s assume he makes this obvious to Alice using the communicative tools of the era. Does Alice comply? Assuming Bob isn’t too big of a jerk, he likely believes that he’s done something in the past to warrant some berries now, despite his present bad luck. But for Alice to agree, she must also possess a correspondingly positive mental recollection of their shared history. And given no physical record, it must align quite closely to the subjective recollection held in Bob’s memory. If they don’t match, Alice should refuse the request.

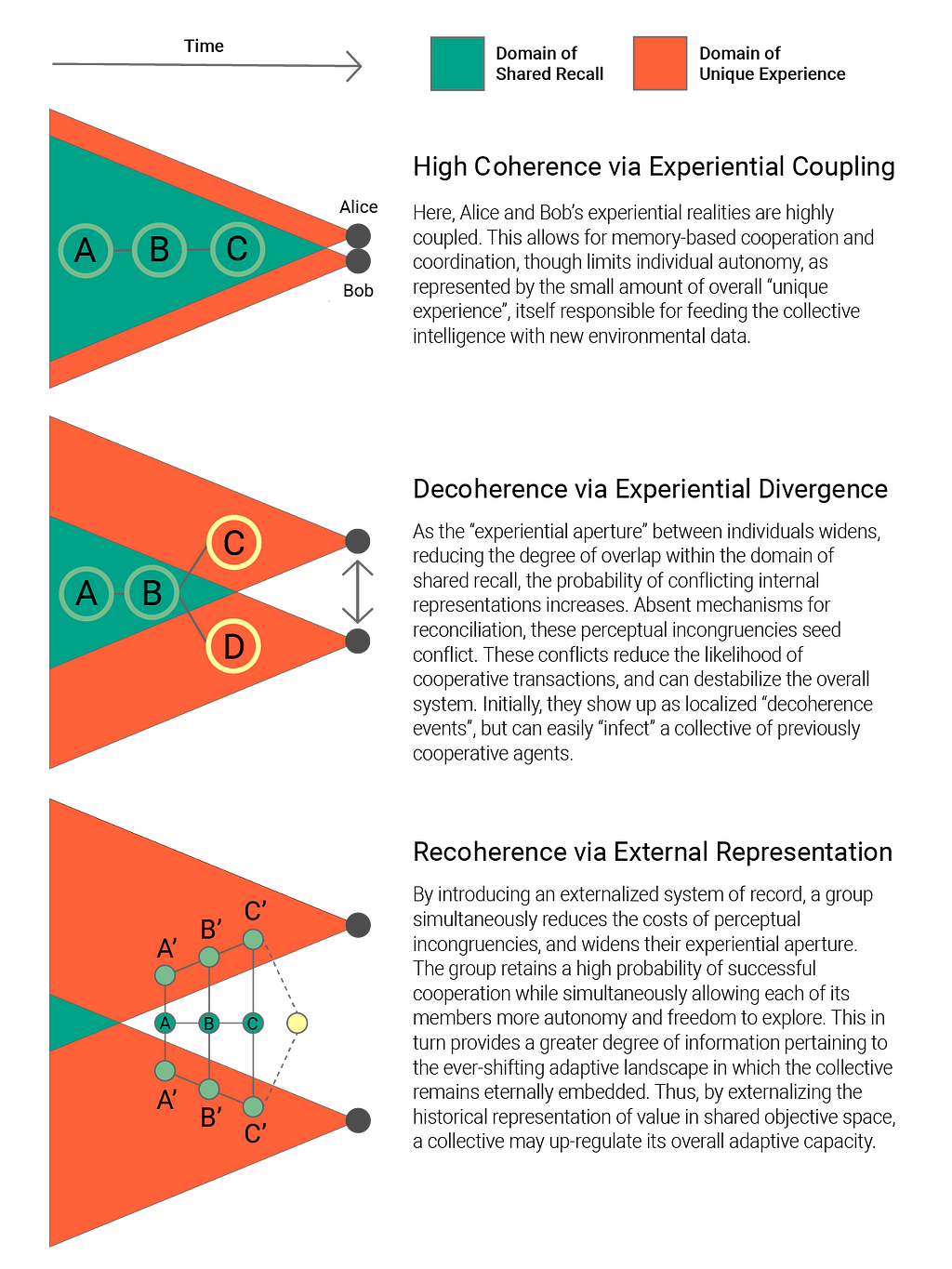

Relying solely upon human memory and momentary incentives presents a substantial barrier to exchange. For Alice’s donation to feel fair, both Alice and Bob’s subjective perceptions — past and present — must possess a high degree of overlap. In engineering terms, to maintain the capacity for reciprocity, the subjective realities of Alice and Bob must remain tightly coupled over time. To understand the fragility of this system, it’s useful to meditate upon how many ways this might go wrong. How many ways can Alice and Bob’s realities decouple — or decohere — over time? Alice and Bob’s memory can vary. Alice and Bob may value past interactions differently. New information may have entered the picture since their last interaction. Alice might be particularly hungry. Bob may be having a bad hair day. The list goes on and on.

That being said, if the exchange does occur, it reaffirms that Alice and Bob’s subjective perceptions of reality have remained in synchrony with one another. Psychologically, they’re still living in the same world. They’ve remained coherent over time, and still exist within the fertile interpersonal soil of shared reality from which bonds of trust may grow. And by strengthening their bond, they also strengthen the overall coherence of the community to which they belong. This strengthening of communal coherence is of great import, though it’s often difficult to understand, measure, or encode its value in the present, given that it mostly pays dividends in the future. The invisible bonds of trust — of communal coherence — return compounding dividends as the collective iterates these interpersonal interactions hundreds, thousands, or millions of times. In other words, a society that nurtures trust increases the probability of favorable interpersonal exchange outcomes over time. A trusting society can extend its conceptual time horizon, and plan accordingly, together as one meta-organism.

A diagrammatic representation of externalization-mediated coherence

A diagrammatic representation of externalization-mediated coherence

But as the size — and by extension the complexity — of a society grows, it becomes impossible to maintain such high degrees of interpersonal coherence over time. Trust begins to erode. A growing community generates a combinatorial explosion of new possibilities, and this increasingly diverse set of life paths widens the gap between the subjective realities of community members, creating tension between individual interactions that depend on the coherent communal reality of the meta-organism. Something has to give, or chaos and violence will arise. And so, humanity externalized methods for keeping itself coherent with respect to its shared history of value, exchange, and reciprocal debts as it continued to expand across the planet. These new tools enabled humans to outsource the burden of maintaining communal coherence to physical systems existing outside individual brains. By encoding shared reality within a capable substitute, outside the vagaries of subjective reality, humanity established a shared environmental reality; in other words, we planted behavioral seeds that would later grow into the explicitly articulated concept of “objective reality”. We had to act it out before we could conceptualize it, and we had to conceptualize it before we could speak of it.

Examples of these proto-monetary accounting systems (such as the quipu pictured at the outset of this section) represent the first physical manifestations of collective human intelligence. Thus, by outsourcing the social coherence problem mentioned earlier to shared objective space, we allowed each member of society more freedom to explore, develop, and differentiate their own subjective interpretation of the world. We lowered the costs of individuation, and therefore opened a new frontier of cognitive exploration allowing for the expansion of individual identity. More importantly, we opened this fecund frontier without also opening the floodgates of chaos characterized by the erosion of social cohesion and trust. In balance, both the individual and the collective meta-organism thrived. Alice and Bob no longer needed to possess nearly identical internal mappings of reality to derive the benefits of exchange. For all intents and purposes, this was a win-win — or positive sum — outcome. Alice and Bob benefited individually from increased cognitive and economic freedom, and the collective social organism benefitted from a coherent, mostly stable explosion of creativity and growth.

Thanks for reading! If you’ve found this content valuable, give me a follow so you don’t miss out on the next installment. There, we’ll explore civilization’s incremental centralization of value abstractions, and the downstream implications for humanity’s existential risk profile.

If you’re feeling generous, and would like to help me create more long-form, interdisciplinary content, consider supporting me on Patreon.

If you use Twitter, you can find me @mattpirkowski.

Crypto Beyond Capitalism: Part 2 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.