Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Rootstock is a pioneering blockchain platform secured by 60% of the hashing power that underpins Bitcoin. This dual-mining capability allows users to mine on both Bitcoin and Rootstock simultaneously without any additional effort or resources. Rootstock is EVM compatible, enabling the deployment of Ethereum smart contracts directly on its network. The platform features Powpeg, a proof-of-work secured, two-way peg that adheres to Bitcoin consensus rules, allowing seamless conversion between BTC and RBTC. Users can leverage their RBTC to interact with a vast array of decentralized applications built on Rootstock.

The Challenges: Meeting the Demand for Precise DeFi Data Analysis

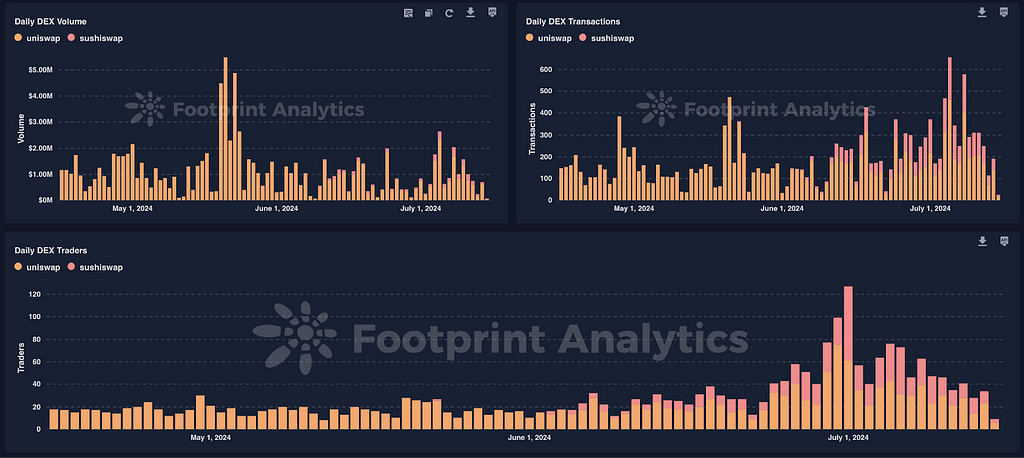

DeFi is a critical component of the Rootstock ecosystem. As more DeFi projects are integrated into Rootstock, the demand for precise data analysis becomes increasingly urgent. Rootstock contributors and community members require comprehensive data insights to make informed, data-driven decisions. Specifically, they need to monitor key metrics related to DEX activity on Rootstock, such as TVL, trading volume, the number of traders, and the number of transactions. However, many data platforms do not support Rootstock’s volume-related data and lack the capability for in-depth analysis, making it challenging to observe and track project growth effectively.

Meanwhile, obtaining comprehensive data through traditional methods is often a cumbersome and time-consuming process. It involves going through multiple steps and can be quite inefficient. To address this issue and streamline its operations, it was important for the Rootstock community to integrate an API solution that would provide real-time data access seamlessly and efficiently.

Why Footprint Analytics?

Footprint Analytics offers multi-chain data analysis perfectly aligned with Rootstock’s requirements. Their state-of-the-art blockchain data solutions provide seamless access to a unified data lake that spans multiple chains, protocols, and domains. With extensive experience in indexing over 30 blockchains, including non-EVM chains, Footprint Analytics’ platform features advanced BI tools and multiple API output options to cater to diverse data needs across various departments and scenarios.

Rootstock’s increasingly diverse ecosystem requires monitoring of multiple project data to understand both the ecosystem’s overall health and the development of individual projects. Footprint Analytics delivers the tools and insights necessary to achieve this.

Additionally, Footprint Analytics was among the first to support data analysis for the Bitcoin ecosystem. Their clientele includes Core and Merlin Chain, with more chains continuously joining their platform.

The Solutions and Measurable Results

Footprint Analytics provided Rootstock with efficient and comprehensive solutions to address these data challenges:

Real-Time Transactions and DEX Volume Monitoring

Footprint Analytics efficiently abstracted and analyzed data on Rootstock, providing advanced Business Intelligence (BI) tools and data APIs. By leveraging Footprint Analytics’ capabilities, data operations on Rootstock are now streamlined, ensuring monitoring and analysis of key metrics, which is crucial for the continued growth and development of its DeFi ecosystem.

“Footprint Analytics’ SQL service is incredibly intuitive, with well-crafted documentation and a top-notch tool for contract submission and decoding, excelling in both speed and completeness. The team is highly professional and technical, consistently providing thorough and effective answers to any questions”.

— Gabriela Castillo Areco, Data Lead, RootstockLabs

Structured DEX Tables

Footprint Analytics created structured DEX tables and rapidly indexed new DEXs, efficiently supporting the evolving data analysis needs of the Rootstock DeFi ecosystem. This efficient process significantly supported the evolving and complex data analysis needs of the Rootstock DeFi ecosystem, ensuring that the system remained robust and adaptable to future developments.

Flexible Dashboards

Footprint Analytics offers highly flexible dashboards for multi-angle drill-down analysis. These dashboards enable the Rootstock community to explore data from various perspectives, providing a comprehensive and detailed view of the ecosystem. This flexibility ensures users can gain deeper insights and make more informed decisions based on the extensive data available. Notable examples include dashboards for Symbiosis, Money On Chain, and OKU.

Footprint Analytics’ support has significantly contributed to Rootstock’s growth, evidenced by a substantial increase in TVL. Comparing data from November 2023 to June 2024, Rootstock experienced an 80.4% growth in TVL.

“Footprint analytics has been transformational for many facets of the Rootstock ecosystem. From developers to the largest dApps, we’ve managed to derive actionable insights to grow our community and execute our strategy.”

– Ongun Özdemir, Sr. Venture Associate, RootstockLabs

Conclusion

The integration of Footprint Analytics with Rootstock has profoundly enhanced the community’s understanding of the Rootstock ecosystem. By ensuring transparency and facilitating data-driven growth, Footprint Analytics has empowered Rootstock to optimize its operations and strategically plan for the future.

_____________________

About Footprint Analytics

Footprint Analytics is a comprehensive blockchain data analytics platform that simplifies complex analysis for businesses and projects in the Web3 ecosystem. It offers tailored solutions that eliminate the need for extensive expertise and infrastructure maintenance. The platform provides long-term growth tools designed to help build and manage communities step by step, emphasizing sustainable growth and user loyalty. By combining powerful analytics with community management tools, Footprint Analytics enables projects to leverage blockchain data effectively for decision-making and growth strategies across various sectors including GameFi, NFT, and DeFi.

Website | X / Twitter | Telegram | Discord

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.